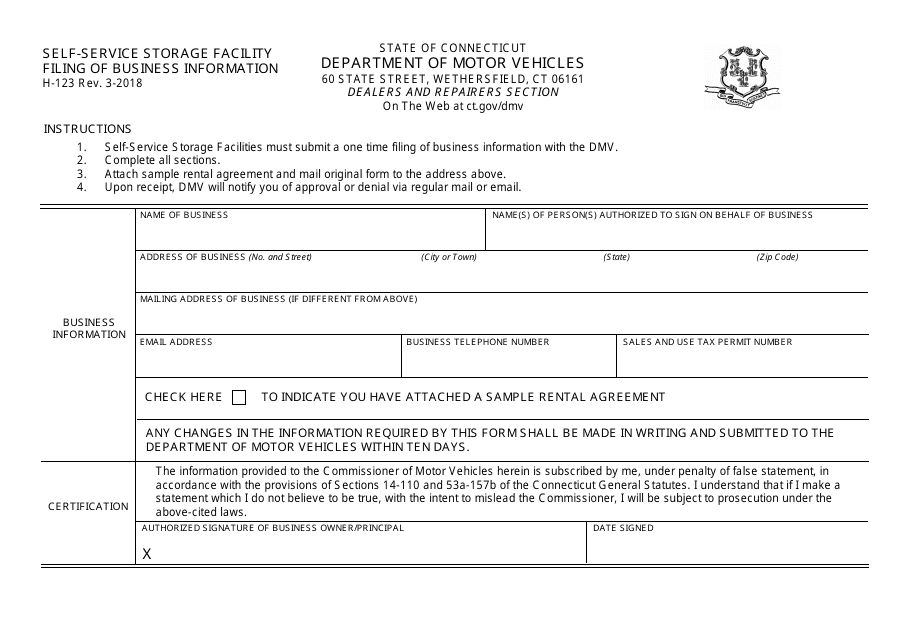

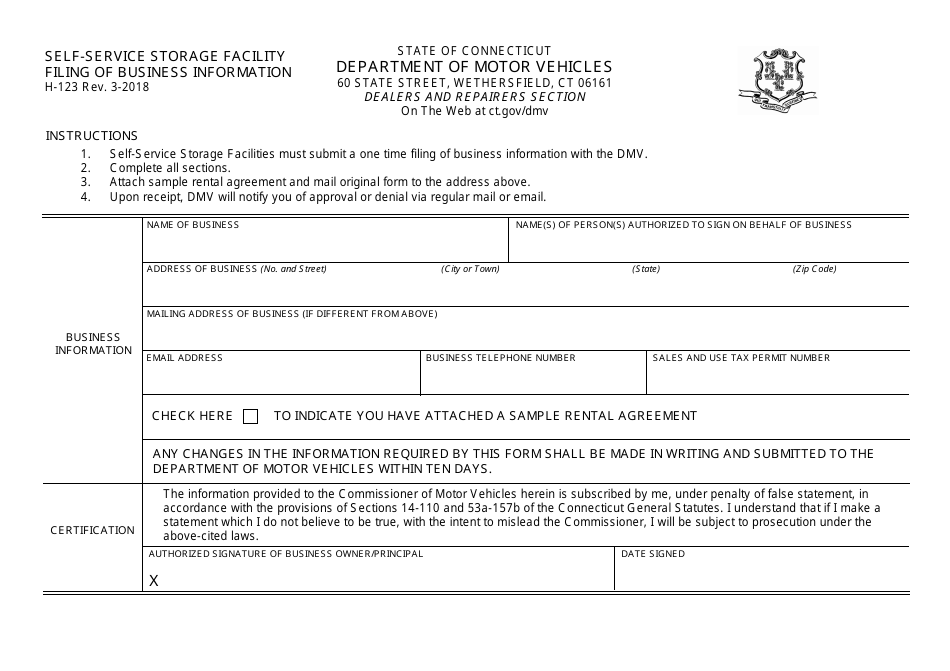

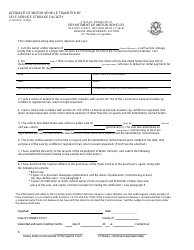

Form H-123 Self-service Storage Facility Filing of Business Information - Connecticut

What Is Form H-123?

This is a legal form that was released by the Connecticut Department of Motor Vehicles - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H-123?

A: Form H-123 is a self-service storage facility filing of business information form in Connecticut.

Q: What is a self-service storage facility?

A: A self-service storage facility is a place where individuals or businesses can rent storage space to store their belongings.

Q: Why do I need to file Form H-123?

A: You need to file Form H-123 if you own or operate a self-service storage facility in Connecticut.

Q: What information do I need to provide on Form H-123?

A: You need to provide information such as your business name, address, contact information, and the names of all owners, partners, or officers of the business.

Q: Is there a fee for filing Form H-123?

A: Yes, there is a fee associated with filing Form H-123. The fee amount is specified on the form.

Q: When do I need to file Form H-123?

A: You need to file Form H-123 within 30 days of starting your self-service storage facility business in Connecticut.

Q: What happens after I file Form H-123?

A: After you file Form H-123, you will receive a certificate of filing from the Connecticut Department of Revenue Services.

Q: Do I need to renew my filing annually?

A: Yes, you need to renew your filing annually by filing a new Form H-123 and paying the required fee.

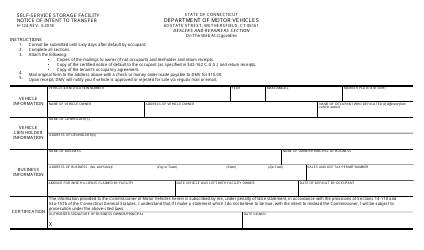

Q: What should I do if there are changes to my business information?

A: If there are changes to your business information, you need to file an amended Form H-123 within 30 days of the change.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Connecticut Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form H-123 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Motor Vehicles.