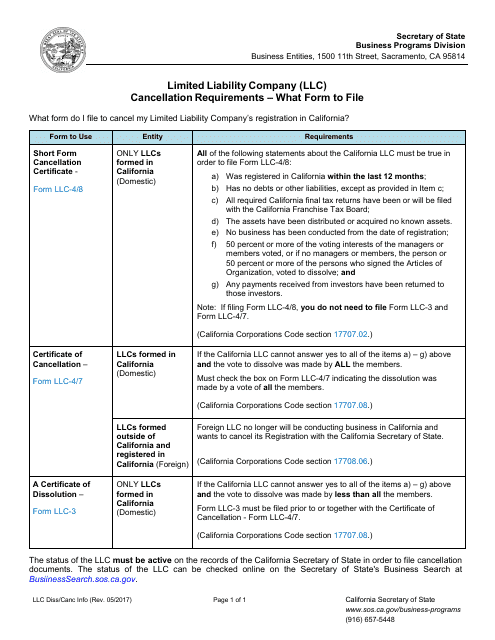

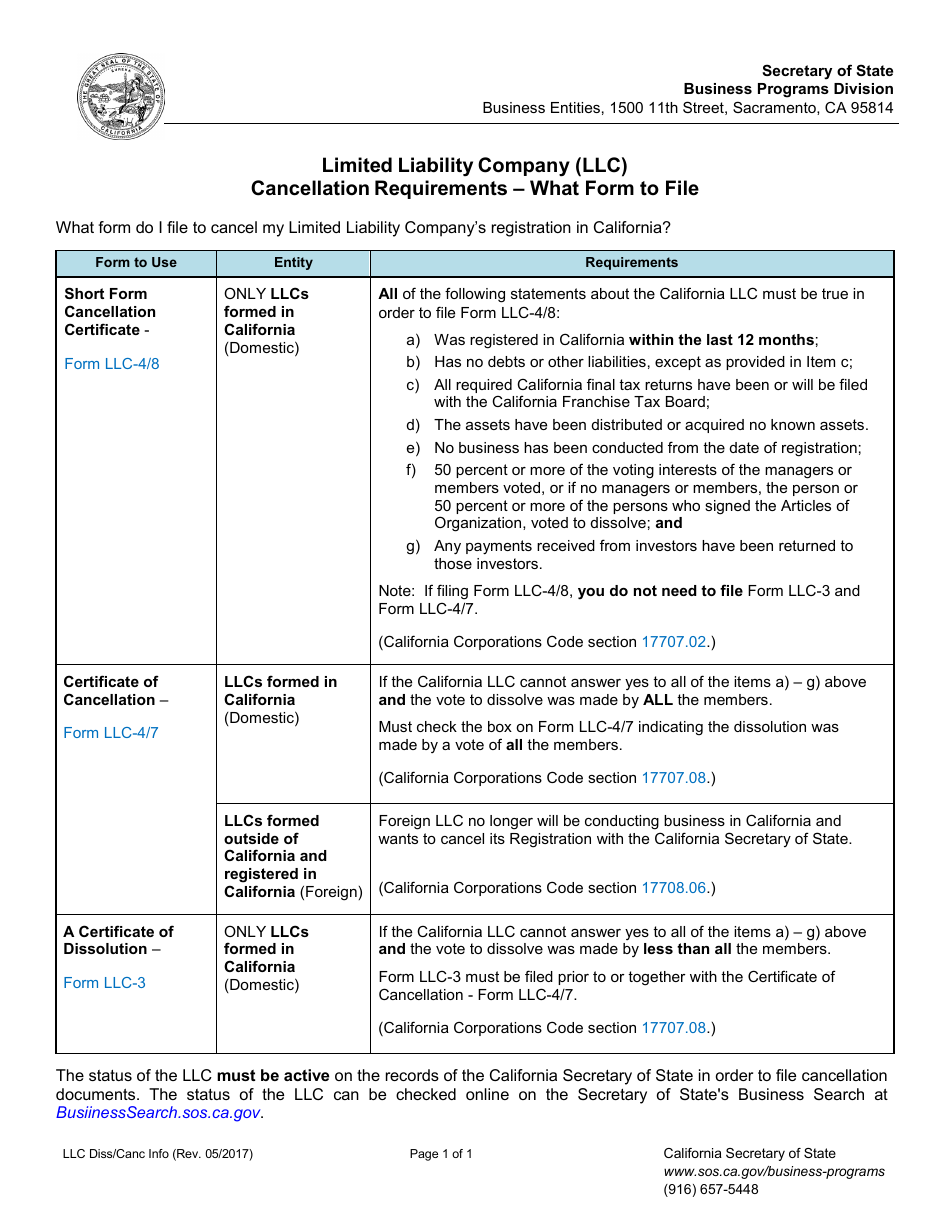

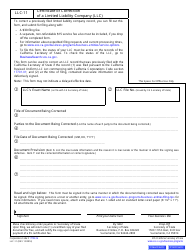

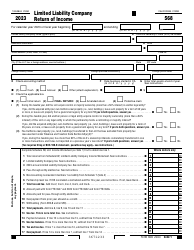

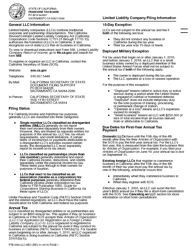

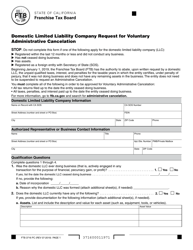

Form LLC-4 / 8 Short Form Cancellation Certificate - California

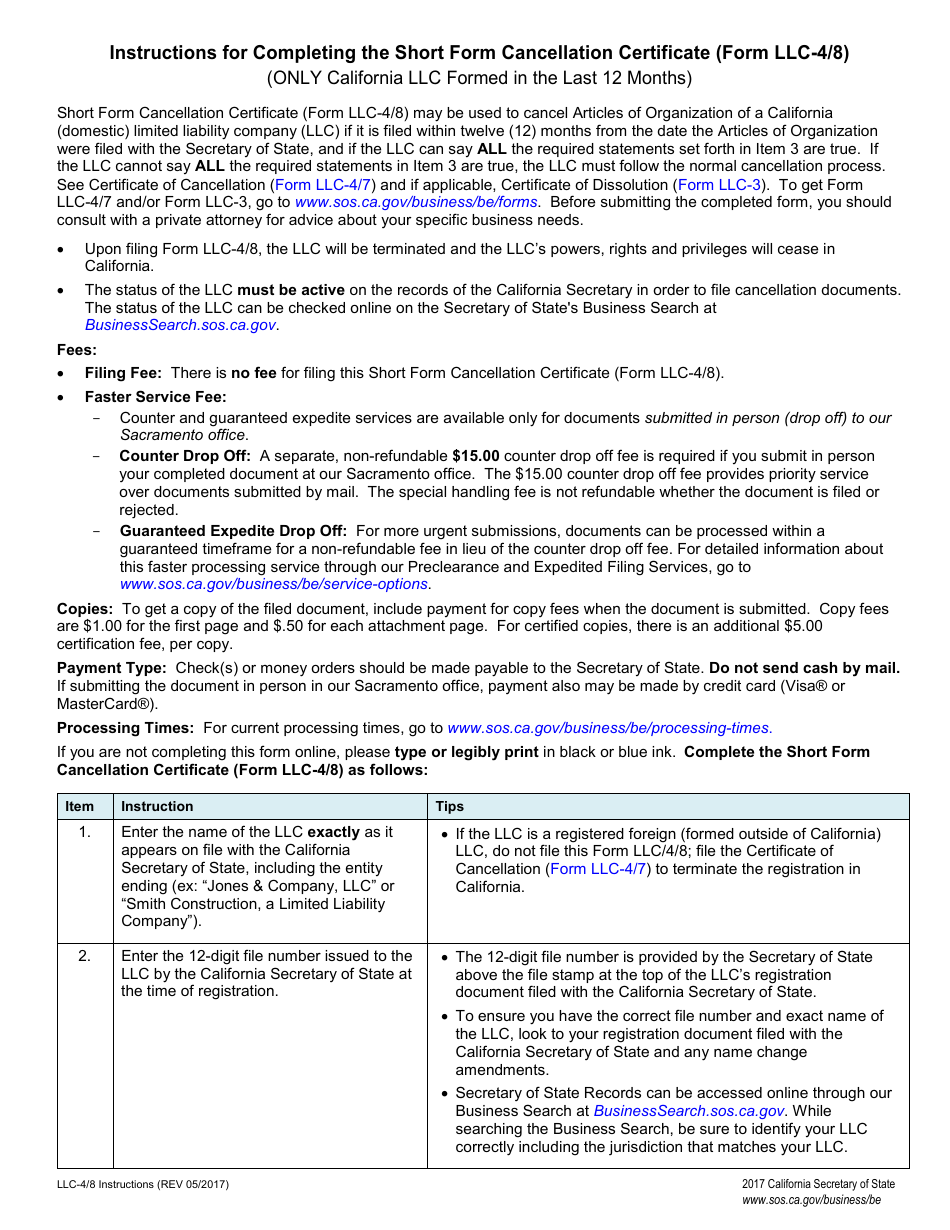

