This version of the form is not currently in use and is provided for reference only. Download this version of

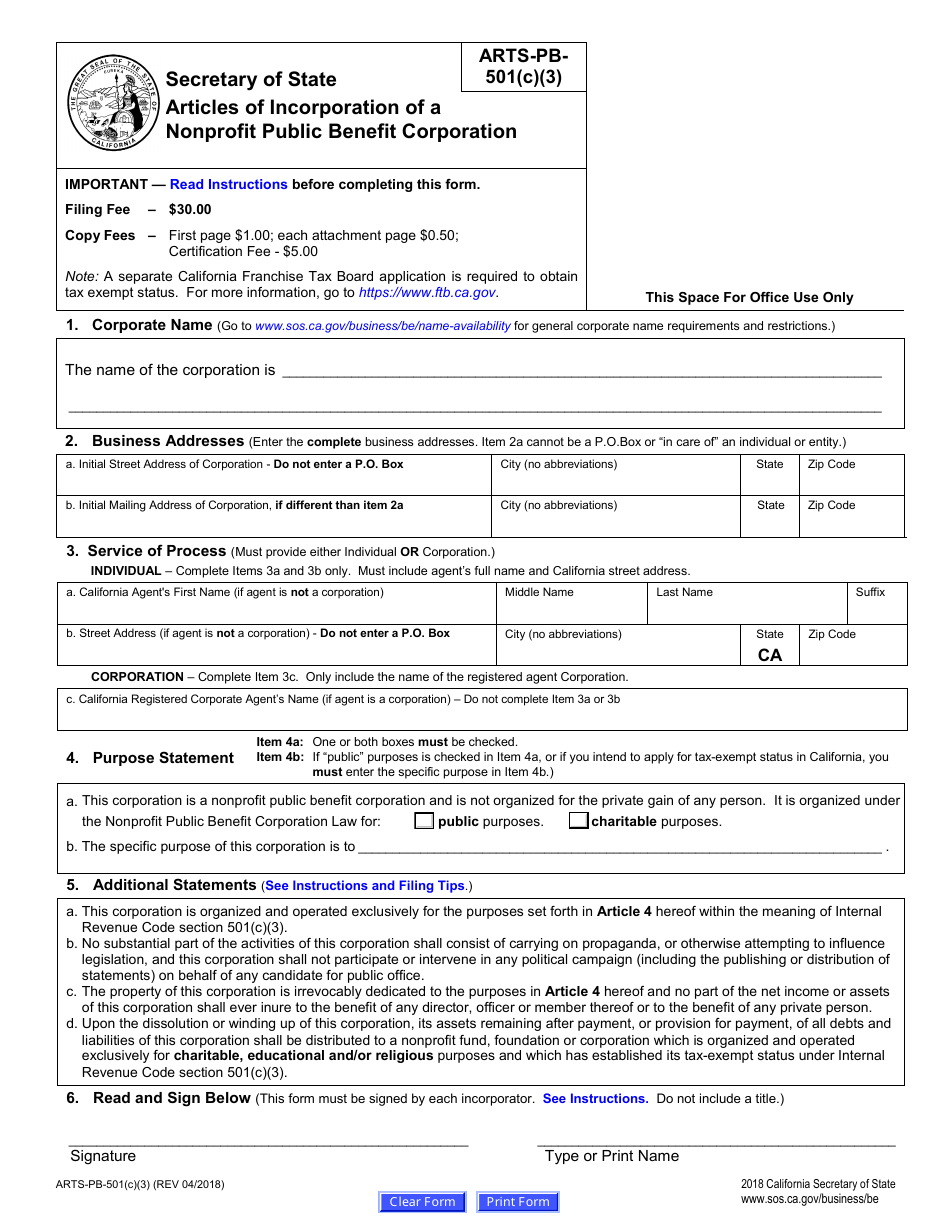

Form ARTS-PB-501(C)(3)

for the current year.

