This version of the form is not currently in use and is provided for reference only. Download this version of

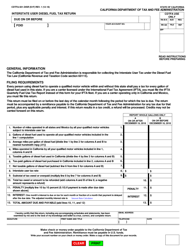

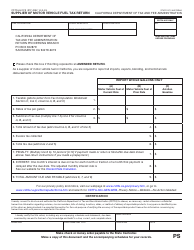

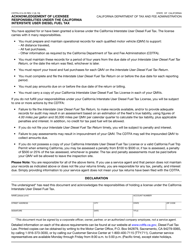

Form CDTFA-501-AU

for the current year.

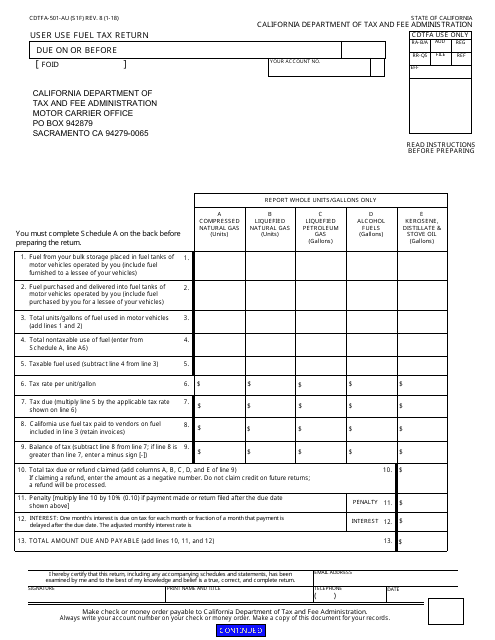

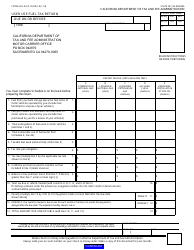

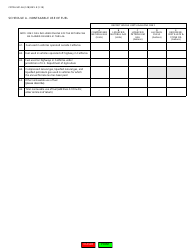

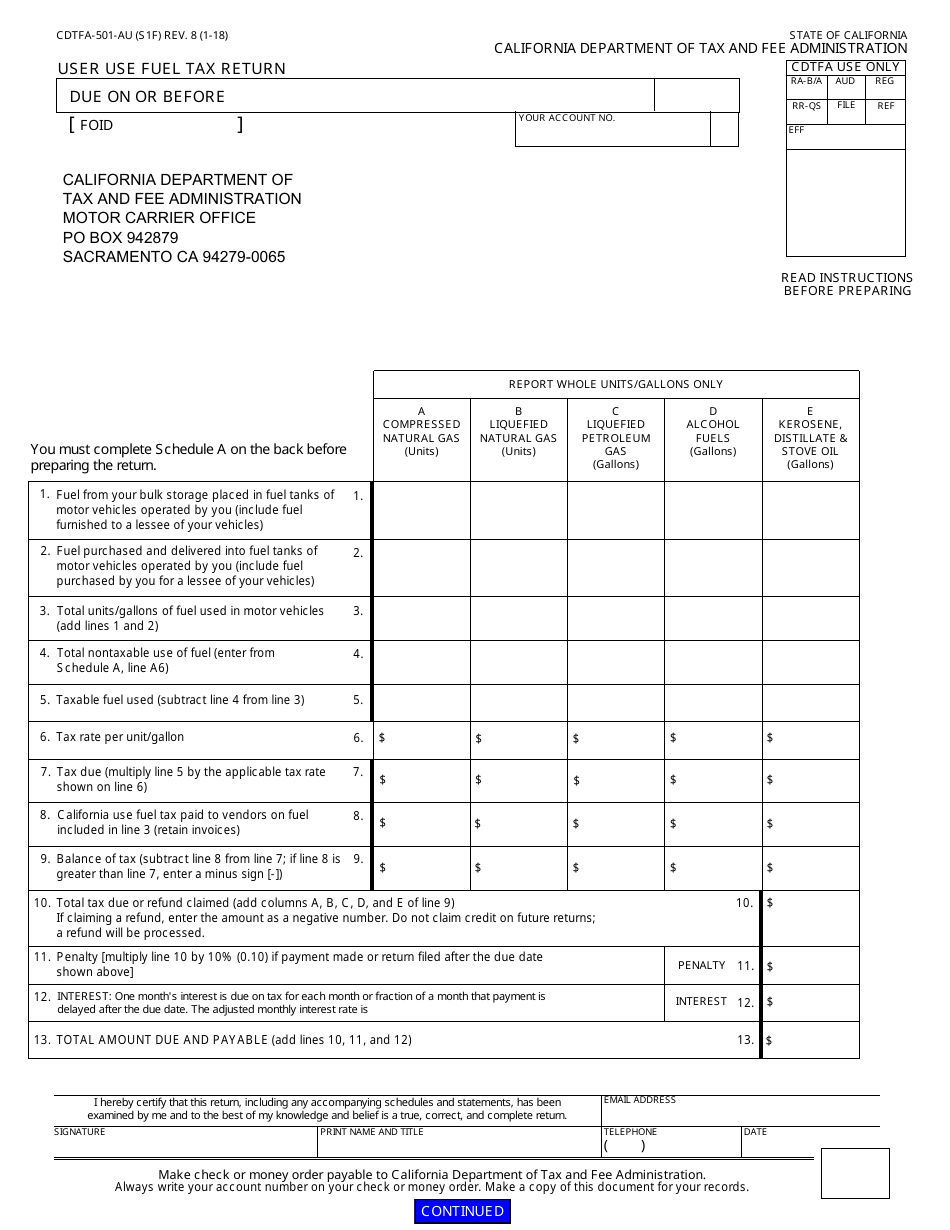

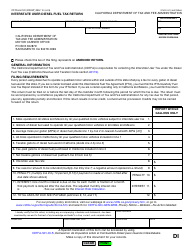

