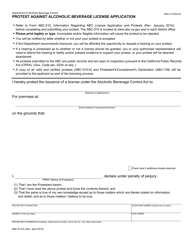

This version of the form is not currently in use and is provided for reference only. Download this version of

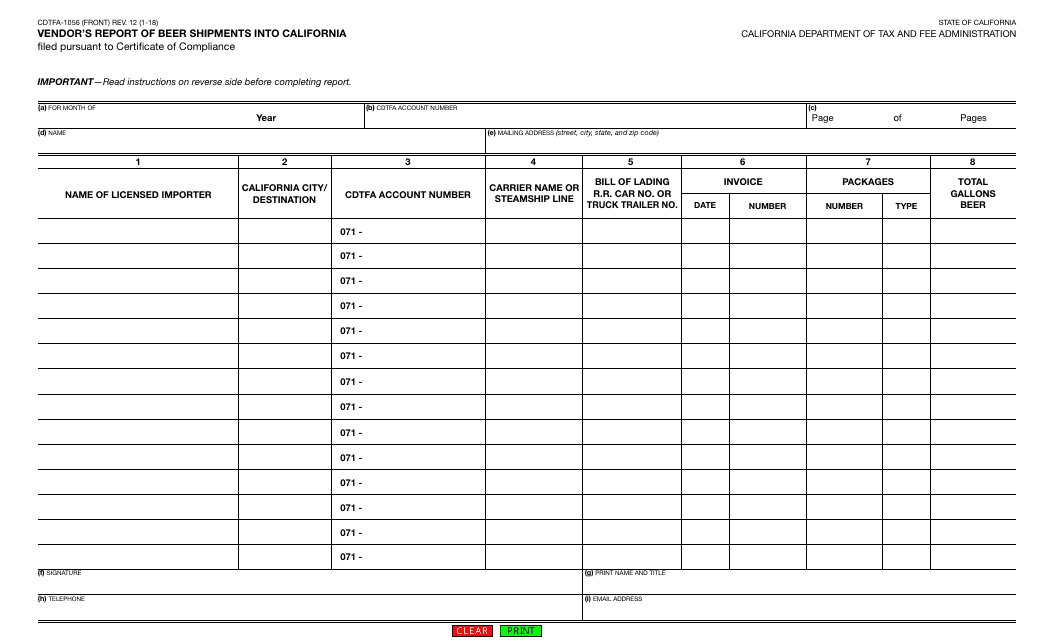

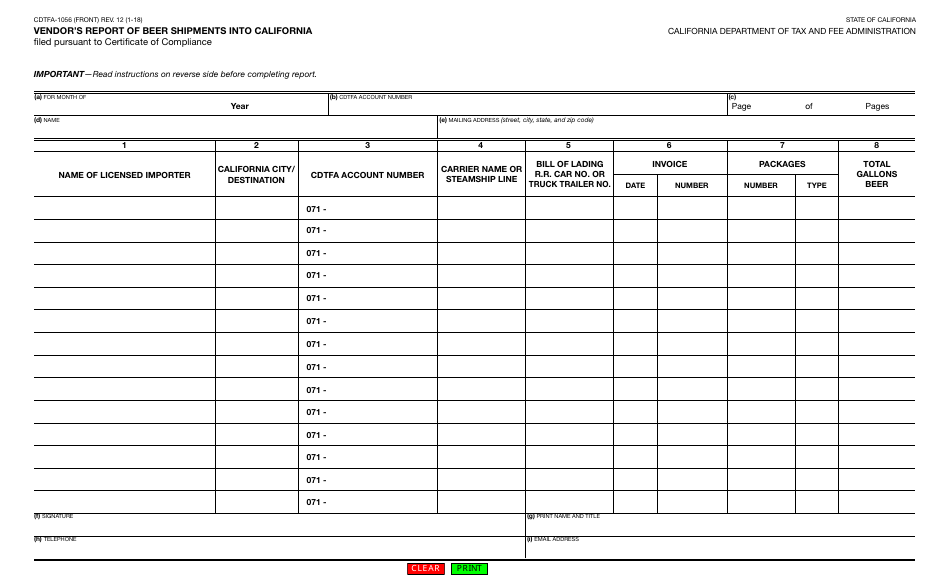

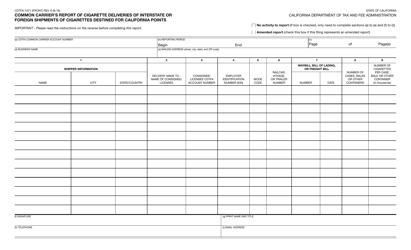

Form CDTFA-1056

for the current year.

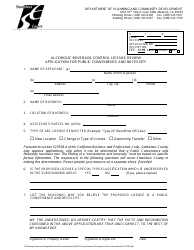

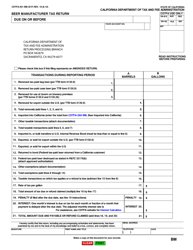

Form CDTFA-1056 Vendor's Report of Beer Shipments Into California - California

What Is Form CDTFA-1056?

