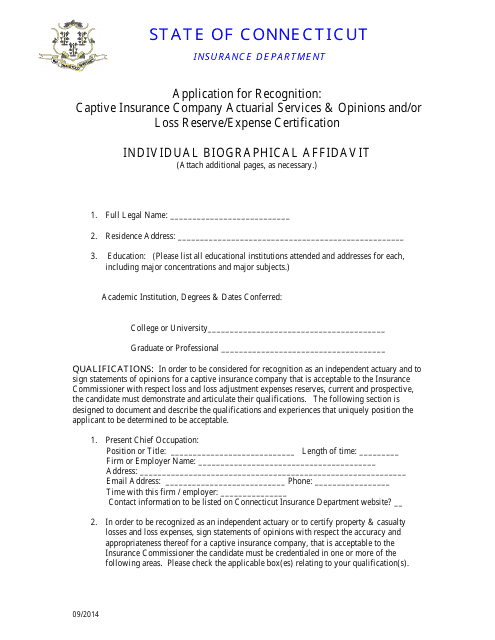

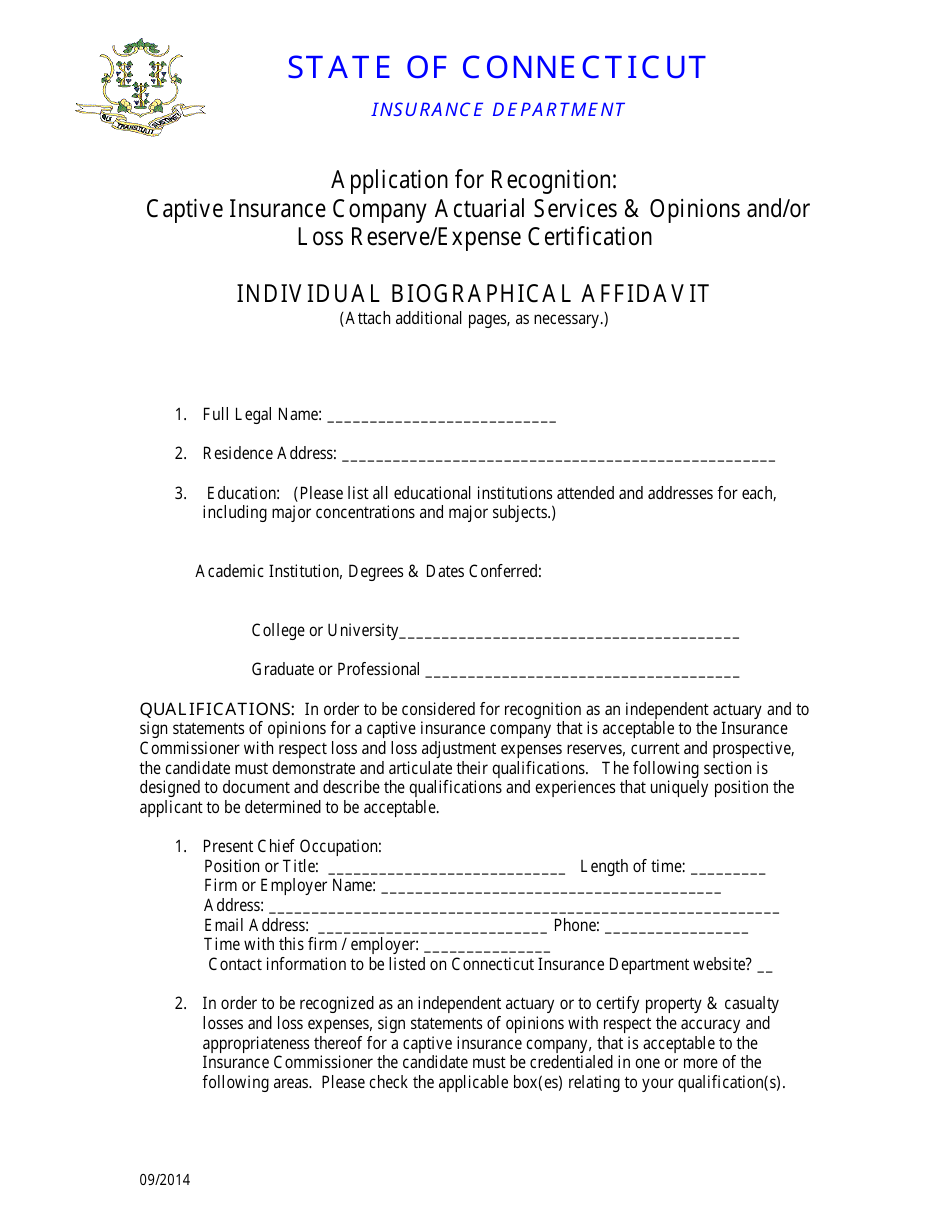

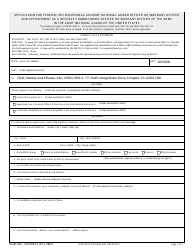

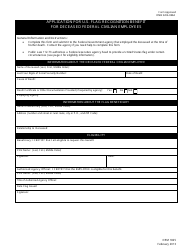

Application for Recognition - Captive Insurance Company Actuarial Services and Opinions and / or Loss Reserve / Expense Certification - Connecticut

Application for Recognition - Captive Insurance Company Actuarial Services and Opinions and/or Loss Reserve/Expense Certification is a legal document that was released by the Connecticut Insurance Department - a government authority operating within Connecticut.

