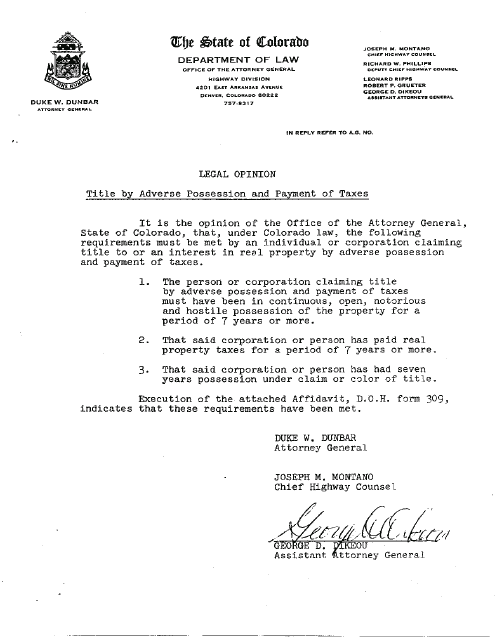

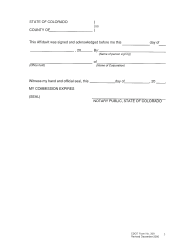

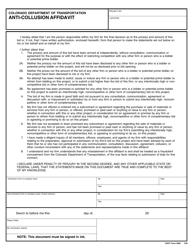

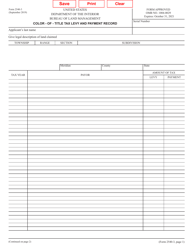

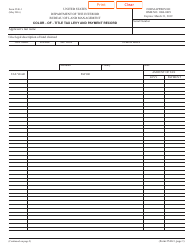

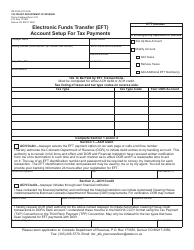

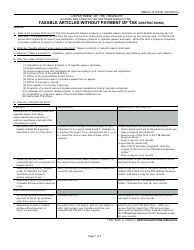

CDOT Form 309 Affidavit of Title by Adverse Possession and Payment of Taxes - Colorado

What Is CDOT Form 309?

This is a legal form that was released by the Colorado Department of Transportation - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

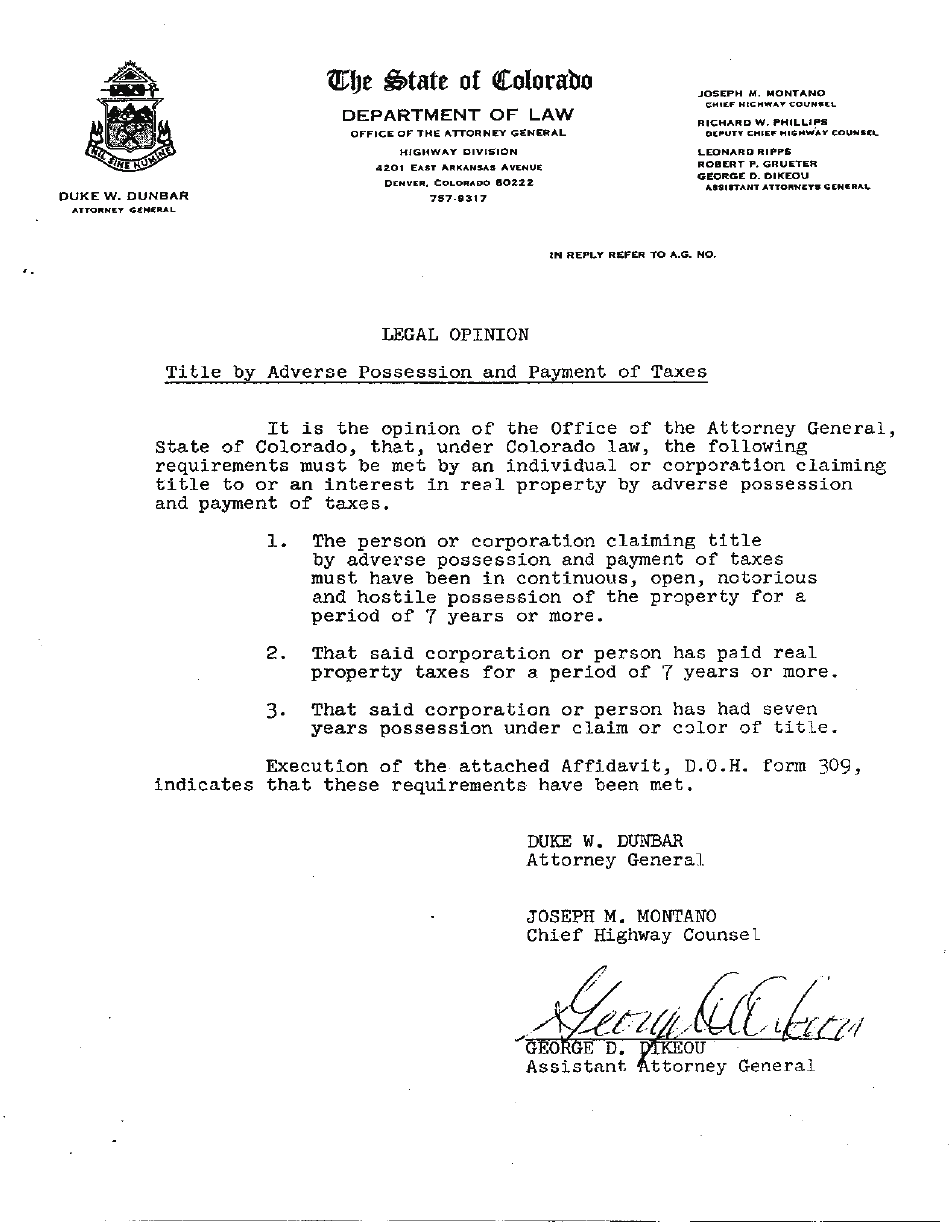

Q: What is CDOT Form 309?