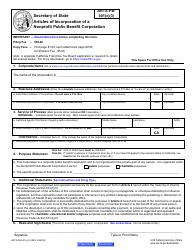

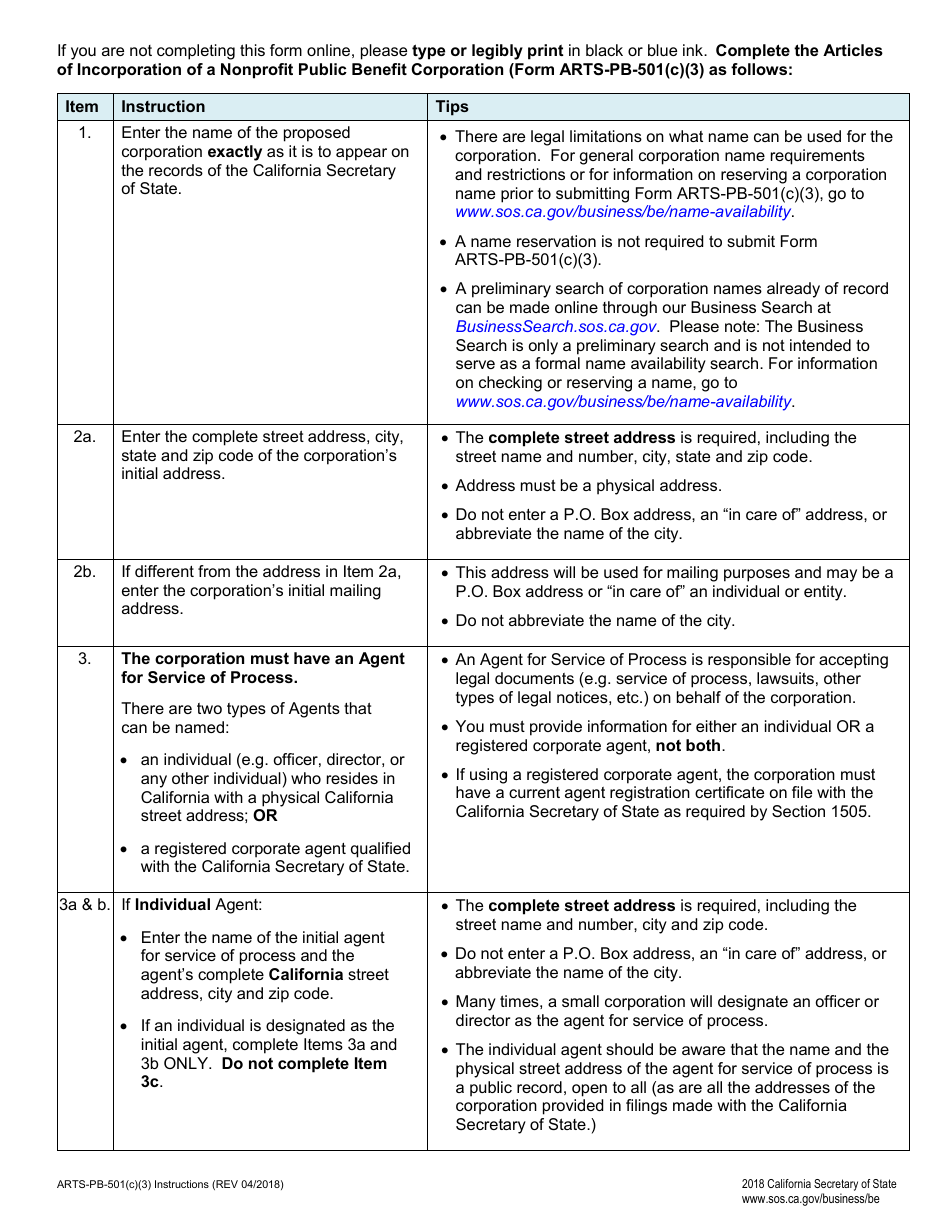

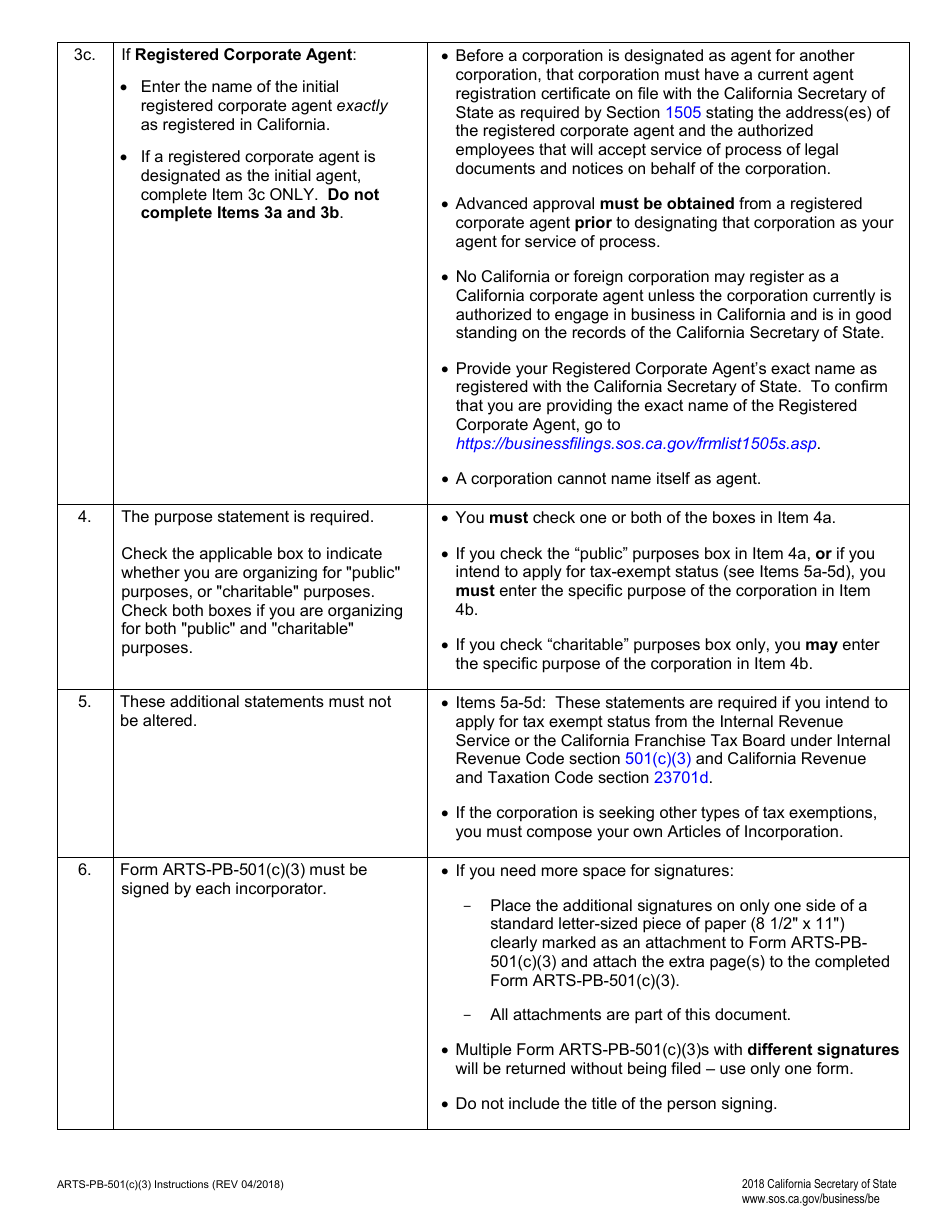

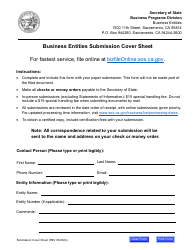

Form ARTS-PB-501(C)(3) Articles of Incorporation of a Nonprofit Public Benefit Corporation - California

