This version of the form is not currently in use and is provided for reference only. Download this version of

Form RST MU-GS

for the current year.

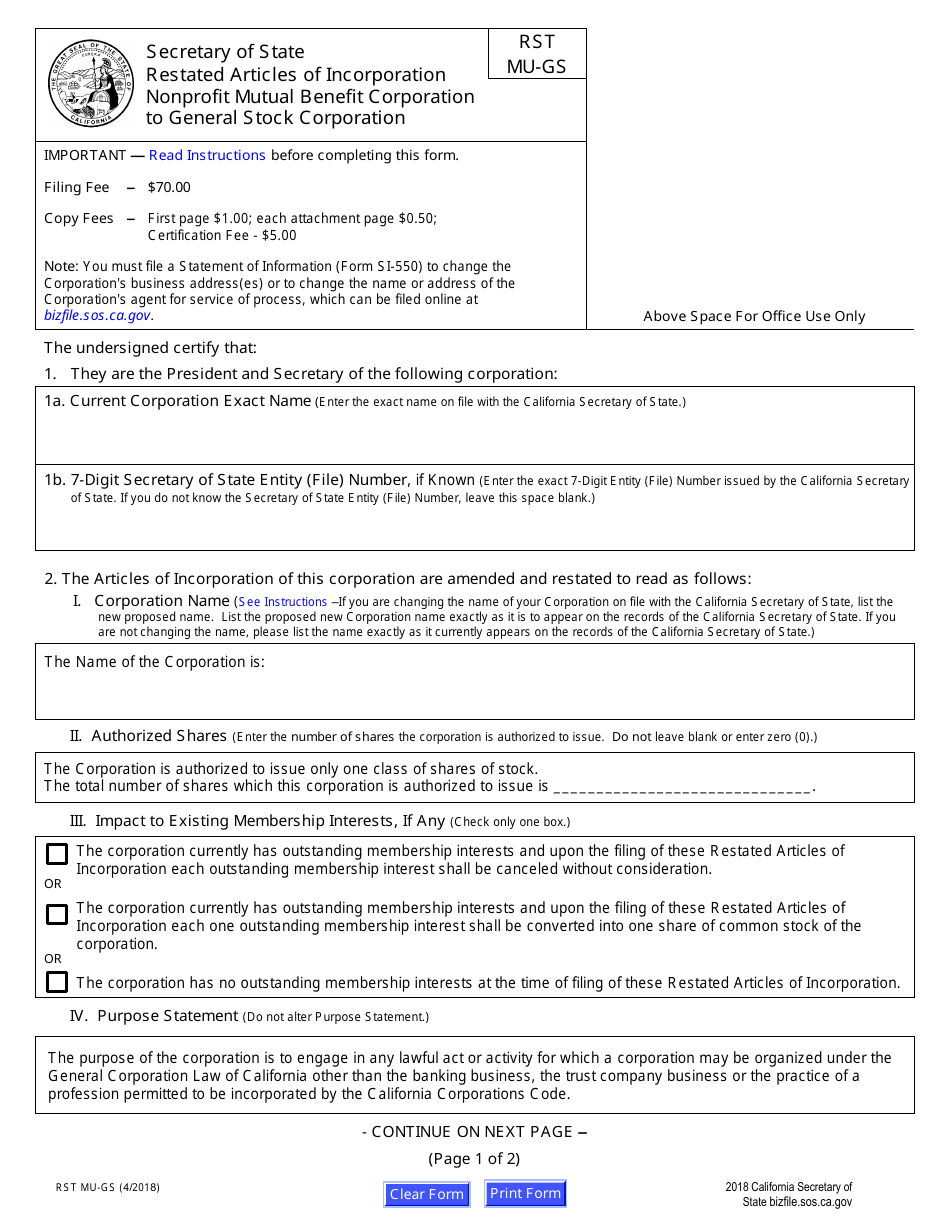

Form RST MU-GS Restated Articles of Incorporation - Nonprofit Mutual Benefit Corporation to General Stock Corporation - California

