This version of the form is not currently in use and is provided for reference only. Download this version of

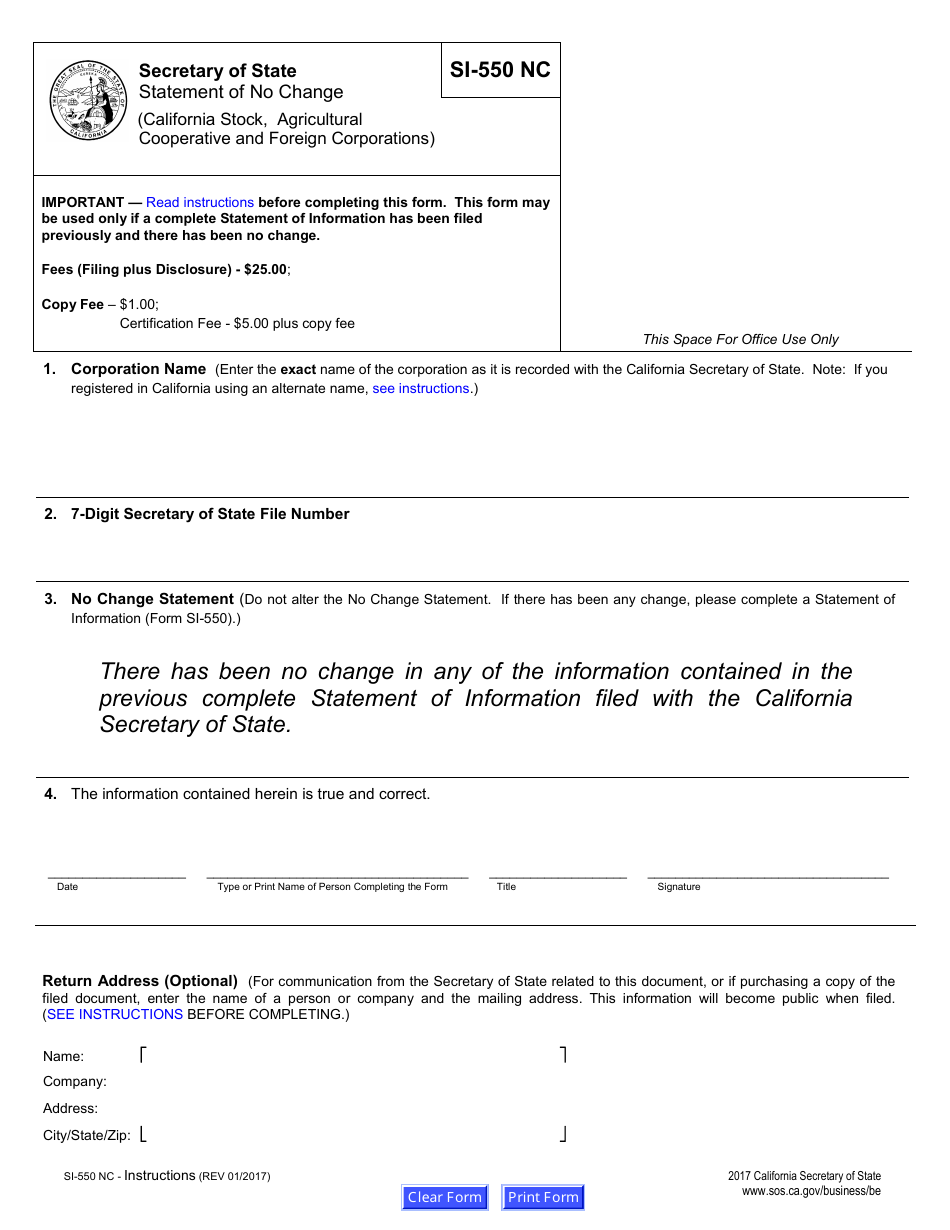

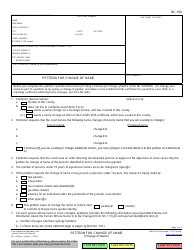

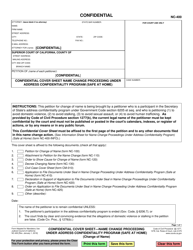

Form SI-550 NC

for the current year.

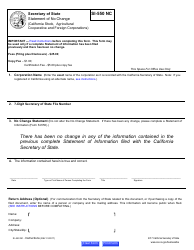

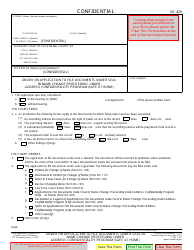

Form SI-550 NC Statement of No Change - California

What Is Form SI-550 NC?