FAQ

Q: What is the purpose of this application?

A: This application is for recognition as an actuary providing services and opinions on captive insurance company actuarial matters or loss reserve/expense certification in Connecticut.

Q: Who can apply for recognition?

A: Any actuary who wishes to provide these services in Connecticut can apply for recognition.

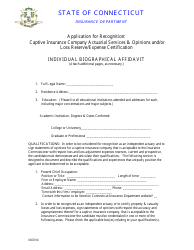

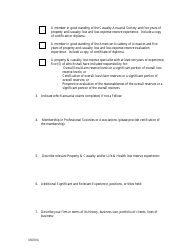

Q: What services can an actuary provide under this recognition?

A: An actuary can provide services and opinions on captive insurance company actuarial matters or loss reserve/expense certification.

Q: What is captive insurance?

A: Captive insurance is a form of self-insurance in which a company creates its own insurance company to cover its risks.

Q: What are actuarial services?

A: Actuarial services involve the assessment of risk and the calculation of insurance premiums and reserves, among other financial calculations.

Q: Who needs loss reserve/expense certification?

A: Captive insurance companies may need loss reserve/expense certification for regulatory compliance and financial reporting purposes.

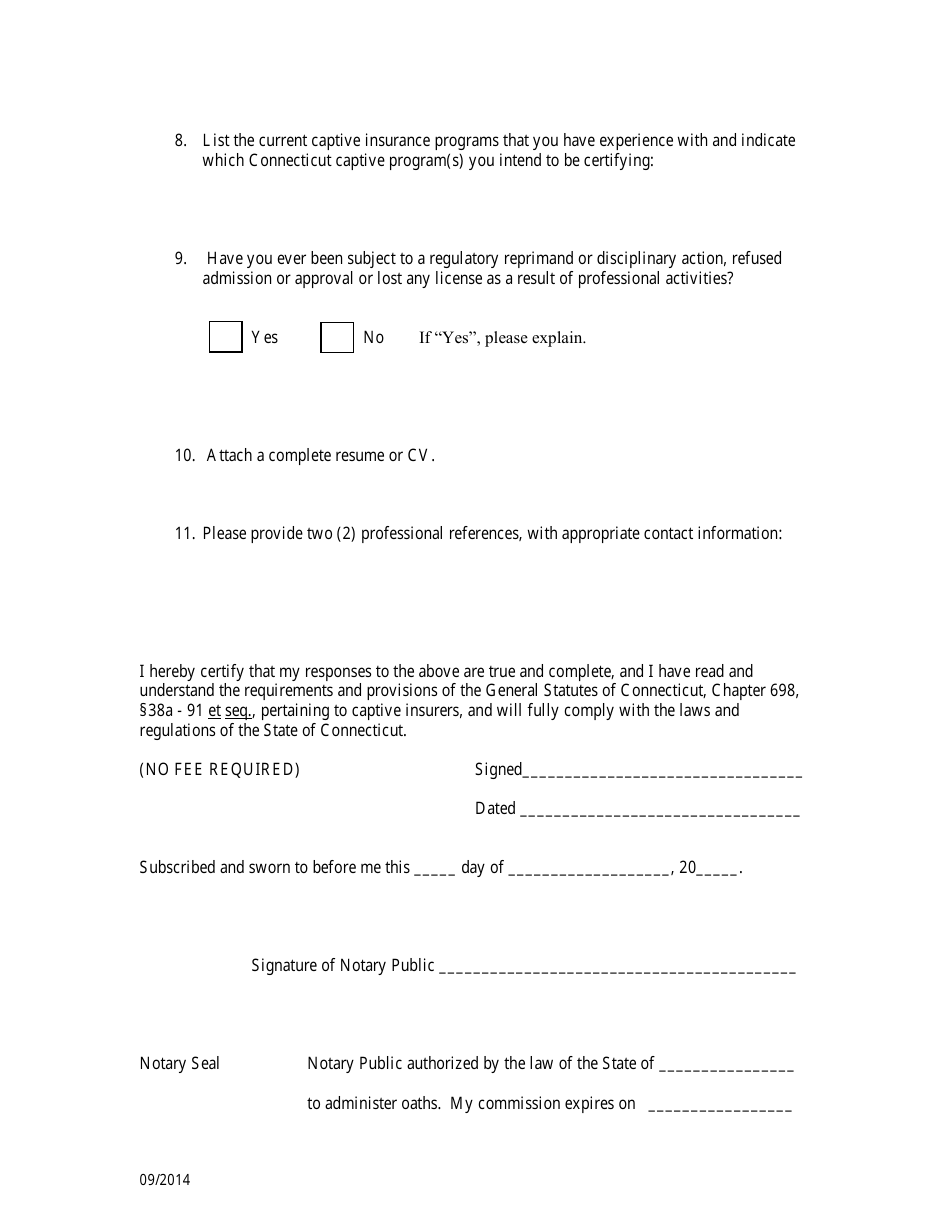

Q: How can I apply for recognition?