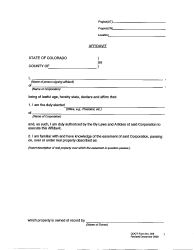

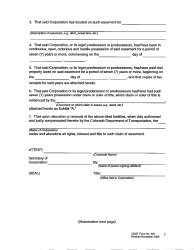

A: CDOT Form 309 is an Affidavit of Title by Adverse Possession and Payment of Taxes.

Q: What is the purpose of CDOT Form 309?

A: The purpose of CDOT Form 309 is to establish ownership of a property through adverse possession and proof of tax payment.

Q: Who should use CDOT Form 309?

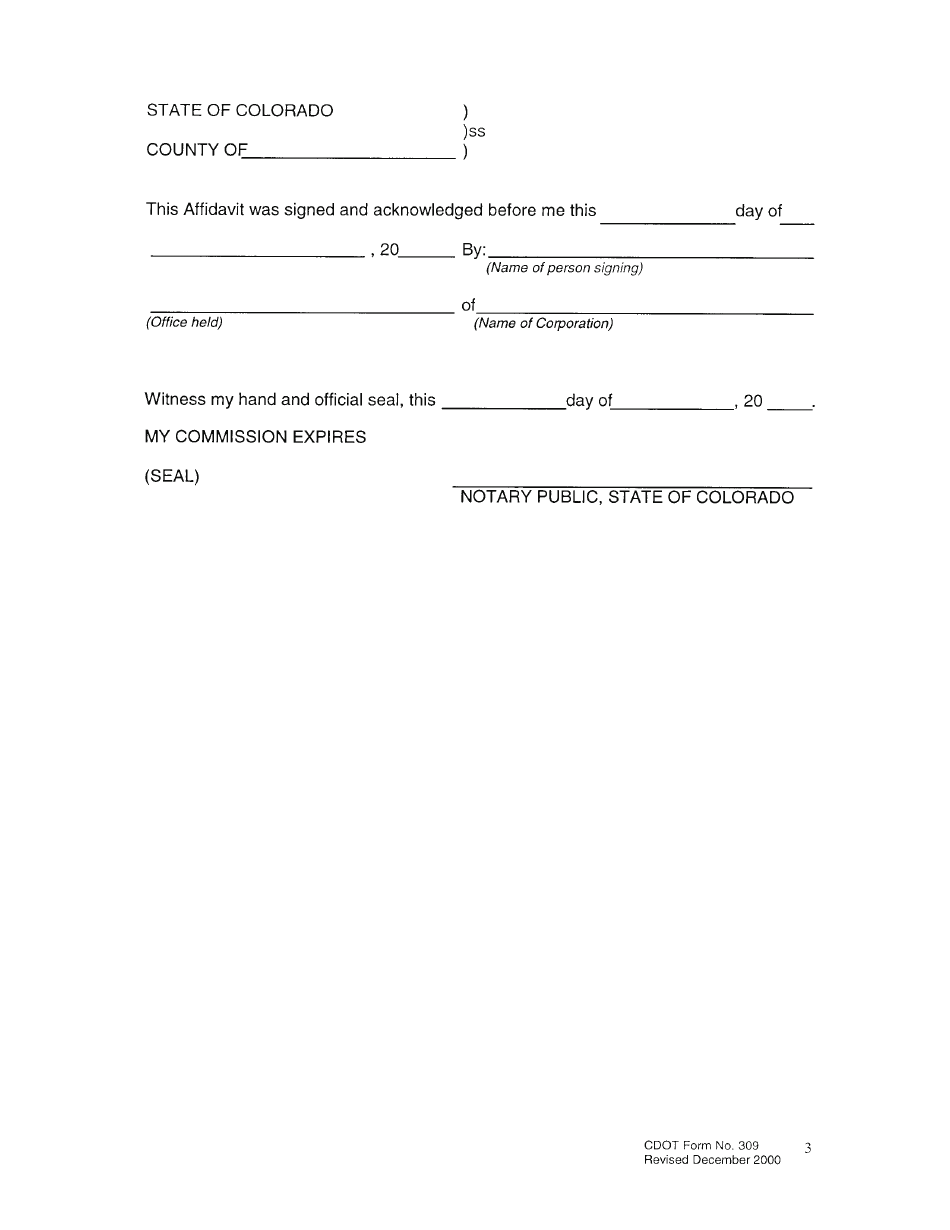

A: CDOT Form 309 should be used by individuals who are claiming ownership of a property through adverse possession and have paid the required taxes.

Q: Are there any fees associated with CDOT Form 309?

A: Yes, there may be fees associated with CDOT Form 309. It is best to check with the CDOT or local offices for more information.

Q: What documents should be submitted with CDOT Form 309?

A: Along with CDOT Form 309, you may need to submit supporting documents such as proof of tax payment, surveys, deeds, and any other relevant documentation.

Q: What happens after submitting CDOT Form 309?

A: After submitting CDOT Form 309, the Colorado Department of Transportation will review the application and supporting documents to determine the validity of the adverse possession claim.

Q: Can CDOT Form 309 be used in other states?

A: No, CDOT Form 309 is specific to Colorado and may not be applicable in other states. Each state may have its own form and requirements for adverse possession claims.

Form Details:

- Released on December 1, 2000;

- The latest edition provided by the Colorado Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of CDOT Form 309 by clicking the link below or browse more documents and templates provided by the Colorado Department of Transportation.