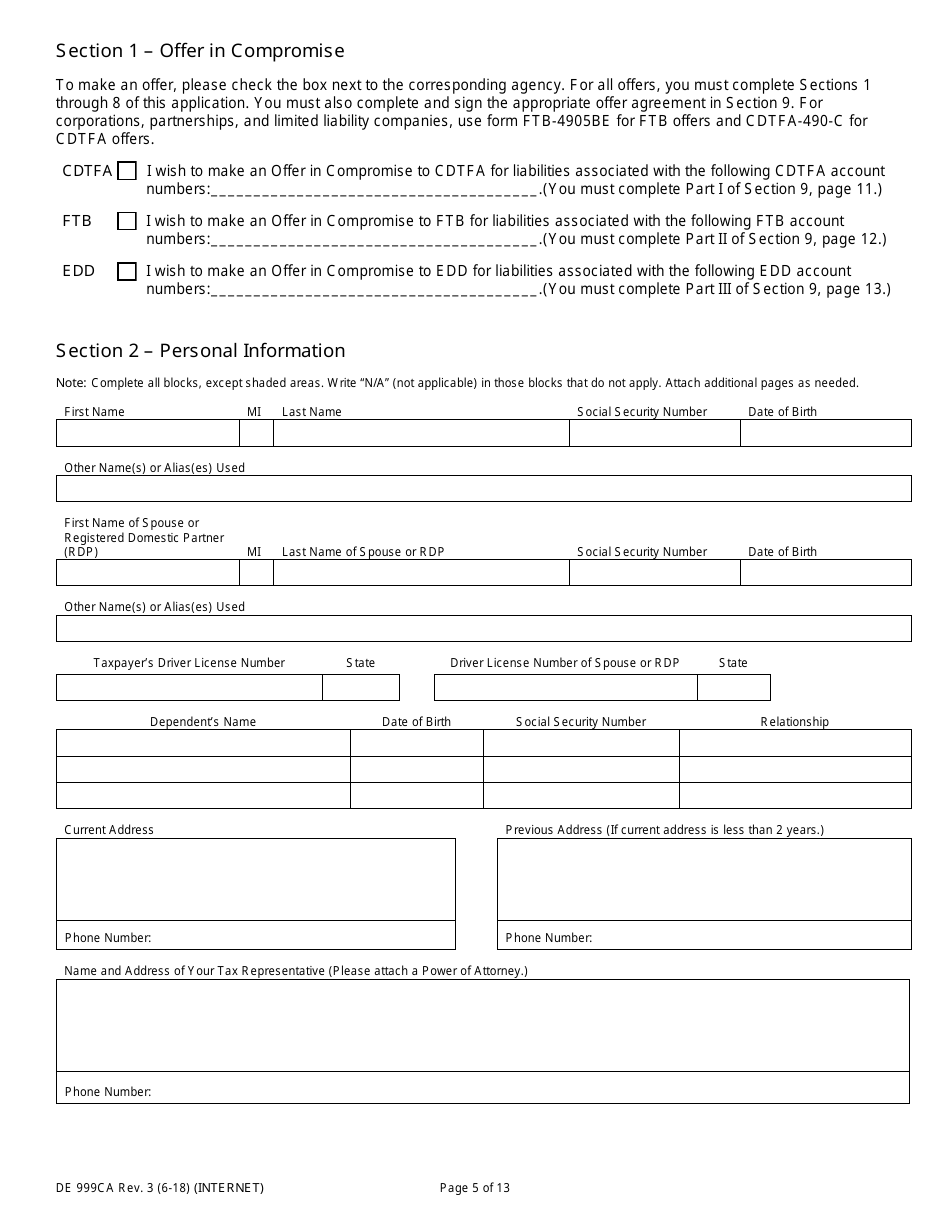

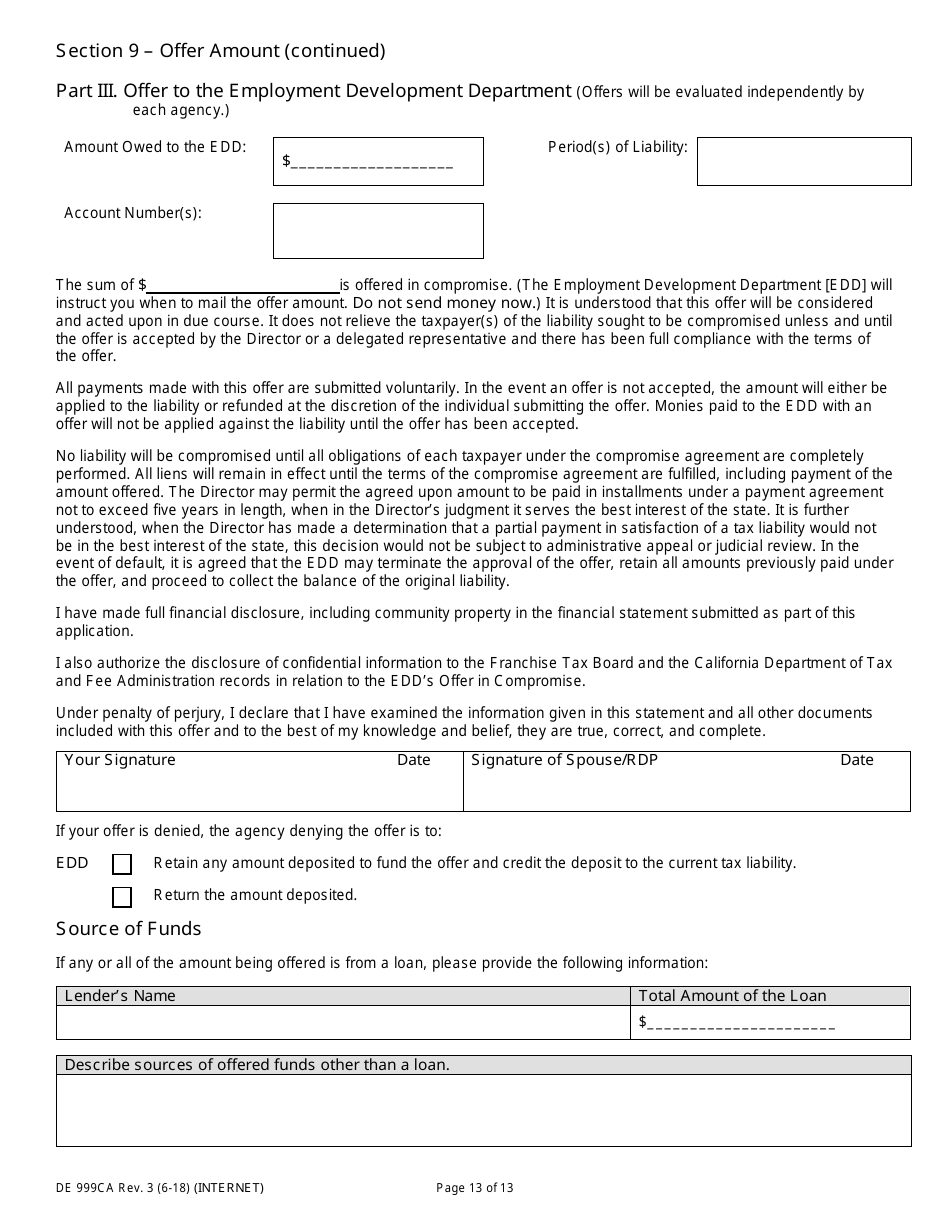

Form DE999CA Multi-Agency Form for Offer in Compromise - California

What Is Form DE999CA?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DE999CA?

A: Form DE999CA is a multi-agency form for Offer in Compromise specifically for California.

Q: What is Offer in Compromise?