Form CDTFA-501-AU User Use Fuel Tax Return - California

What Is Form CDTFA-501-AU?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CDTFA-501-AU?

A: CDTFA-501-AU is a User Use Fuel Tax Return form in California.

Q: Who needs to file CDTFA-501-AU?

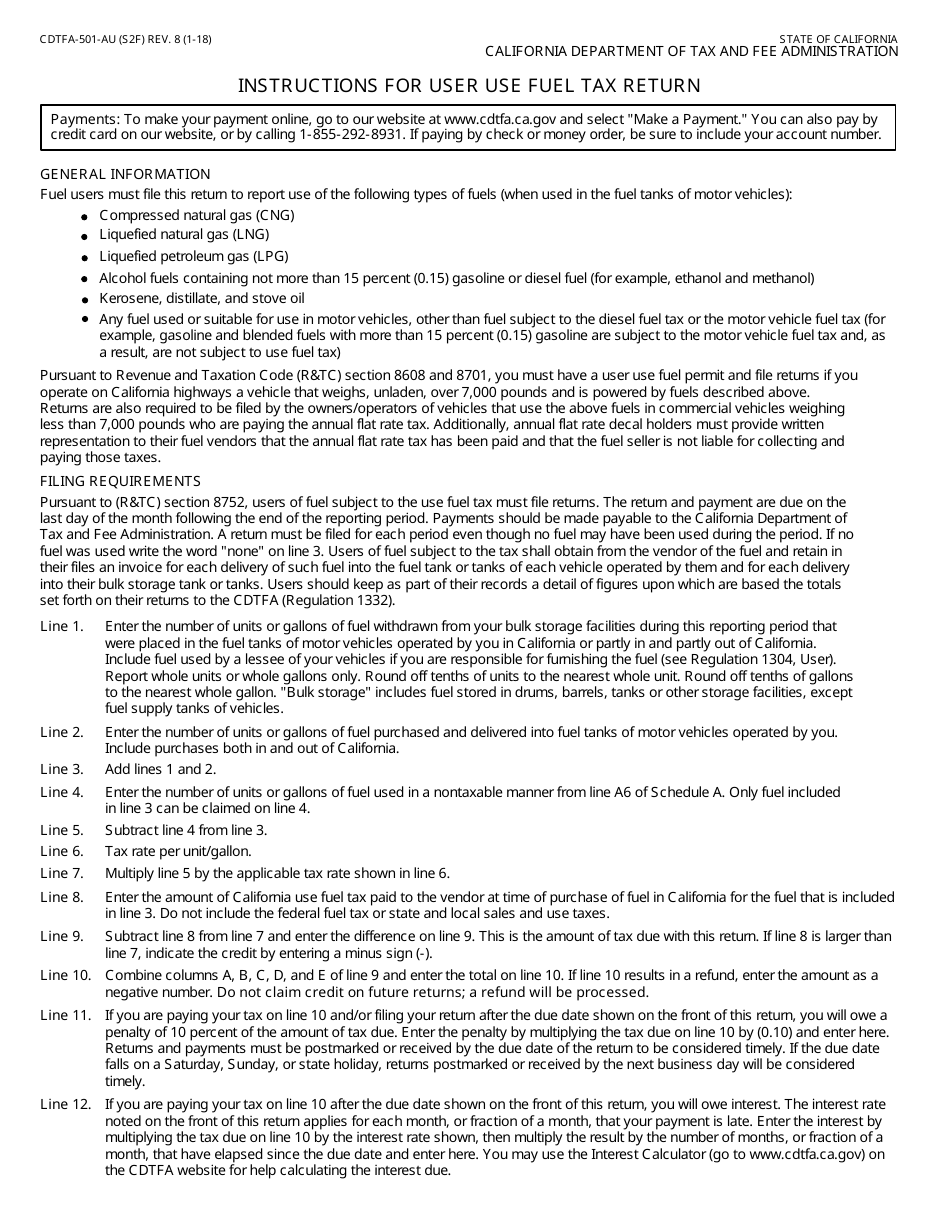

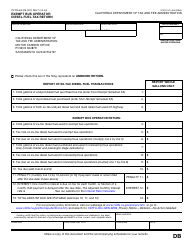

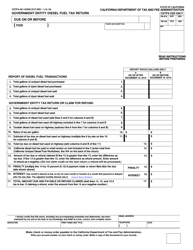

A: Any user or bulk purchaser of fuel in California needs to file CDTFA-501-AU.