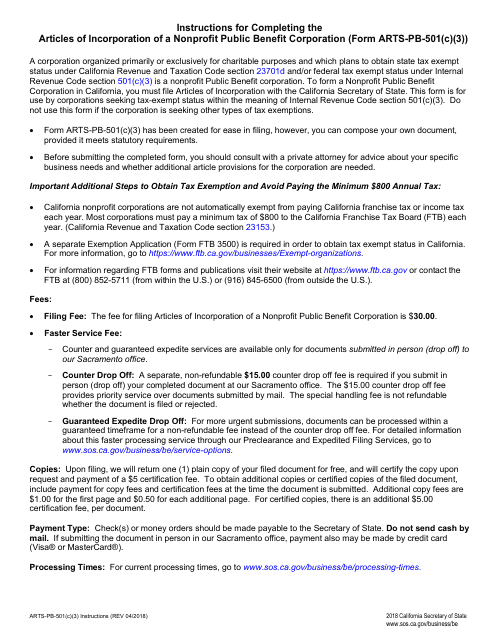

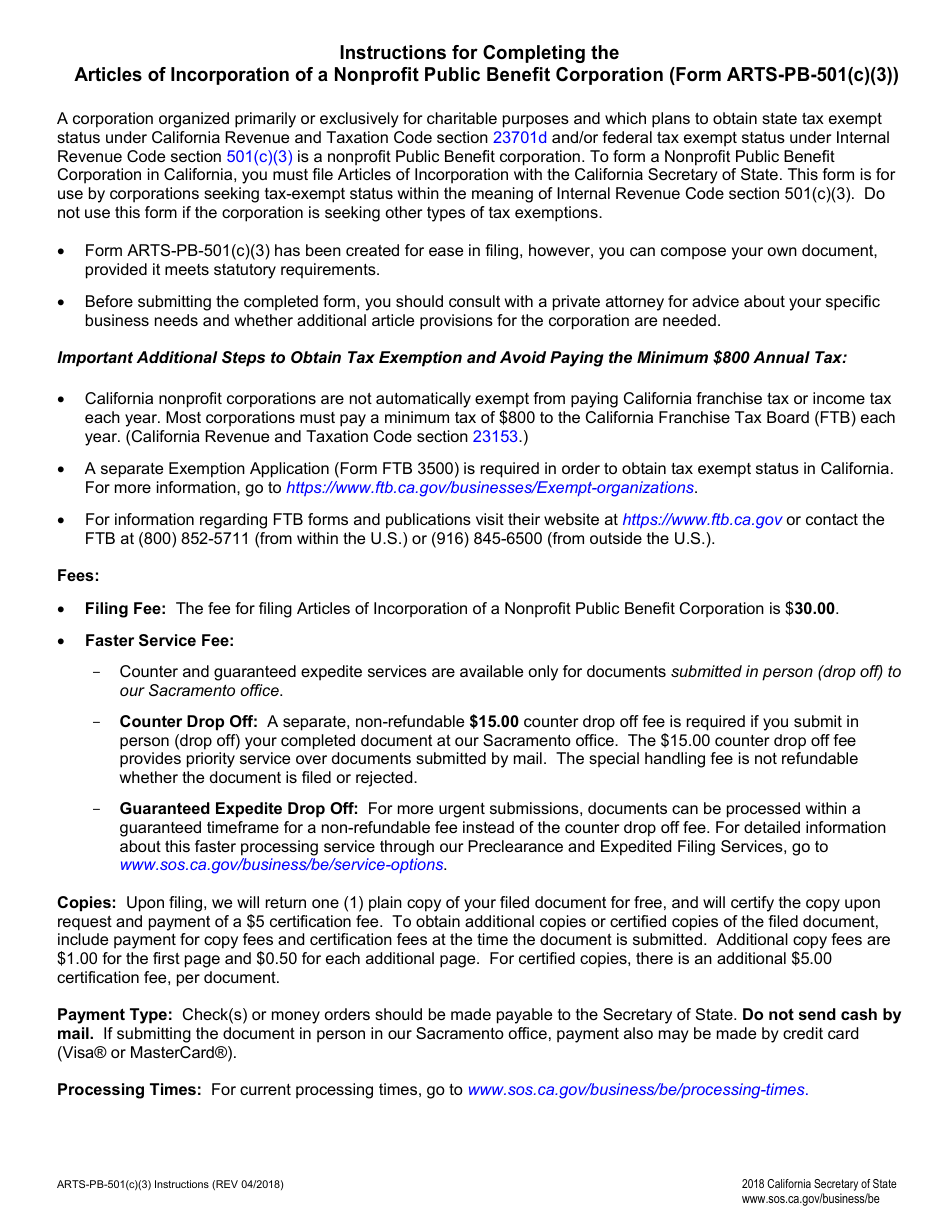

What Is Form ARTS-PB-501(C)(3)?

