This version of the form is not currently in use and is provided for reference only. Download this version of

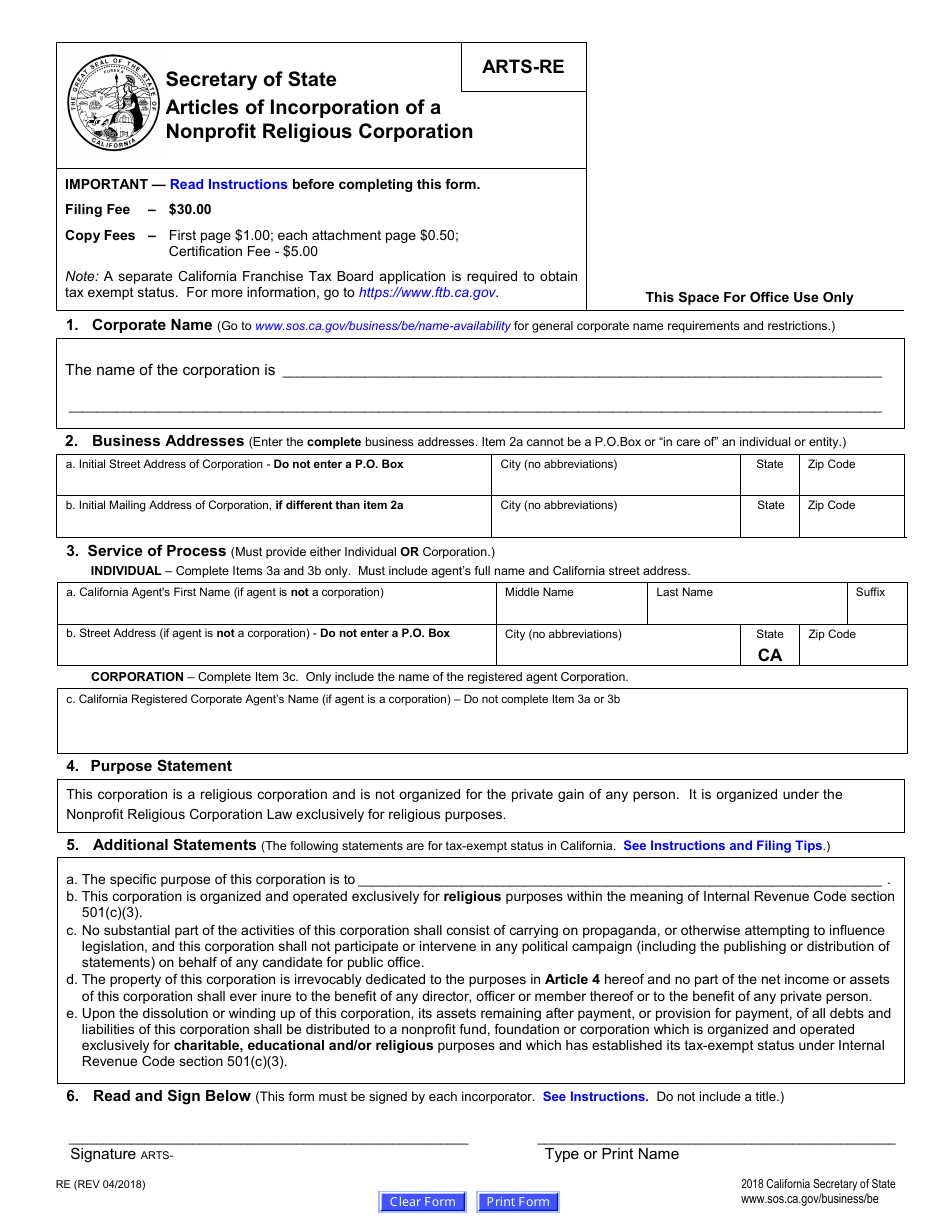

Form ARTS-RE

for the current year.

Form ARTS-RE Articles of Incorporation of a Nonprofit Religious Corporation - California

What Is Form ARTS-RE?

