This version of the form is not currently in use and is provided for reference only. Download this version of

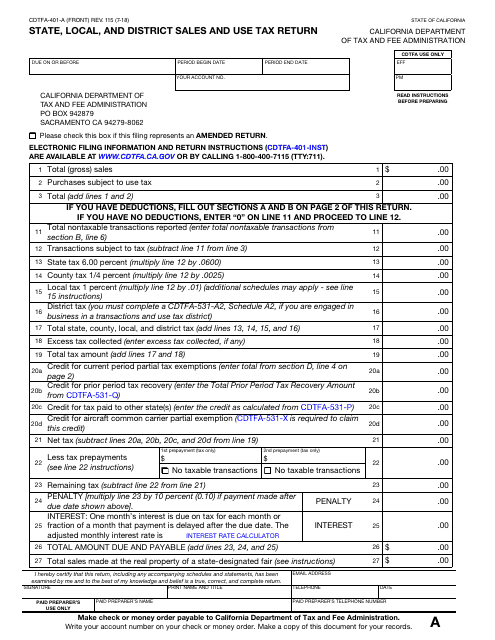

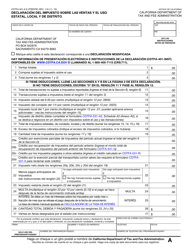

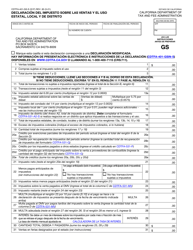

Form CDTFA-401-A

for the current year.

