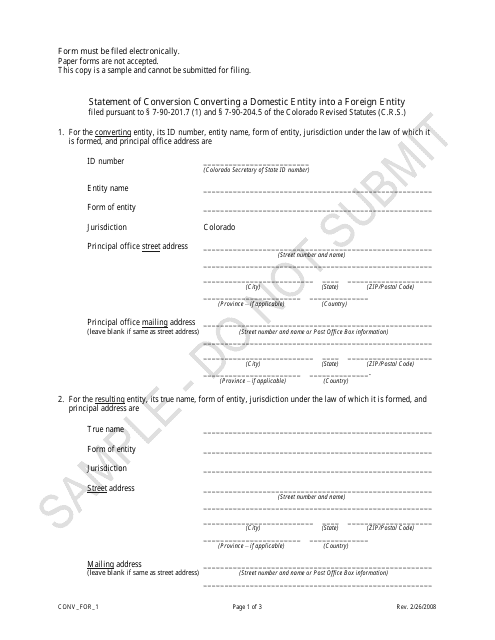

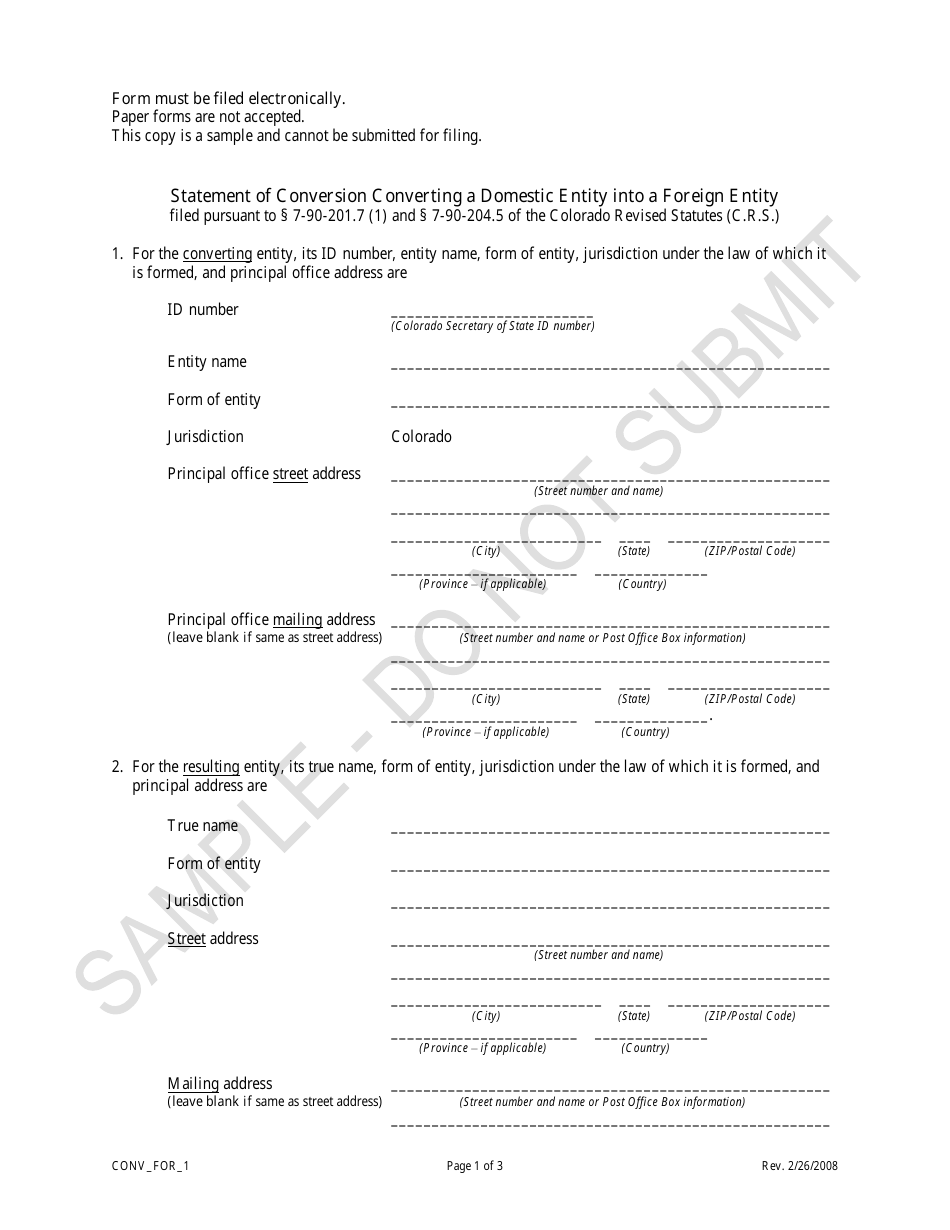

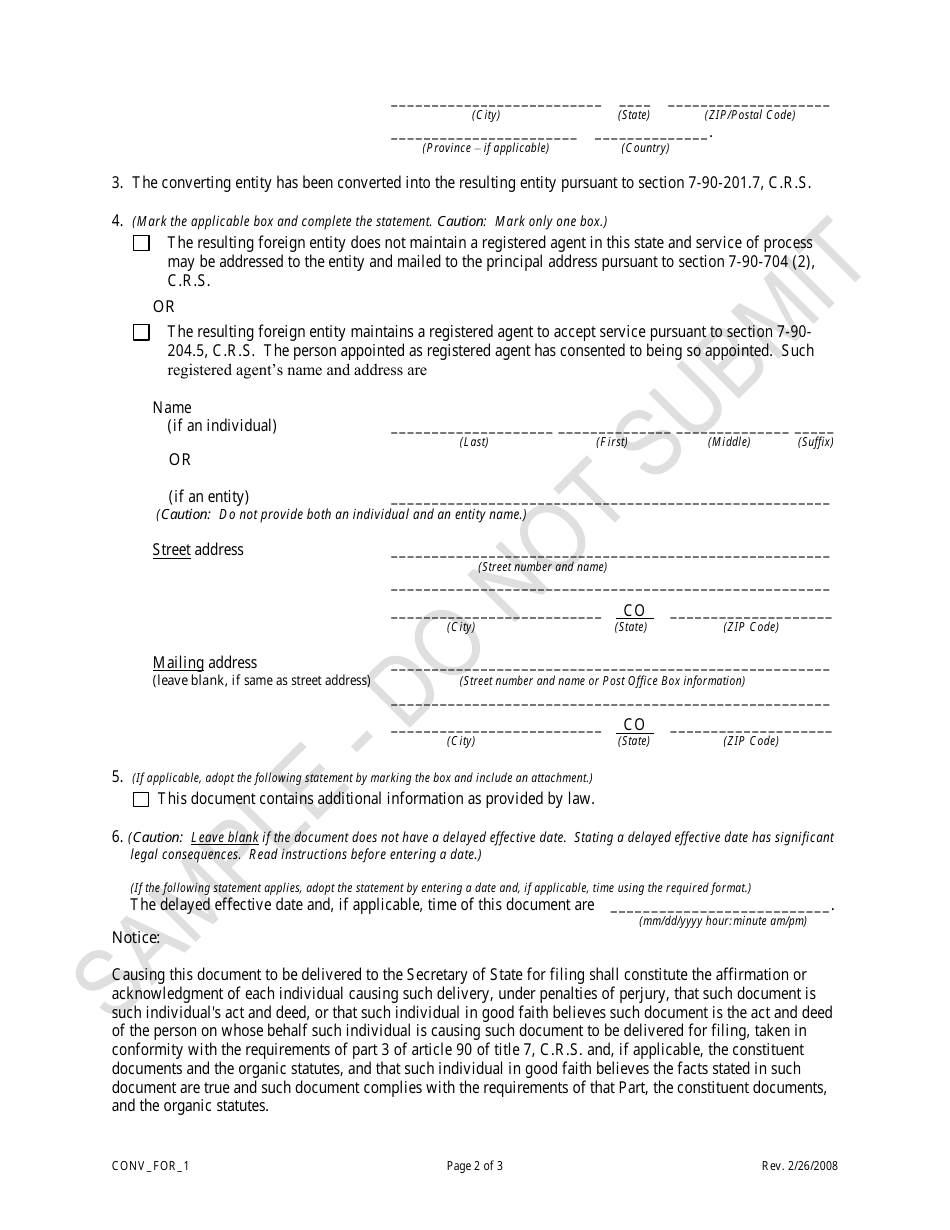

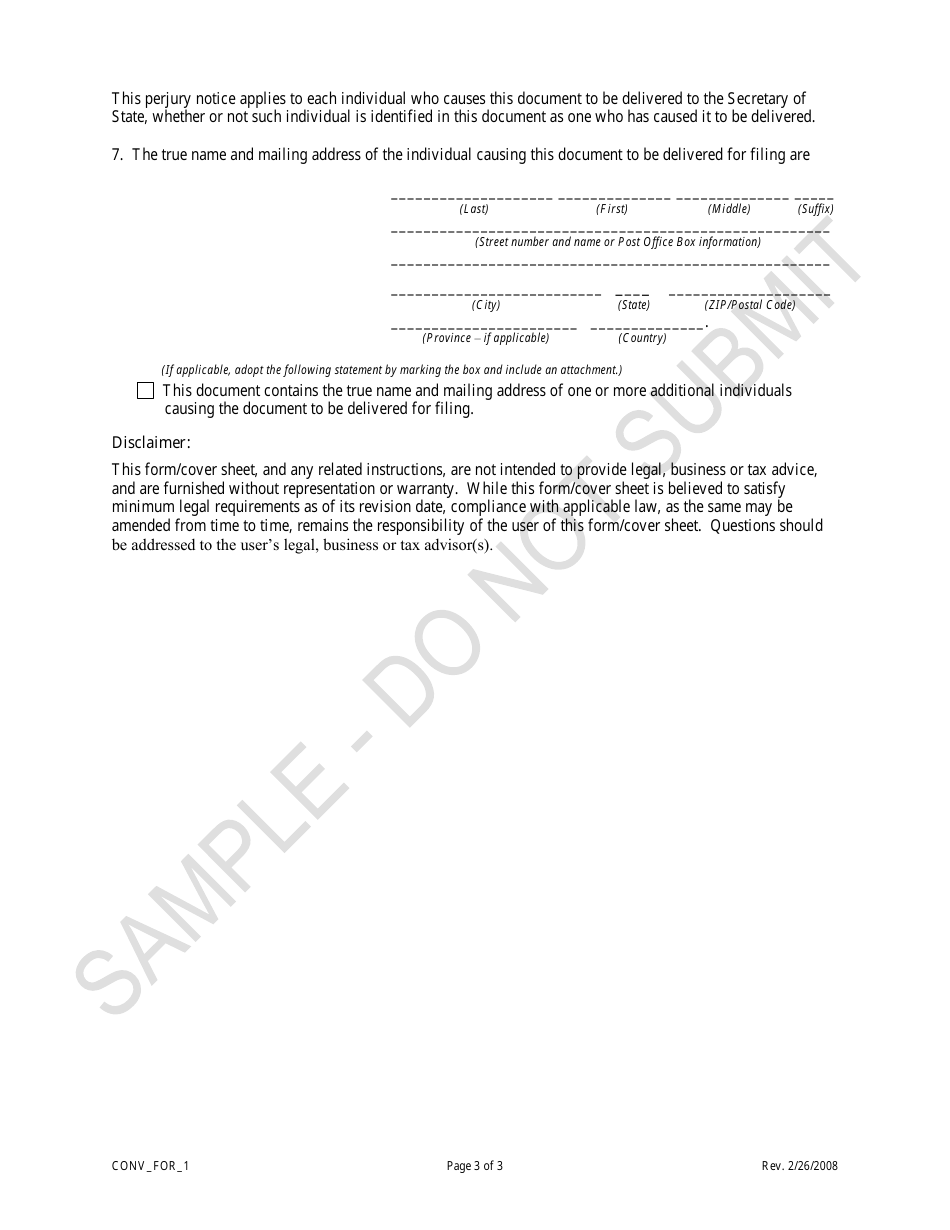

Statement of Conversion Converting a Domestic Entity Into a Foreign Entity - Sample - Colorado

Statement of Conversion Converting a Foreign Entity - Sample is a legal document that was released by the Colorado Secretary of State - a government authority operating within Colorado.

FAQ

Q: What is the process of converting a domestic entity into a foreign entity?

A: The process involves transforming a company registered in one state (domestic entity) into a company registered in another state (foreign entity).

Q: What is a domestic entity?

A: A domestic entity is a company that is registered and operates in a specific state.

Q: What is a foreign entity?

A: A foreign entity is a company that is registered and operates in a state other than its home state.

Q: Why would a company want to convert into a foreign entity?

A: Companies may choose to convert into a foreign entity to expand their operations into new states or take advantage of different business opportunities in other states.

Q: What is the primary benefit of converting into a foreign entity?

A: The primary benefit is that the company can legally operate in another state and take advantage of its business environment and opportunities.

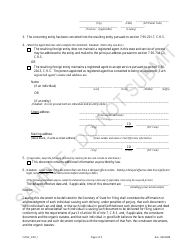

Q: What are the steps involved in converting a domestic entity into a foreign entity in Colorado?

A: The specific steps may vary, but generally, the process involves filing an application with the Secretary of State, paying the required fees, and complying with any additional state-specific requirements.

Form Details:

- Released on February 26, 2008;

- The latest edition currently provided by the Colorado Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.