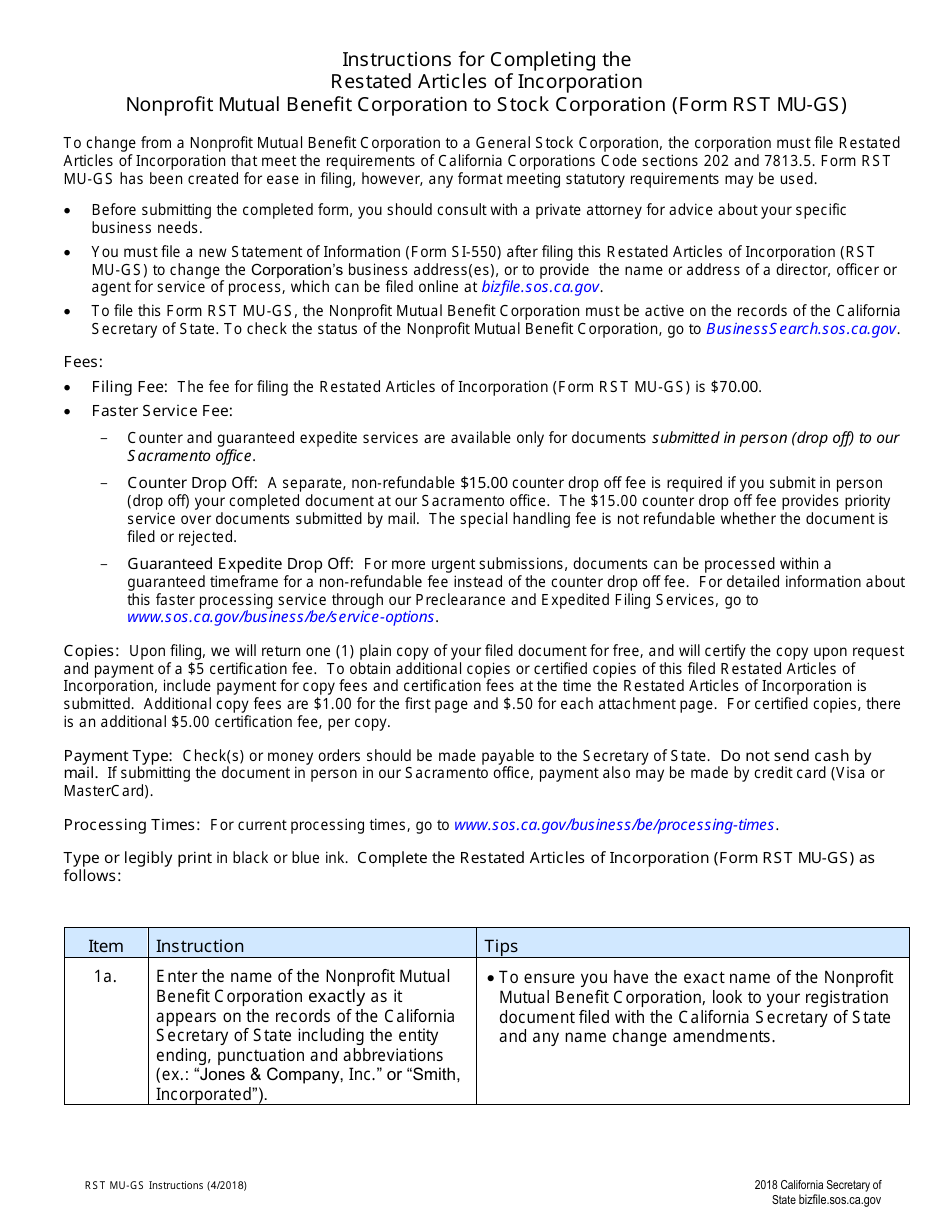

What Is Form RST MU-GS?

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an RST MU-GS Restated Articles of Incorporation?

