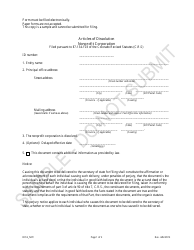

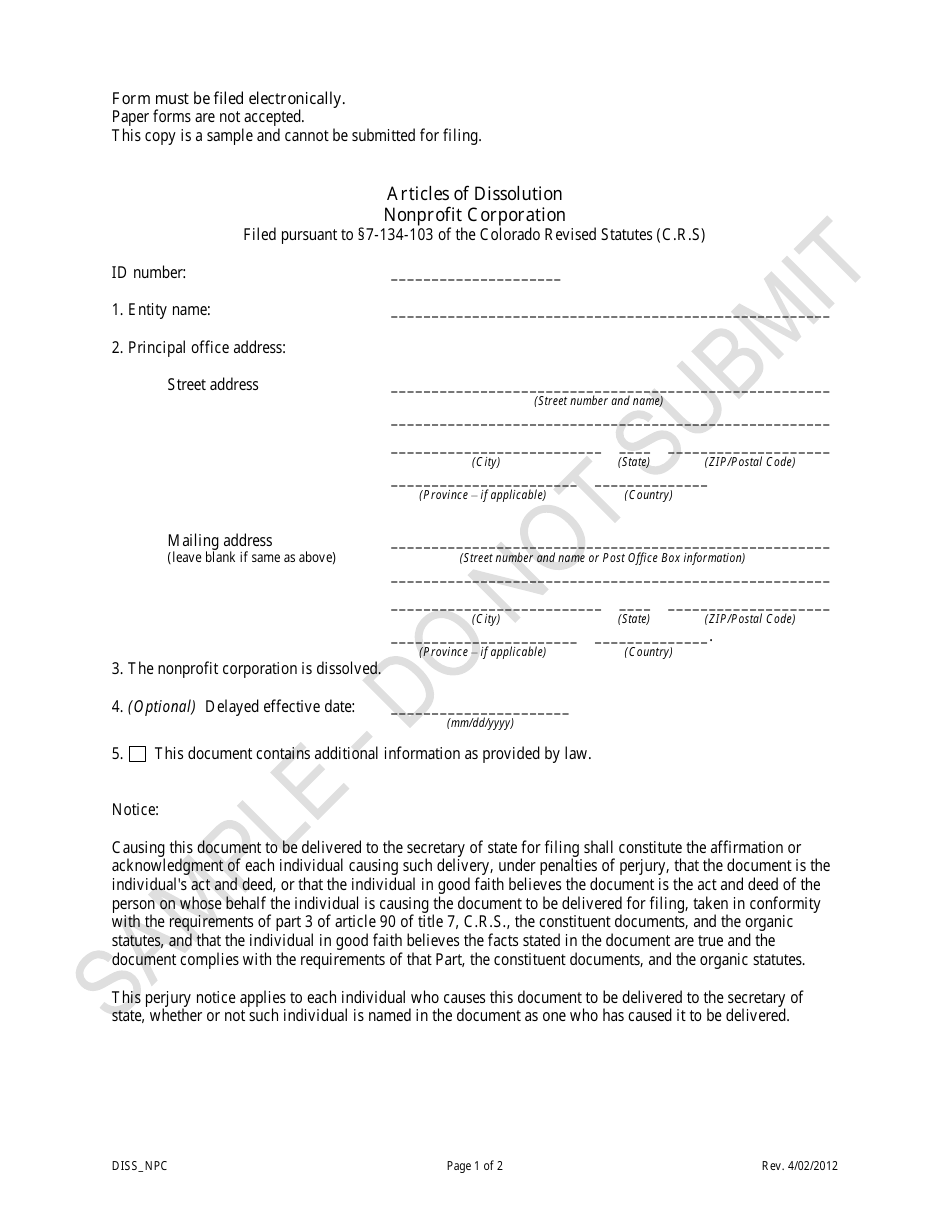

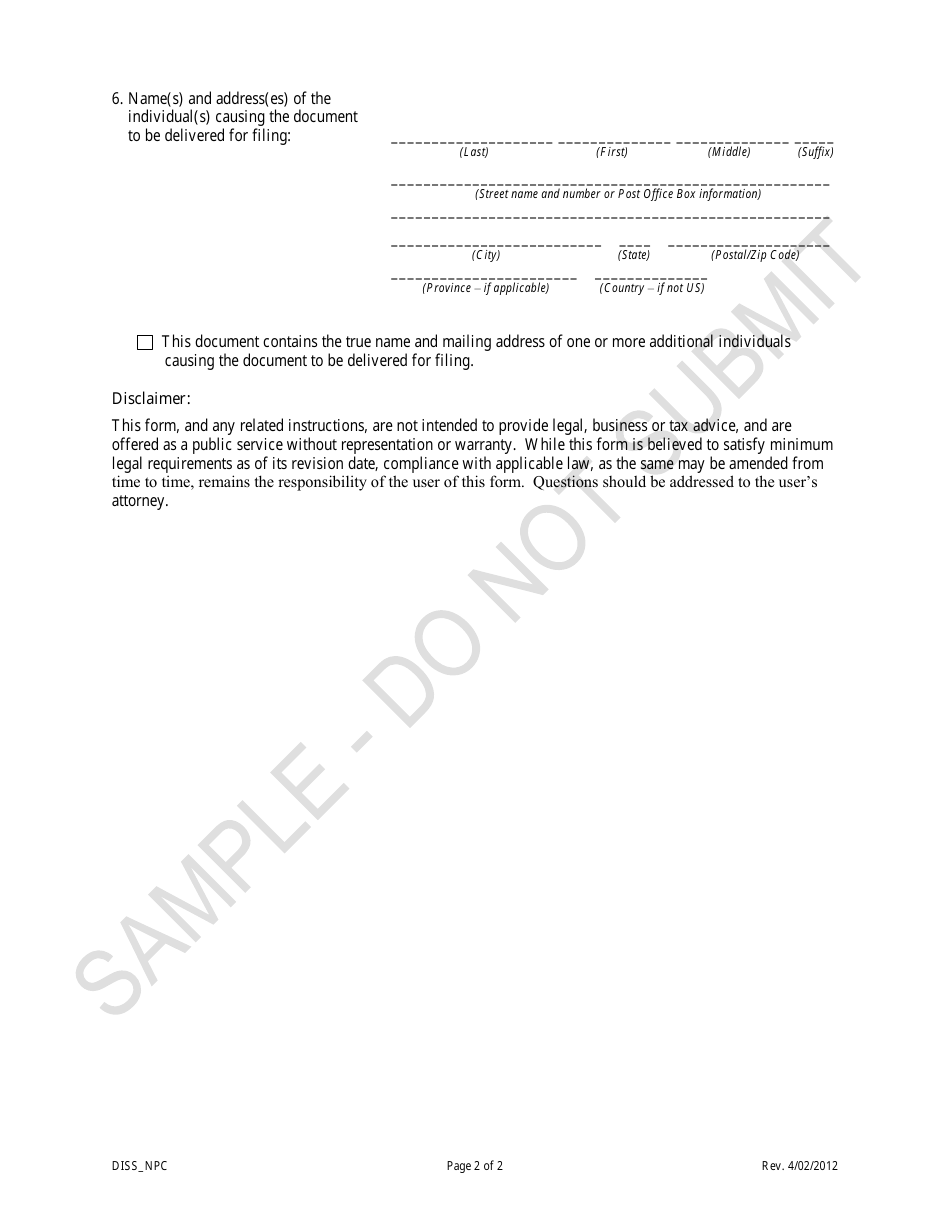

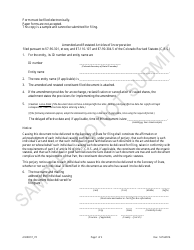

Articles of Dissolution - Nonprofit Corporations - Sample - Colorado

Articles of Dissolution - Nonprofit Corporations - Sample is a legal document that was released by the Colorado Secretary of State - a government authority operating within Colorado.

FAQ

Q: What are Articles of Dissolution?

A: Articles of Dissolution are legal documents that officially terminate the existence of a nonprofit corporation.

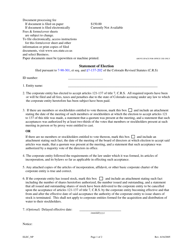

Q: Who can file Articles of Dissolution for a nonprofit corporation?

A: The Articles of Dissolution can be filed by the board of directors or the incorporators of the nonprofit corporation.

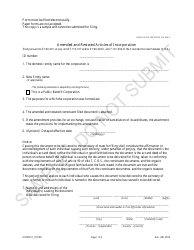

Q: What information is required in the Articles of Dissolution?

A: The Articles of Dissolution typically require the name of the nonprofit corporation, the reasons for dissolution, and a statement that all debts and obligations have been paid.

Q: Is there a fee for filing the Articles of Dissolution?

A: Yes, there is a fee for filing the Articles of Dissolution. The fee amount may vary, so it is recommended to check with the Colorado Secretary of State for the current fee schedule.

Q: What happens after the Articles of Dissolution are filed?

A: Once the Articles of Dissolution are filed and approved, the nonprofit corporation's legal existence is officially terminated.

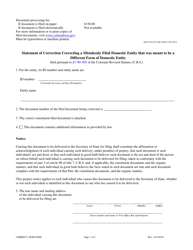

Q: Are there any ongoing obligations after filing the Articles of Dissolution?

A: After filing the Articles of Dissolution, the nonprofit corporation is generally no longer required to file annual reports or maintain its corporate status in Colorado.

Q: Can a dissolved nonprofit corporation be revived or reinstated in the future?

A: Yes, it is possible to revive or reinstate a dissolved nonprofit corporation in Colorado, but specific requirements and procedures will need to be followed.

Form Details:

- Released on April 2, 2012;

- The latest edition currently provided by the Colorado Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.