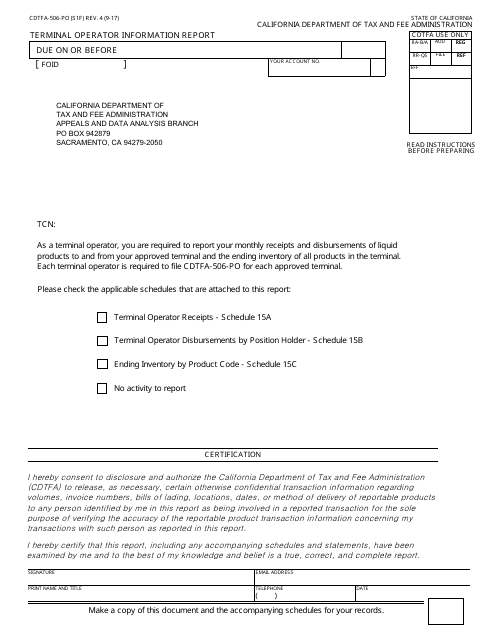

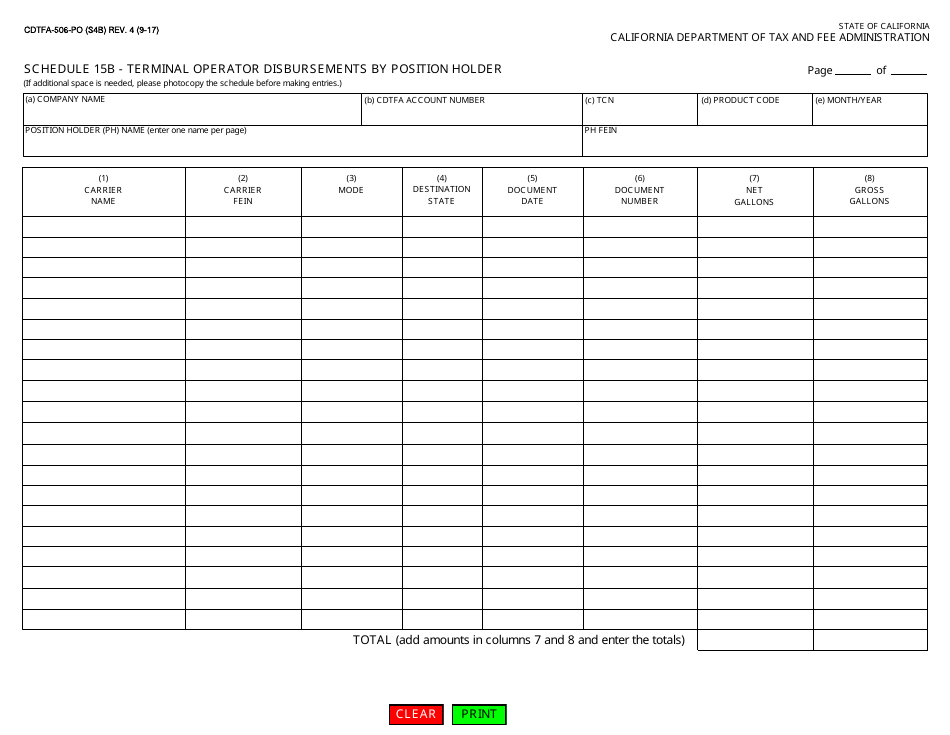

Form CDTFA-506-PO Terminal