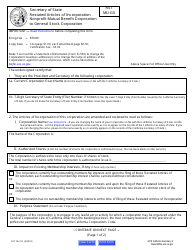

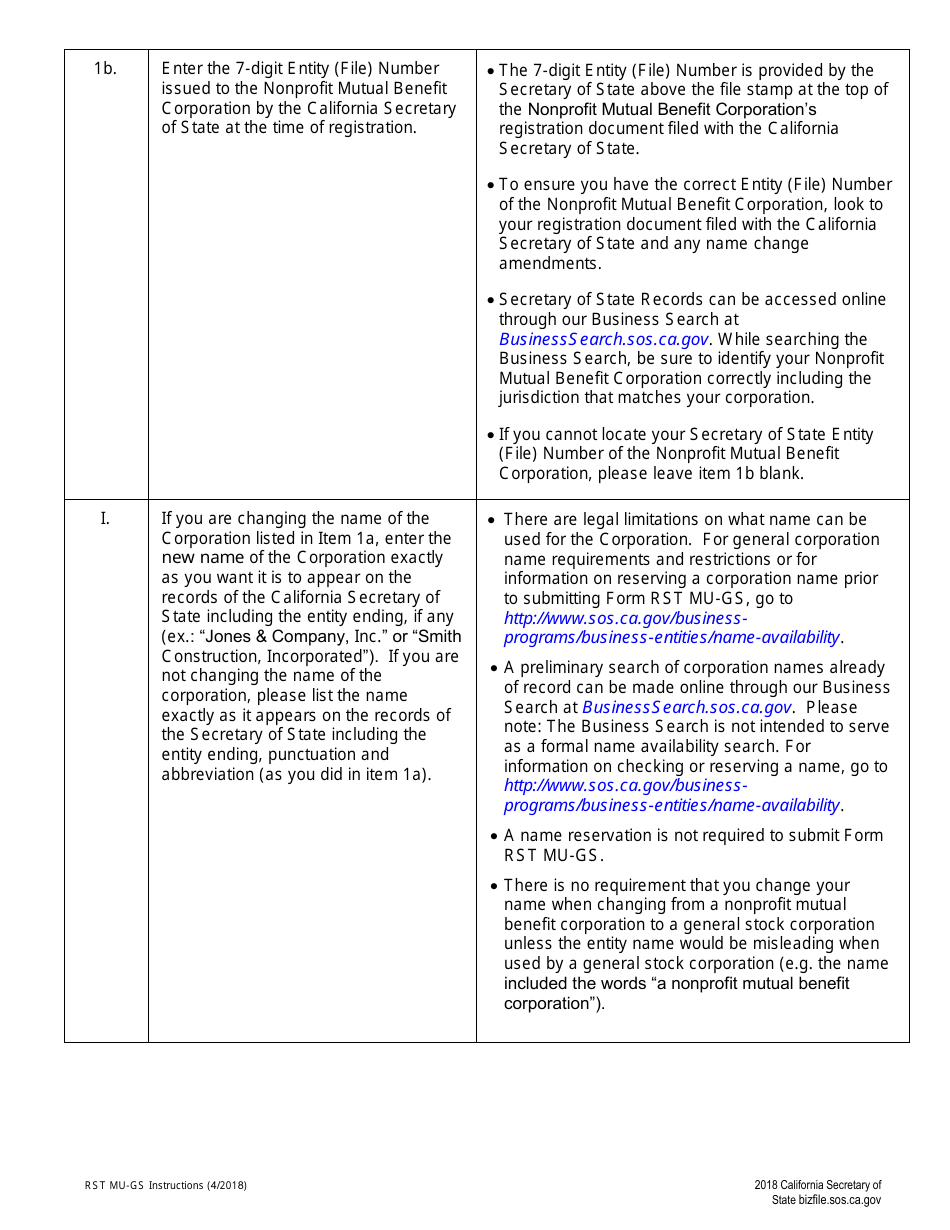

A: An RST MU-GS Restated Articles of Incorporation is a legal document that amends and restates the original articles of incorporation of a nonprofit mutual benefit corporation to convert it into a general stock corporation.

Q: What is a nonprofit mutual benefit corporation?

A: A nonprofit mutual benefit corporation is a type of organization that operates for the benefit of its members or a specific group of people, rather than to make a profit.

Q: What is a general stock corporation?

A: A general stock corporation is a business entity that is owned by shareholders and operates with the primary goal of making a profit.

Q: Why would a nonprofit mutual benefit corporation convert to a general stock corporation?

A: There are several reasons why a nonprofit mutual benefit corporation might choose to convert to a general stock corporation, including the desire to raise capital through the sale of stock or to attract investors.