A: You can apply for recognition by submitting the required application and documentation to the appropriate regulatory authority.

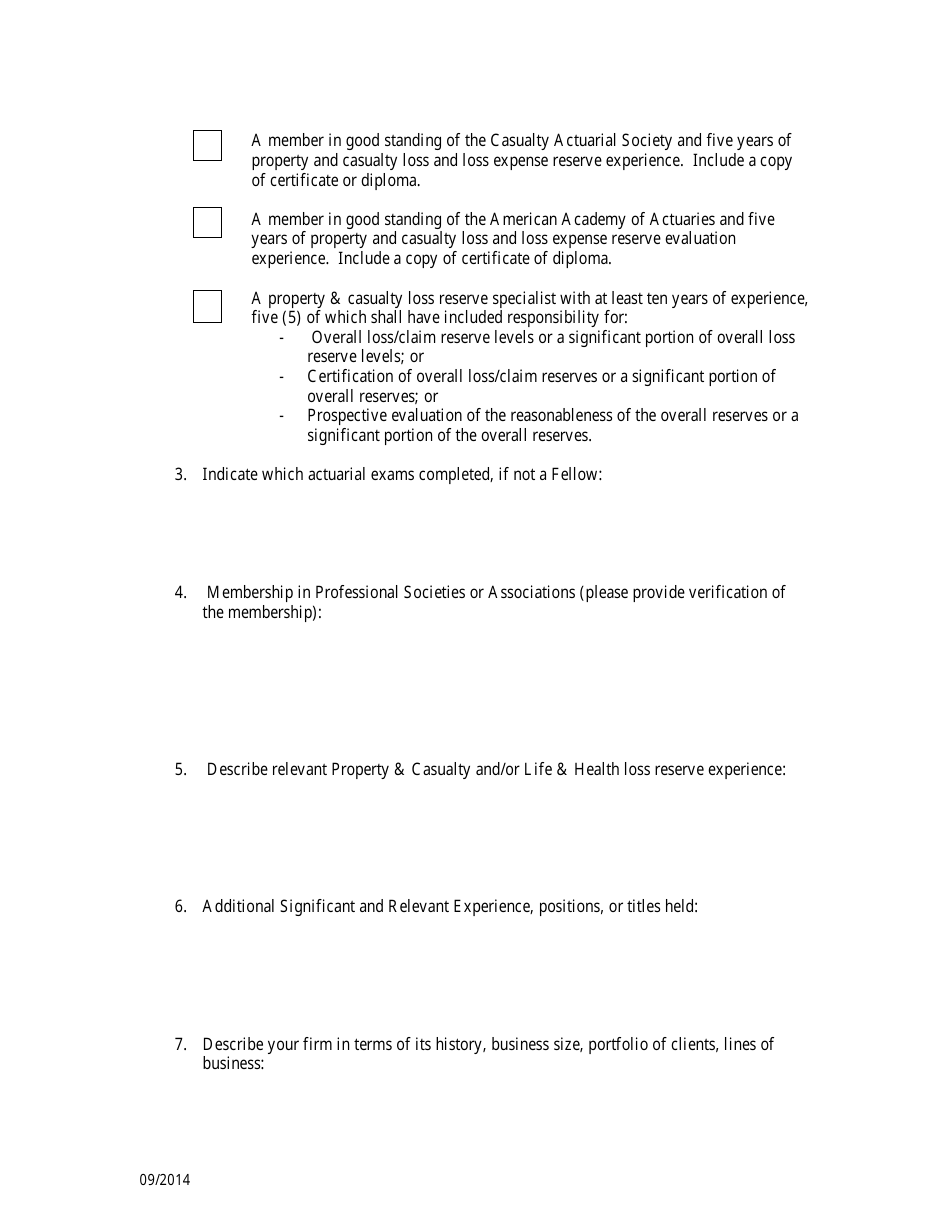

Q: What are the requirements for recognition?

A: The specific requirements for recognition may vary by jurisdiction, so it is important to review the applicable regulations and guidelines.

Q: Is there a fee for applying for recognition?

A: There may be a fee associated with the application for recognition, which is typically specified in the regulations or guidelines.

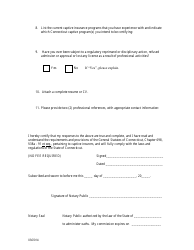

Form Details:

- Released on September 1, 2014;

- The latest edition currently provided by the Connecticut Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Connecticut Insurance Department.