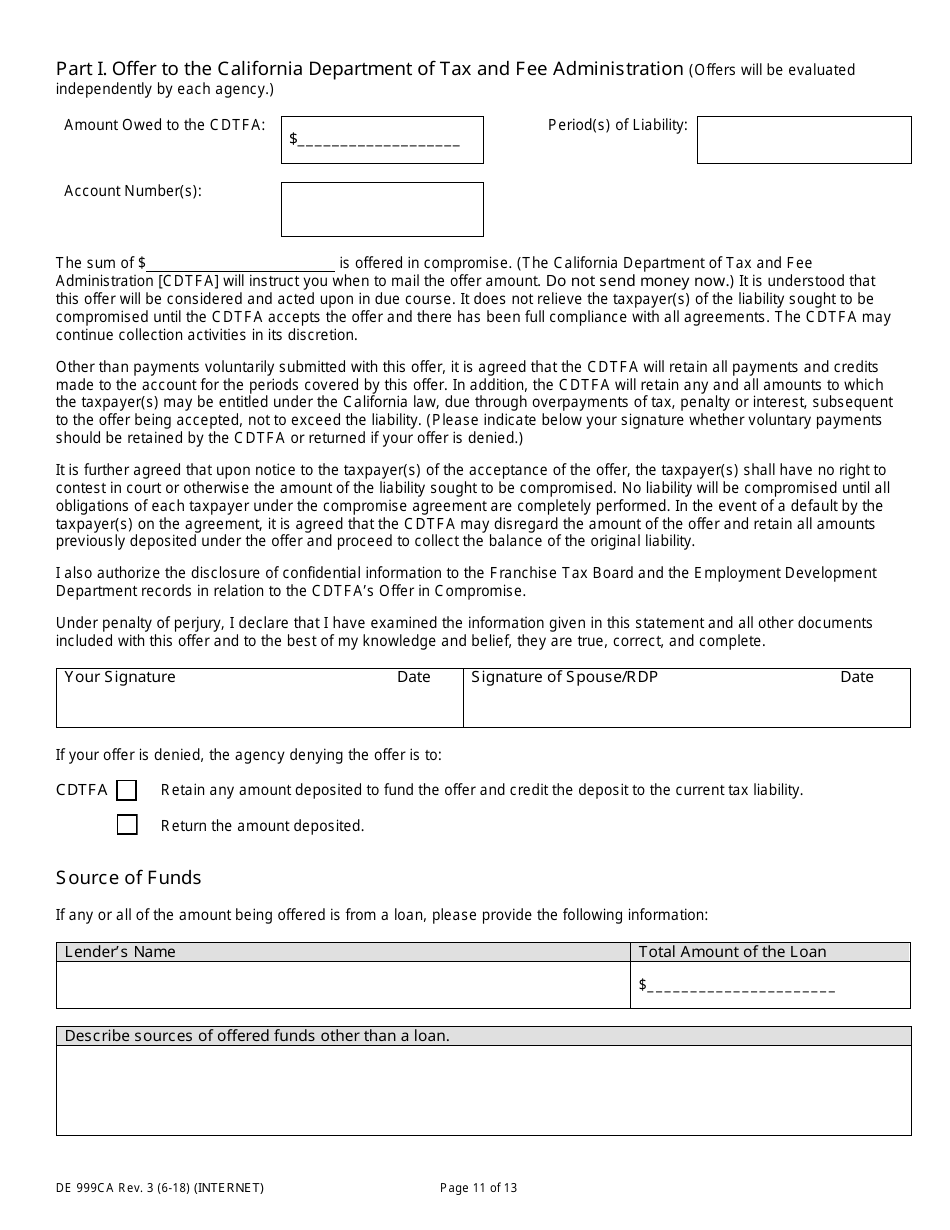

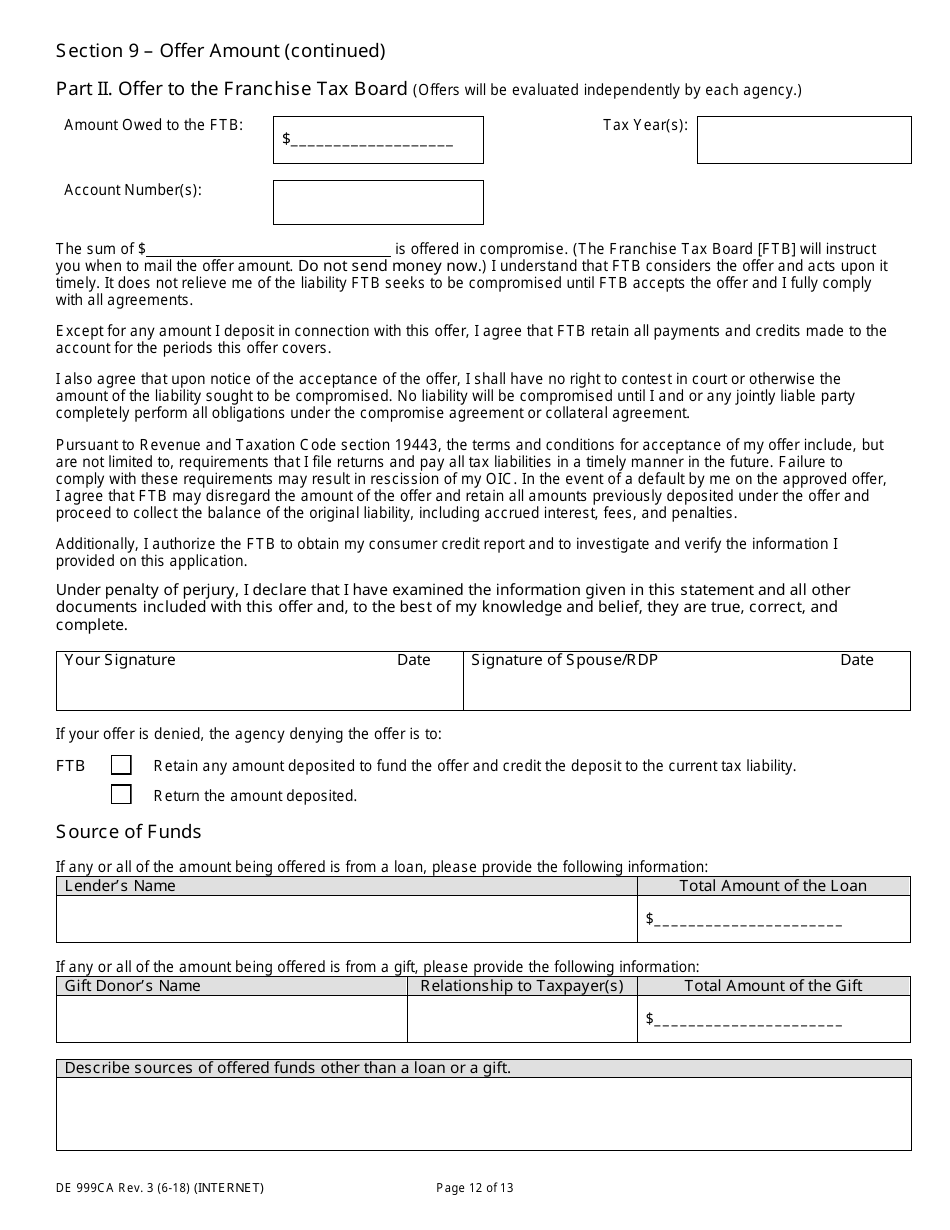

A: Offer in Compromise is a program that allows taxpayers to settle their tax liabilities for less than the full amount owed.

Q: Who can use Form DE999CA?

A: Form DE999CA is specifically designed for taxpayers in California who wish to submit an Offer in Compromise.

Q: Which agencies are involved in Form DE999CA?

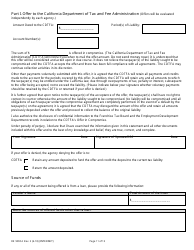

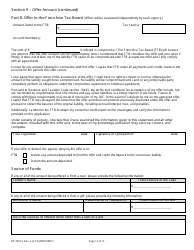

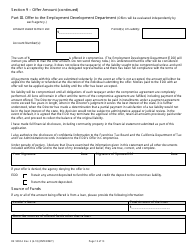

A: Form DE999CA is a multi-agency form, which means it involves multiple agencies in California, such as the Franchise Tax Board and the Employment Development Department.

