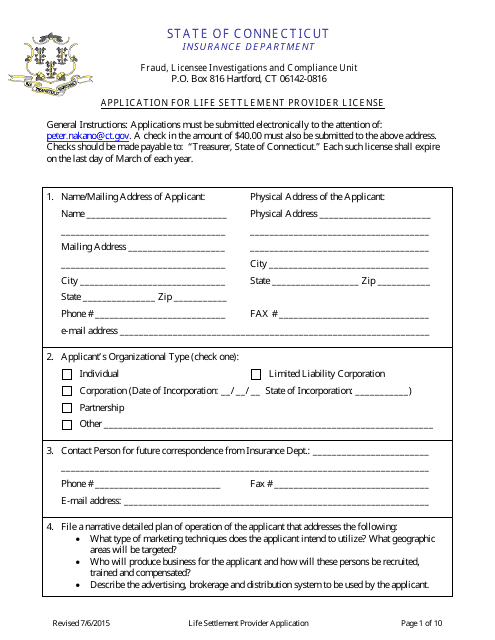

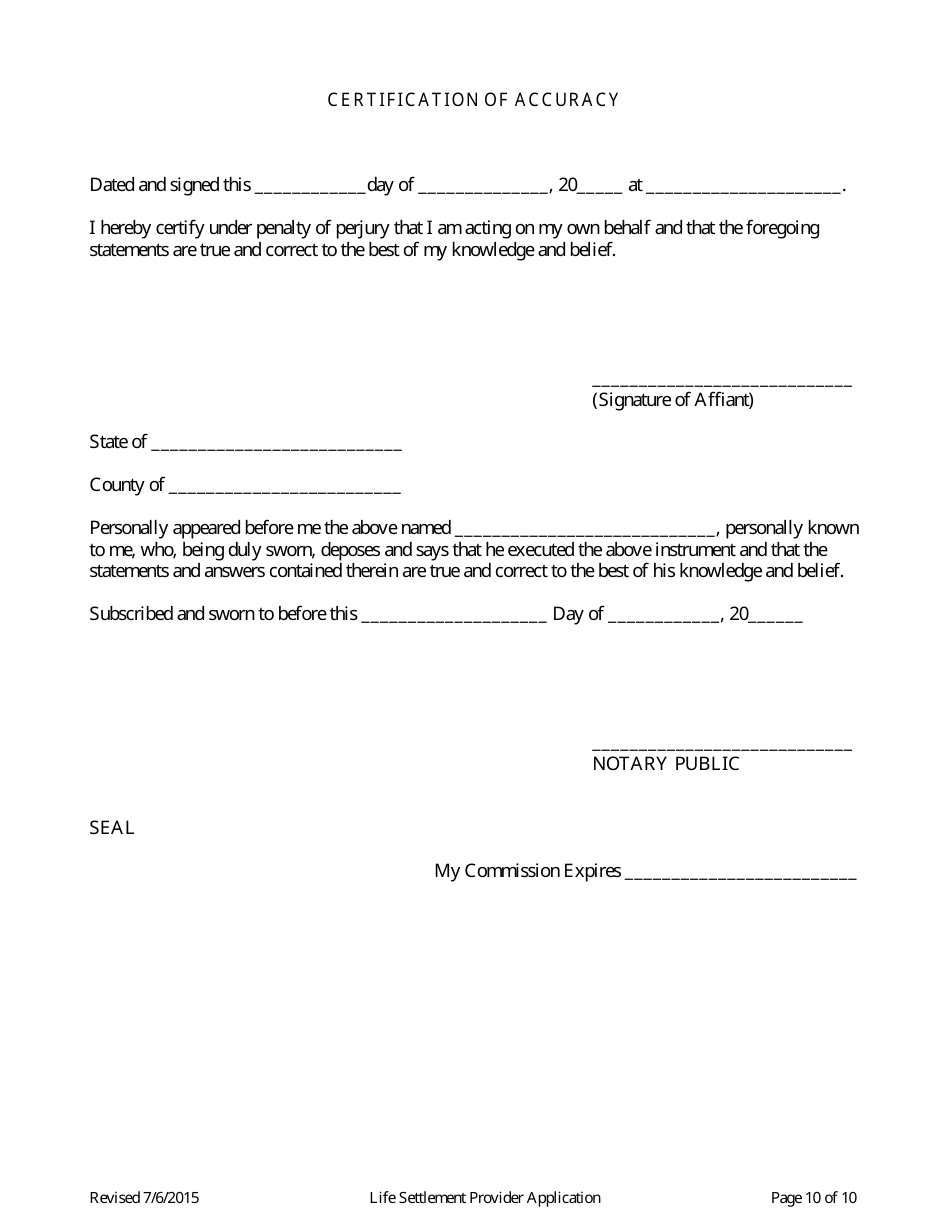

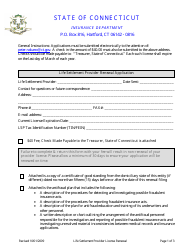

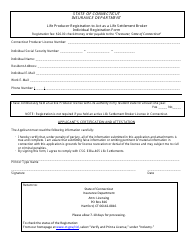

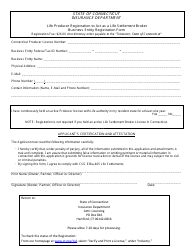

Application for Life Settlement Provider License - Connecticut

Application for Life Settlement Provider License is a legal document that was released by the Connecticut Insurance Department - a government authority operating within Connecticut.

FAQ

Q: What is an application for Life Settlement Provider License?

A: An application for Life Settlement Provider License is a document required to be submitted to obtain a license to operate as a life settlement provider in the state of Connecticut.

Q: What is a Life Settlement Provider?

A: A Life Settlement Provider is a company or individual that buys life insurance policies from policyholders in exchange for a lump sum payment.

Q: Why do I need a license to be a Life Settlement Provider in Connecticut?

A: You need a license to be a Life Settlement Provider in Connecticut to ensure compliance with state laws and regulations and to protect consumers.

Q: What is the process for obtaining a Life Settlement Provider License in Connecticut?

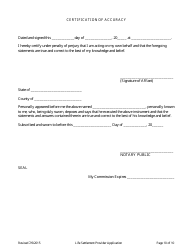

A: The process for obtaining a Life Settlement Provider License in Connecticut involves submitting a completed application, paying the required fees, providing background information, and meeting certain eligibility criteria.

Q: What are the eligibility criteria for a Life Settlement Provider License in Connecticut?

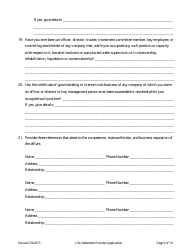

A: The eligibility criteria for a Life Settlement Provider License in Connecticut may include having a minimum net worth, being of good character and reputation, and having the necessary qualifications and experience.

Q: Are there any fees for obtaining a Life Settlement Provider License in Connecticut?

A: Yes, there are fees associated with obtaining a Life Settlement Provider License in Connecticut. The specific fees can be found in the application instructions or guidance provided by the licensing authority.

Q: How long does it take to process a Life Settlement Provider License application in Connecticut?

A: The processing time for a Life Settlement Provider License application in Connecticut can vary, but it may take several months to complete the review and approval process.

Q: Are there any continuing requirements or obligations after obtaining a Life Settlement Provider License in Connecticut?

A: Yes, there are continuing requirements and obligations for Life Settlement Providers in Connecticut, including maintaining appropriate records, submitting regular reports, and complying with applicable laws and regulations.

Form Details:

- Released on July 6, 2015;

- The latest edition currently provided by the Connecticut Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Connecticut Insurance Department.