This version of the form is not currently in use and is provided for reference only. Download this version of

Form SI-PT

for the current year.

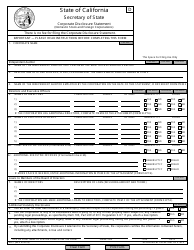

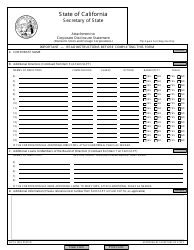

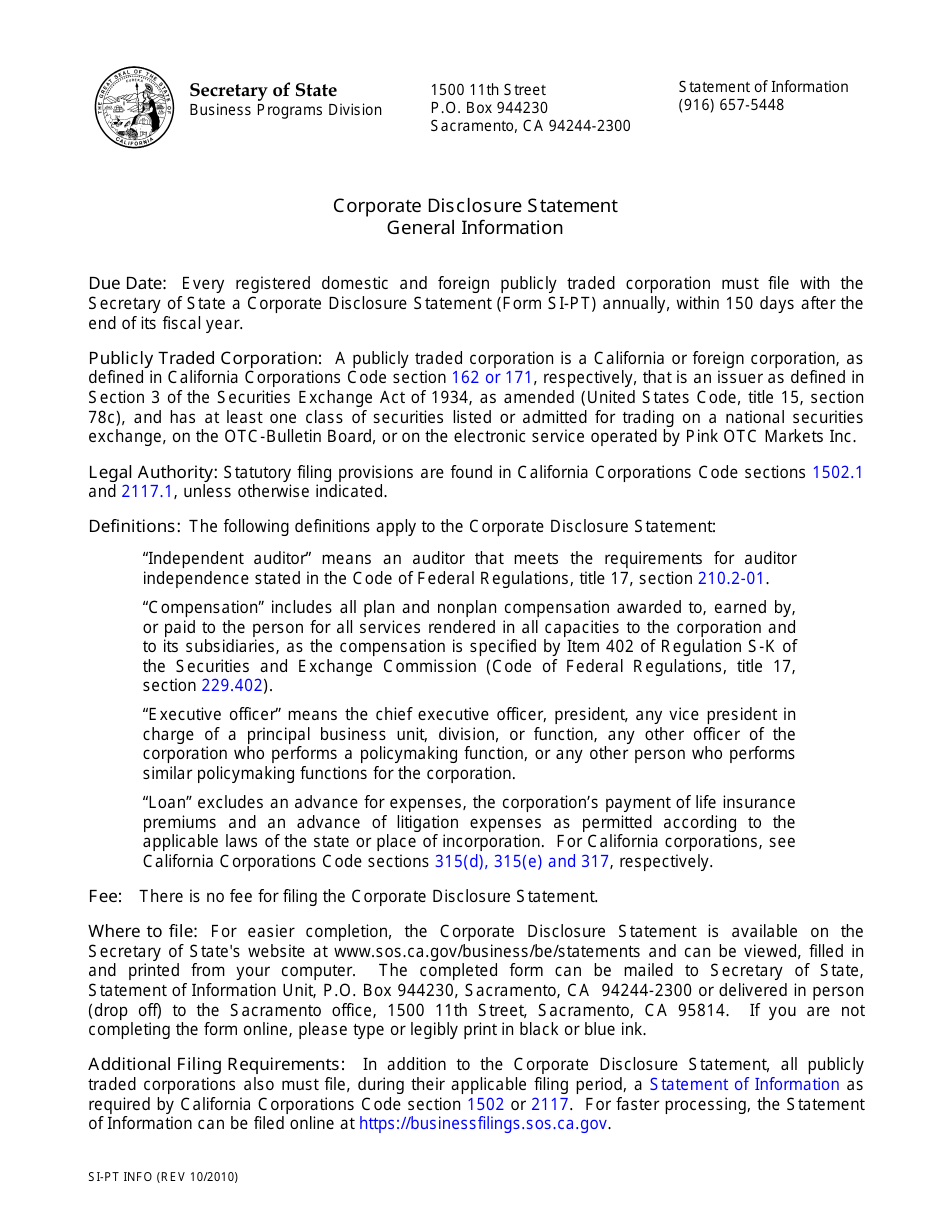

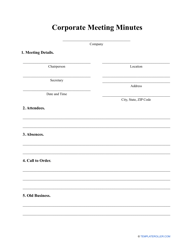

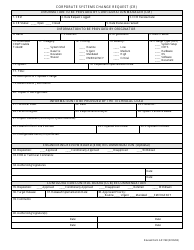

Form SI-PT Corporate Disclosure Statement (Domestic Stock and Foreign Corporations) - California

What Is Form SI-PT?

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

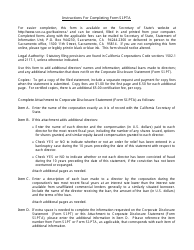

Q: What is Form SI-PT?

A: Form SI-PT is a Corporate Disclosure Statement required by the state of California for domestic stock and foreign corporations.

Q: Who needs to file Form SI-PT?

A: Domestic stock and foreign corporations operating in California are required to file Form SI-PT.

Q: What information is required in Form SI-PT?

A: Form SI-PT requires corporations to disclose basic information such as their name, address, type of business, and details of their officers and directors.

Q: When should Form SI-PT be filed?

A: Form SI-PT must be filed within 90 days of the corporation's initial registration with the California Secretary of State or within 90 days of any changes in the corporation's officers or directors.

Q: Is there a fee for filing Form SI-PT?

A: Yes, there is a filing fee associated with Form SI-PT. The fee amount may vary, so it's best to check with the California Secretary of State's office for the current fee schedule.

Q: What happens if I fail to file Form SI-PT?

A: Failure to file Form SI-PT may result in penalties and the corporation may lose its ability to legally operate in California.

Q: Are there any exemptions from filing Form SI-PT?

A: Certain types of corporations, such as nonprofit corporations, are exempt from filing Form SI-PT. It's best to consult with the California Secretary of State's office to determine if your corporation qualifies for an exemption.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SI-PT by clicking the link below or browse more documents and templates provided by the California Secretary of State.