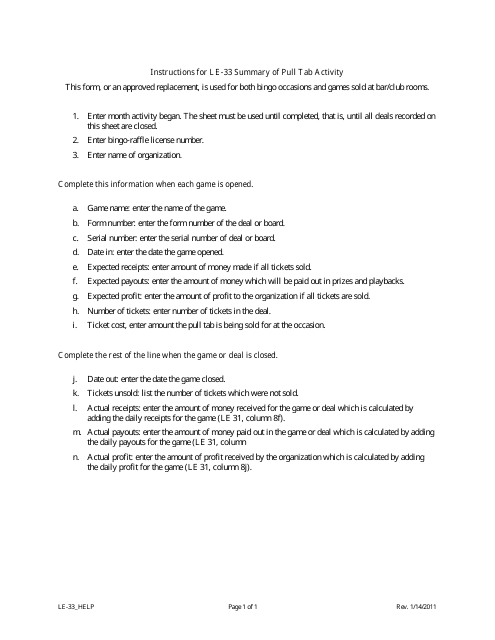

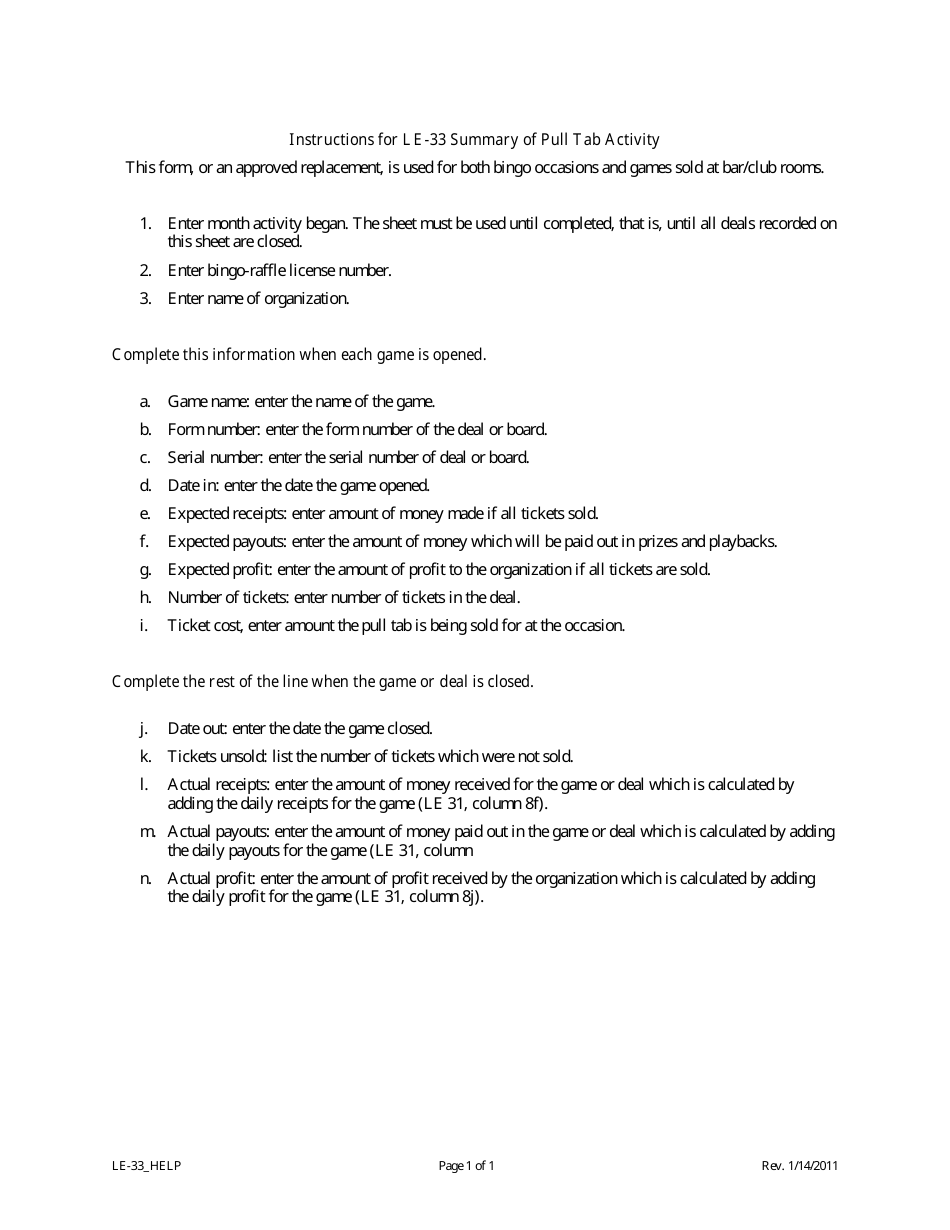

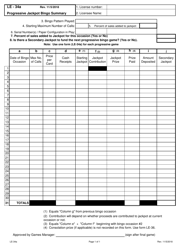

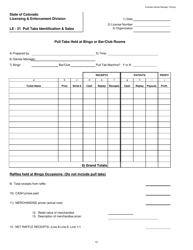

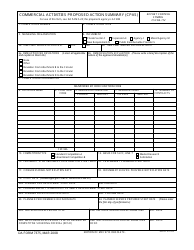

Instructions for Form LE-33 Summary of Pull-Tab Activity - Colorado

This document contains official instructions for Form LE-33 , Summary of Pull-Tab Activity - a form released and collected by the Colorado Secretary of State. An up-to-date fillable Form LE-33 is available for download through this link.

FAQ

Q: What is Form LE-33?

A: Form LE-33 is a summary of pull-tab activity form used in Colorado.

Q: Who needs to fill out Form LE-33?

A: Any organization or individual that conducts pull-tab activity in Colorado.

Q: What is pull-tab activity?

A: Pull-tab activity refers to the sale of pull-tabs, which are small tickets with perforated tabs that can be pulled to reveal potential prizes.

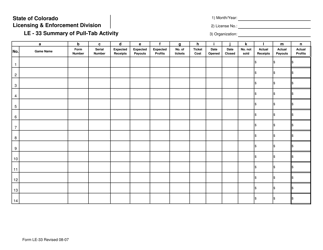

Q: What information is required on Form LE-33?

A: Form LE-33 requires the organization's name, address, federal employer identification number (FEIN), pull-tab gross receipts, and other related information.

Q: When is Form LE-33 due?

A: Form LE-33 is due annually, by the 15th day of the fourth month following the end of the organization's fiscal year.

Q: Are there any penalties for not filing Form LE-33?

A: Yes, failure to file Form LE-33 or filing it late can lead to penalties and interest charges.

Q: Is there a fee for filing Form LE-33?

A: No, there is no fee for filing Form LE-33.

Q: What should I do if I have questions about Form LE-33?

A: If you have questions about Form LE-33, you can contact the Colorado Department of Revenue for assistance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Colorado Secretary of State.