Operator Information Report - California

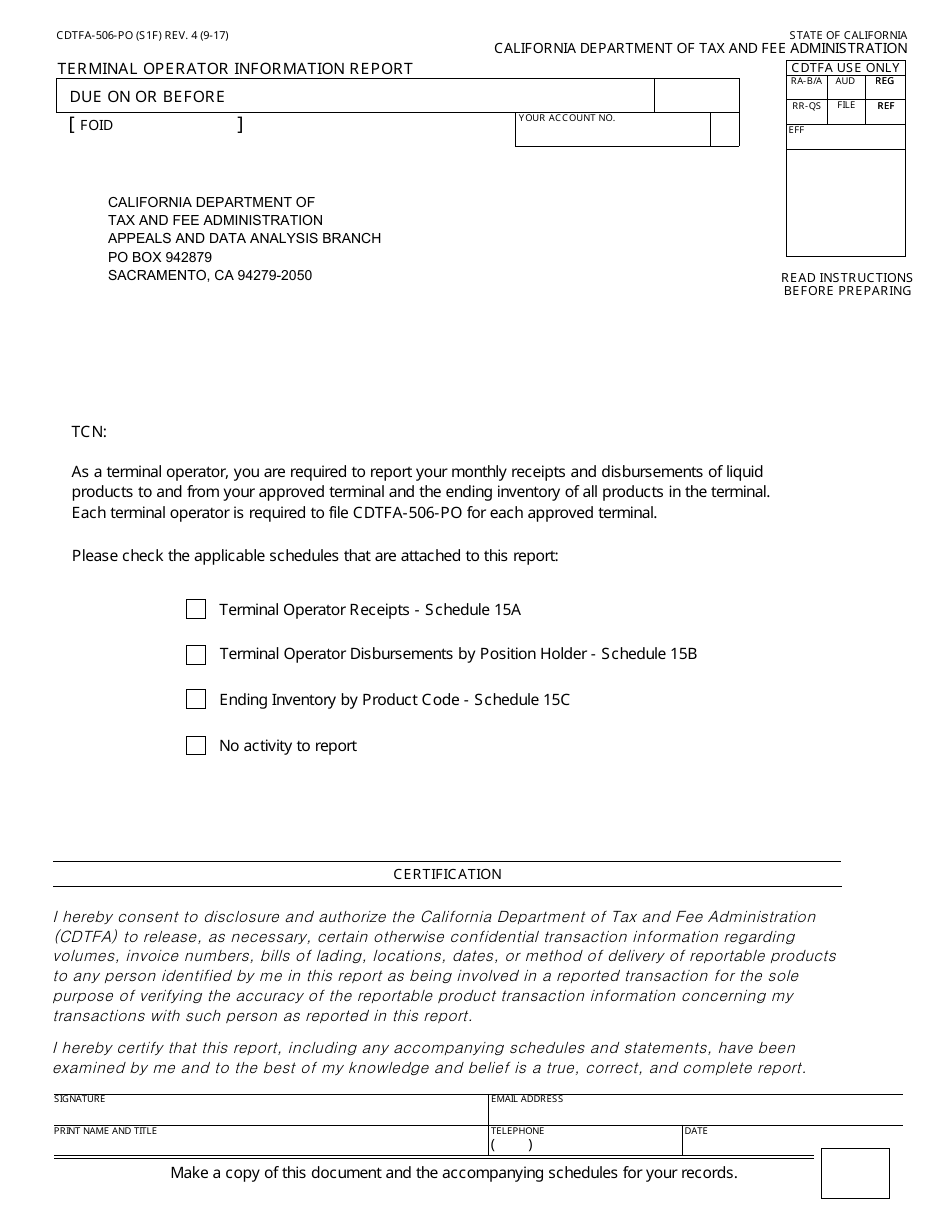

What Is Form CDTFA-506-PO?

