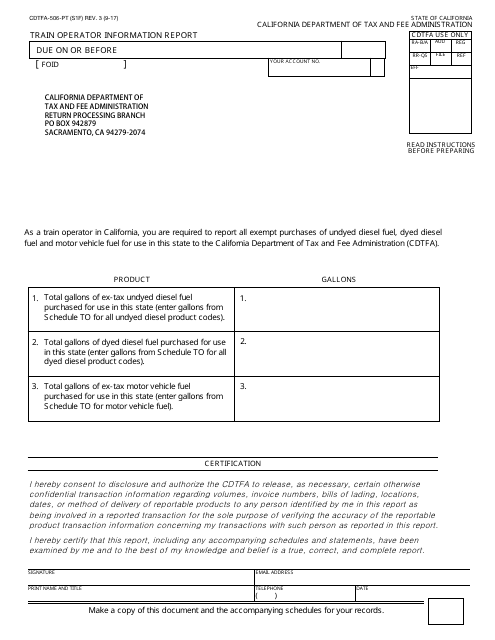

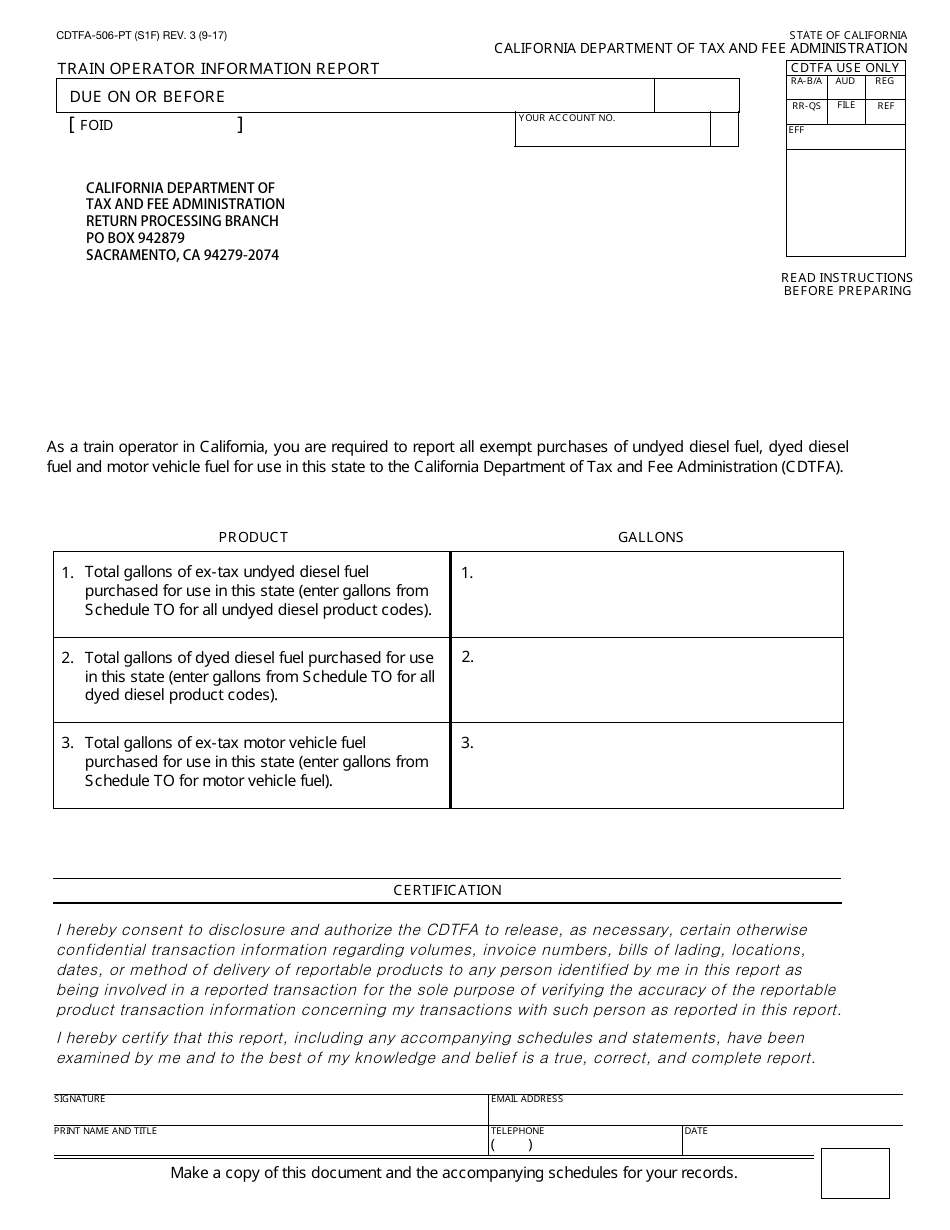

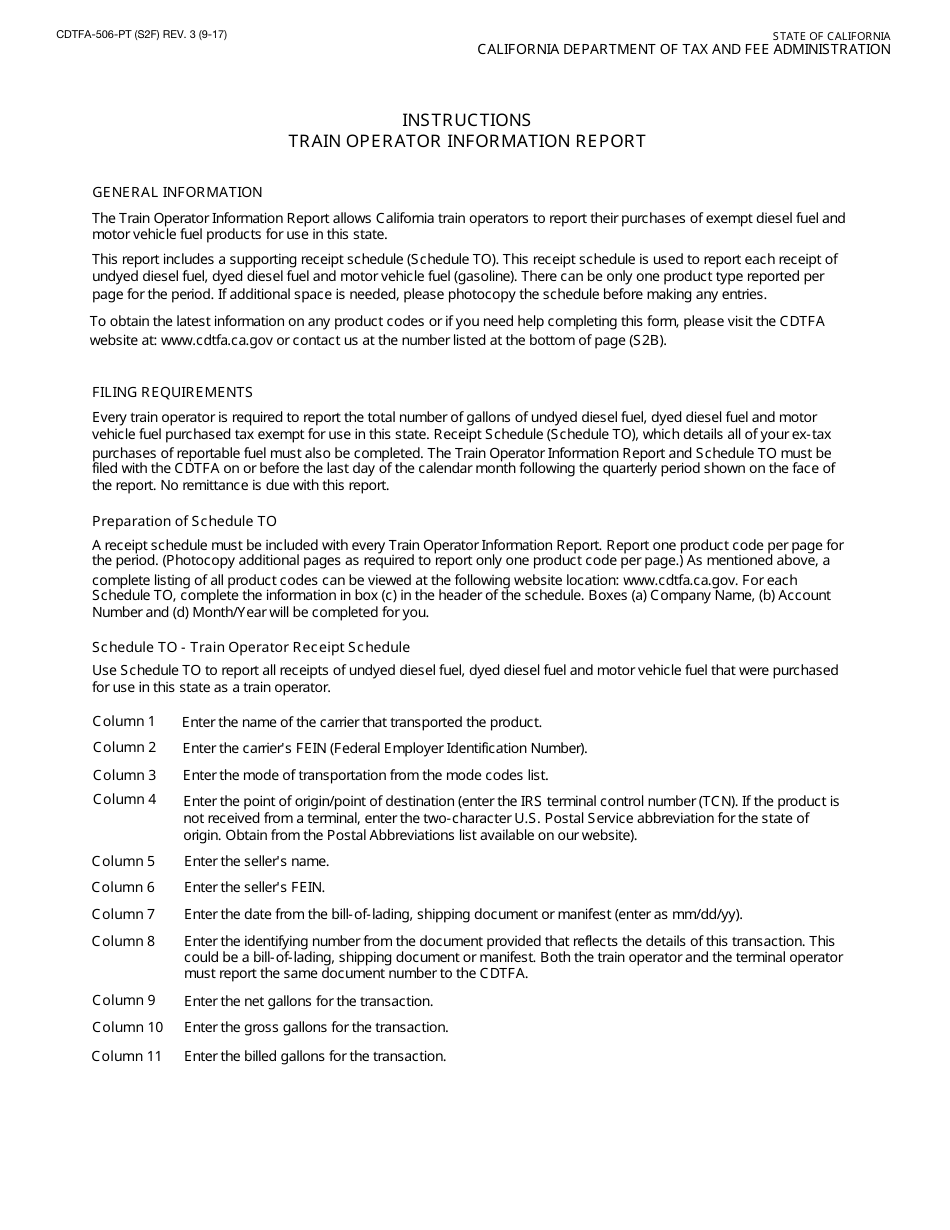

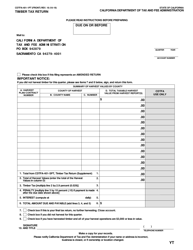

Form CDTFA-506-PT Train Operator Information Report - California

What Is Form CDTFA-506-PT?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-506-PT?

A: Form CDTFA-506-PT is the Train Operator Information Report that needs to be filed in California.

Q: Who needs to file Form CDTFA-506-PT?

A: Train operators operating in California need to file Form CDTFA-506-PT.

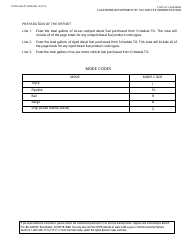

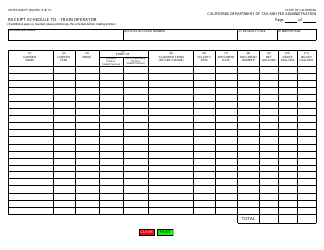

Q: What information is required in Form CDTFA-506-PT?

A: Form CDTFA-506-PT requires train operators to provide information about their business operations, including revenue and expenses.

Q: Is Form CDTFA-506-PT specific to train operators in California?

A: Yes, Form CDTFA-506-PT is specific to train operators operating in California.

Q: When is the deadline to file Form CDTFA-506-PT?

A: The deadline to file Form CDTFA-506-PT is typically on a quarterly basis.

Q: Are there any penalties for not filing Form CDTFA-506-PT?

A: Yes, there may be penalties for not filing Form CDTFA-506-PT or for filing it late.

Q: Is there a fee to file Form CDTFA-506-PT?

A: No, there is no fee to file Form CDTFA-506-PT.

Q: Who should I contact for more information about Form CDTFA-506-PT?

A: For more information about Form CDTFA-506-PT, you can contact the California Department of Tax and Fee Administration (CDTFA).

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-506-PT by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.