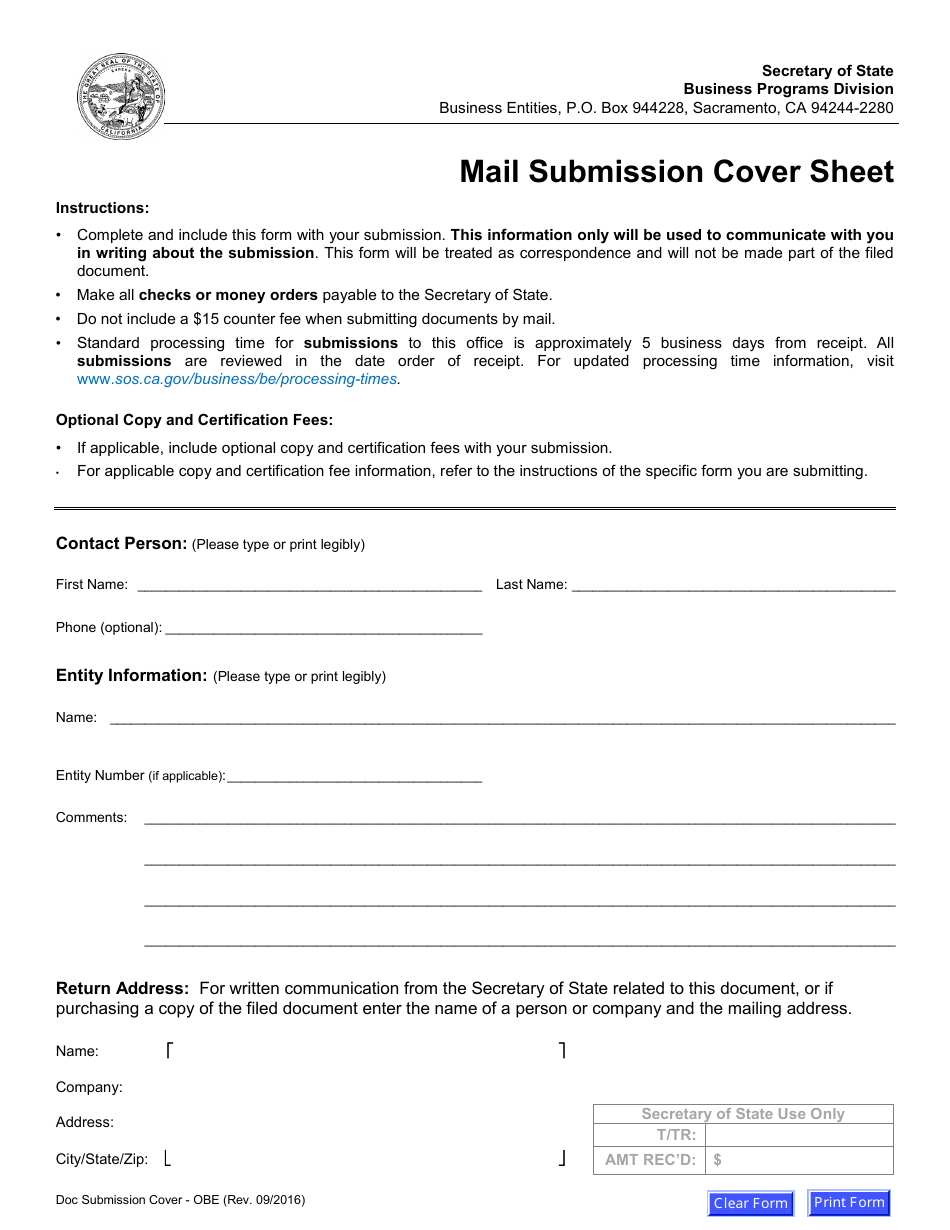

What Is Form LLC-4/8?

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LLC-4/8?

A: Form LLC-4/8 is a short form cancellation certificate used in California.

Q: What is the purpose of Form LLC-4/8?

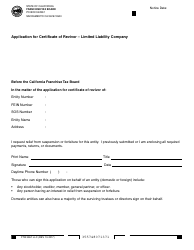