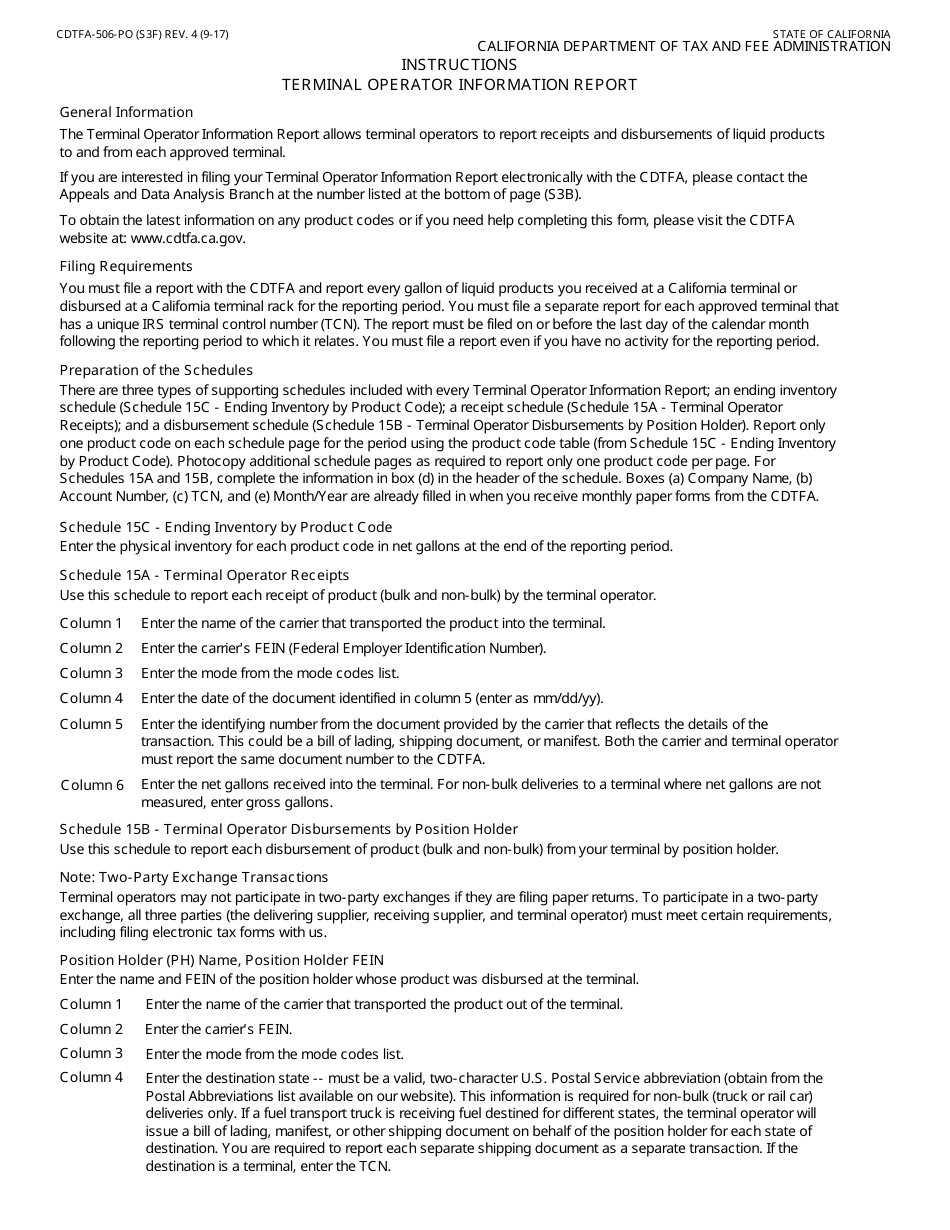

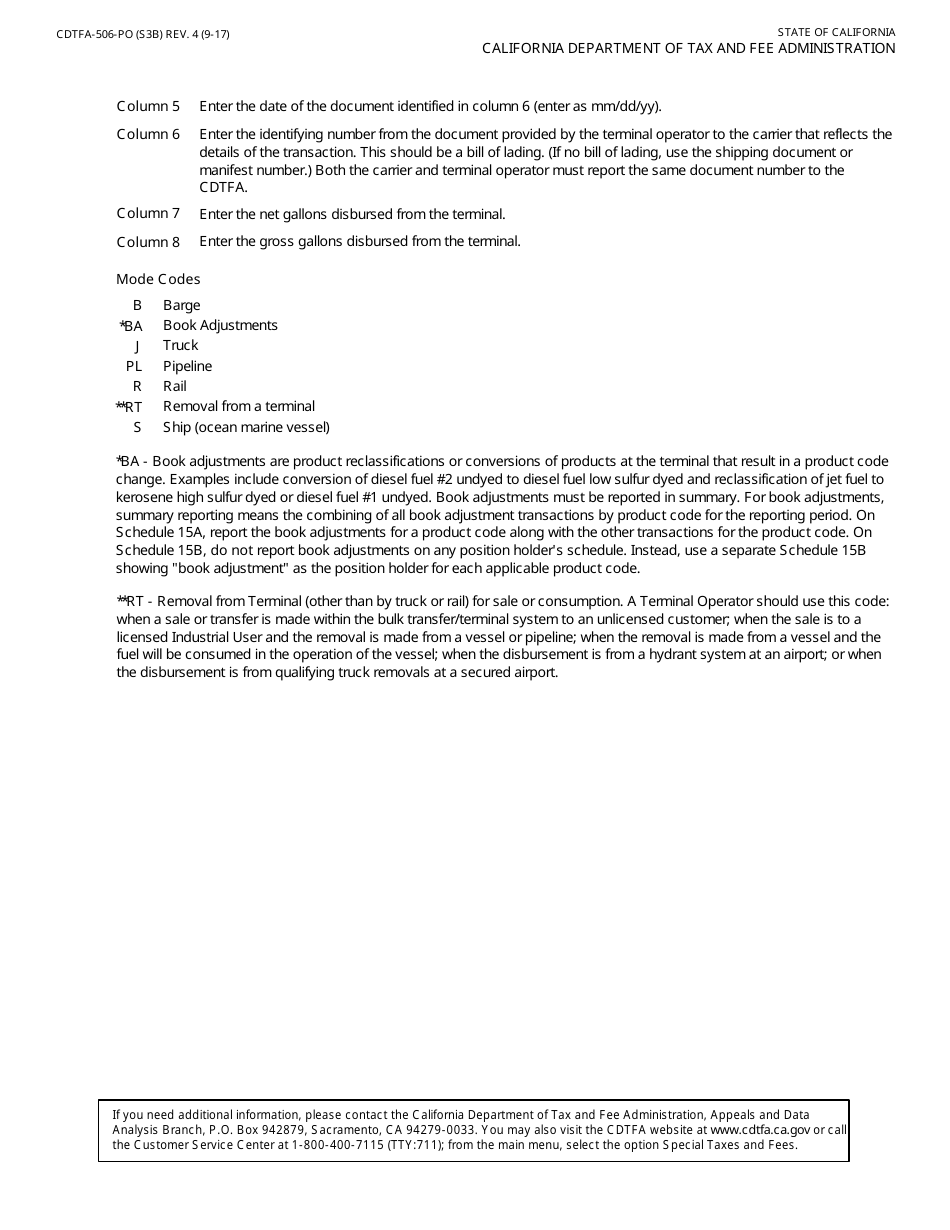

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-506-PO?

A: Form CDTFA-506-PO is the Terminal Operator Information Report that is filed by terminal operators in California.

Q: Who needs to file Form CDTFA-506-PO?

A: Terminal operators in California need to file Form CDTFA-506-PO.