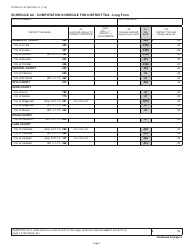

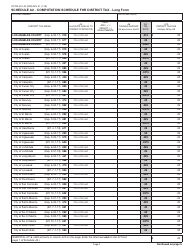

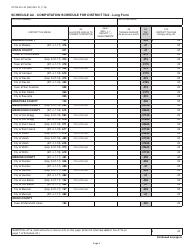

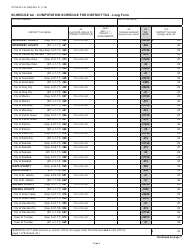

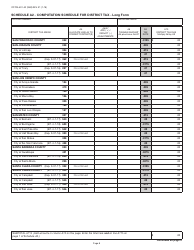

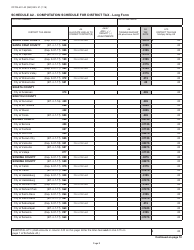

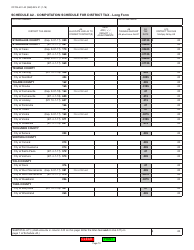

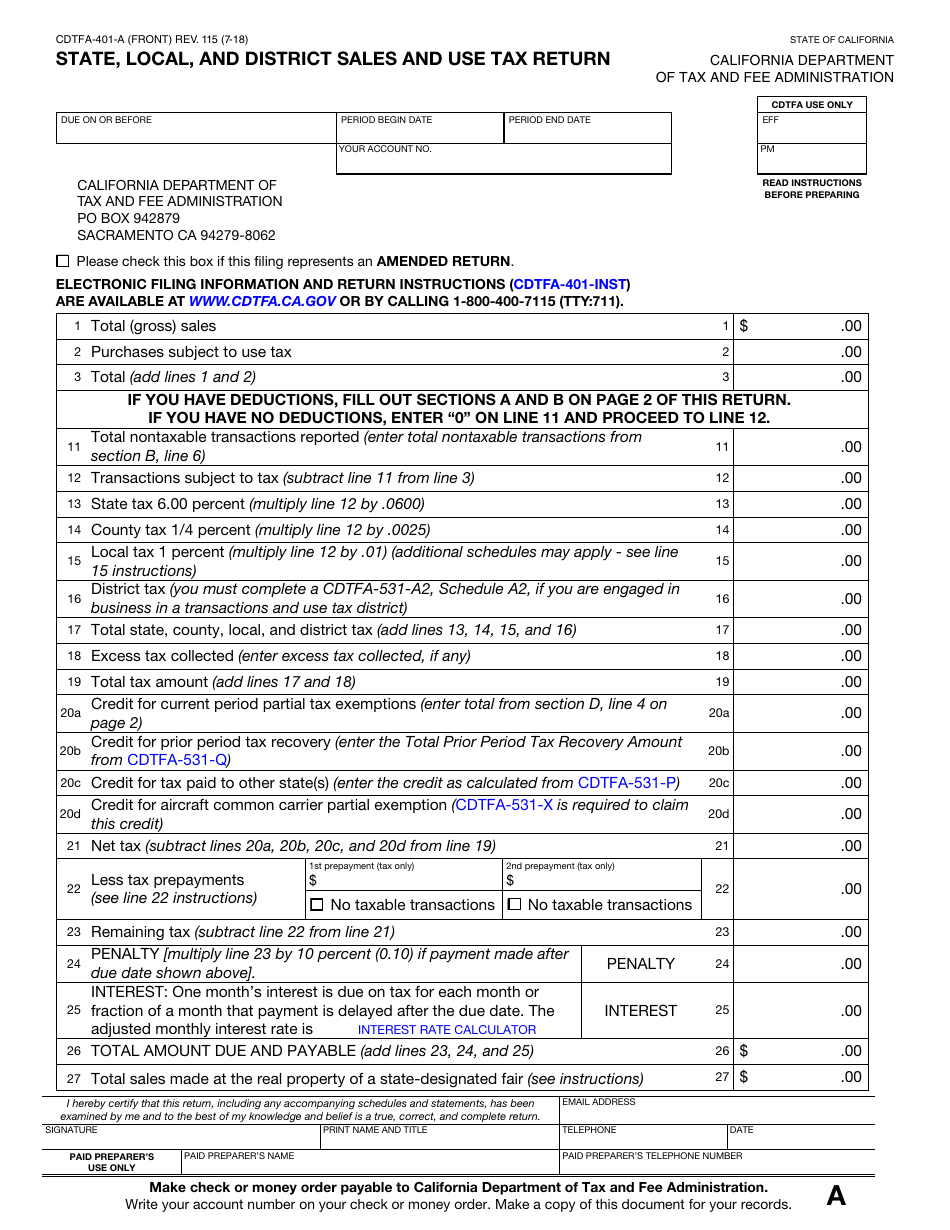

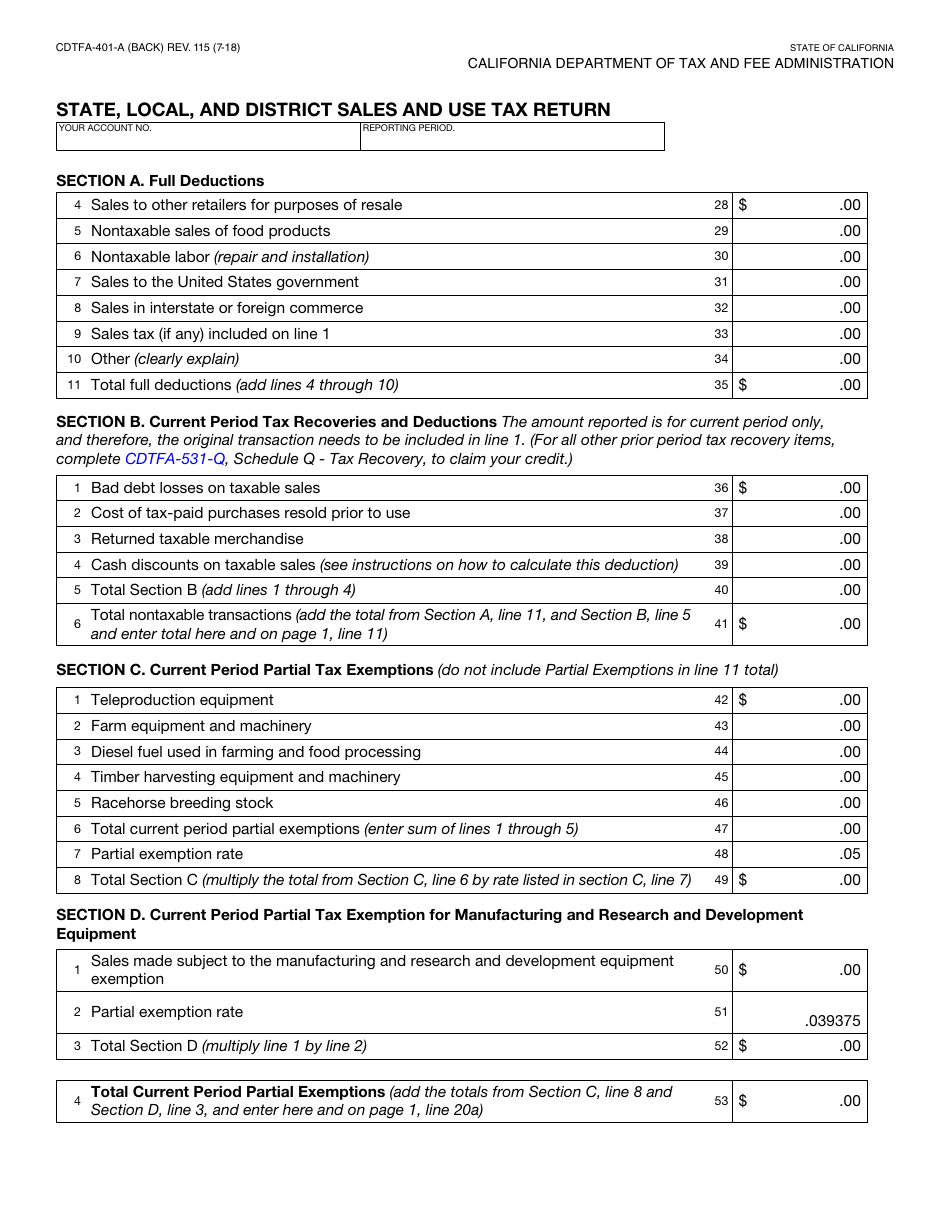

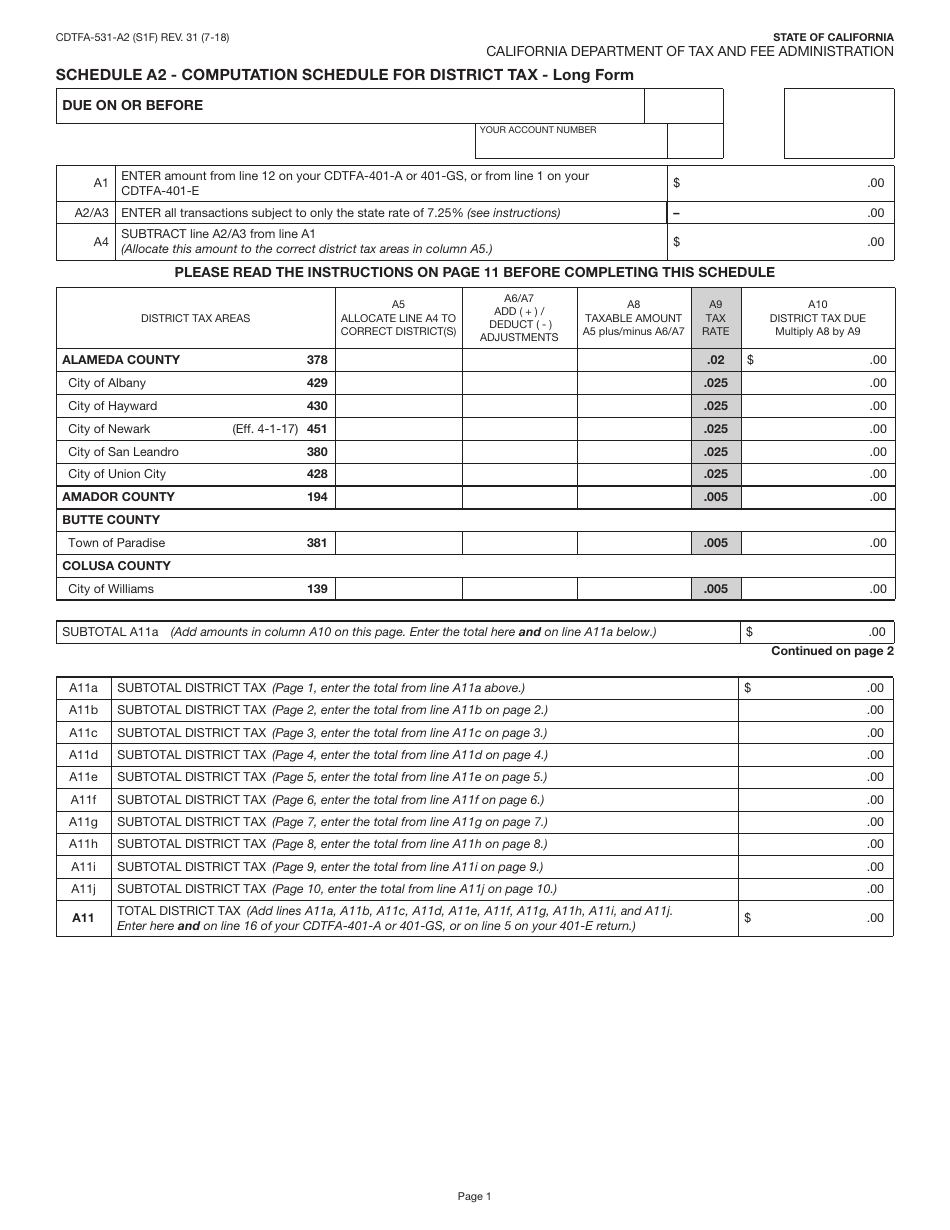

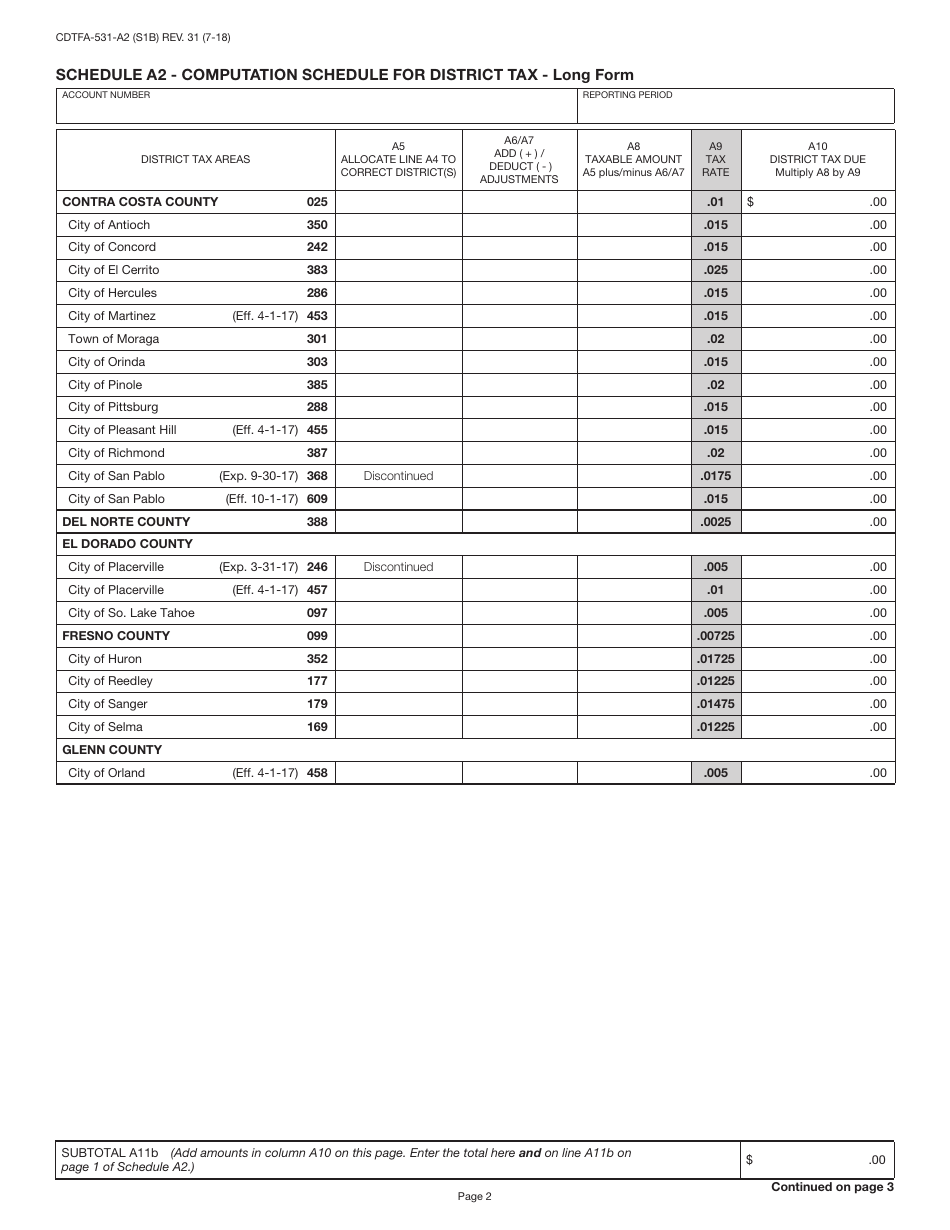

