This version of the form is not currently in use and is provided for reference only. Download this version of

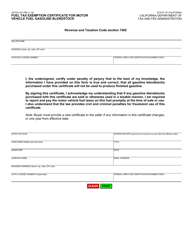

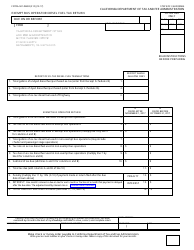

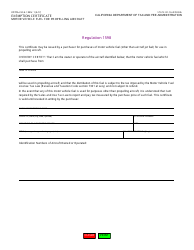

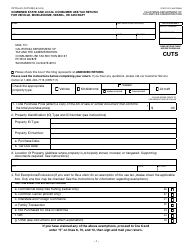

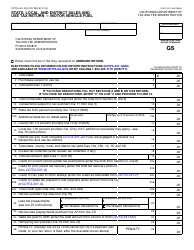

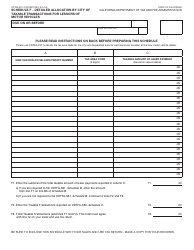

Form CDTFA-106

for the current year.

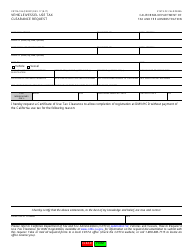

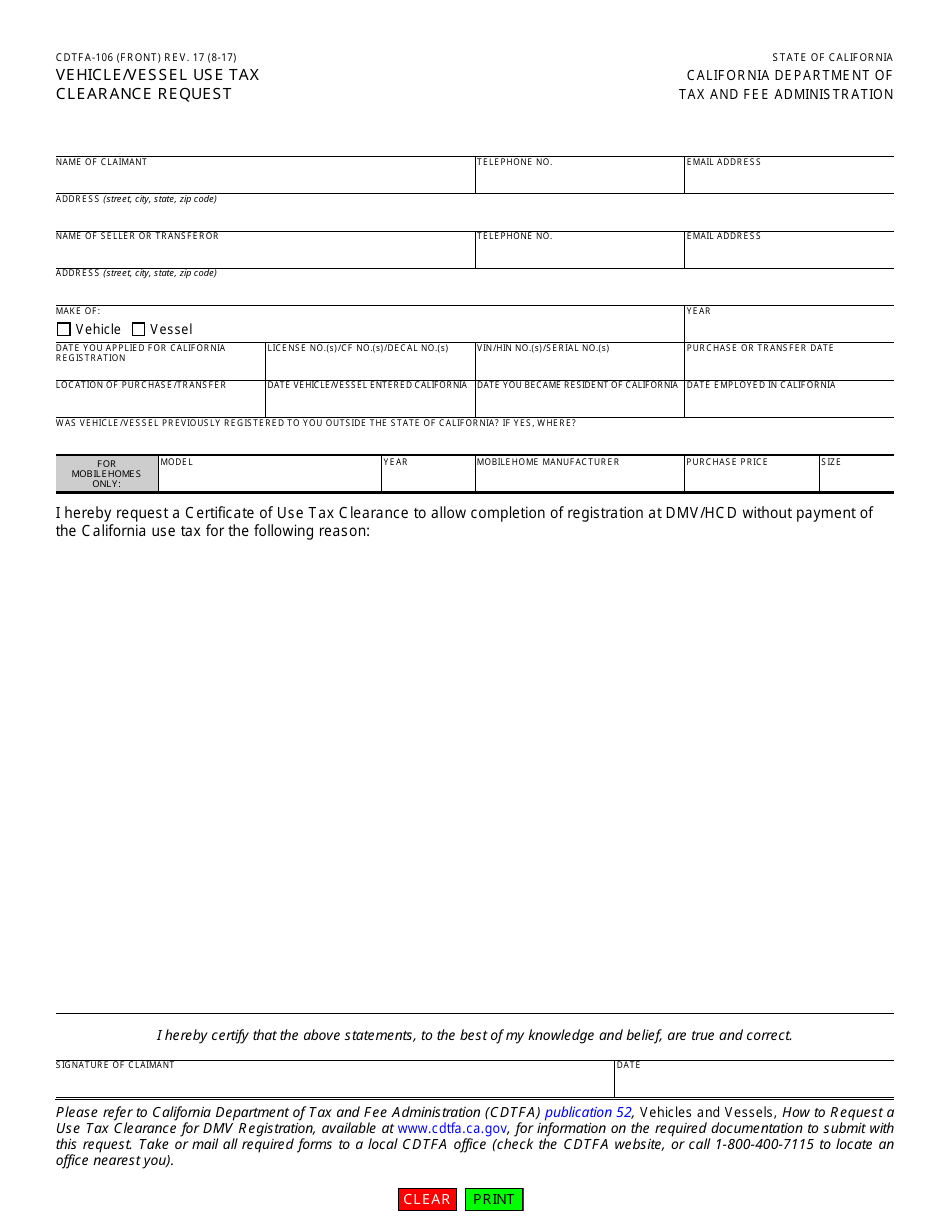

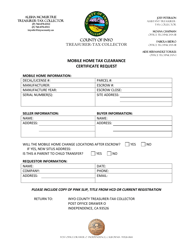

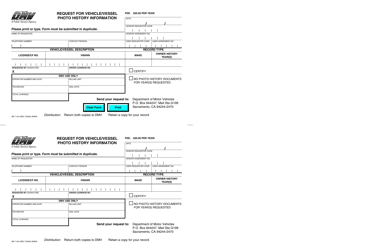

Form CDTFA-106 Vehicle / Vessel Use Tax Clearance Request - California

What Is Form CDTFA-106?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-106?

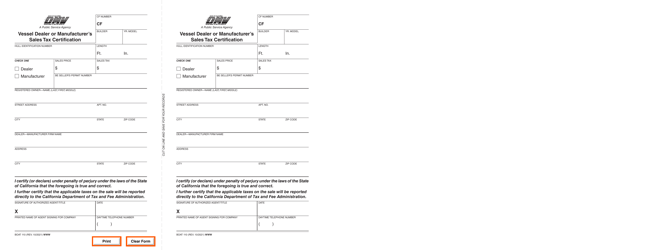

A: Form CDTFA-106 is a Vehicle/Vessel Use Tax Clearance Request form used in California.

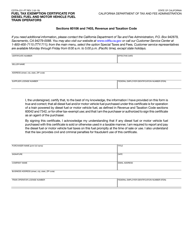

Q: What is the purpose of Form CDTFA-106?

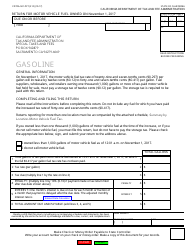

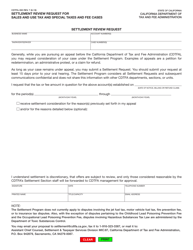

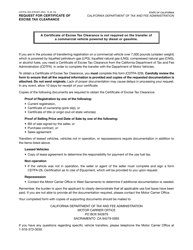

A: The purpose of Form CDTFA-106 is to request a clearance from the California Department of Tax and Fee Administration (CDTFA) for the payment of vehicle/vessel use tax.

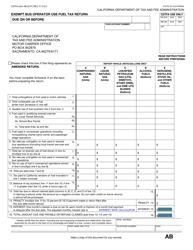

Q: Who needs to use Form CDTFA-106?