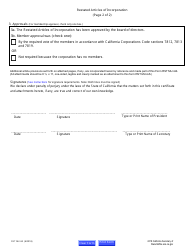

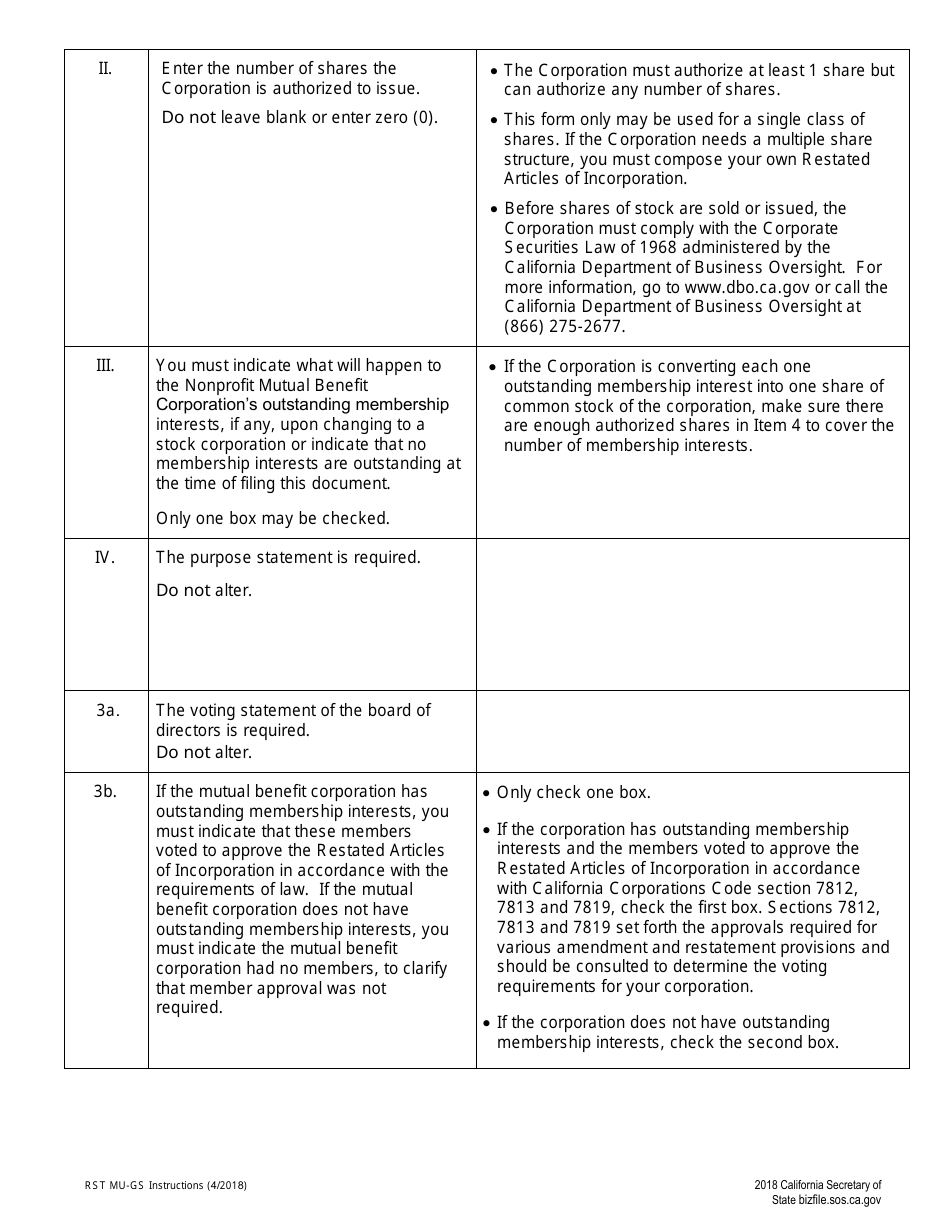

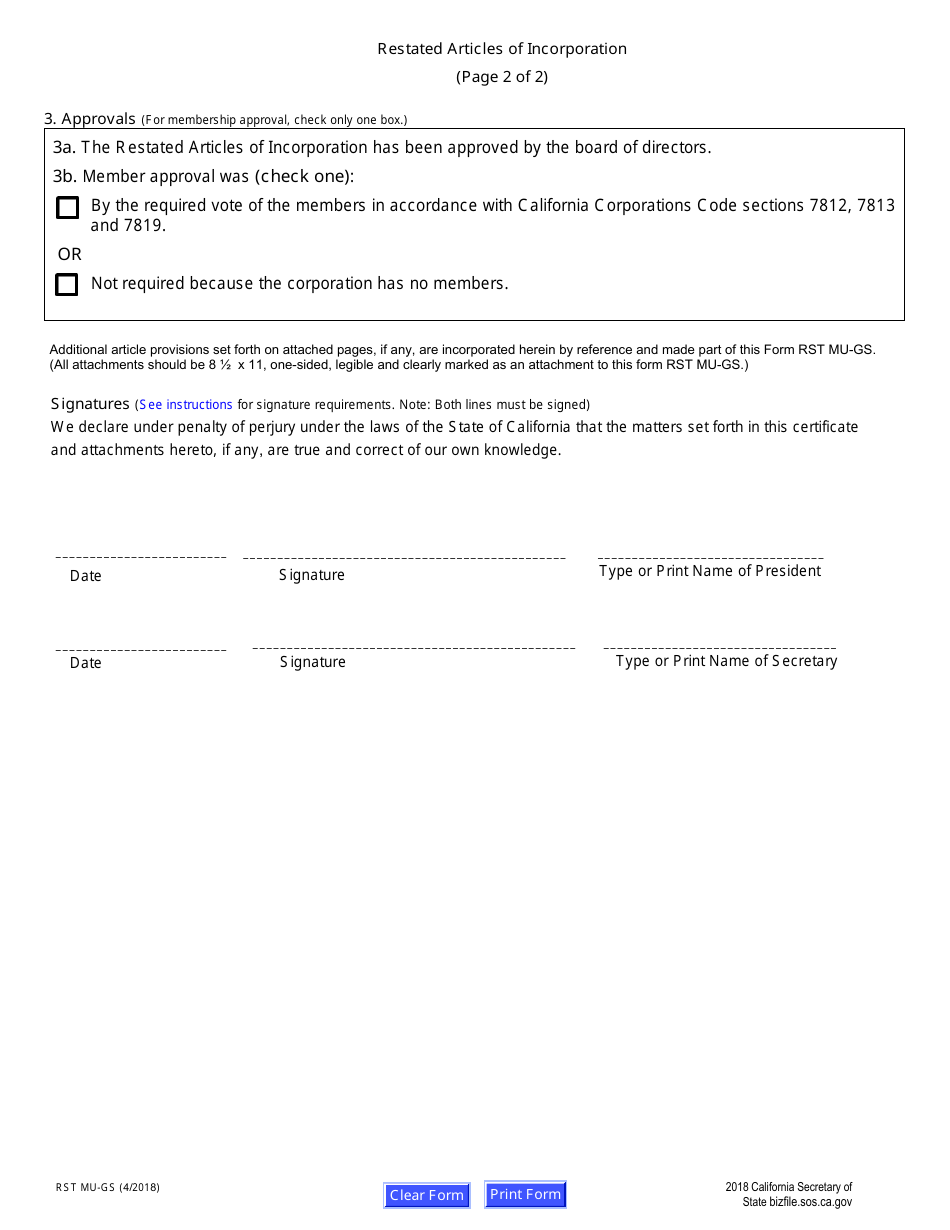

Q: What does the conversion from a nonprofit mutual benefit corporation to a general stock corporation entail?

A: The conversion typically involves amending and restating the articles of incorporation to reflect the change in corporate structure, as well as obtaining any necessary approvals and making any required filings with the state of California.

Q: What are the implications of converting to a general stock corporation?

A: Converting to a general stock corporation can have various implications, such as the ability to issue and sell stock, the need to comply with additional regulations, and a change in the company's tax status.