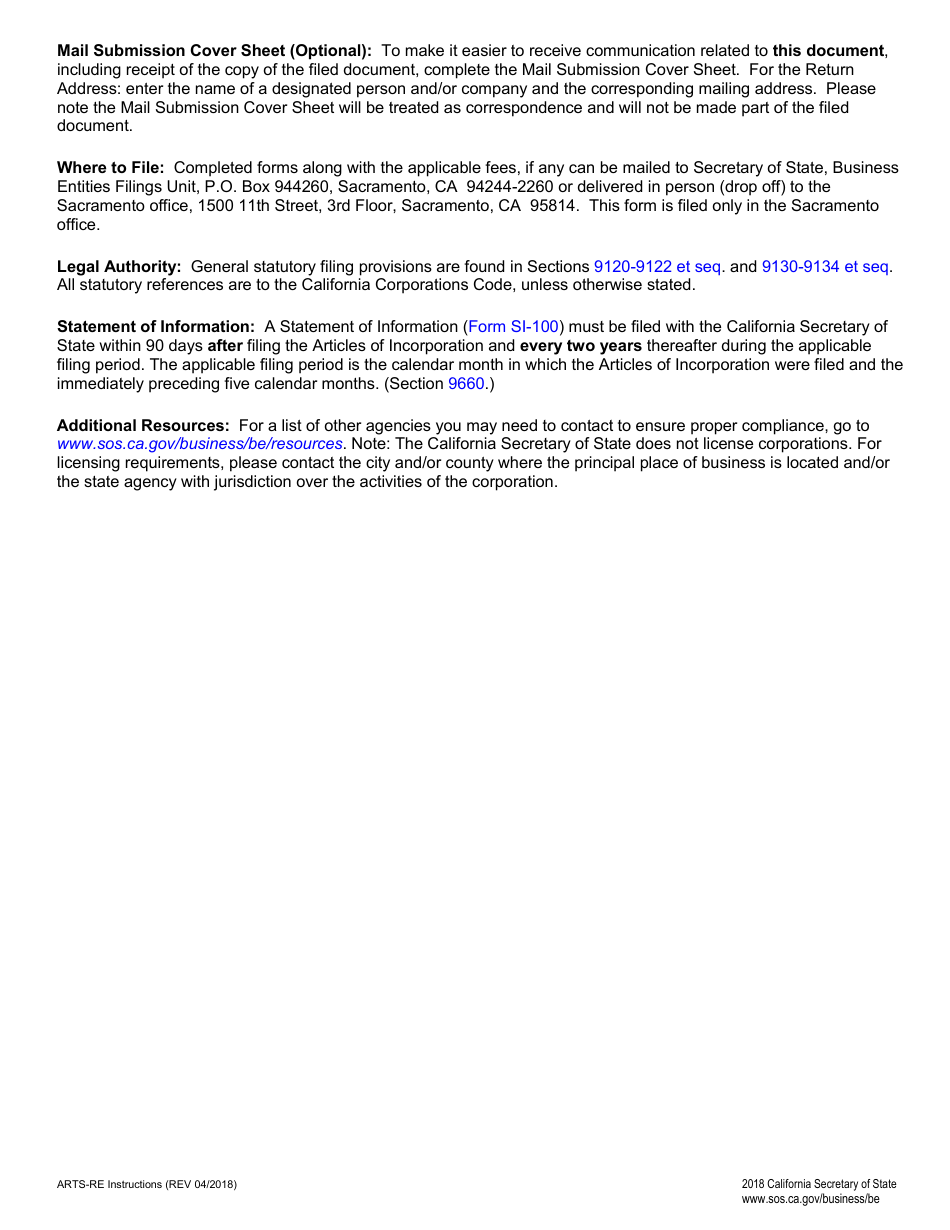

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of the ARTS-RE Articles of Incorporation?

A: The purpose of the ARTS-RE Articles of Incorporation is to establish a nonprofit religious corporation in California.

Q: What is a nonprofit religious corporation?

A: A nonprofit religious corporation is an organization formed for religious or spiritual purposes, which operates without the goal of making profit.

Q: What is the ARTS-RE form used for?

A: The ARTS-RE form is used specifically for incorporating a nonprofit religious corporation in California.