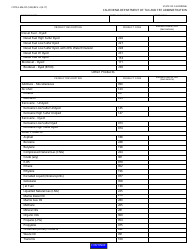

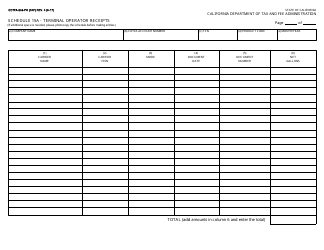

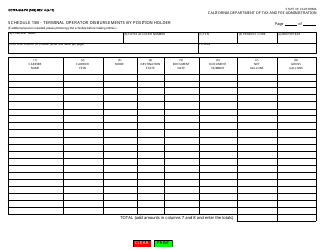

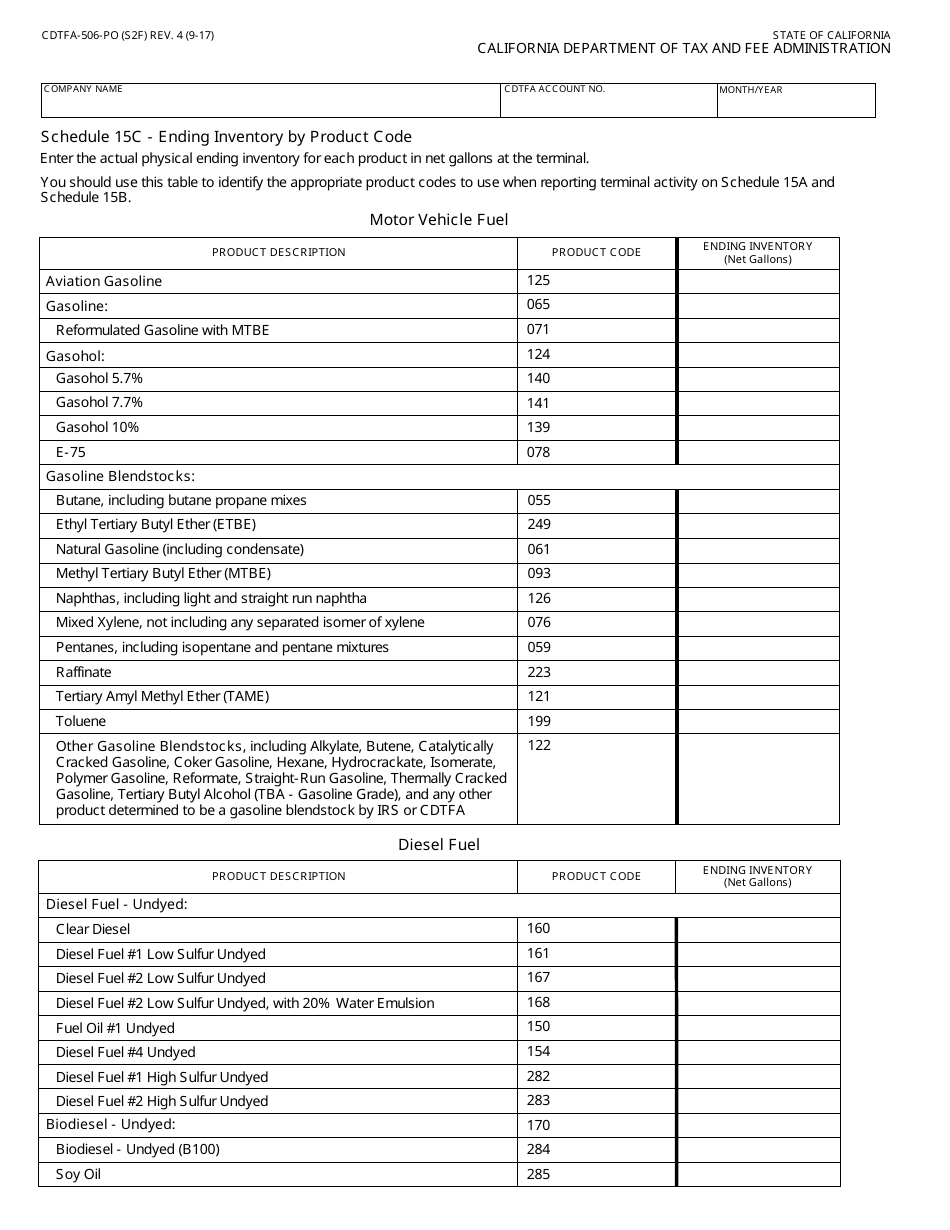

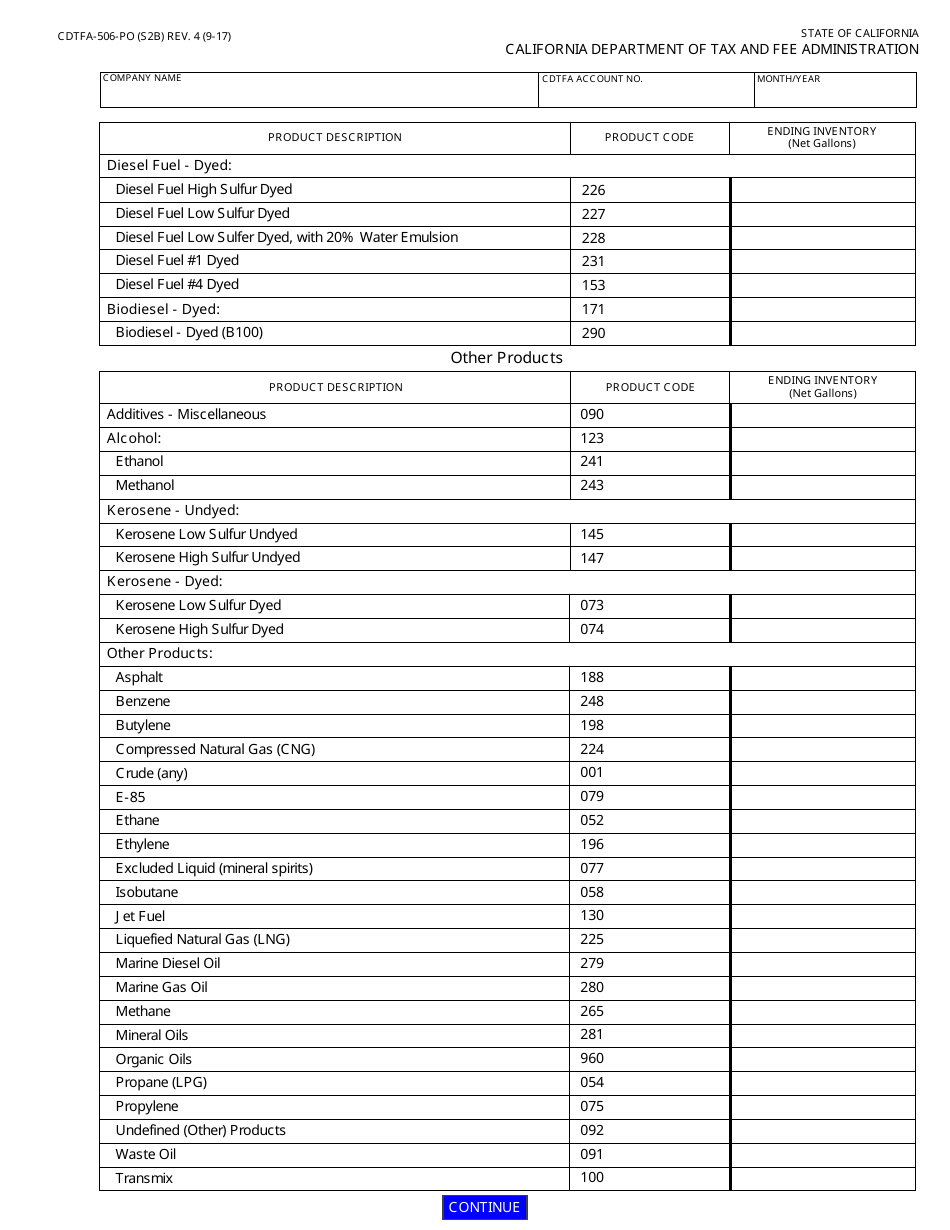

Q: What information is required on Form CDTFA-506-PO?

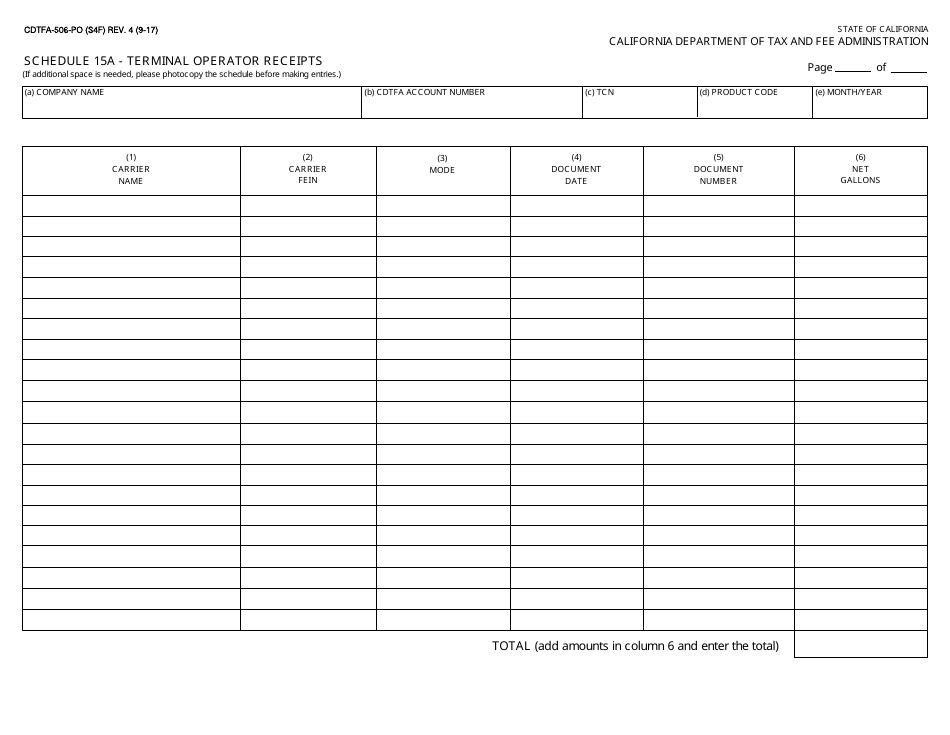

A: Form CDTFA-506-PO requires terminal operators to provide information such as the name and address of the terminal, total unblended gallons received, and other details related to fuel sales.

Q: When is Form CDTFA-506-PO due?

A: Form CDTFA-506-PO is due on a monthly basis, with the due date falling on the 28th day of the month following the reporting period.

Q: Are there any penalties for not filing or late filing Form CDTFA-506-PO?

A: Yes, there are penalties for not filing or late filing Form CDTFA-506-PO. The penalties can vary depending on the amount of tax due and the length of the delay.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-506-PO by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.