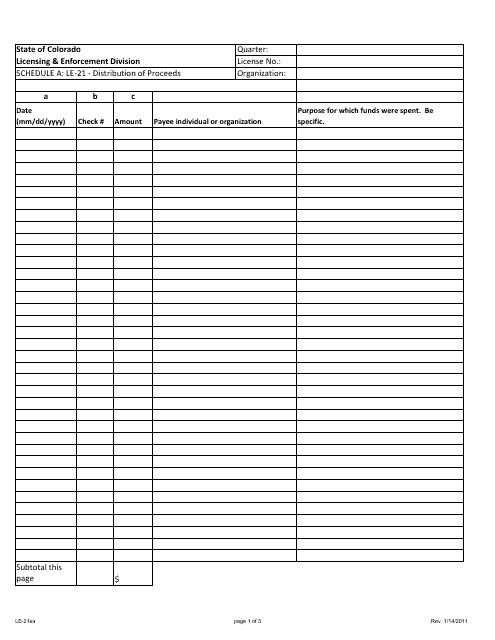

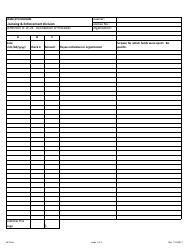

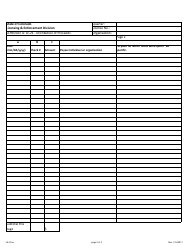

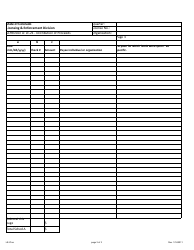

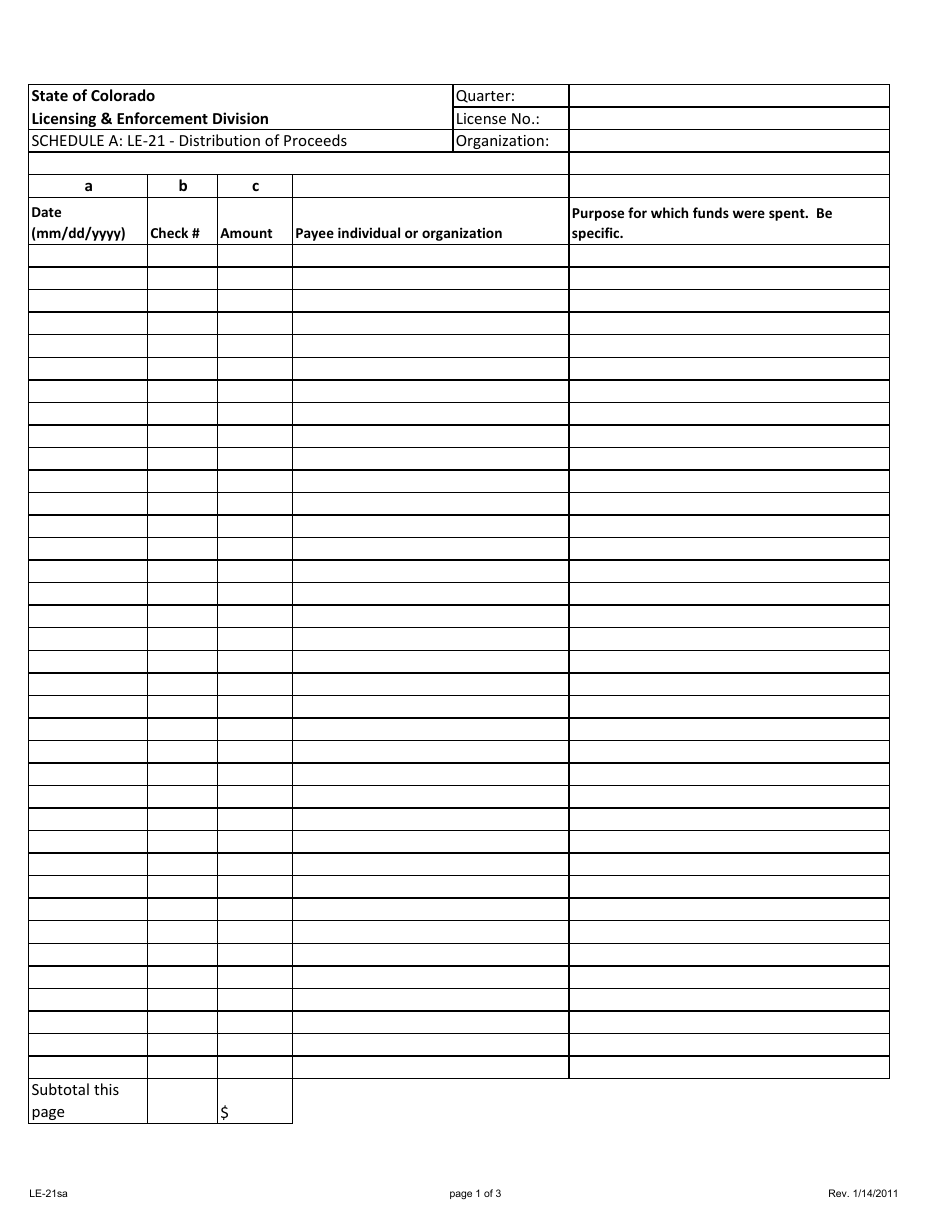

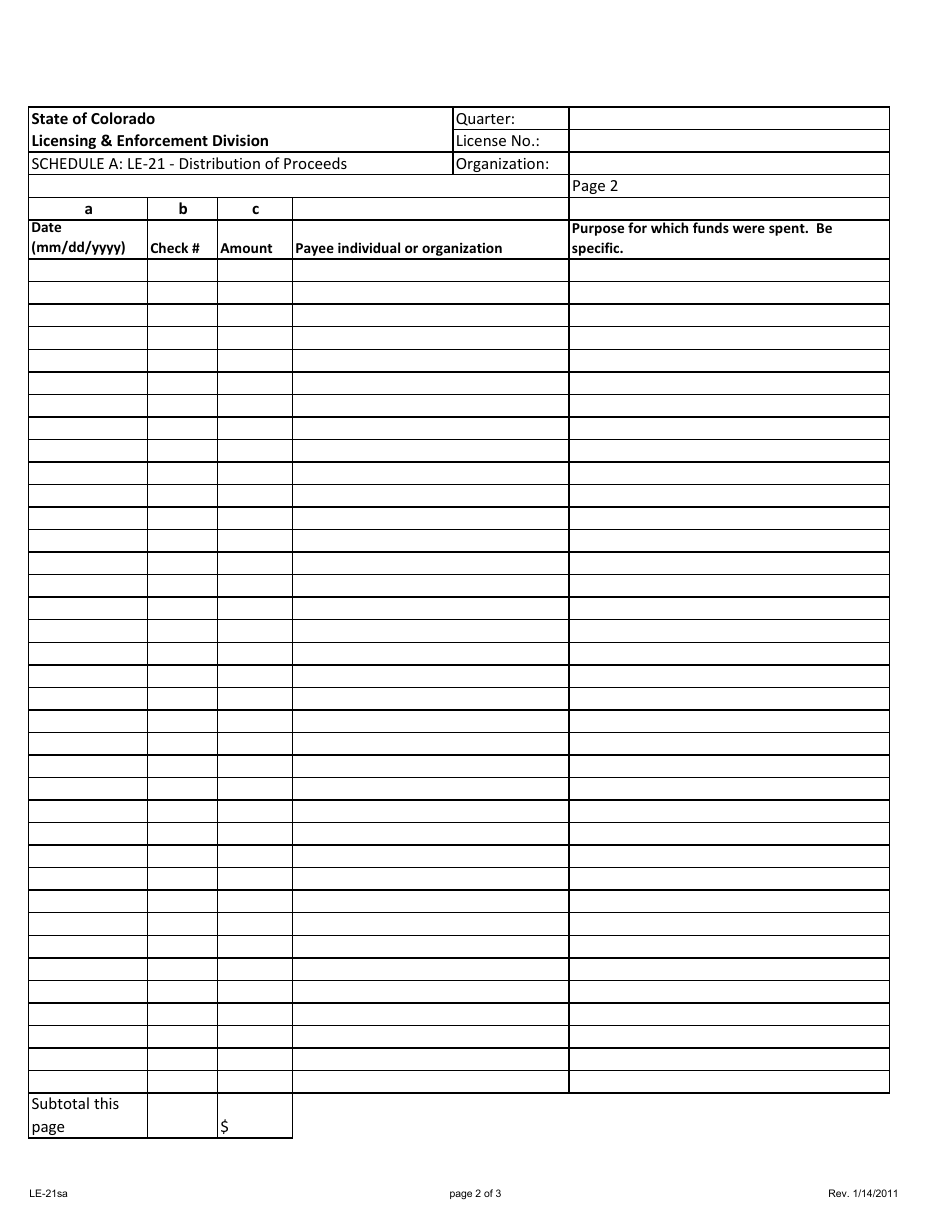

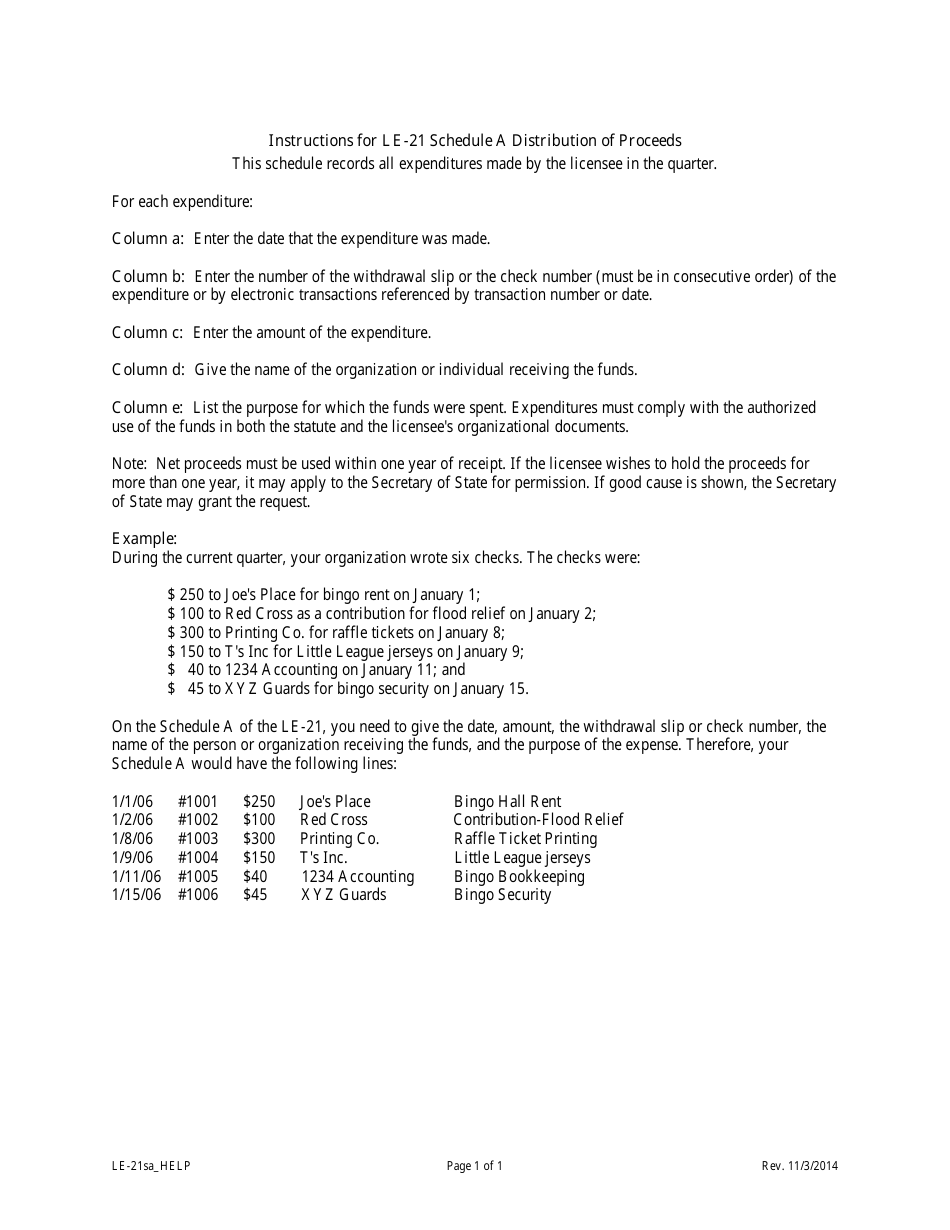

Form LE-21 Schedule A Distribution of Proceeds - Colorado

What Is Form LE-21 Schedule A?

This is a legal form that was released by the Colorado Secretary of State - a government authority operating within Colorado.The document is a supplement to Form LE-21, Quarterly Report. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LE-21?

A: Form LE-21 is a schedule used to report the distribution of proceeds in Colorado.

Q: Who needs to file Form LE-21?

A: Anyone who is involved in a transaction that requires the distribution of proceeds in Colorado needs to file Form LE-21.

Q: What is the purpose of Form LE-21?

A: The purpose of Form LE-21 is to provide a detailed breakdown of how the proceeds from a transaction are distributed.

Q: What information is required on Form LE-21?

A: Form LE-21 requires information such as the names and addresses of the parties involved in the transaction, a description of the property, and the amount of proceeds distributed to each party.

Q: When is Form LE-21 due?

A: Form LE-21 is typically due at the time of closing or within a specified timeframe set by the Colorado Real Estate Commission.

Q: Are there any filing fees for Form LE-21?

A: There are no specific filing fees associated with Form LE-21, but there may be other fees associated with the transaction itself.

Q: What happens if I don't file Form LE-21?

A: Failure to file Form LE-21 in a timely manner can result in penalties or fines imposed by the Colorado Real Estate Commission.

Form Details:

- Released on January 14, 2011;

- The latest edition provided by the Colorado Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LE-21 Schedule A by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.