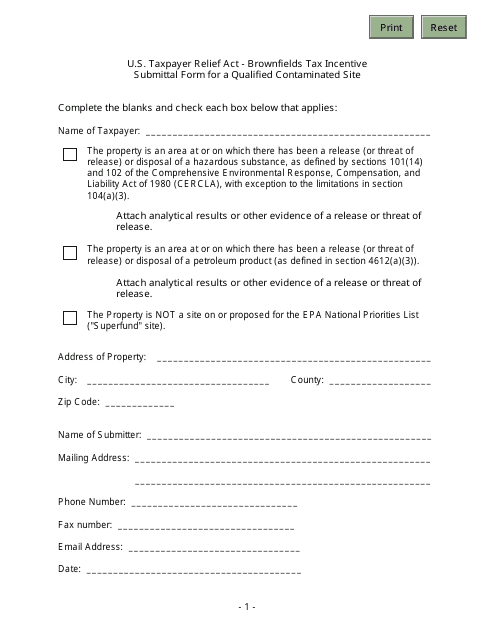

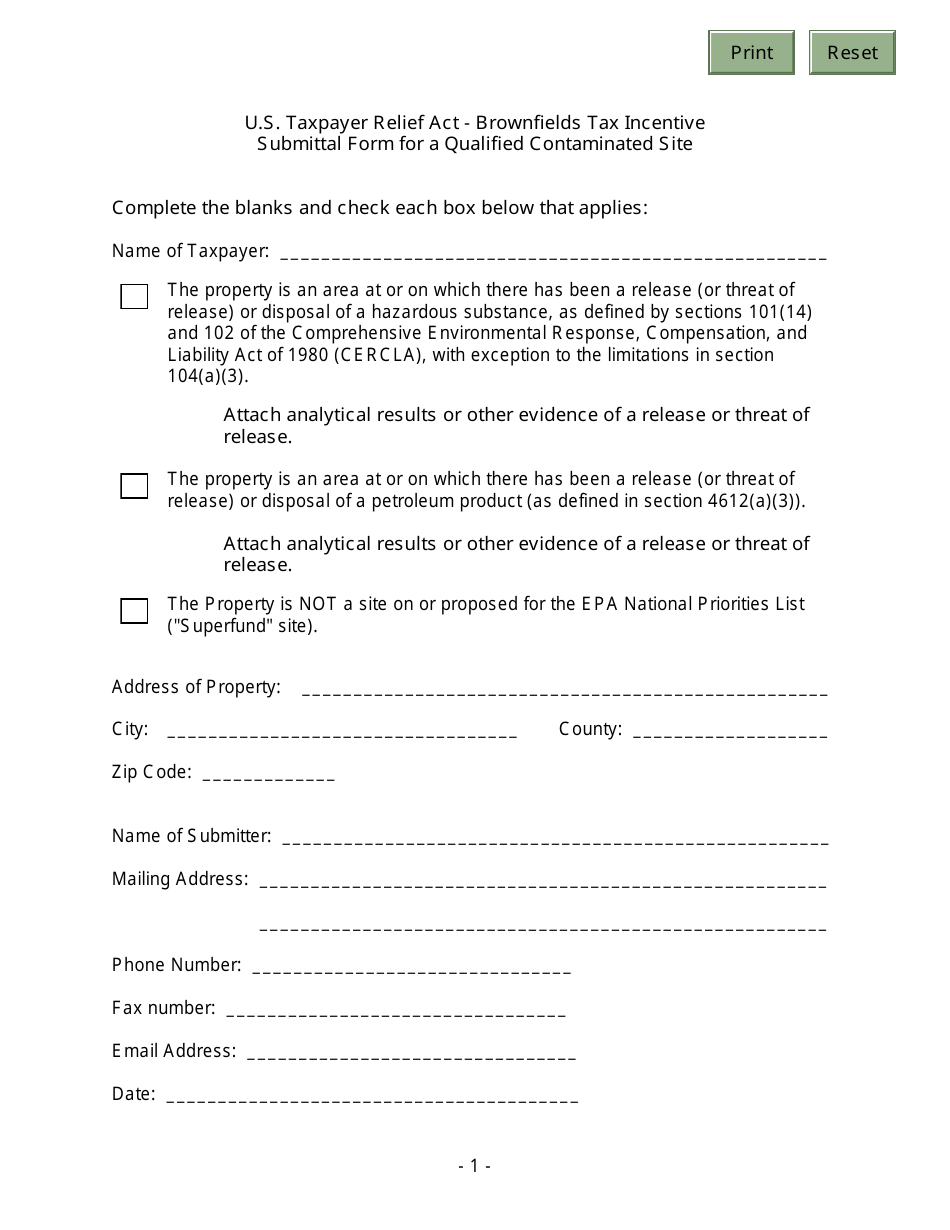

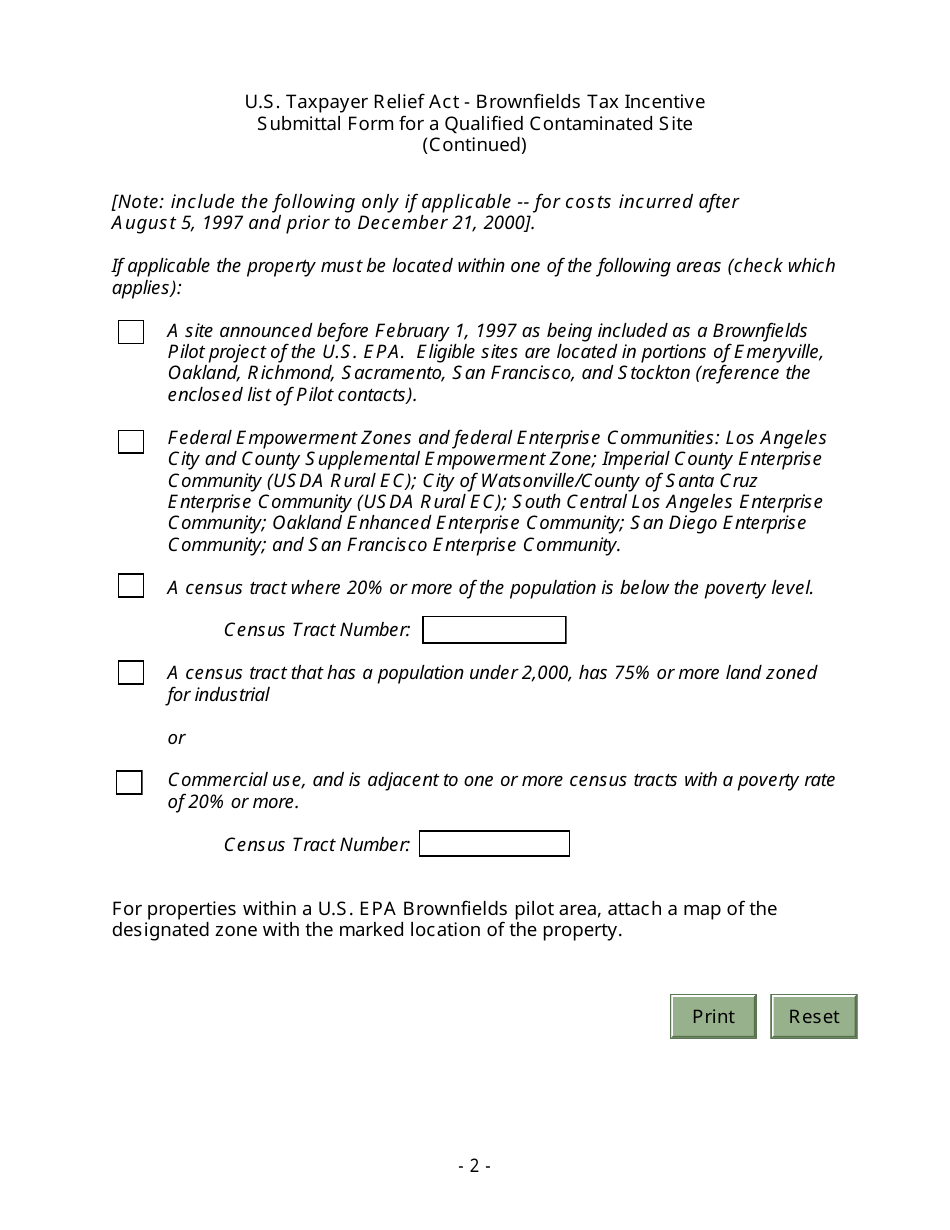

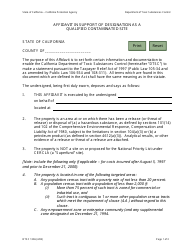

Brownfields Tax Incentive Submittal Form for a Qualified Contaminated Site - California

Brownfields Tax Incentive Submittal Form for a Qualified Contaminated Site is a legal document that was released by the California Department of Toxic Substances Control - a government authority operating within California.

FAQ

Q: What is a Brownfields Tax Incentive?

A: A Brownfields Tax Incentive is a benefit provided by the government to encourage the cleanup and redevelopment of contaminated sites.

Q: What is the purpose of the Brownfields Tax Incentive Submittal Form?

A: The purpose of the Brownfields Tax Incentive Submittal Form is to apply for tax incentives available for cleaning up qualified contaminated sites in California.

Q: Who is eligible to submit the Brownfields Tax Incentive Submittal Form?

A: Property owners or developers who are planning to clean up a contaminated site in California may submit the form.

Q: What are the benefits of submitting the Brownfields Tax Incentive Submittal Form?

A: Submitting the form can result in tax incentives, such as credits or deductions, that can help offset the costs of cleaning up a contaminated site.

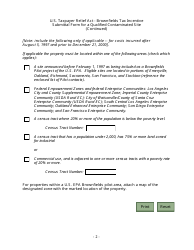

Q: What information is required on the Brownfields Tax Incentive Submittal Form?

A: The form typically requires information about the property, the nature and extent of contamination, the proposed cleanup plan, and the estimated costs of cleanup.

Q: Are there any deadlines for submitting the Brownfields Tax Incentive Submittal Form?

A: Deadlines may vary depending on the specific tax incentive program, so it is important to check the guidelines and requirements of the program.

Q: What happens after I submit the Brownfields Tax Incentive Submittal Form?

A: After submitting the form, it will be reviewed by the appropriate government agency, and if approved, you may be eligible for the tax incentives associated with cleaning up a contaminated site.

Q: Can I receive multiple tax incentives for the same contaminated site?

A: In some cases, it may be possible to receive multiple tax incentives for the same contaminated site, depending on the eligibility criteria and requirements of the different programs.

Form Details:

- The latest edition currently provided by the California Department of Toxic Substances Control;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Toxic Substances Control.