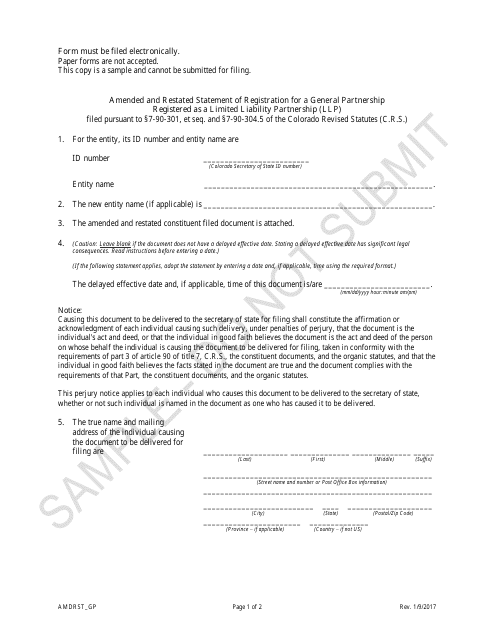

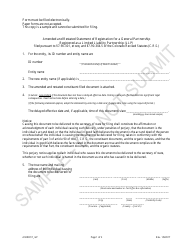

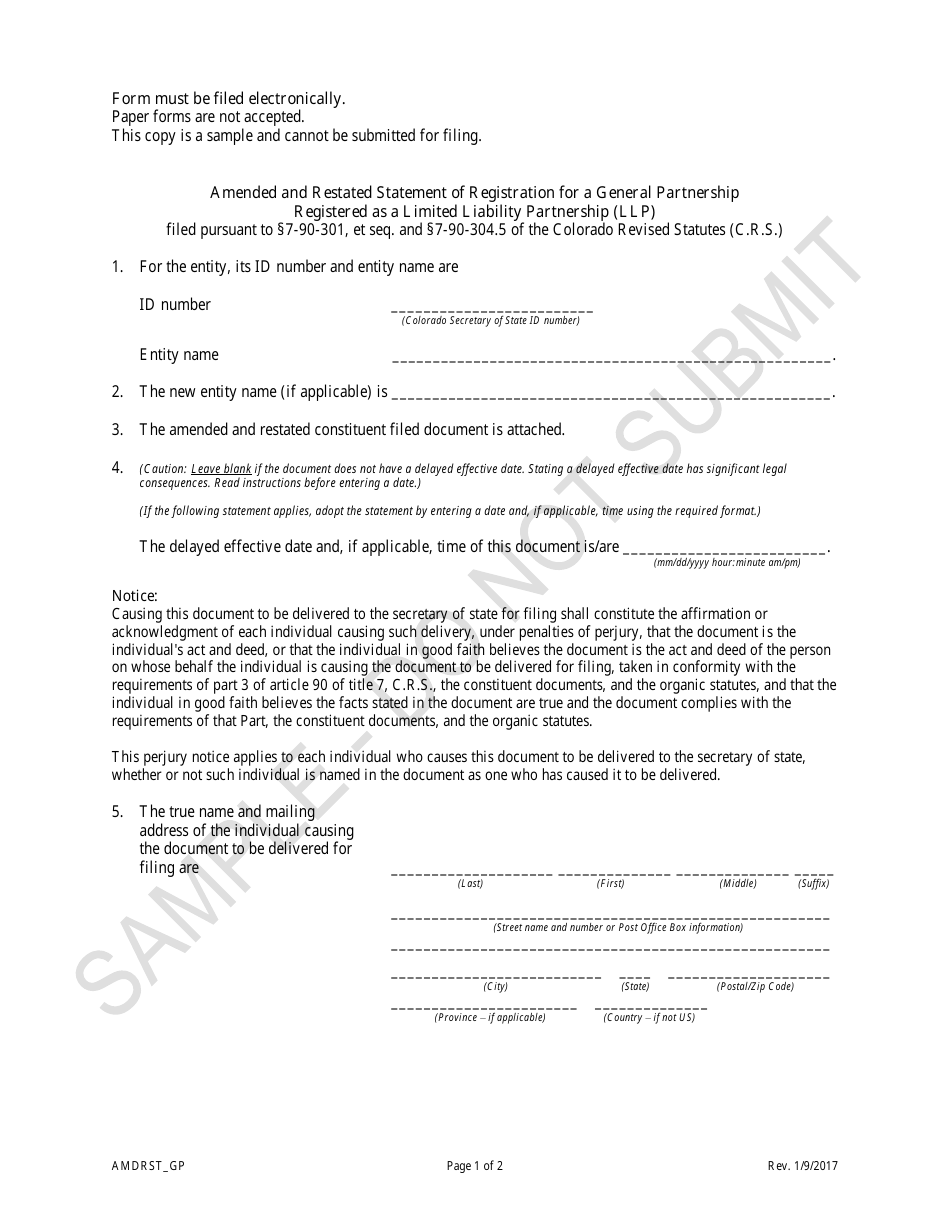

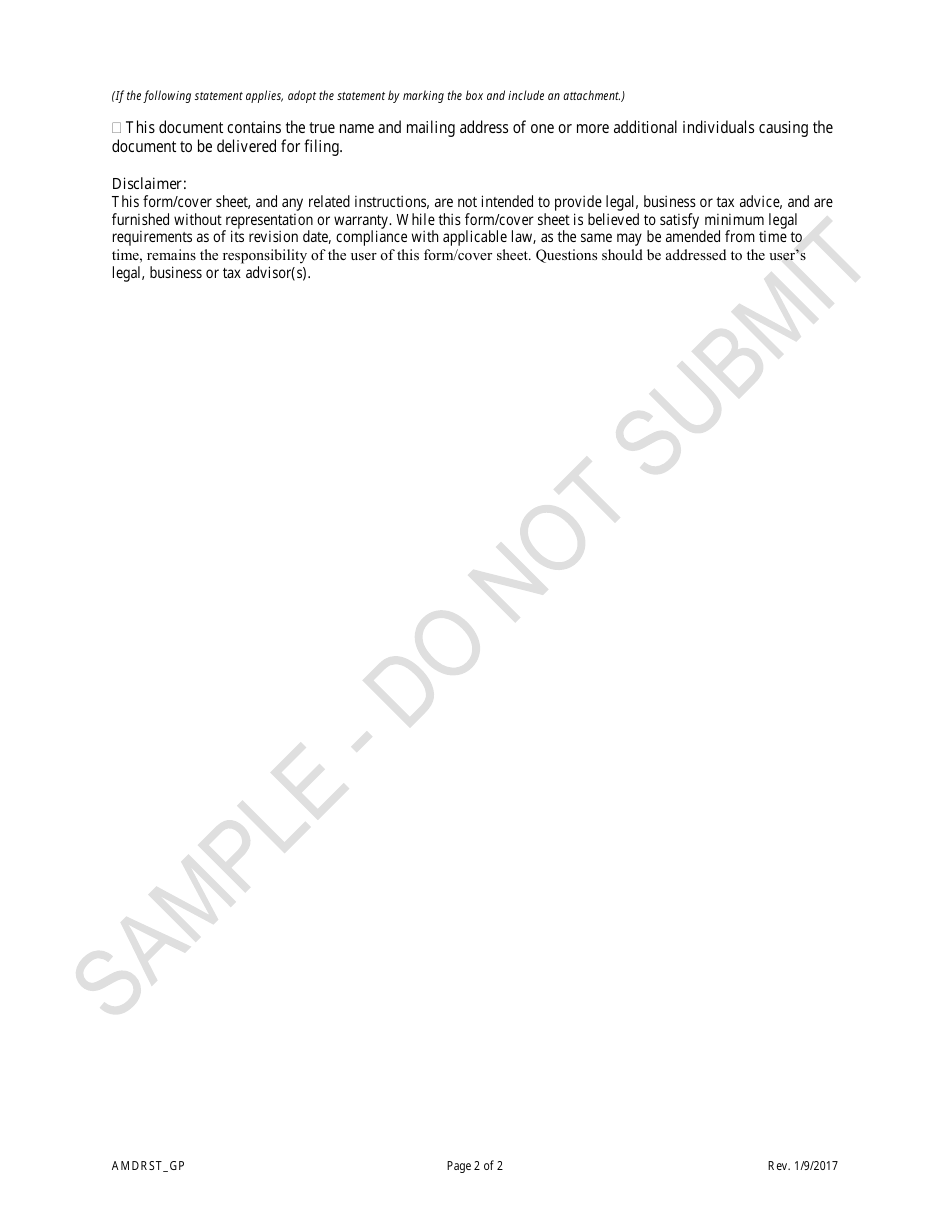

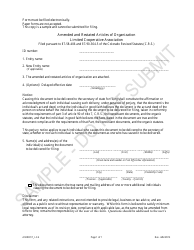

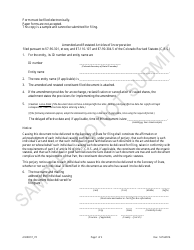

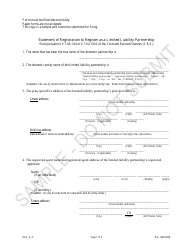

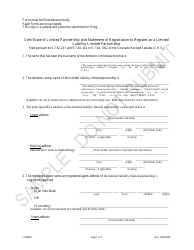

Amended and Restated Statement of Registration for a General Partnership Registered as a Limited Liability Partnership (LLP ) - Sample - Colorado

Amended and Restated Statement of Registration for a General Partnership Registered as a Limited Liability Partnership (LLP ) - Sample is a legal document that was released by the Colorado Secretary of State - a government authority operating within Colorado.

FAQ

Q: What is the purpose of an Amended and Restated Statement of Registration?

A: The purpose of an Amended and Restated Statement of Registration is to make changes or updates to the original registration document of a general partnership registered as a Limited Liability Partnership (LLP) in Colorado.