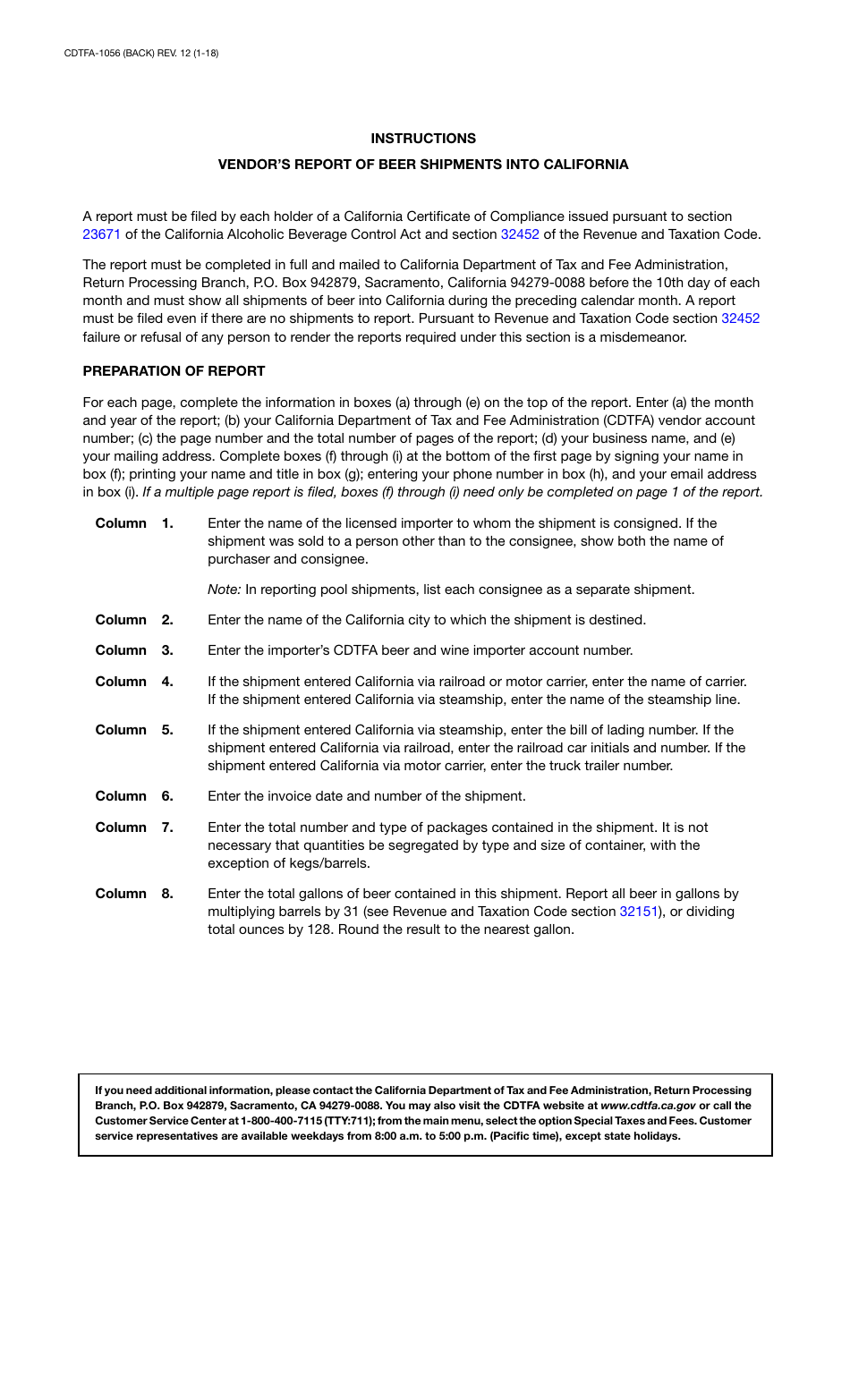

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-1056?

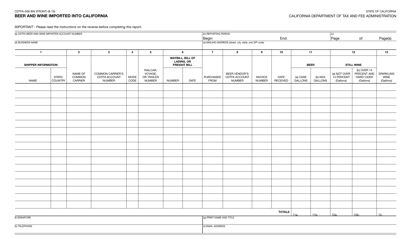

A: Form CDTFA-1056 is the Vendor's Report of Beer Shipments Into California.

Q: Who needs to file Form CDTFA-1056?

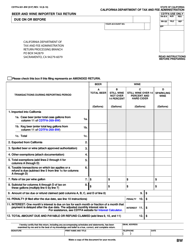

A: Vendors who ship beer into California are required to file Form CDTFA-1056.

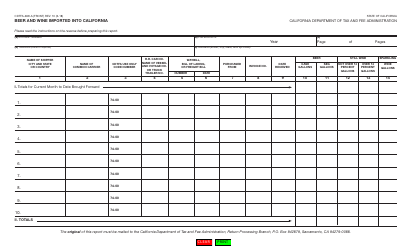

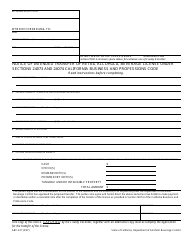

Q: What information is required on Form CDTFA-1056?

A: Form CDTFA-1056 requires vendors to provide details about the beer shipments, including the type of beer, quantity, and value.

Q: When is Form CDTFA-1056 due?

A: Form CDTFA-1056 is due on a monthly basis, by the last day of the month following the reporting period.

Q: Is there a penalty for not filing Form CDTFA-1056?

A: Yes, there can be penalties for not filing Form CDTFA-1056 or for filing it late.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-1056 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.