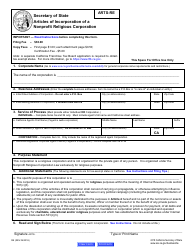

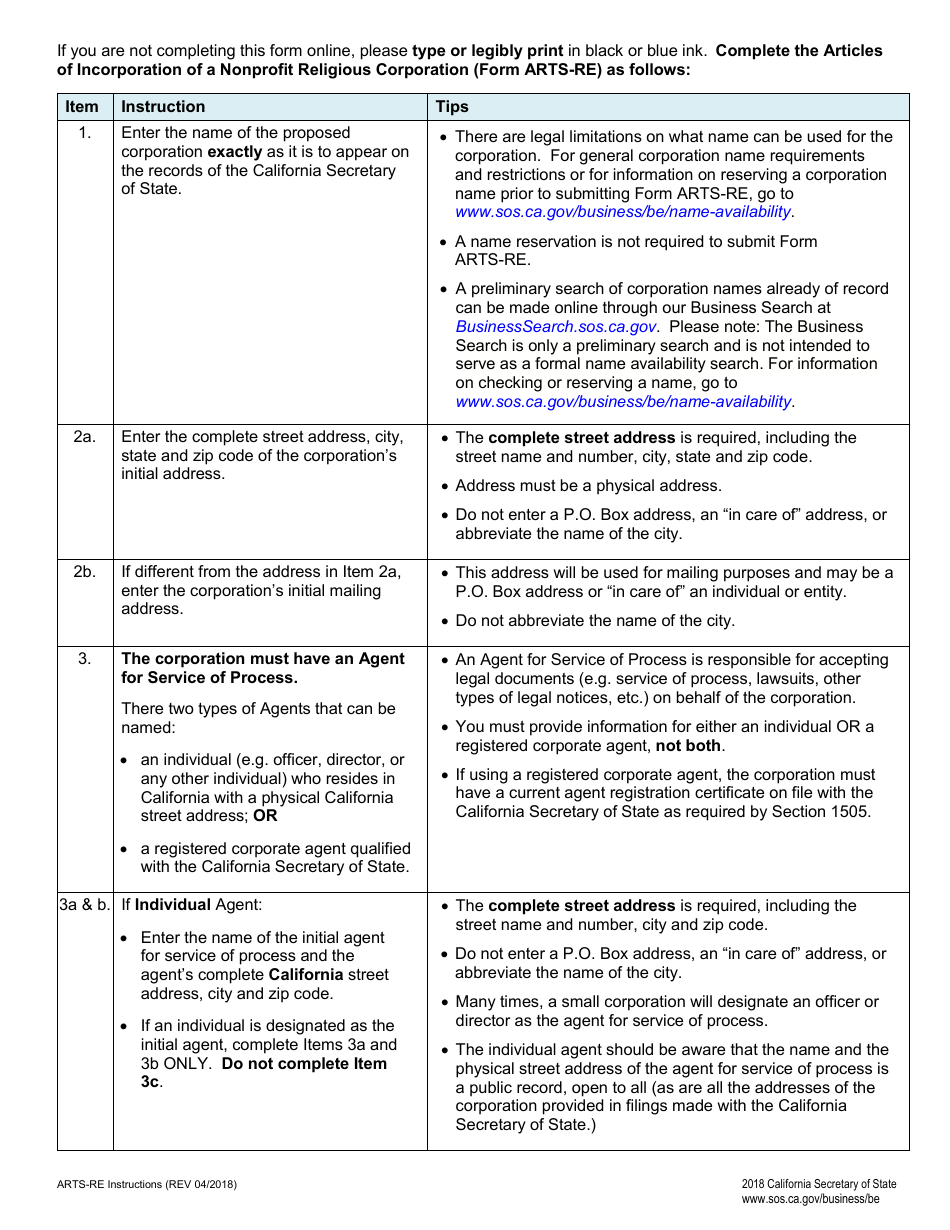

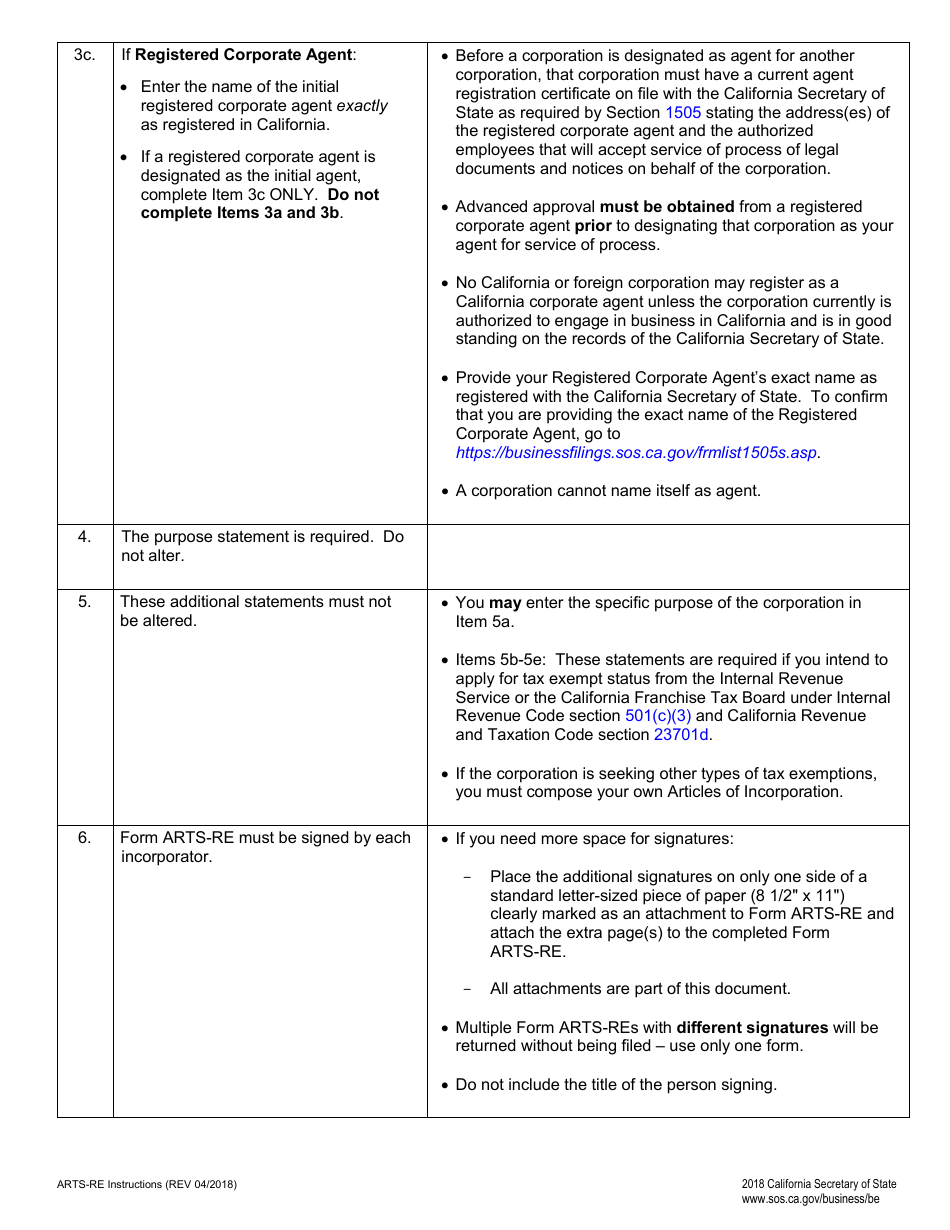

Q: What information is required in the ARTS-RE Articles of Incorporation?

A: The ARTS-RE Articles of Incorporation requires information such as the corporation's name, purpose, agent for service of process, and initial street address.

