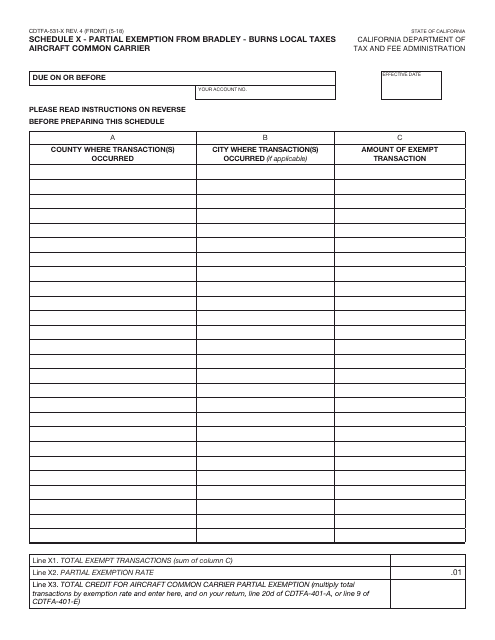

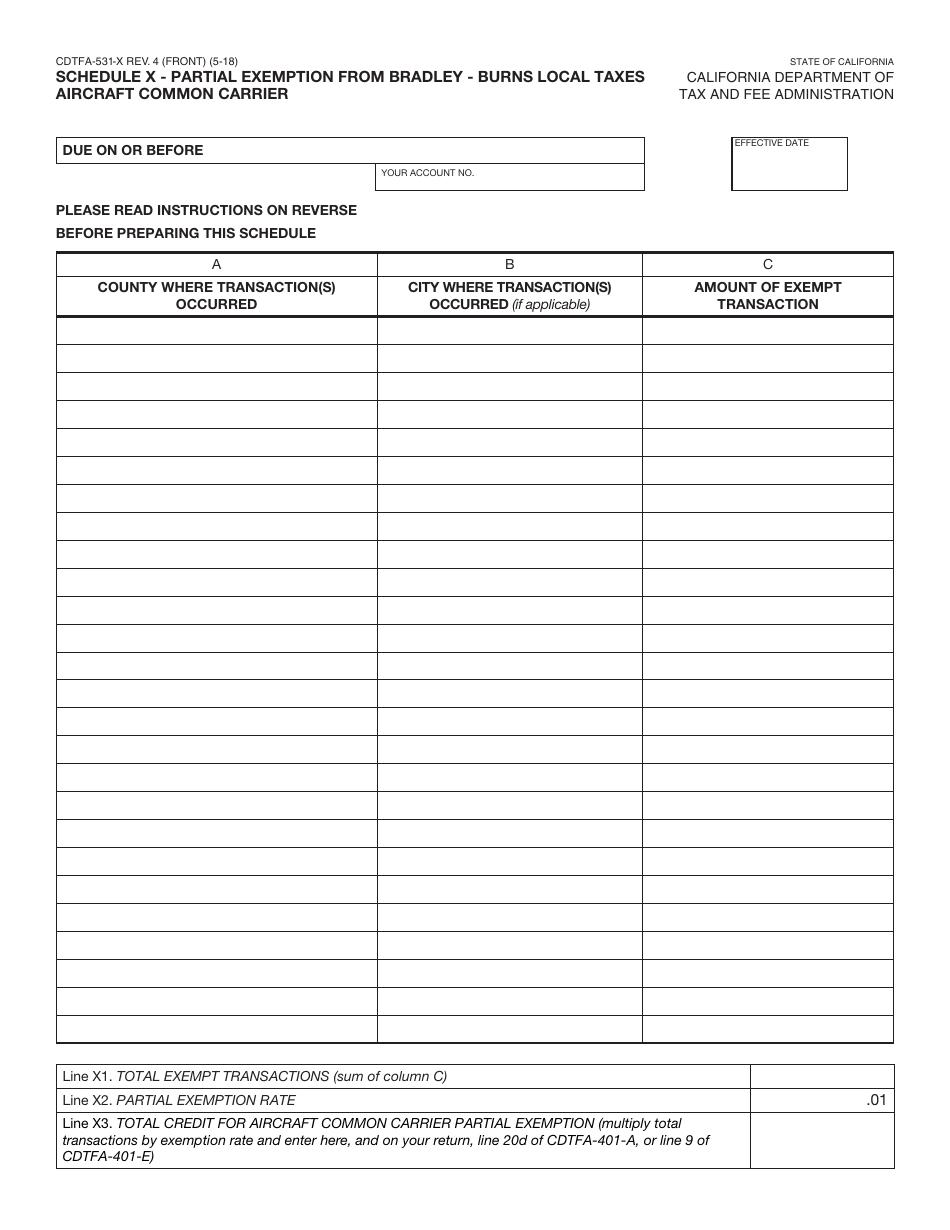

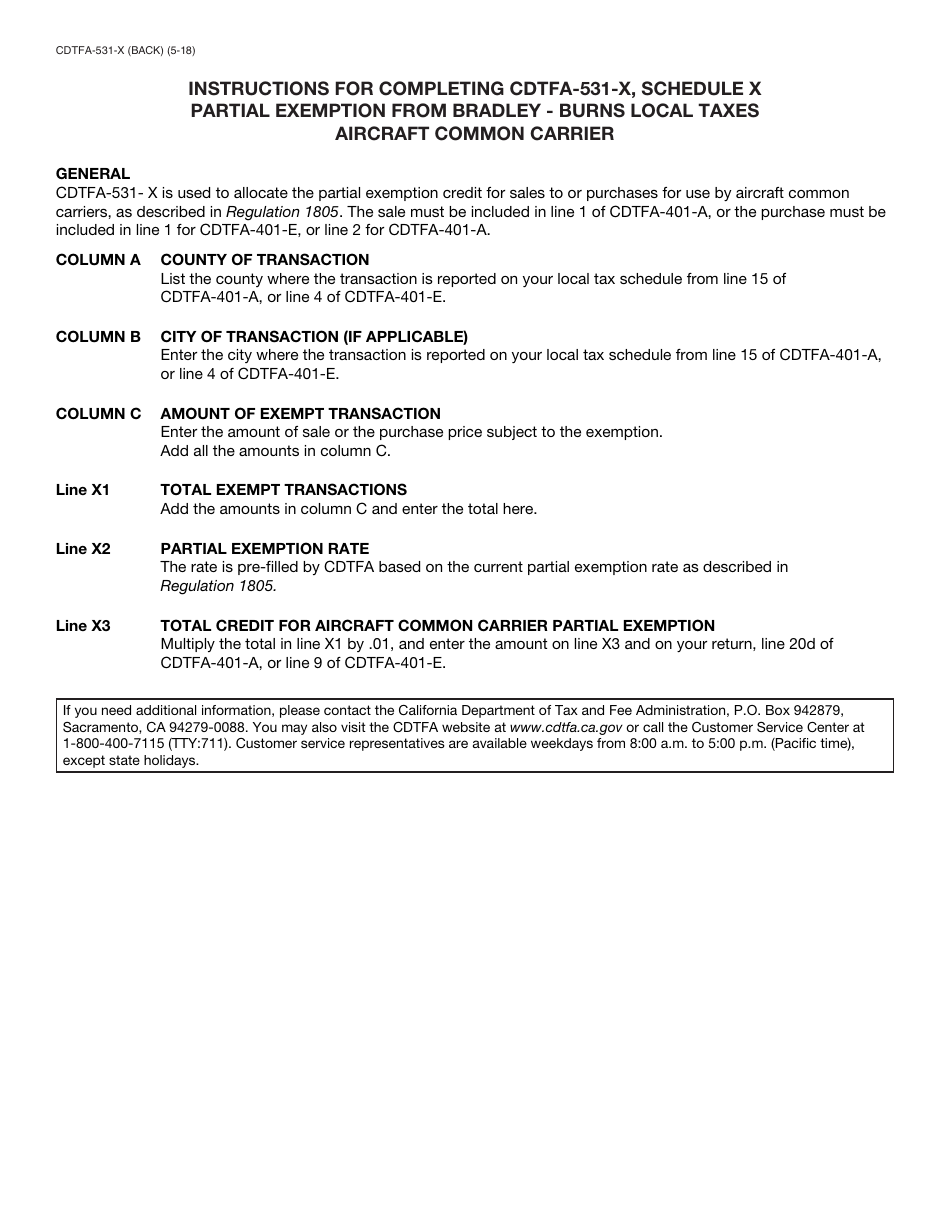

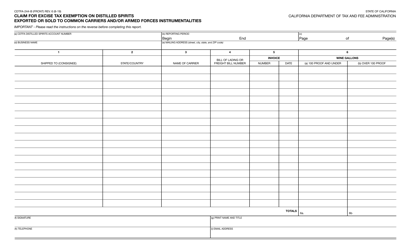

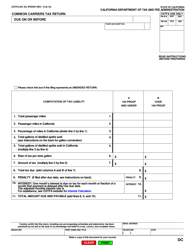

Form CDTFA-531-X Schedule X Partial Exemption From Bradley - Burns Local Taxes Aircraft Common Carrier - California

What Is Form CDTFA-531-X Schedule X?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-531-X?

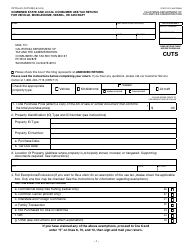

A: Form CDTFA-531-X is a schedule used for claiming partial exemption from Bradley-Burns local taxes for aircraft common carrier businesses in California.

Q: Who uses Form CDTFA-531-X?

A: Aircraft common carrier businesses in California use Form CDTFA-531-X to claim partial exemption from Bradley-Burns local taxes.

Q: What is the purpose of Form CDTFA-531-X?

A: The purpose of Form CDTFA-531-X is to facilitate the partial exemption from Bradley-Burns local taxes for aircraft common carrier businesses in California.

Q: What is the Bradley-Burns local tax?

A: The Bradley-Burns local tax is a local sales and use tax imposed in California.

Q: What does a partial exemption mean?

A: A partial exemption means that only a portion of the tax amount is applicable to certain businesses or transactions.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-531-X Schedule X by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.