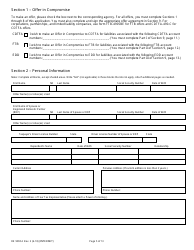

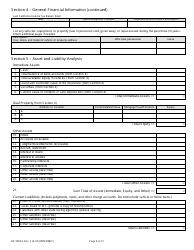

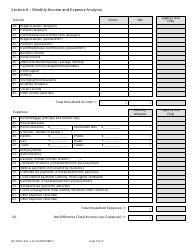

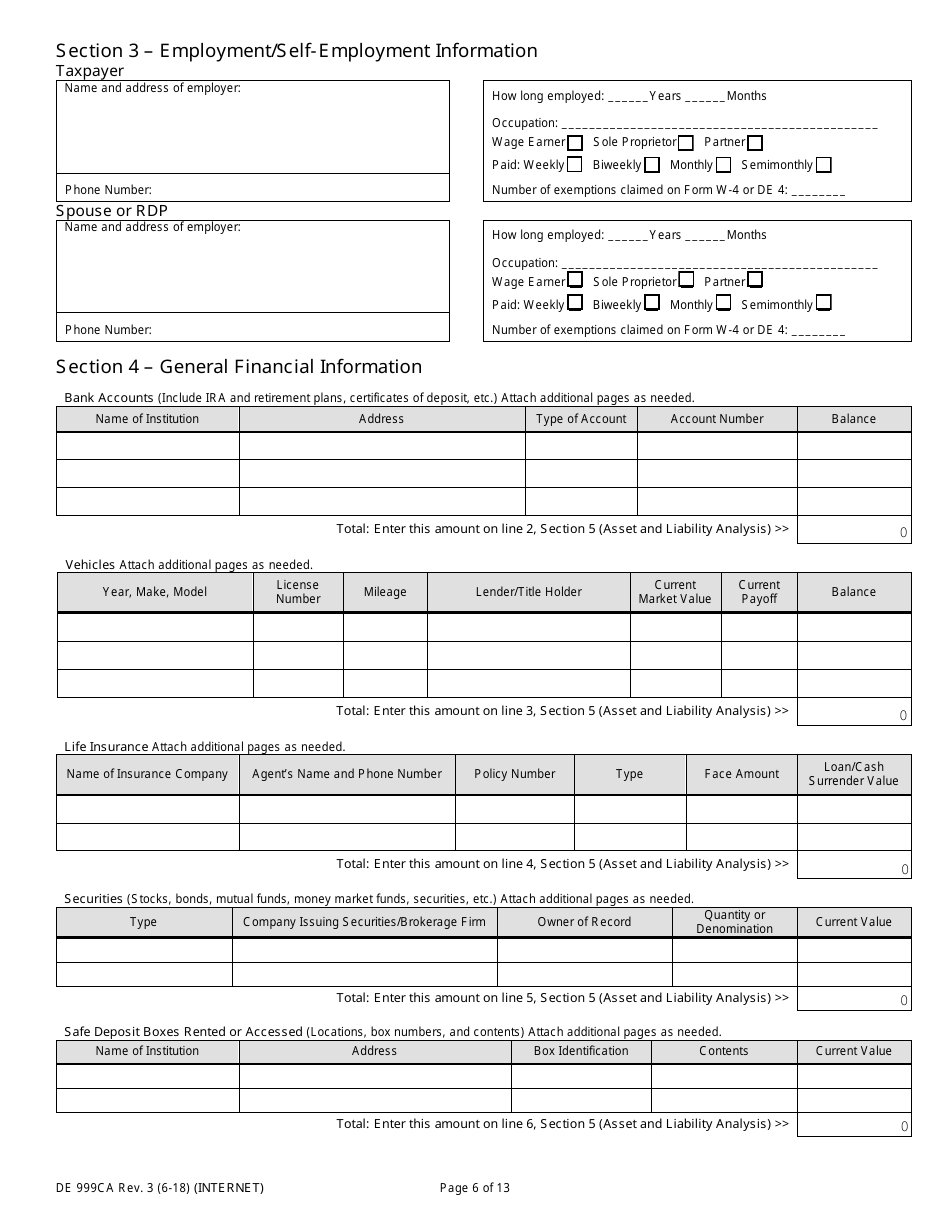

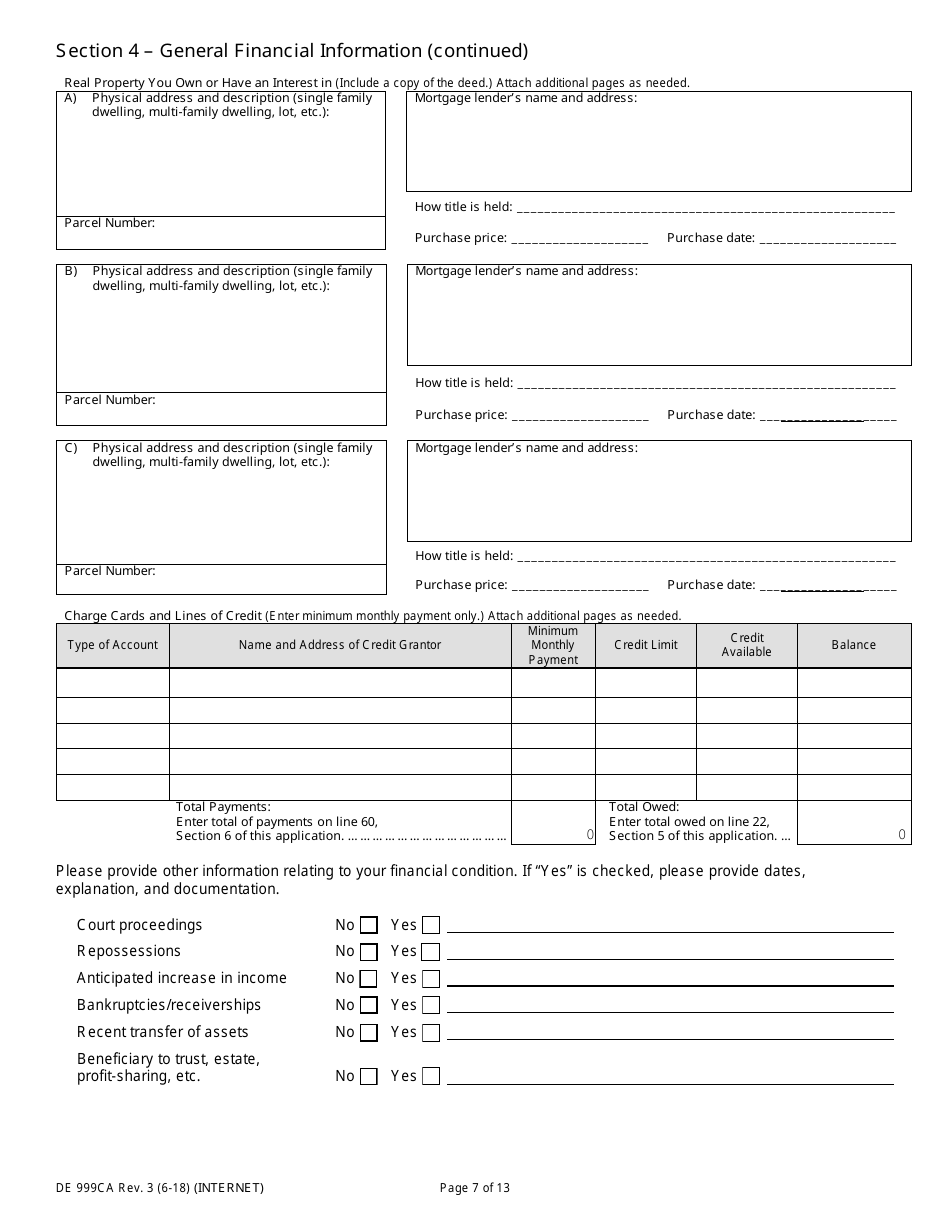

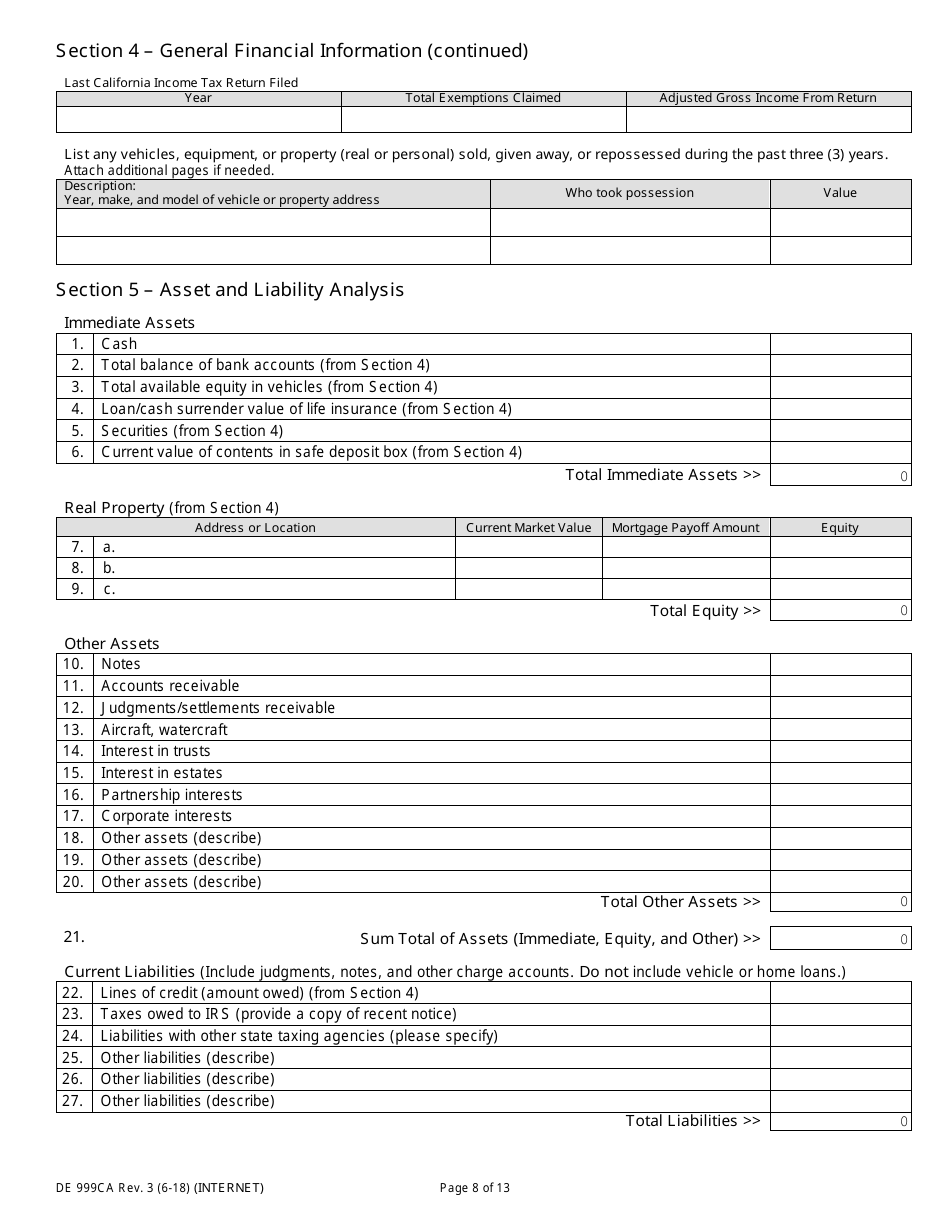

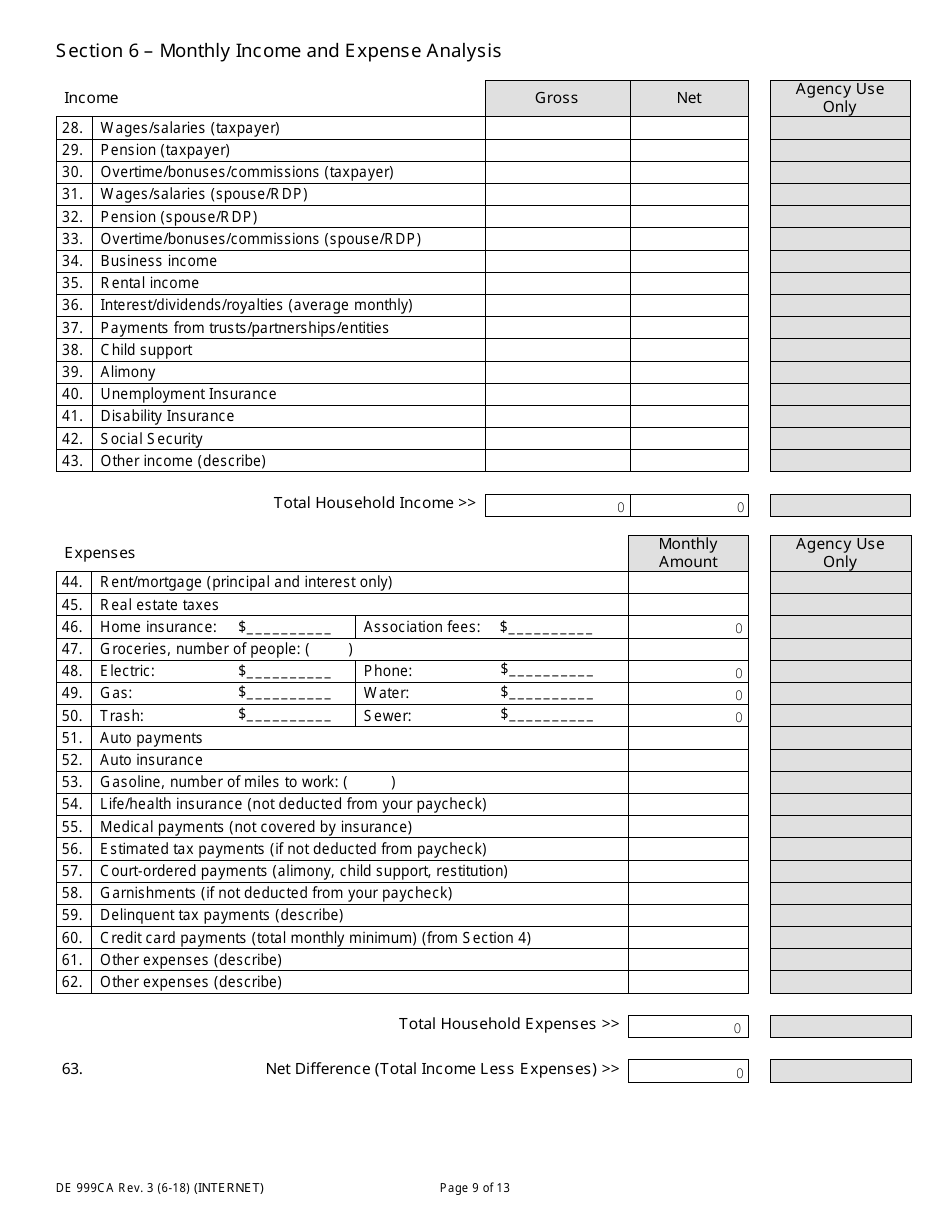

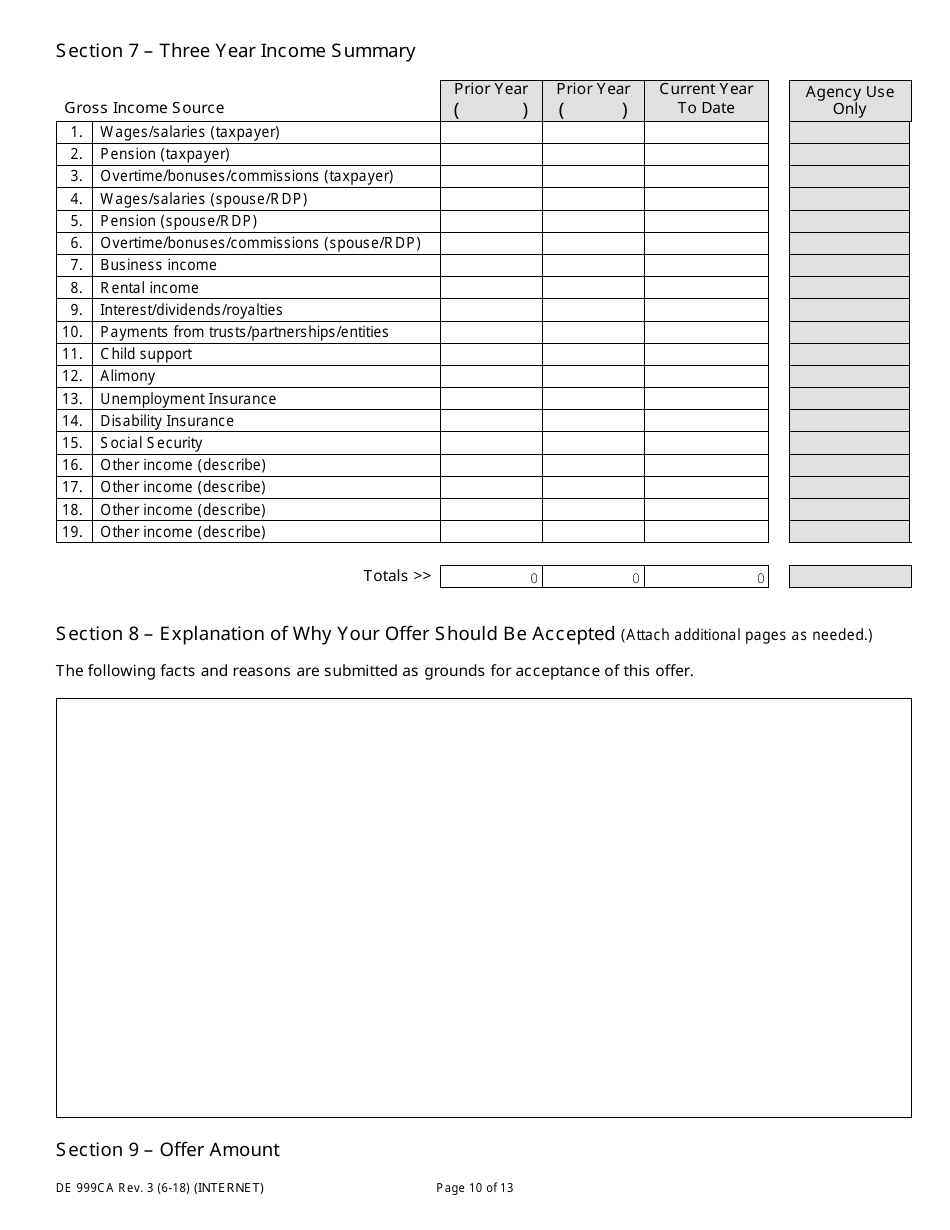

Q: How do I fill out Form DE999CA?

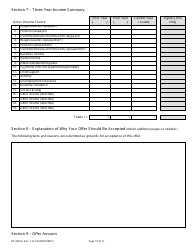

A: To fill out Form DE999CA, you need to provide accurate information about your financial situation, income, assets, and expenses, as well as details about your tax liabilities.

Q: What is the purpose of Form DE999CA?

A: The purpose of Form DE999CA is to gather information from taxpayers in California who are seeking to settle their tax debts through the Offer in Compromise program.

Q: Is there a fee for submitting Form DE999CA?

A: Yes, there is a non-refundable fee for submitting Form DE999CA. The fee amount may vary, so it's best to check the instructions provided with the form.

Q: What should I do after submitting Form DE999CA?

A: After submitting Form DE999CA, you should wait for a response from the relevant agencies. They will review your offer and determine whether to accept or reject it.

Form Details:

- Released on June 3, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DE999CA by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.