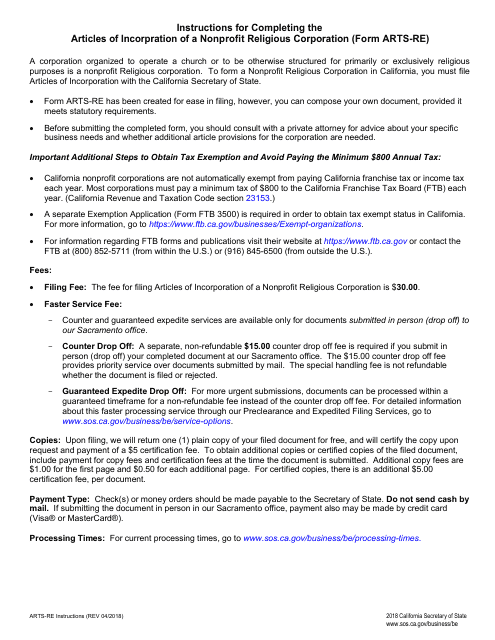

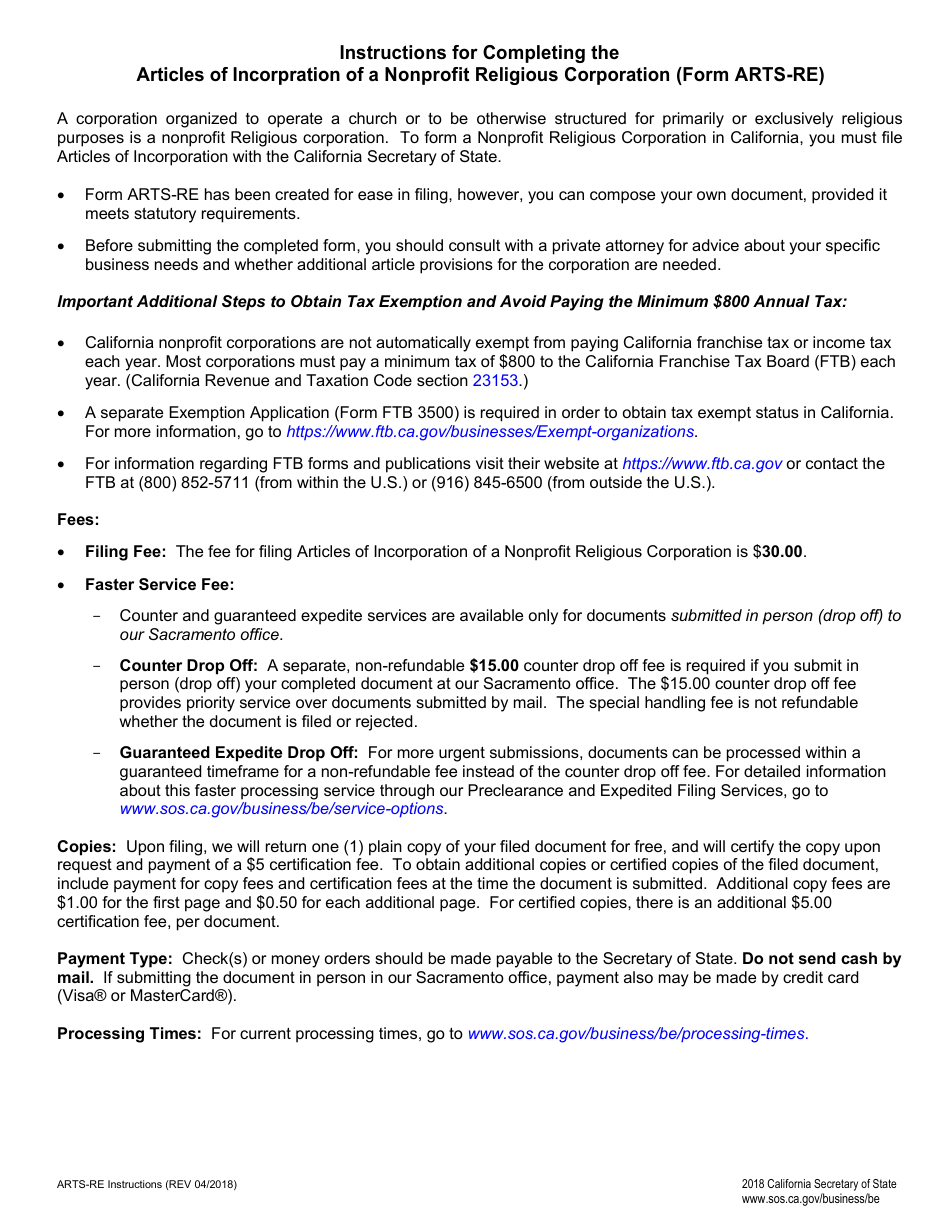

Q: Do I need to pay a fee to file the ARTS-RE Articles of Incorporation?

A: Yes, there is a filing fee associated with submitting the ARTS-RE Articles of Incorporation in California.

Q: Can I make changes to the ARTS-RE Articles of Incorporation after filing?