A: The purpose of Form LLC-4/8 is to officially cancel a limited liability company (LLC) in California.

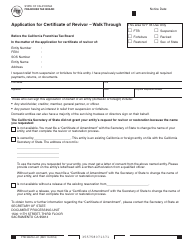

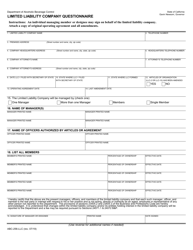

Q: Who can use Form LLC-4/8?

A: Form LLC-4/8 can be used by the members or managers of an LLC in California to cancel the LLC.

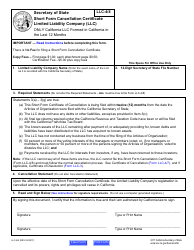

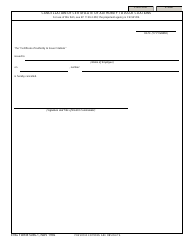

Q: What information is required on Form LLC-4/8?

A: Form LLC-4/8 requires information about the LLC, including its name, address, and the date of cancellation.

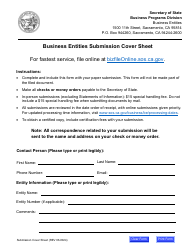

Q: Are there any fees associated with filing Form LLC-4/8?

A: Yes, there is a filing fee associated with submitting Form LLC-4/8.