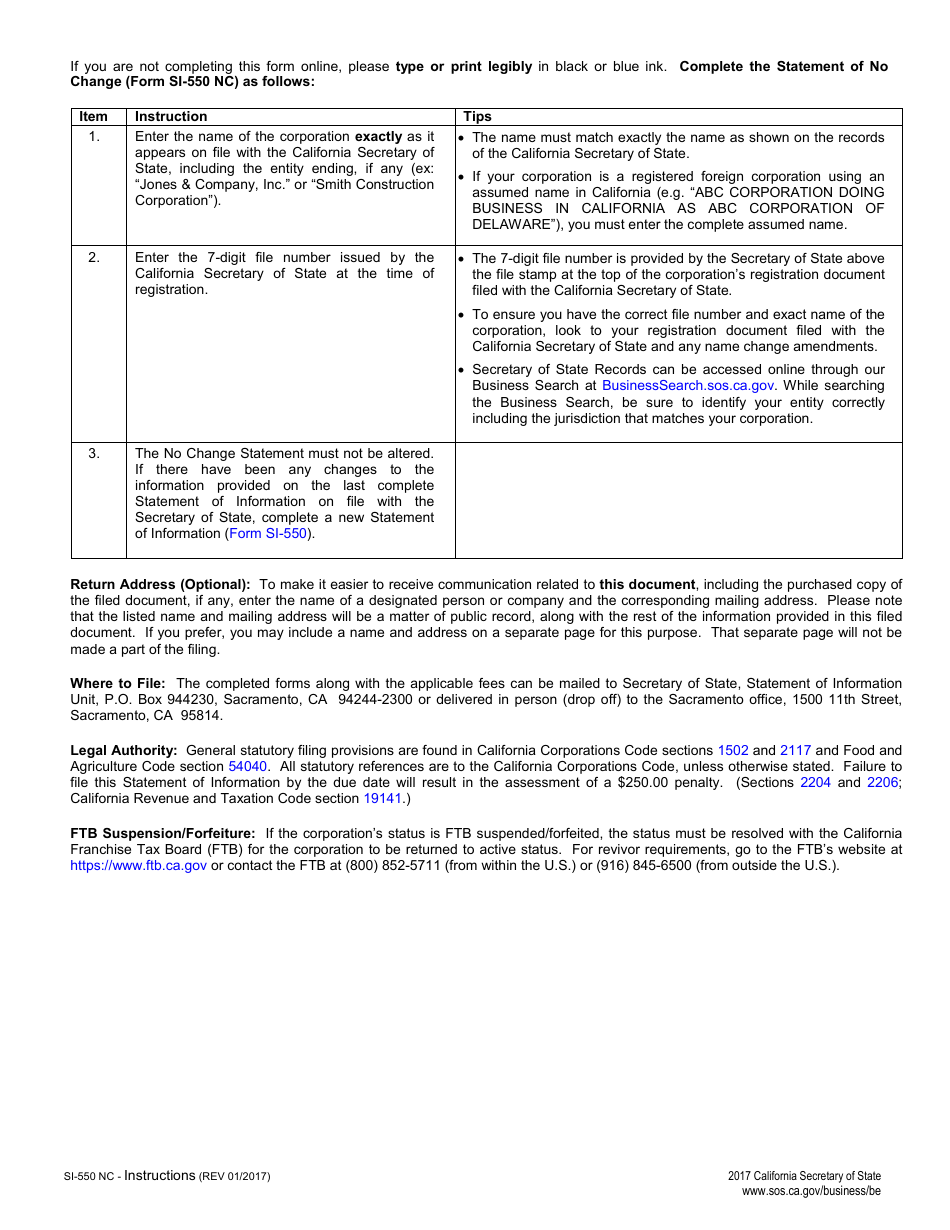

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

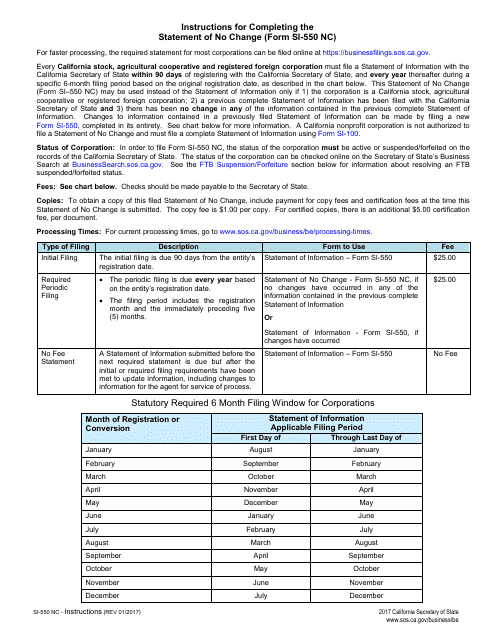

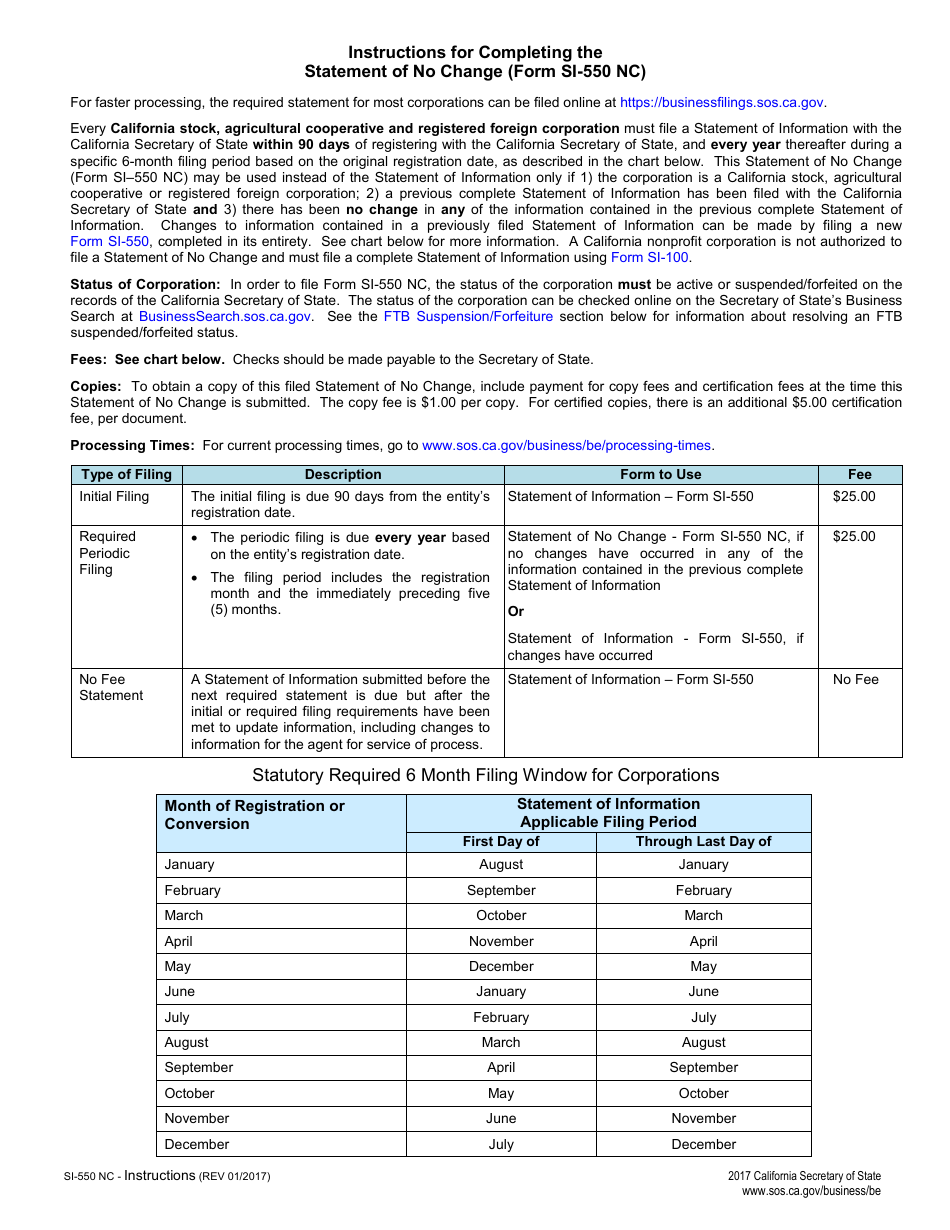

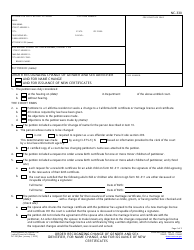

Q: What is Form SI-550 NC?

A: Form SI-550 NC is the Statement of No Change for businesses in California.

Q: What is the purpose of Form SI-550 NC?

A: The purpose of Form SI-550 NC is to report that there have been no changes to the information previously filed with the California Secretary of State for an LLC or corporation.

Q: Who needs to complete Form SI-550 NC?

A: LLCs and corporations in California need to complete Form SI-550 NC if there have been no changes to their previously filed information.

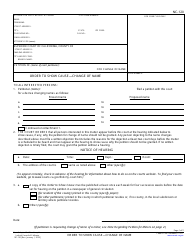

Q: When should Form SI-550 NC be filed?

A: Form SI-550 NC should be filed annually with the California Secretary of State within 90 days of the end of the tax year.

Q: Is there a fee for filing Form SI-550 NC?

A: Yes, there is a filing fee of $20 for submitting Form SI-550 NC.

Q: What should I do if there have been changes to my business?

A: If there have been changes to your business, you must file the appropriate form to report those changes instead of filing Form SI-550 NC.

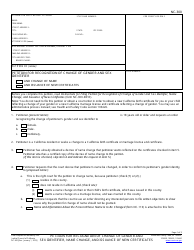

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SI-550 NC by clicking the link below or browse more documents and templates provided by the California Secretary of State.