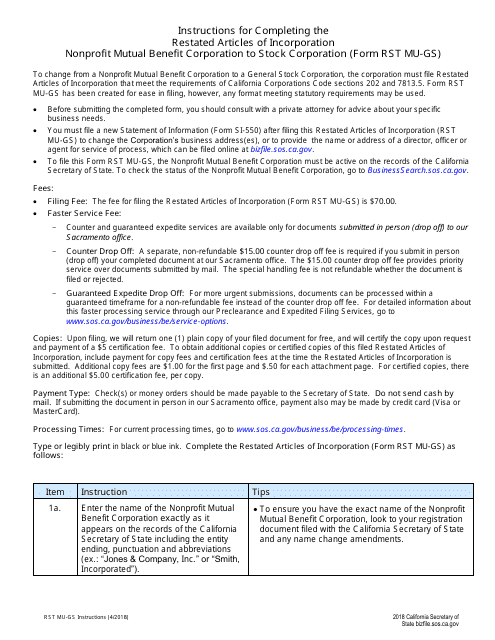

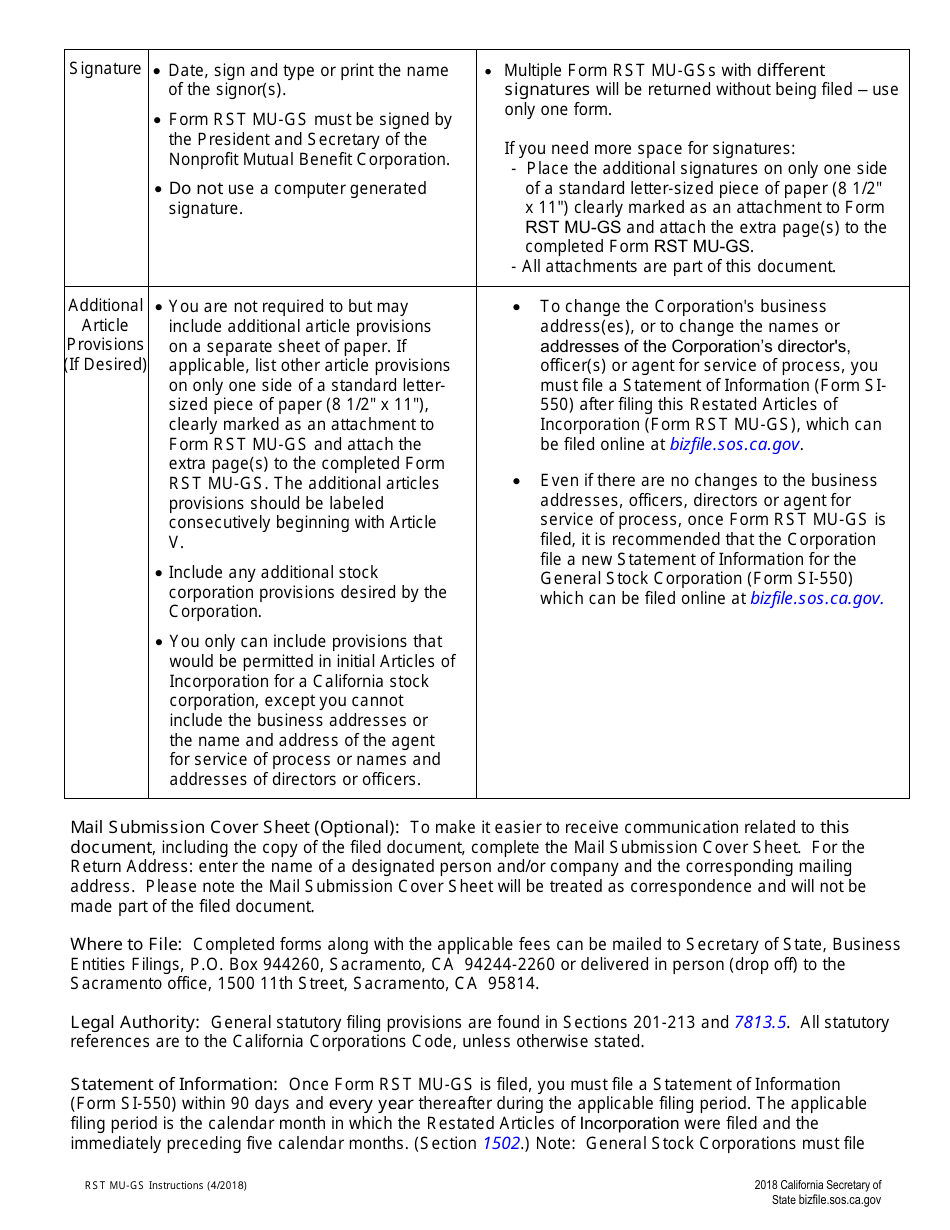

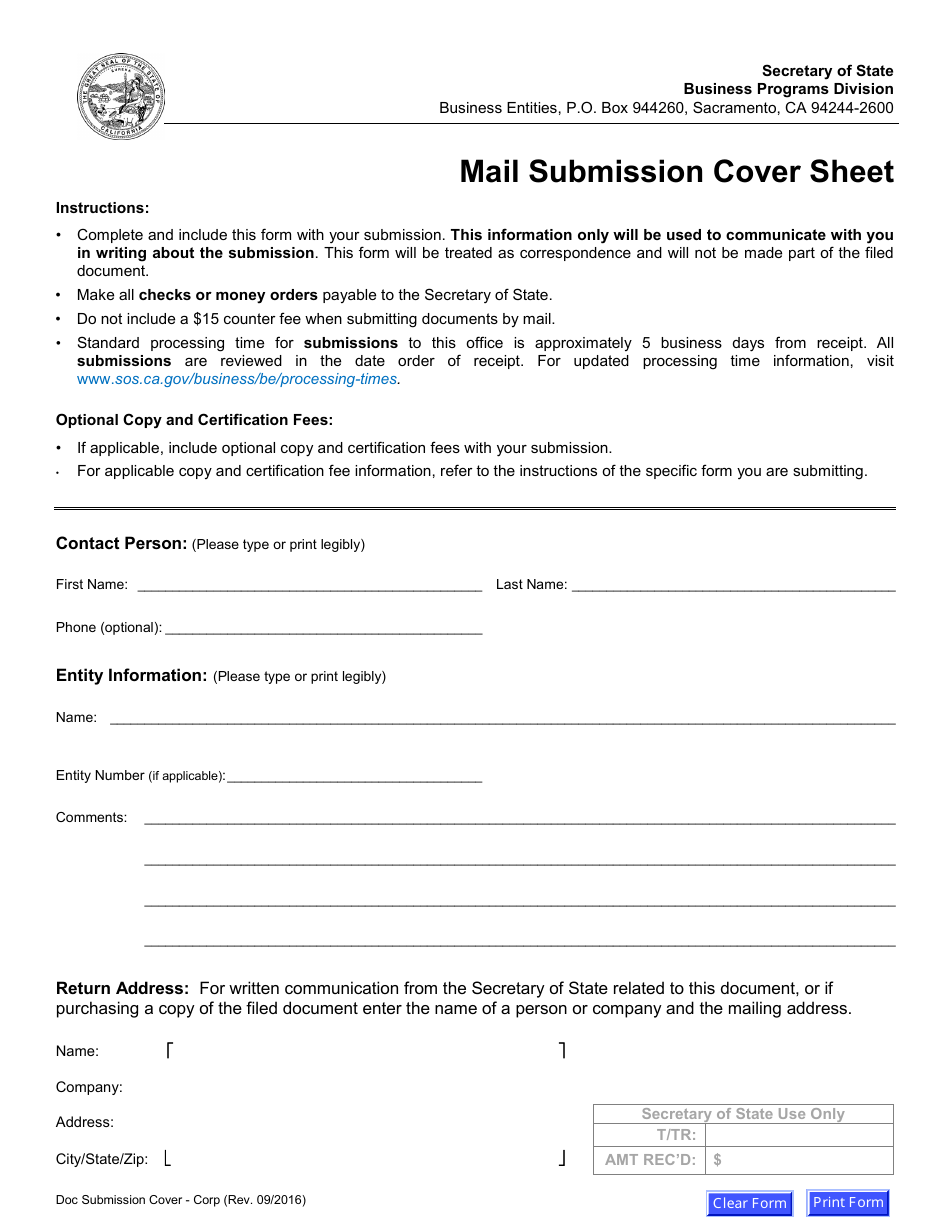

Q: What are the filing requirements for the RST MU-GS Restated Articles of Incorporation?

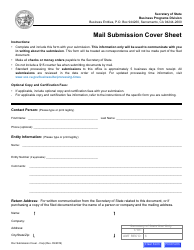

A: The filing requirements for the RST MU-GS Restated Articles of Incorporation include submitting the completed form to the California Secretary of State and paying the required filing fees.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RST MU-GS by clicking the link below or browse more documents and templates provided by the California Secretary of State.