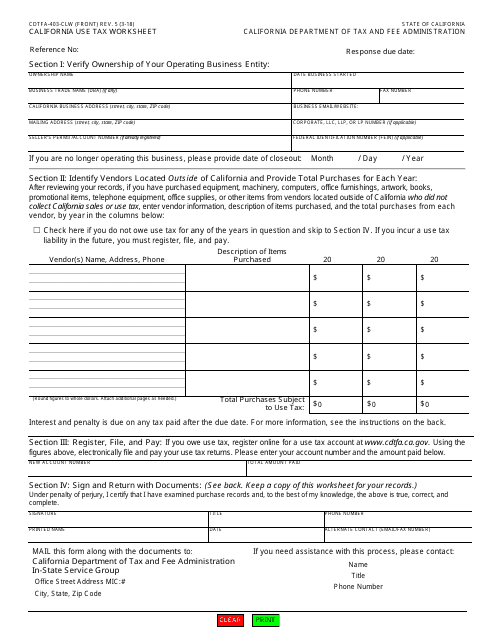

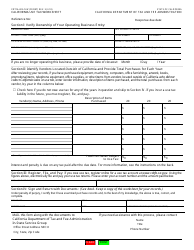

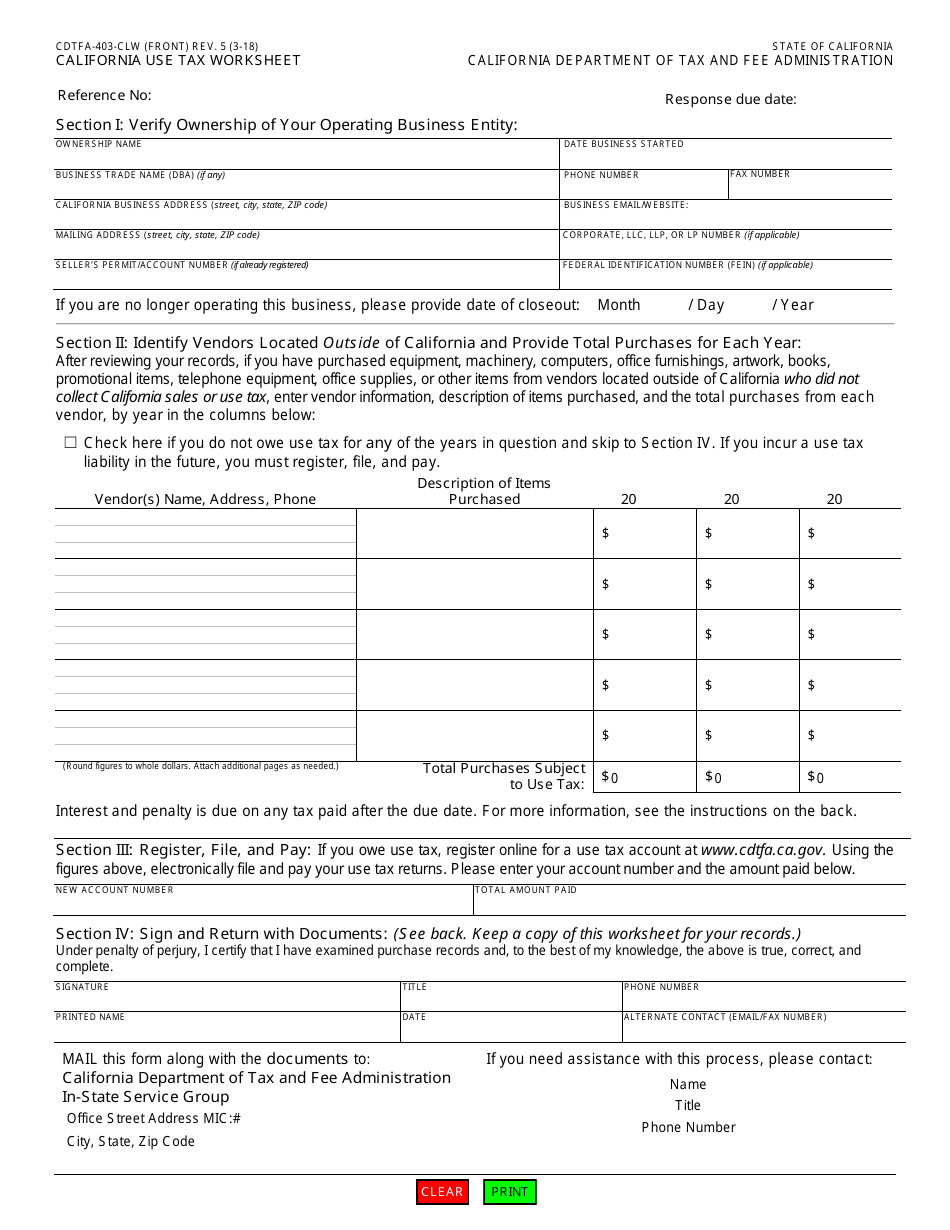

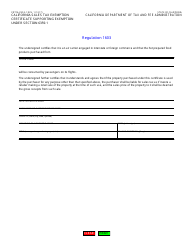

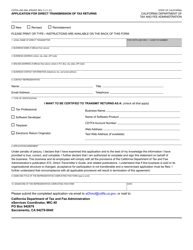

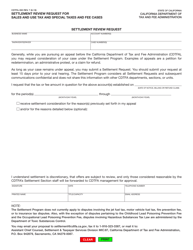

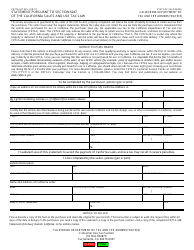

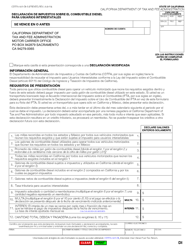

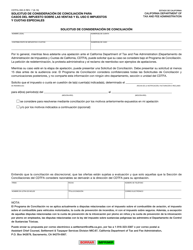

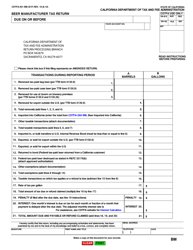

Form CDTFA-403-CLW California Use Tax Worksheet - California

What Is Form CDTFA-403-CLW?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

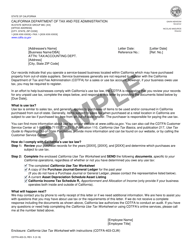

Q: What is Form CDTFA-403-CLW?

A: Form CDTFA-403-CLW is the California Use Tax Worksheet.

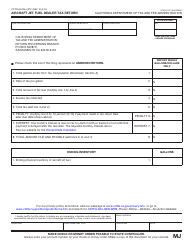

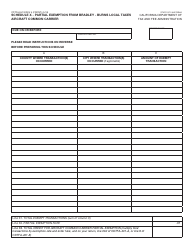

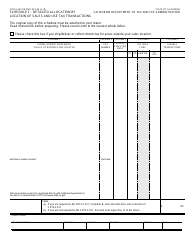

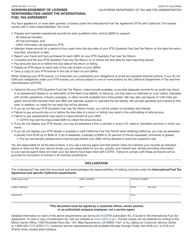

Q: What is Use Tax?