A: Yes, amendments can be made to the ARTS-RE Articles of Incorporation by filing the appropriate forms with the California Secretary of State.

Q: Is it necessary to have an attorney to fill out the ARTS-RE Articles of Incorporation?

A: No, it is not necessary to have an attorney to fill out the ARTS-RE Articles of Incorporation, but legal advice can be helpful.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the California Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

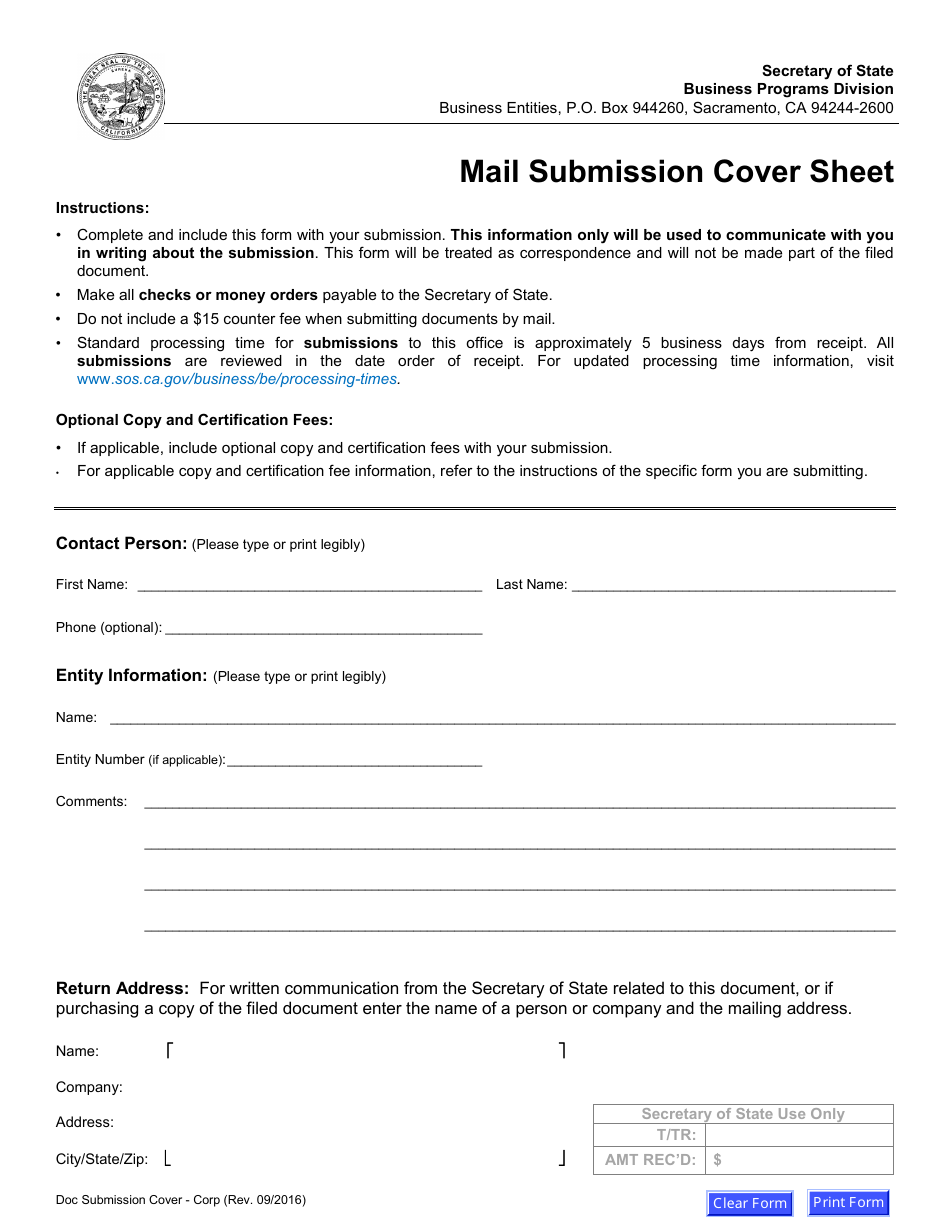

Download a fillable version of Form ARTS-RE by clicking the link below or browse more documents and templates provided by the California Secretary of State.