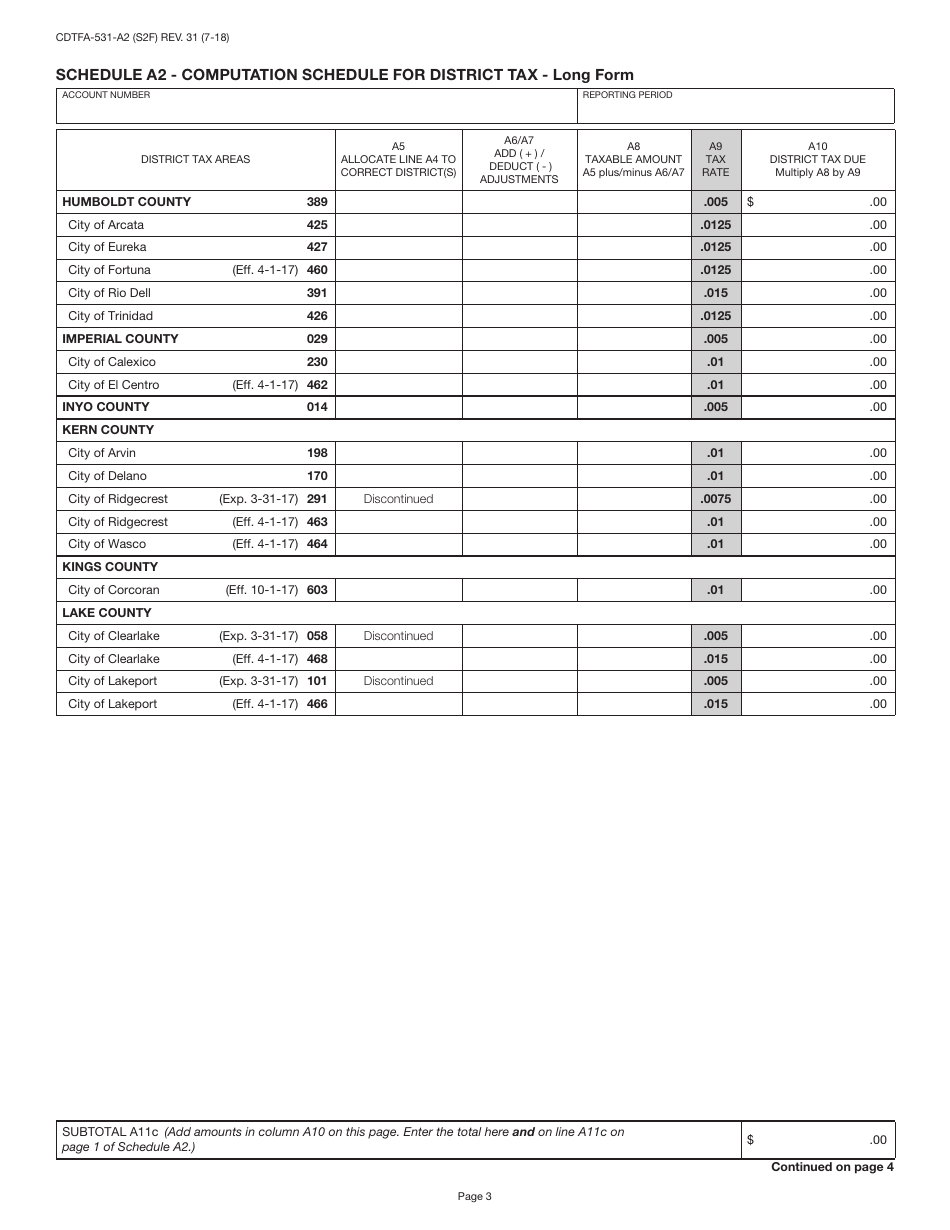

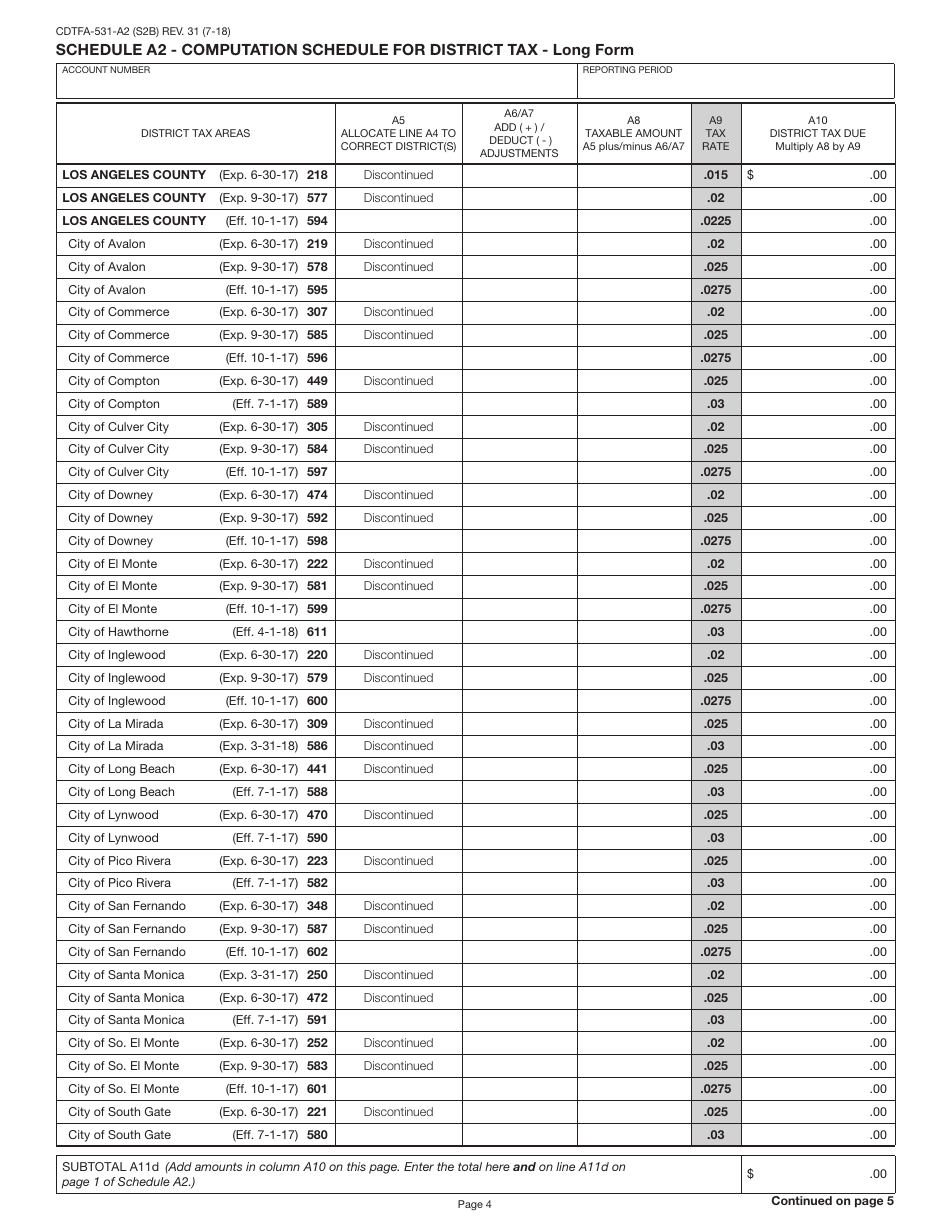

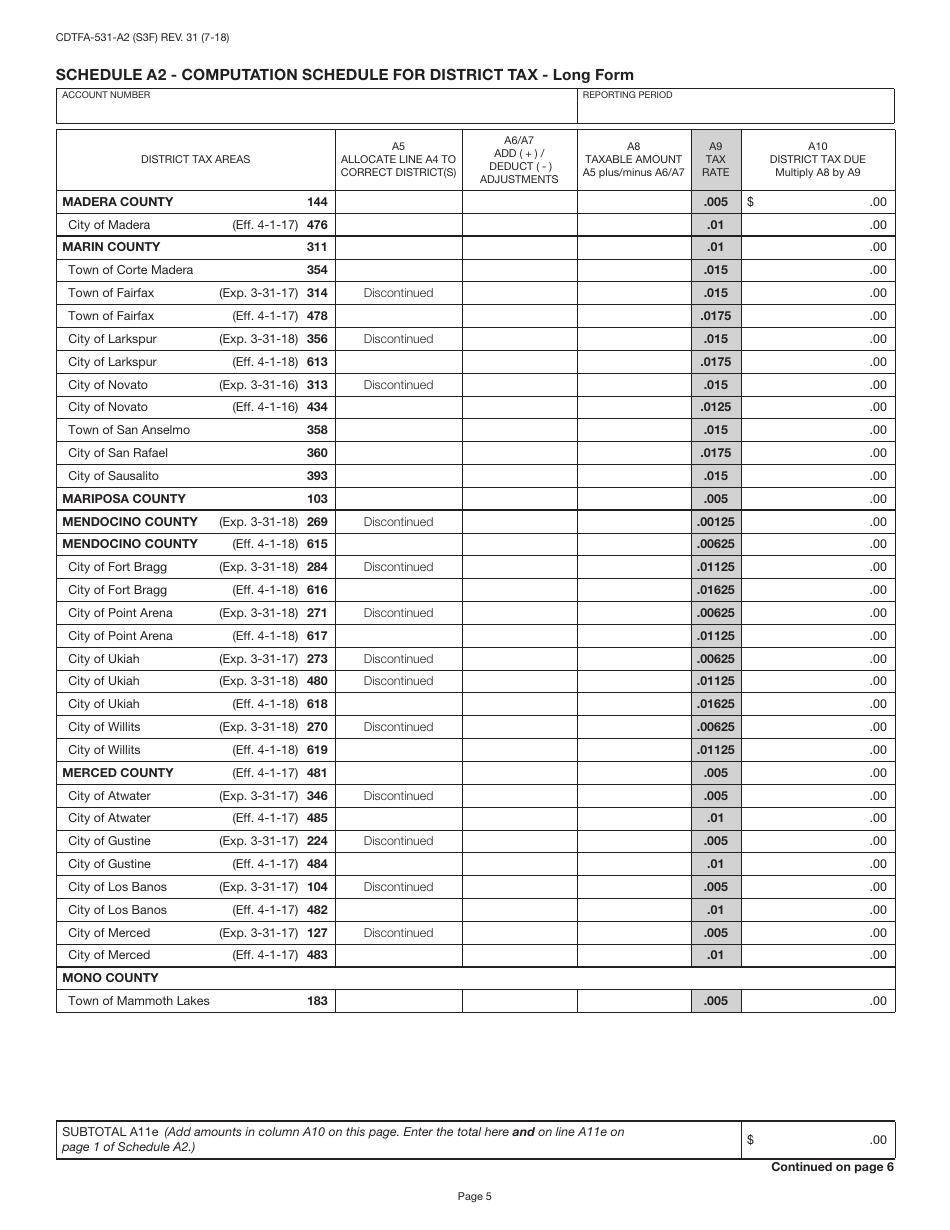

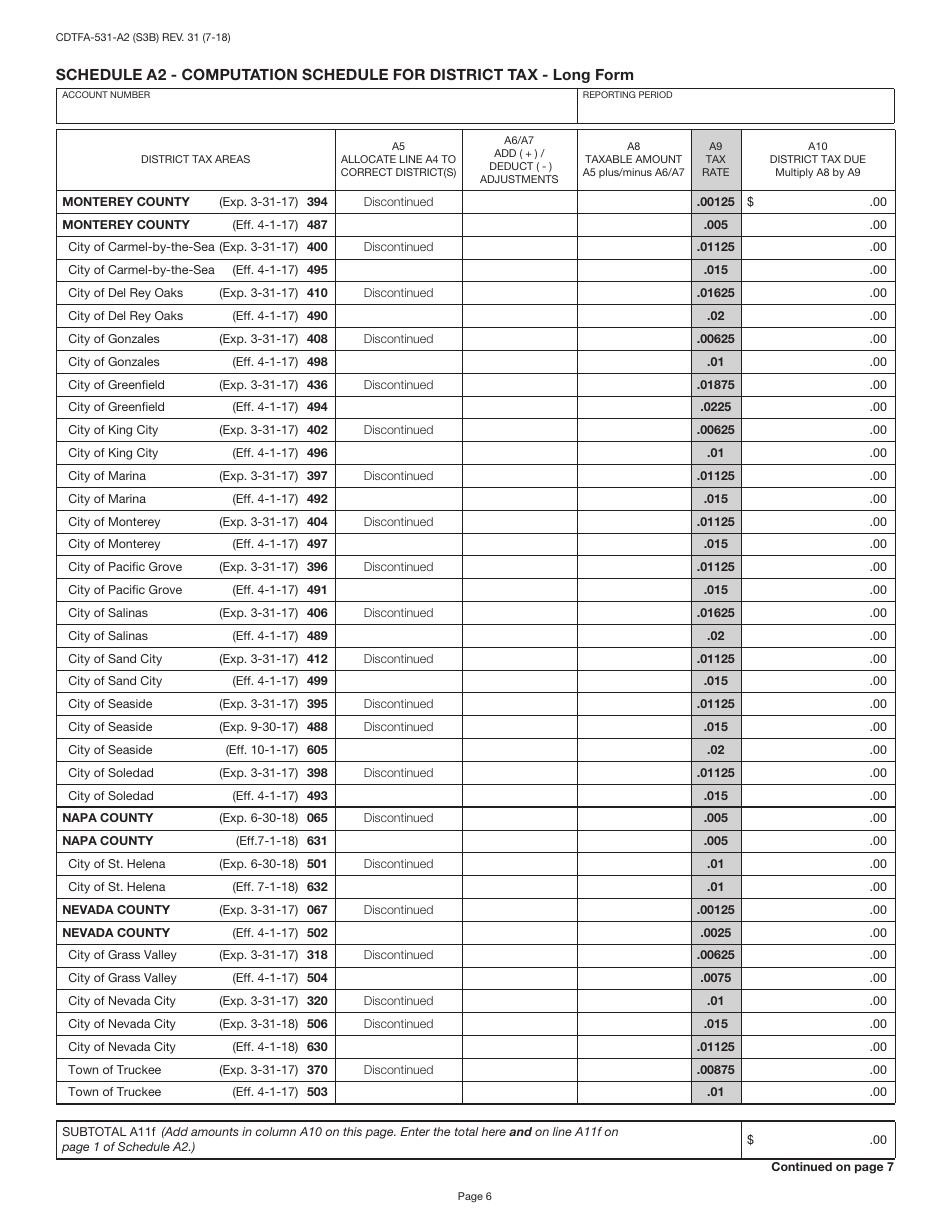

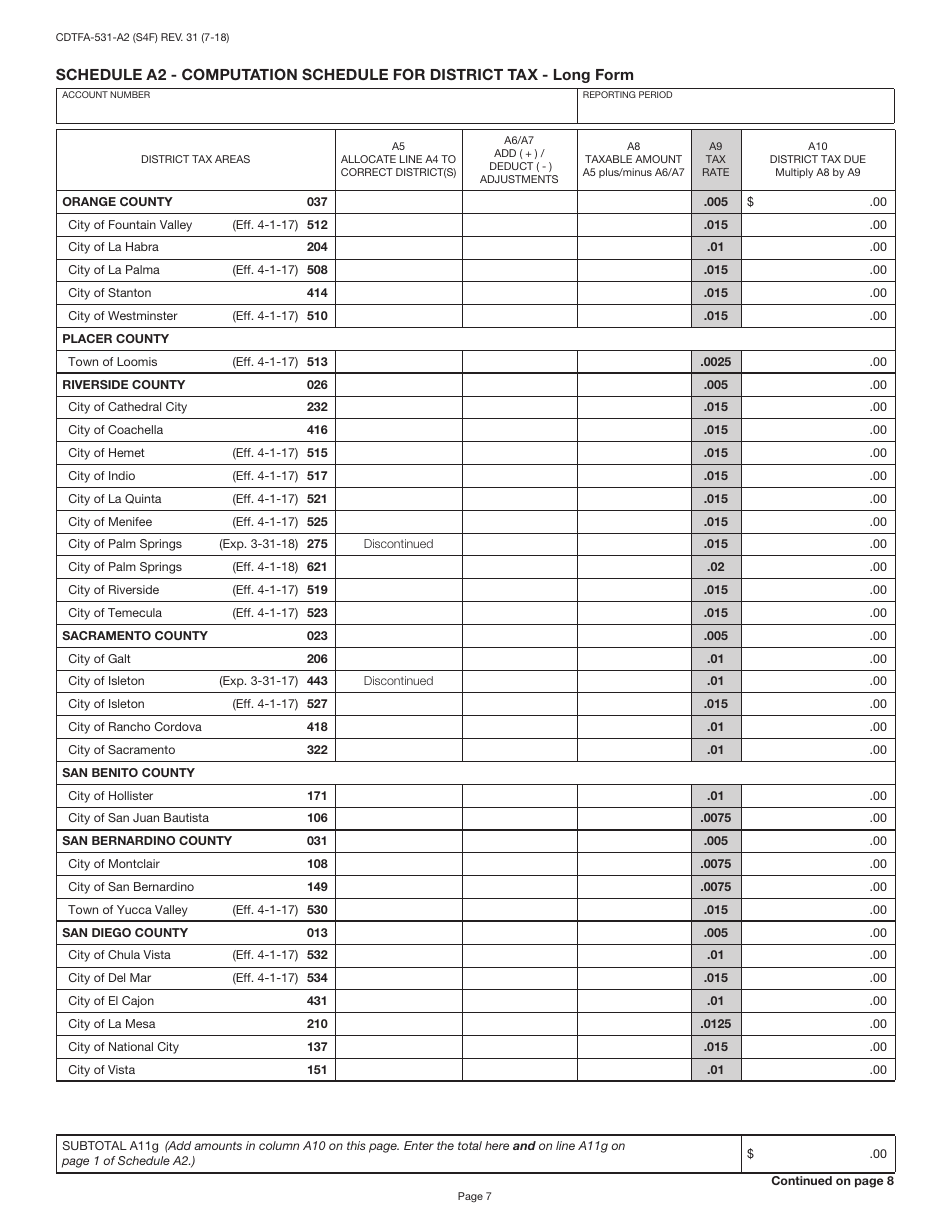

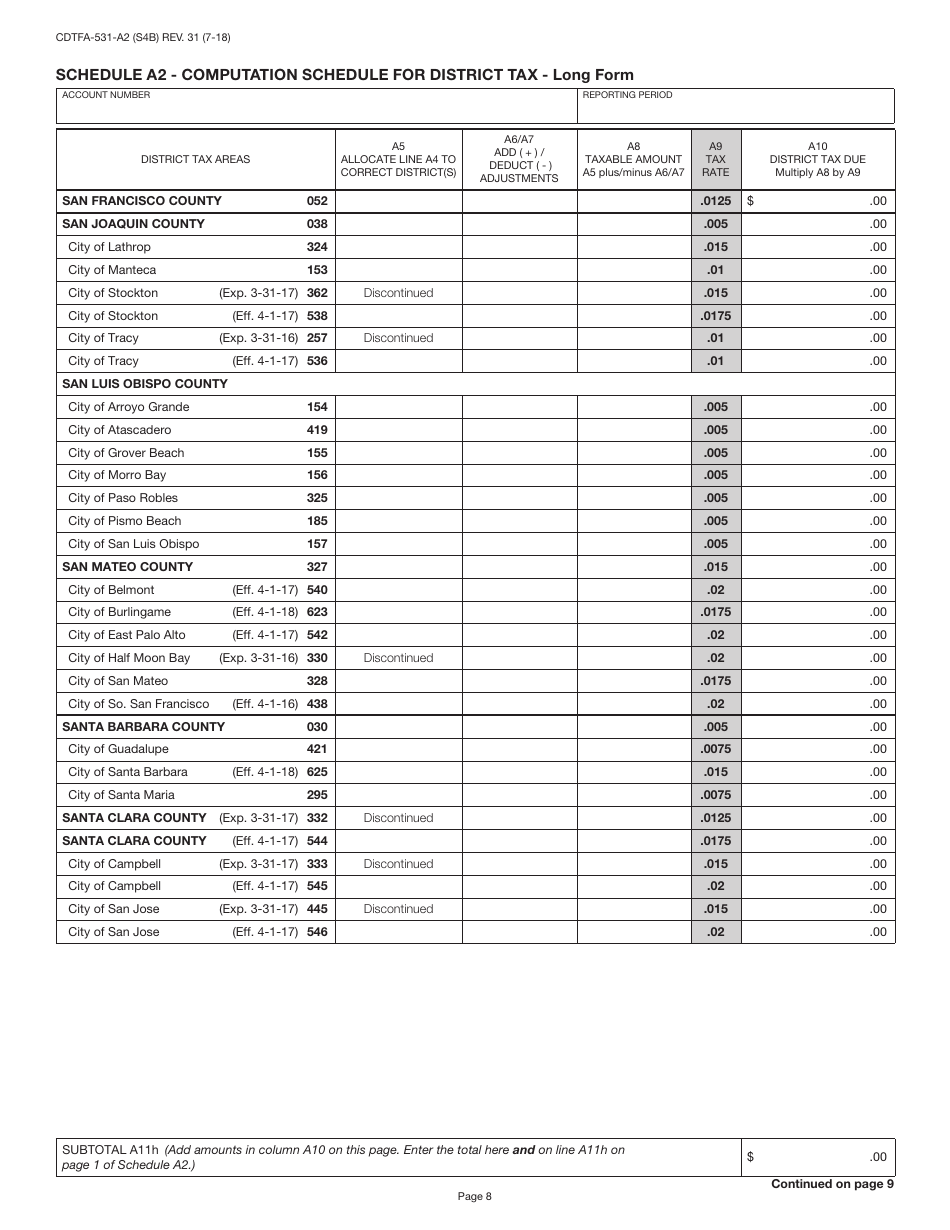

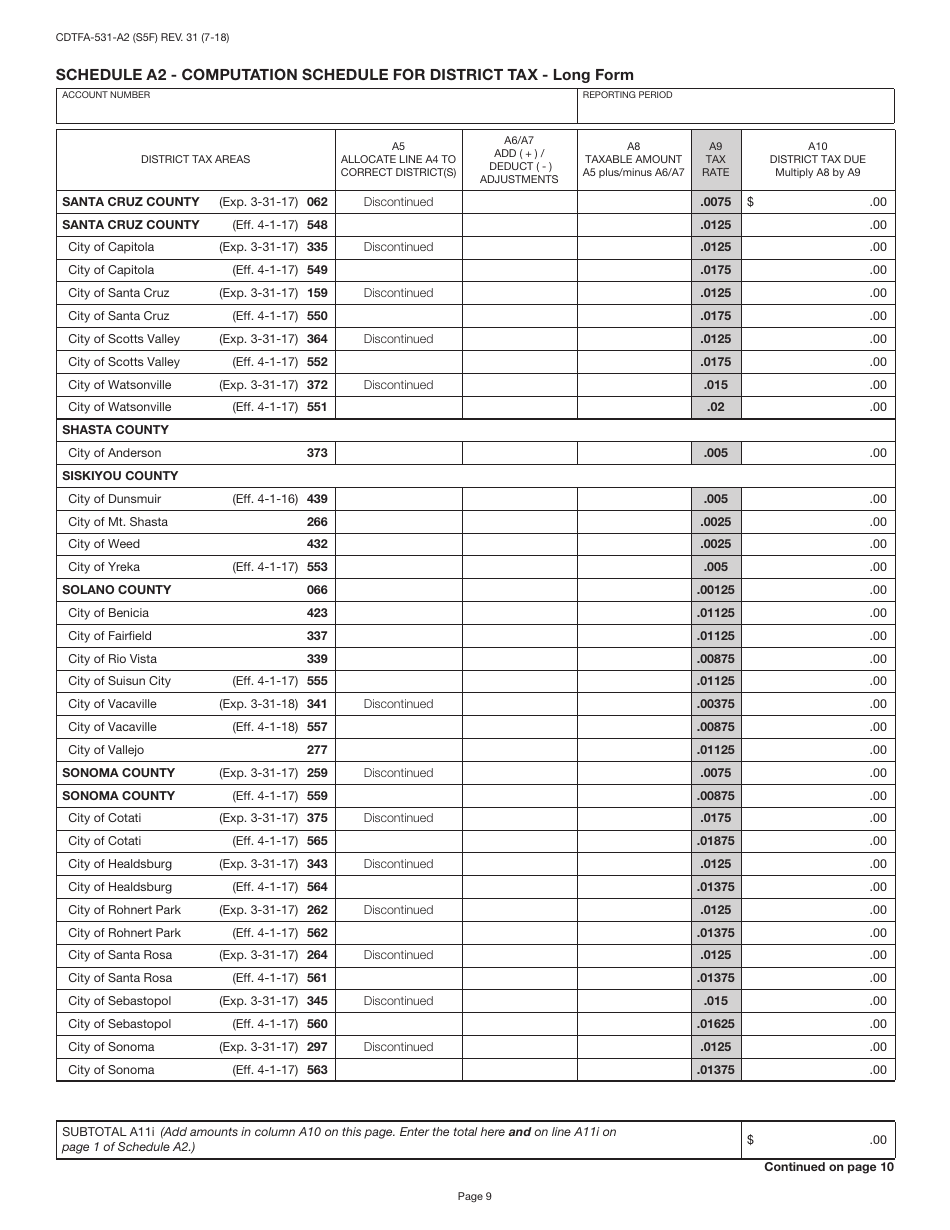

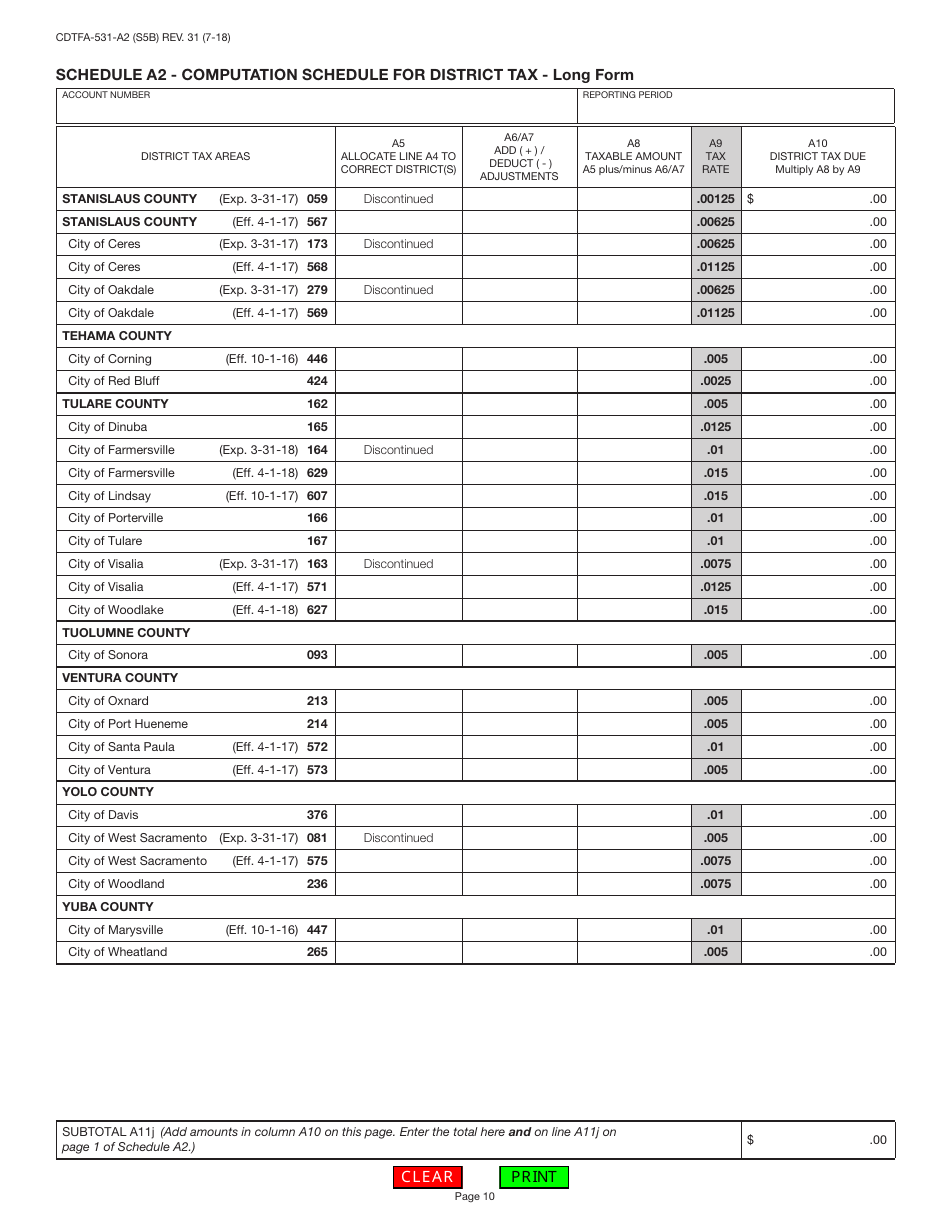

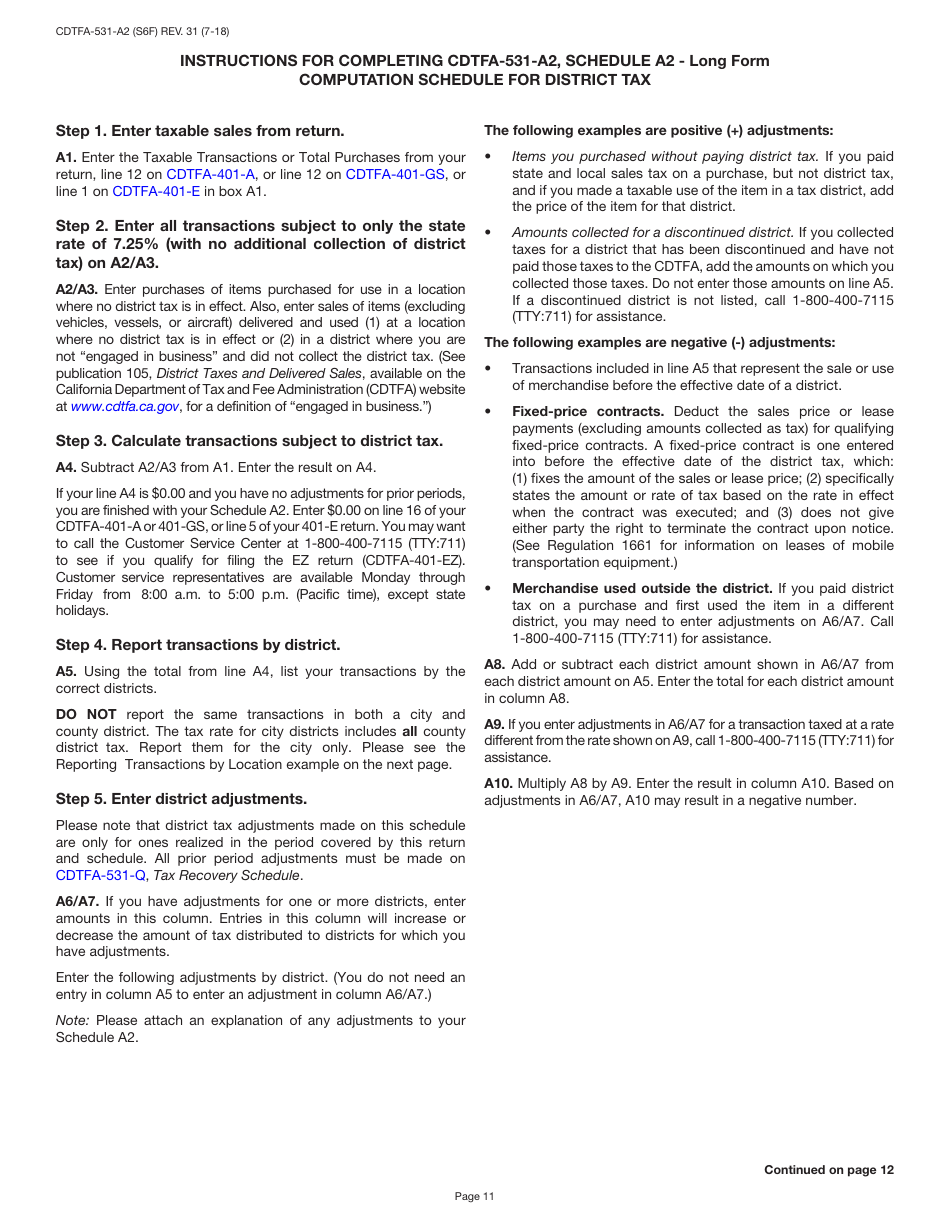

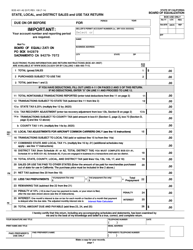

