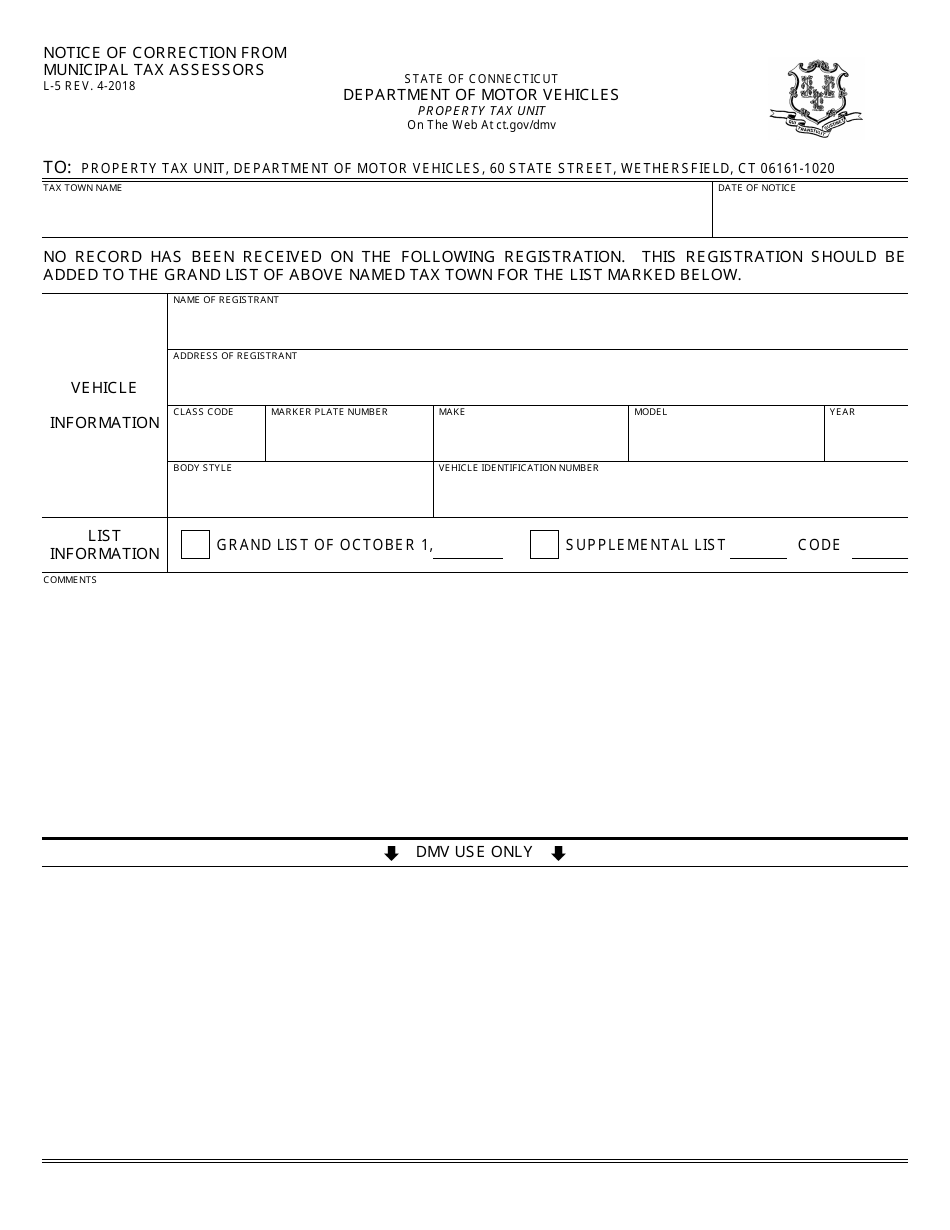

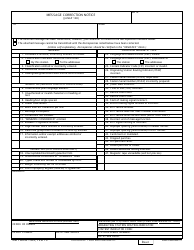

Form L-5 Notice of Correction From Municipal Tax Assessors - Connecticut

What Is Form L-5?

This is a legal form that was released by the Connecticut Department of Motor Vehicles - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

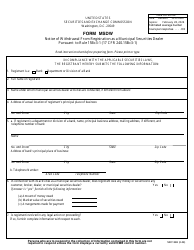

Q: What is Form L-5?

A: Form L-5 is a Notice of Correction from Municipal Tax Assessors in Connecticut.

Q: What is the purpose of Form L-5?

A: The purpose of Form L-5 is to notify property owners about corrections made to their tax assessments by the Municipal Tax Assessors.

Q: Who sends Form L-5?

A: Form L-5 is sent by the Municipal Tax Assessors in Connecticut.

Q: Why would someone receive Form L-5?

A: Someone would receive Form L-5 if there are corrections made to their tax assessments by the Municipal Tax Assessors.

Q: What should I do if I receive Form L-5?

A: If you receive Form L-5, you should review the corrections made and contact the Municipal Tax Assessors if you have any questions or concerns.

Q: Is Form L-5 mandatory?

A: Yes, Form L-5 is mandatory if there are corrections made to your tax assessments by the Municipal Tax Assessors.

Q: Is there a deadline for responding to Form L-5?

A: Yes, there is a deadline for responding to Form L-5. The specific deadline will be mentioned in the notice.

Q: Can I appeal the corrections mentioned in Form L-5?

A: Yes, you can appeal the corrections mentioned in Form L-5. Contact the Municipal Tax Assessors for information on the appeals process.

Q: Are there any fees associated with appealing the corrections mentioned in Form L-5?

A: There may be fees associated with appealing the corrections mentioned in Form L-5. Contact the Municipal Tax Assessors for more information.

Q: Can I request an extension to respond to Form L-5?

A: Yes, you can request an extension to respond to Form L-5. Contact the Municipal Tax Assessors to discuss your situation.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Connecticut Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-5 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Motor Vehicles.