Q: What is a general partnership?

A: A general partnership is a business structure where two or more individuals form an agreement to jointly operate a business for profit.

Q: What is a Limited Liability Partnership (LLP)?

A: A Limited Liability Partnership (LLP) is a type of partnership where the partners have limited liability, similar to shareholders in a corporation.

Q: What does it mean to amend and restate a statement of registration?

A: To amend and restate a statement of registration means to update or revise the original registration document.

Q: Who should file an Amended and Restated Statement of Registration?

A: A general partnership registered as a Limited Liability Partnership (LLP) in Colorado should file an Amended and Restated Statement of Registration to make changes or updates to their registration.

Q: What kind of changes can be made in an Amended and Restated Statement of Registration?

A: An Amended and Restated Statement of Registration can be used to make changes to the partnership's name, address, registered agent, duration, and other relevant information.

Q: What are the requirements for filing an Amended and Restated Statement of Registration?

A: The requirements for filing an Amended and Restated Statement of Registration may vary by state, but generally include submitting the updated document along with any required fees to the appropriate state agency.

Q: What are the benefits of registering as a Limited Liability Partnership (LLP)?

A: Registering as a Limited Liability Partnership (LLP) provides the partners with limited liability, meaning their personal assets are protected in case of business debts or liabilities.

Q: What other documents might be required for a general partnership registered as an LLP?

A: Other documents that may be required for a general partnership registered as an LLP include partnership agreements, tax forms, and relevant licenses or permits, depending on the nature of the business.

Form Details:

- Released on January 9, 2017;

- The latest edition currently provided by the Colorado Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.