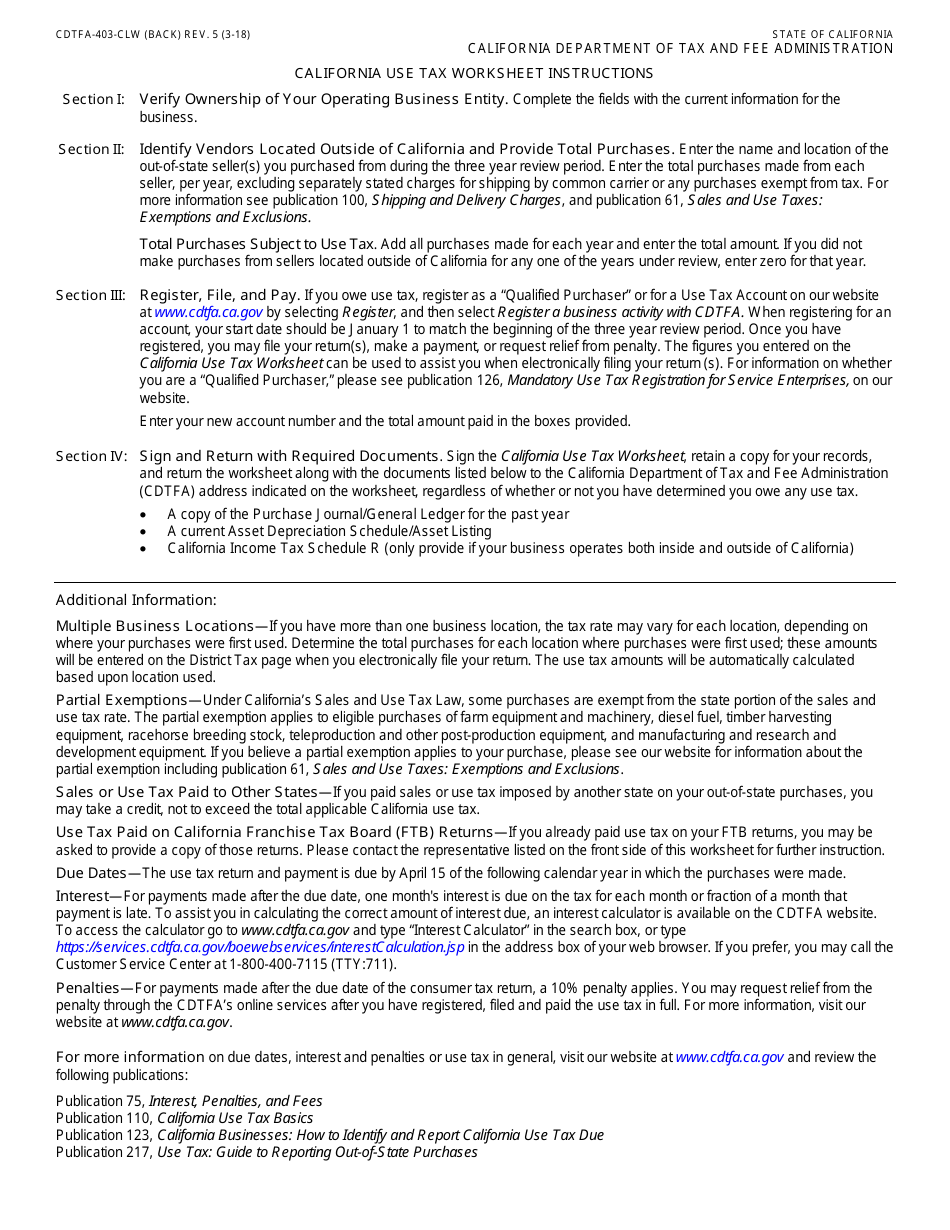

A: Use Tax is a tax on the use, storage, or consumption of tangible personal property purchased for use in California.

Q: When is Use Tax due?

A: Use Tax is due whenever tangible personal property is purchased for use in California without the payment of California sales tax.

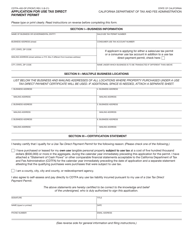

Q: What is the purpose of the California Use Tax Worksheet?

A: The purpose of the worksheet is to help individuals calculate and report their use tax liability.

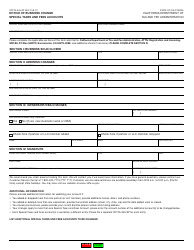

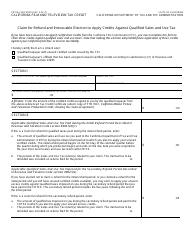

Q: Do I have to file a California Use Tax return?

A: Yes, if you owe use tax, you are required to file a return and report the tax due.

Q: What happens if I don't file a California Use Tax return?

A: Failure to file a use tax return may result in penalties and interest being assessed on the tax due.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-403-CLW by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.