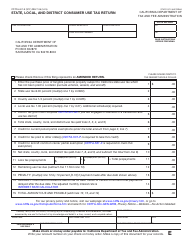

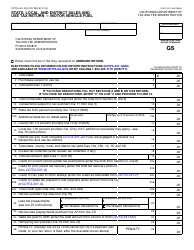

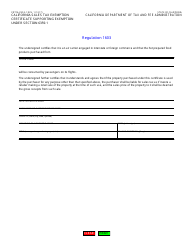

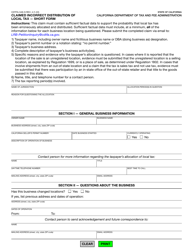

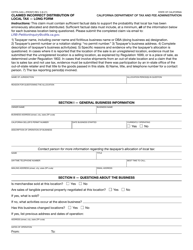

Form CDTFA-401-A State, Local, and District Sales and Use Tax Return - California

What Is Form CDTFA-401-A?

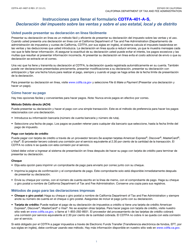

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CDTFA-401-A?

A: Form CDTFA-401-A is the State, Local, and District Sales and Use Tax Return for California.

Q: Who needs to file Form CDTFA-401-A?

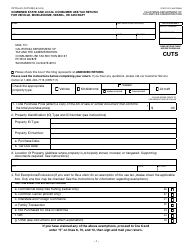

A: Any businesses or individuals who are required to collect sales and use tax in California must file Form CDTFA-401-A.

Q: What is the purpose of Form CDTFA-401-A?

A: The purpose of Form CDTFA-401-A is to report and remit the sales and use tax collected by businesses in California.