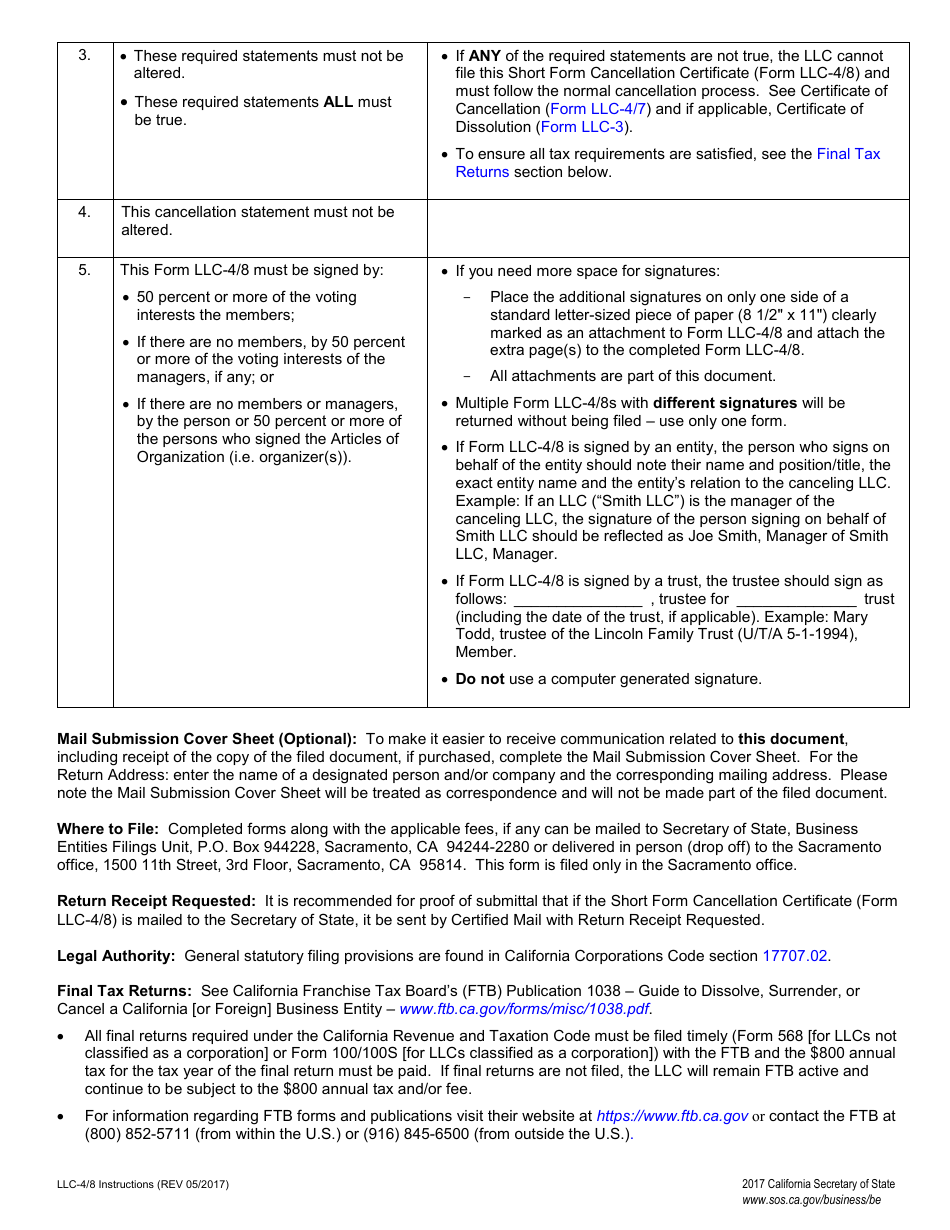

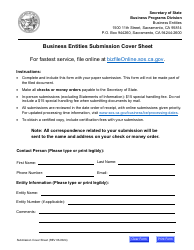

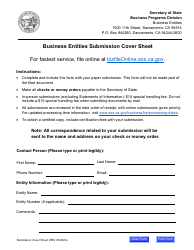

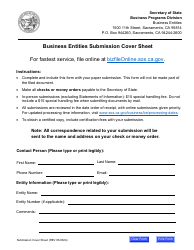

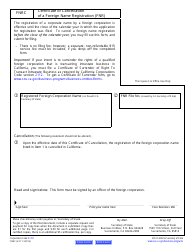

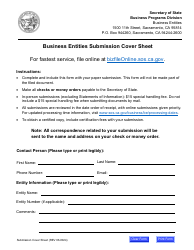

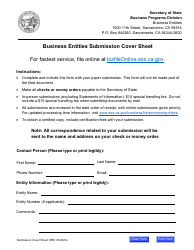

Q: How do I submit Form LLC-4/8?

A: Form LLC-4/8 can be submitted by mail or in person to the California Secretary of State's office.

Q: Is there a deadline for filing Form LLC-4/8?

A: There is no specific deadline for filing Form LLC-4/8, but it is recommended to file it as soon as possible after the LLC has been cancelled.

Q: What happens after I submit Form LLC-4/8?

A: Once Form LLC-4/8 is processed and approved, the LLC will be officially cancelled in California.

Q: Can I withdraw my LLC cancellation after submitting Form LLC-4/8?

A: No, once Form LLC-4/8 is submitted and processed, the cancellation of the LLC cannot be reversed.

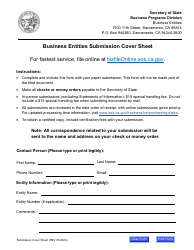

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLC-4/8 by clicking the link below or browse more documents and templates provided by the California Secretary of State.