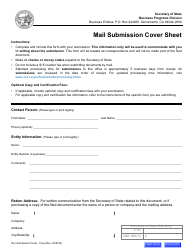

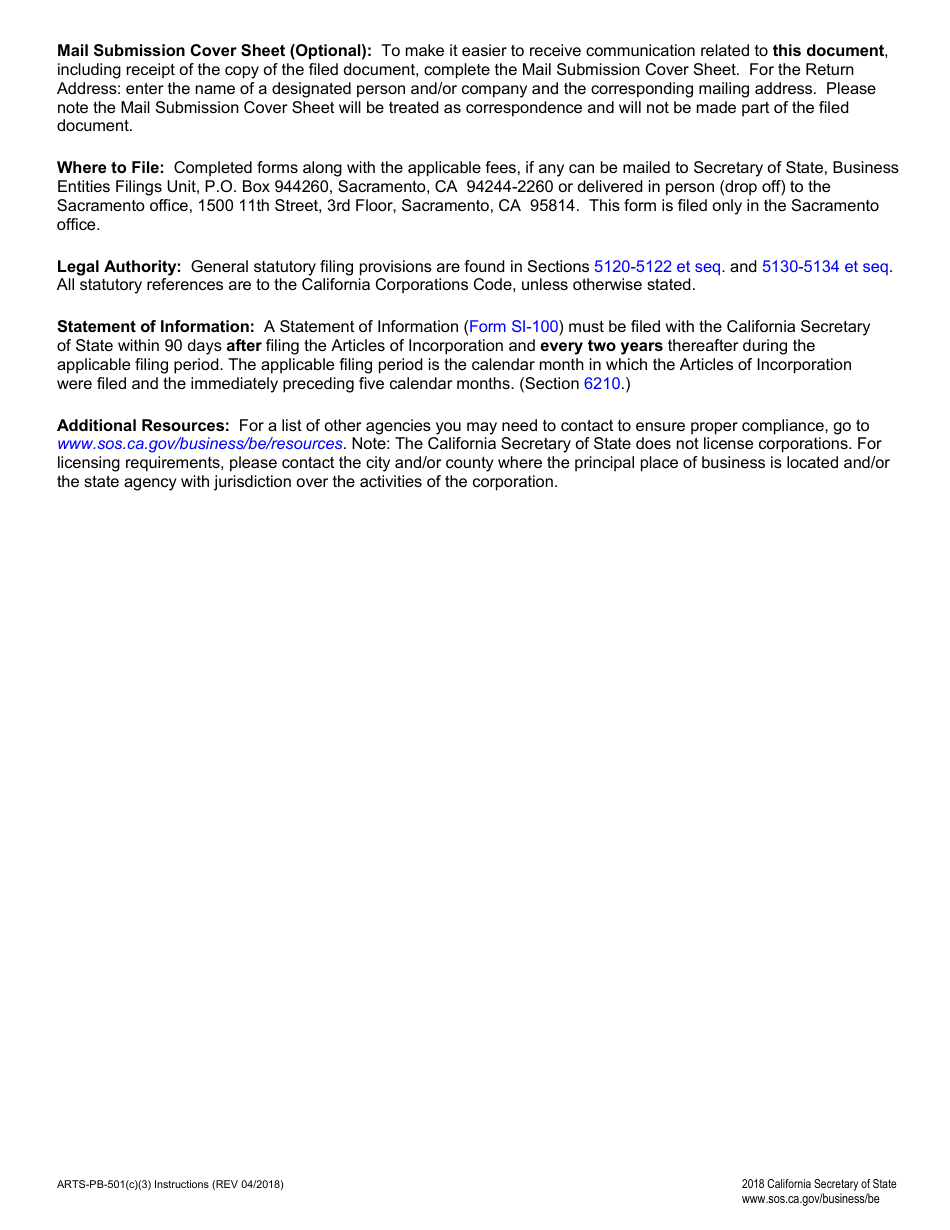

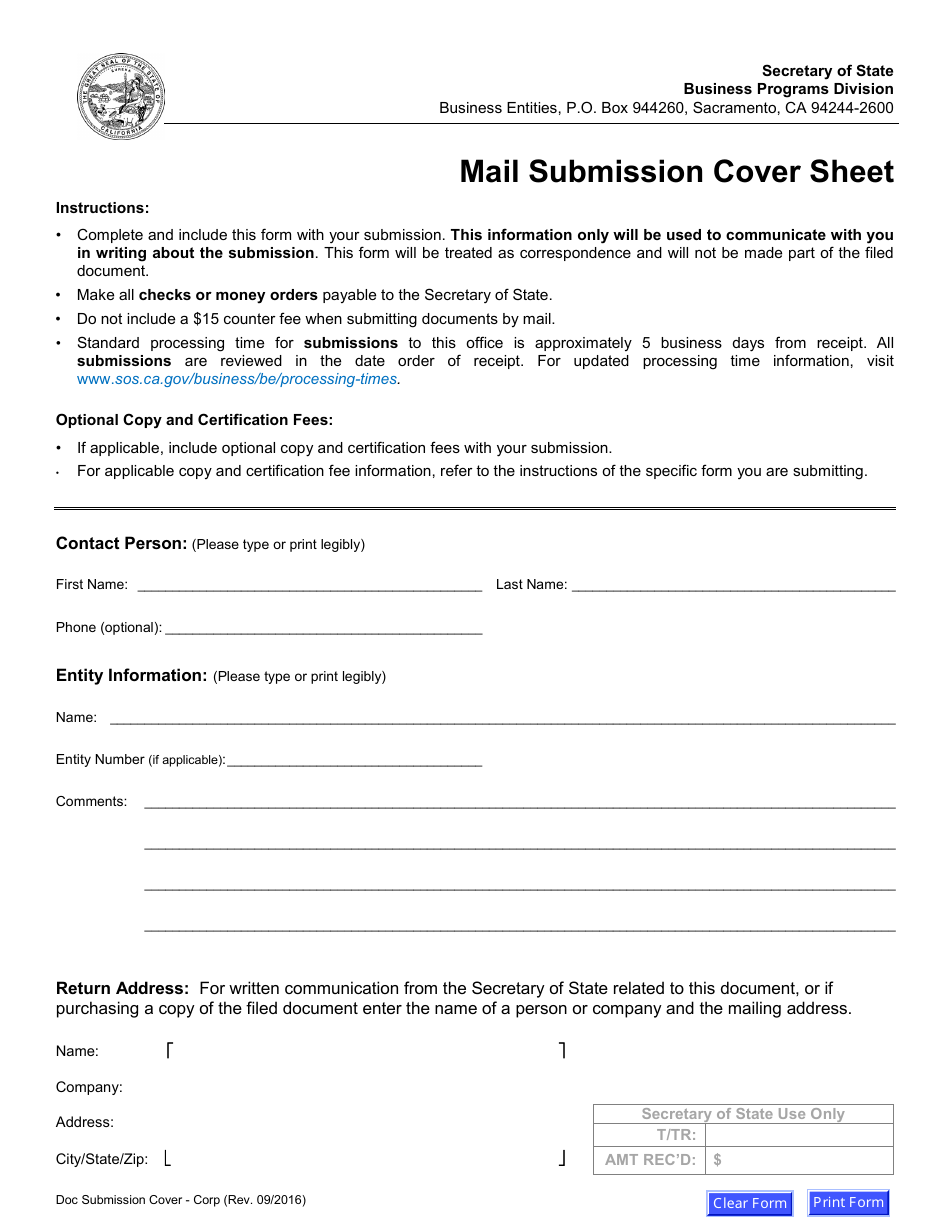

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ARTS-PB-501(C)(3)?

A: ARTS-PB-501(C)(3) is a specific form of Articles of Incorporation for a Nonprofit Public Benefit Corporation in California.

Q: What is a Nonprofit Public Benefit Corporation?

A: A Nonprofit Public Benefit Corporation is a type of organization that operates for the benefit of the public or a specific community.

Q: What is the purpose of the Articles of Incorporation?

A: The Articles of Incorporation is a legal document that establishes the existence of a corporation and defines its purpose and structure.

Q: What is required to qualify as a 501(c)(3) organization?

A: To qualify as a 501(c)(3) organization, it must be organized and operated exclusively for religious, charitable, scientific, or educational purposes.

Q: What is the significance of being a 501(c)(3) organization?

A: Being a 501(c)(3) organization allows for tax-exempt status, meaning the organization is exempt from certain federal and state taxes.

Q: Who can file the ARTS-PB-501(C)(3) Articles of Incorporation?

A: The ARTS-PB-501(C)(3) Articles of Incorporation can be filed by individuals or groups looking to establish a nonprofit public benefit corporation in California.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ARTS-PB-501(C)(3) by clicking the link below or browse more documents and templates provided by the California Secretary of State.