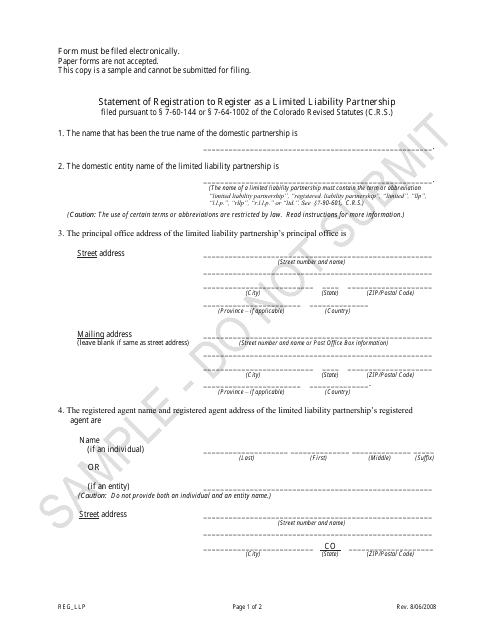

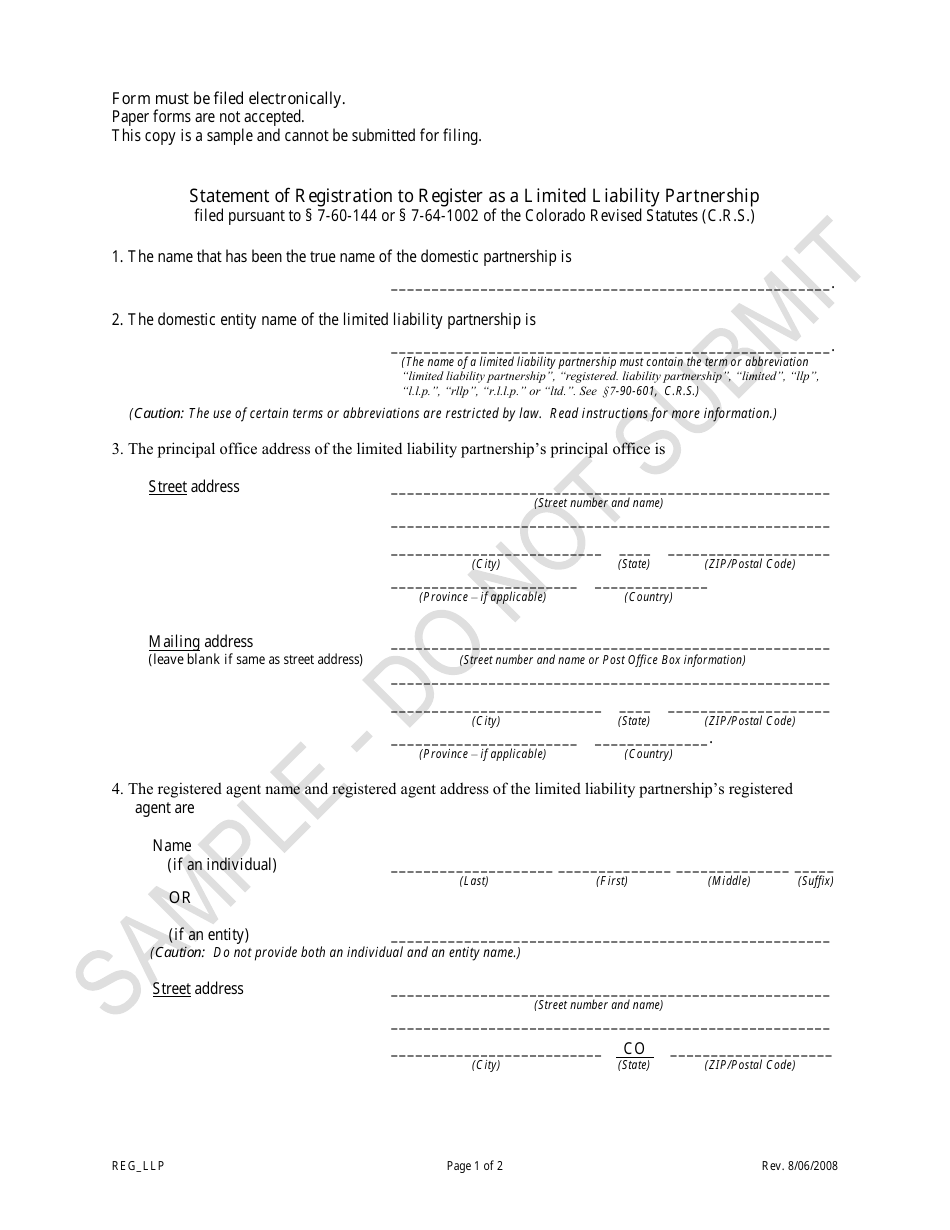

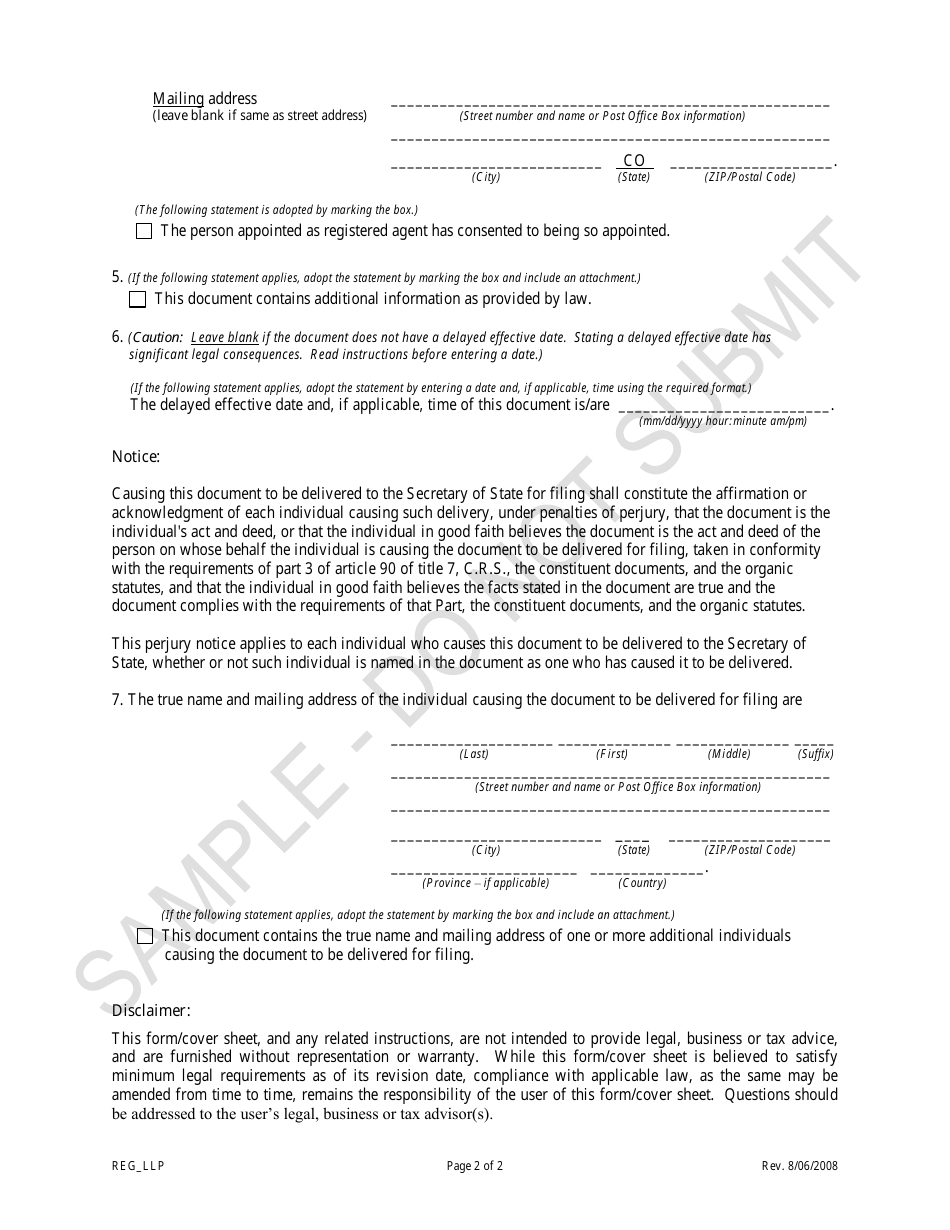

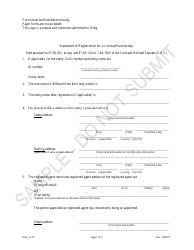

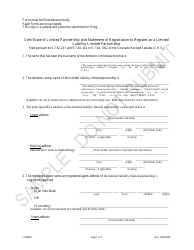

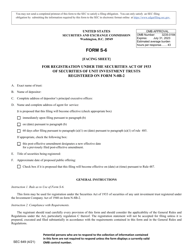

Statement of Registration to Register as a Limited Liability Partnership - Sample - Colorado

Statement of Registration to Register as a Limited Liability Partnership - Sample is a legal document that was released by the Colorado Secretary of State - a government authority operating within Colorado.

FAQ

Q: What is a Limited Liability Partnership?

A: A Limited Liability Partnership (LLP) is a legal business structure that combines the organizational flexibility of a partnership with the limited liability protection of a corporation.

Q: Why would someone want to register as a Limited Liability Partnership?

A: By registering as an LLP, partners can protect their personal assets from business liabilities while still enjoying the flexibility and tax benefits of a partnership.

Q: What are the requirements to register as a Limited Liability Partnership in Colorado?

A: In Colorado, you need to submit a Statement of Registration, pay the required fees, and meet certain eligibility criteria, such as having at least two partners.

Q: How much does it cost to register as a Limited Liability Partnership in Colorado?

A: The cost to register as an LLP in Colorado is $50, payable to the Secretary of State.

Q: Can a sole proprietorship register as a Limited Liability Partnership?

A: No, a sole proprietorship cannot register as an LLP. An LLP requires at least two partners.

Q: Do partners in an LLP have personal liability?

A: No, partners in an LLP have limited personal liability. This means their personal assets are generally protected from business liabilities.

Q: How is an LLP taxed?

A: LLPs are generally taxed as pass-through entities, meaning the profits and losses pass through to the partners who report them on their individual tax returns.

Q: What are the advantages of registering as a Limited Liability Partnership?

A: The main advantages of an LLP are limited liability protection for partners, flexibility in management and decision-making, and potential tax benefits.

Q: How long does it take to register as a Limited Liability Partnership?

A: The processing time can vary, but it typically takes a few business days to process a Statement of Registration for an LLP in Colorado.

Form Details:

- Released on August 6, 2008;

- The latest edition currently provided by the Colorado Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.