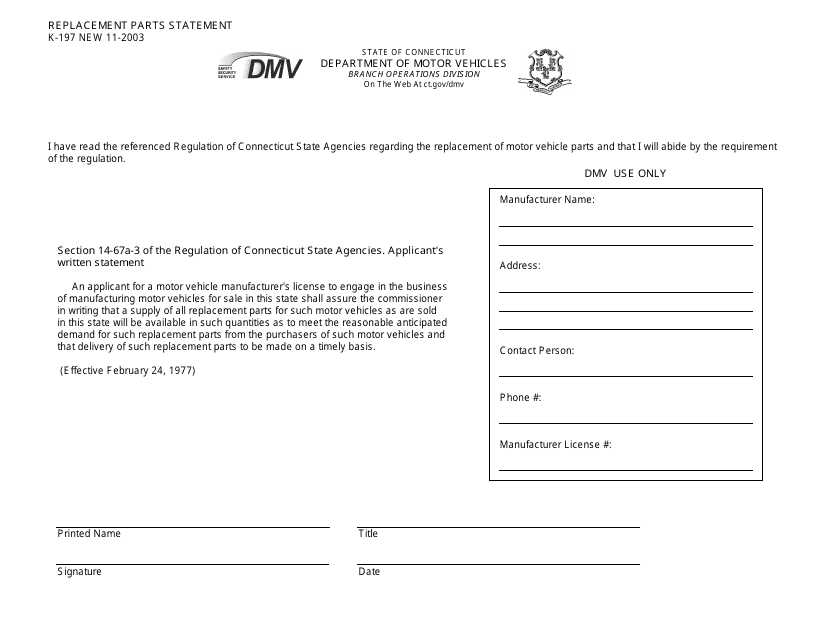

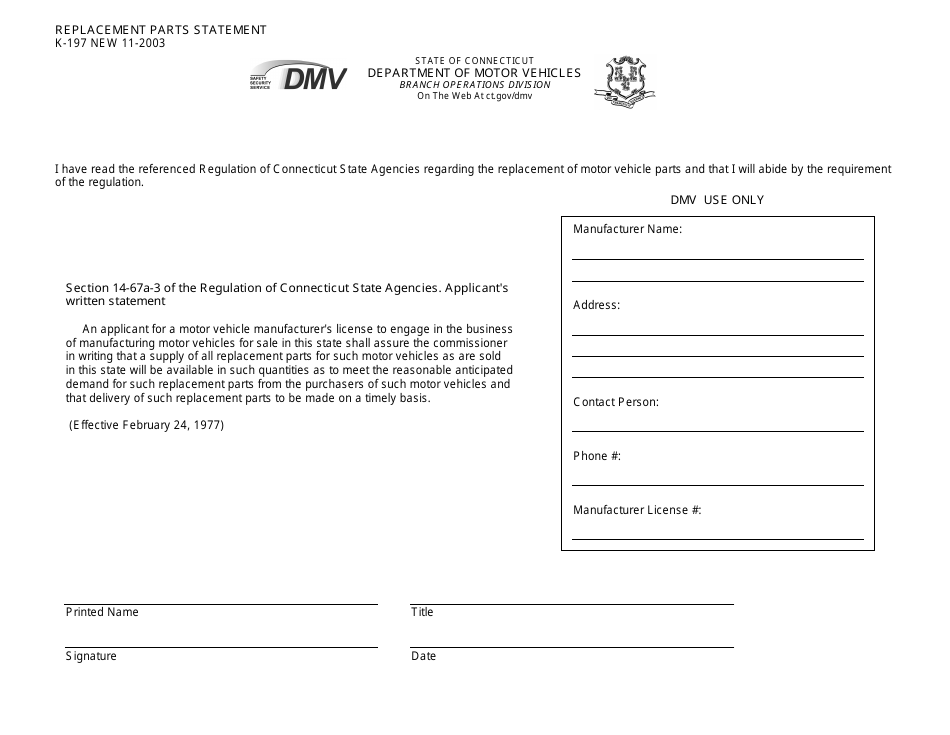

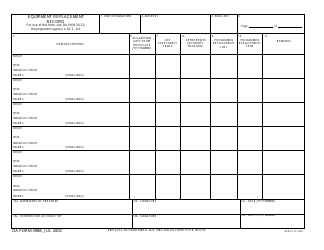

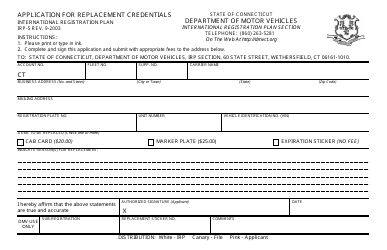

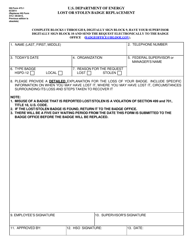

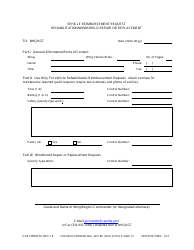

Form K-197 Replacement Parts Statement - Connecticut

What Is Form K-197?

This is a legal form that was released by the Connecticut Department of Motor Vehicles - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

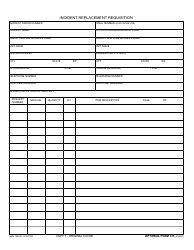

Q: What is Form K-197?

A: Form K-197 is the Replacement Parts Statement.

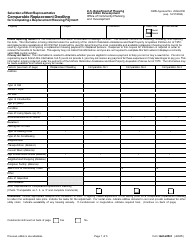

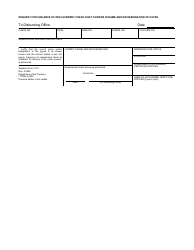

Q: What is the purpose of Form K-197?

A: The purpose of Form K-197 is to report sales and use tax liabilities on replacement parts.

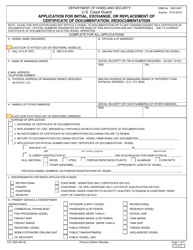

Q: Who needs to file Form K-197?

A: Dealers and repairers who sell or install replacement parts in Connecticut need to file Form K-197.

Q: When is Form K-197 due?

A: Form K-197 is due annually by January 31st.

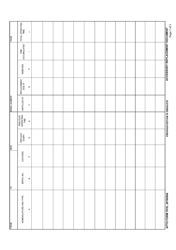

Q: What should I include on Form K-197?

A: You should include the total sales of replacement parts and the total sales tax collected on Form K-197.

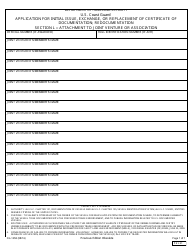

Q: What are the consequences of not filing Form K-197?

A: Failure to file Form K-197 may result in penalties and interest charges.

Q: Is there a fee to file Form K-197?

A: No, there is no fee to file Form K-197.

Q: Can I file Form K-197 electronically?

A: Yes, you can file Form K-197 electronically through the Connecticut Taxpayer Service Center.

Q: Who can I contact for more information about Form K-197?

A: You can contact the Connecticut Department of Revenue Services for more information about Form K-197.

Form Details:

- Released on November 1, 2003;

- The latest edition provided by the Connecticut Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-197 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Motor Vehicles.