Q: What is the purpose of CDTFA-501-AU?

A: The purpose of CDTFA-501-AU is to report and pay user use fuel taxes in California.

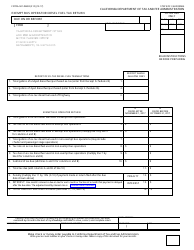

Q: When is the deadline to file CDTFA-501-AU?

A: CDTFA-501-AU must be filed by the last day of the month following the end of the reporting period.

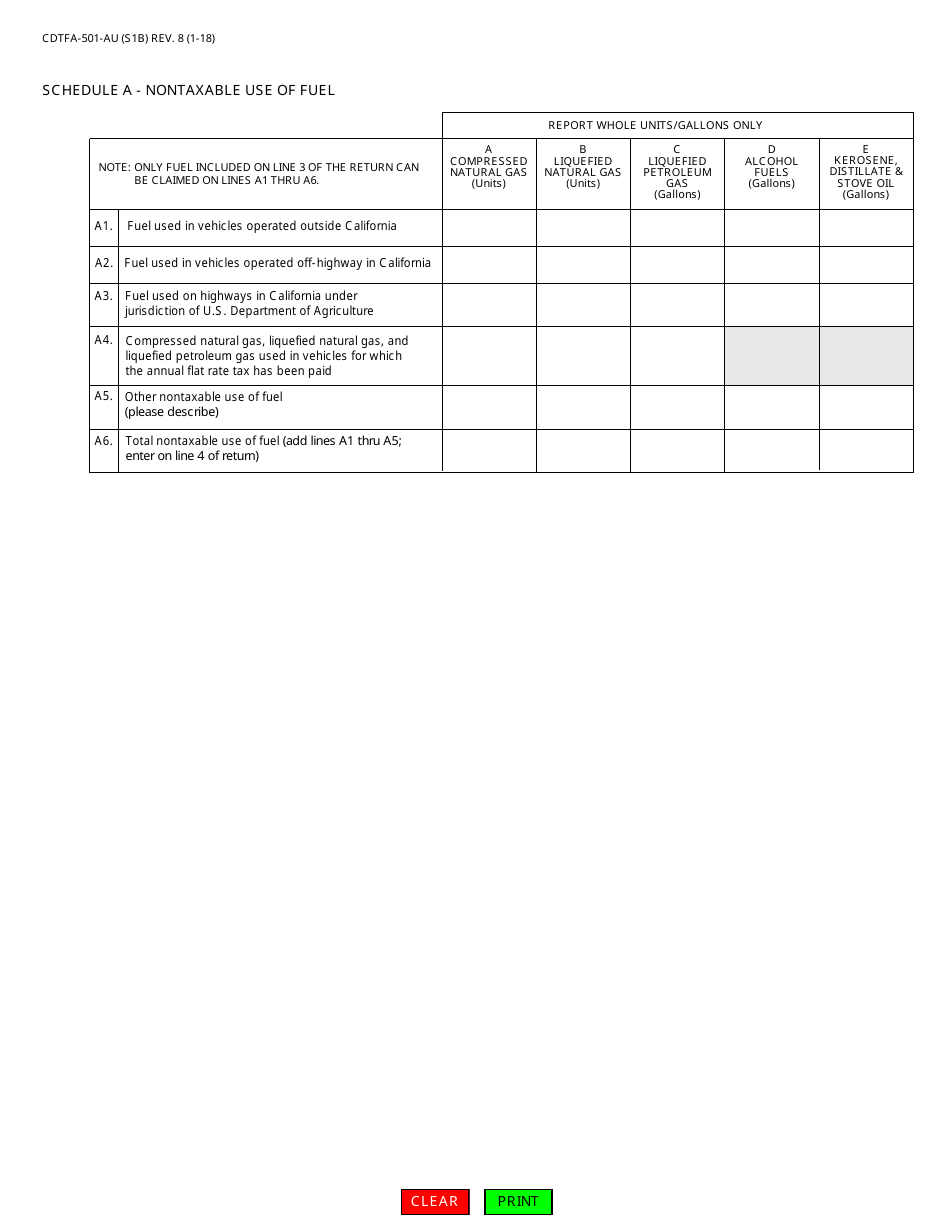

Q: What information is required to fill out CDTFA-501-AU?

A: You will need to provide details such as fuel type, gallons used or purchased, and total tax due.

Q: Do I need to file CDTFA-501-AU if I don't use fuel in California?

A: No, CDTFA-501-AU is only for users or bulk purchasers of fuel in California.

Q: Is there a penalty for late filing of CDTFA-501-AU?

A: Yes, there may be penalties and interest for late filing or failure to file CDTFA-501-AU.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-AU by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.