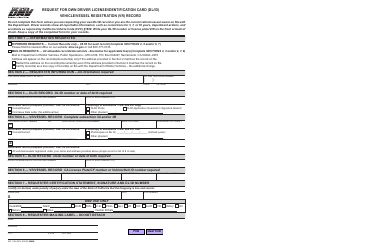

A: Form CDTFA-106 needs to be used by individuals or businesses in California who wish to obtain a clearance for the payment of vehicle/vessel use tax.

Q: Do I need to pay a fee to submit Form CDTFA-106?

A: No, there is no fee to submit Form CDTFA-106.

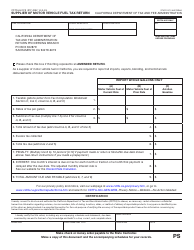

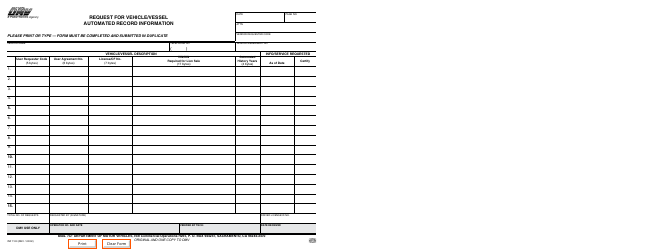

Q: What information do I need to provide on Form CDTFA-106?

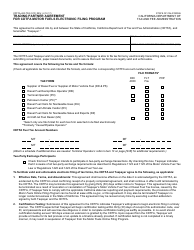

A: You will need to provide information such as your name, address, vehicle/vessel details, and any supporting documentation related to the payment of vehicle/vessel use tax.

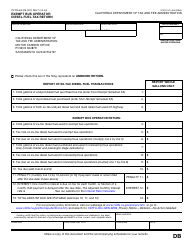

Q: How long does it take to receive a clearance after submitting Form CDTFA-106?

A: The processing time for a clearance request can vary, but you should allow several weeks for the California Department of Tax and Fee Administration (CDTFA) to review your submission.

Q: What happens if I don't obtain a clearance for vehicle/vessel use tax?

A: If you do not obtain a clearance for vehicle/vessel use tax, you may have difficulty registering or transferring ownership of a vehicle or vessel in California.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-106 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.