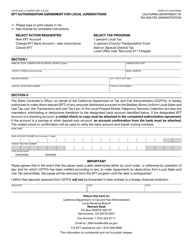

Q: How often do I need to file Form CDTFA-401-A?

A: The frequency of filing Form CDTFA-401-A depends on your estimated sales tax liability. It could be monthly, quarterly, or annually.

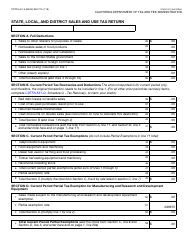

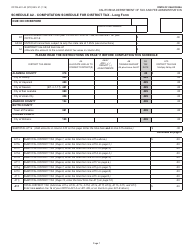

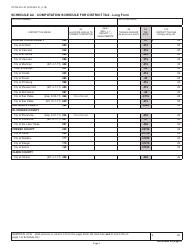

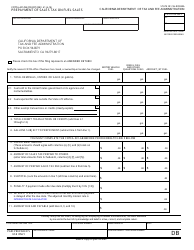

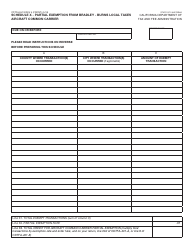

Q: What information do I need to include on Form CDTFA-401-A?

A: You will need to provide details about your sales, use tax owed, and any allowable or refundable credits or deductions.

Q: What happens if I don't file Form CDTFA-401-A?

A: Failure to file Form CDTFA-401-A or pay the sales and use tax owed can result in penalties, interest, and other enforcement actions.

Q: Are there any exemptions or exclusions to filing Form CDTFA-401-A?

A: Some businesses may qualify for exemptions or exclusions from filing Form CDTFA-401-A. It is best to consult the CDTFA or a tax professional for specific guidance.

Q: Can I make changes or amend a filed Form CDTFA-401-A?

A: Yes, if you need to make changes to a filed Form CDTFA-401-A, you can file an amended return to correct any errors or omissions.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-401-A by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.