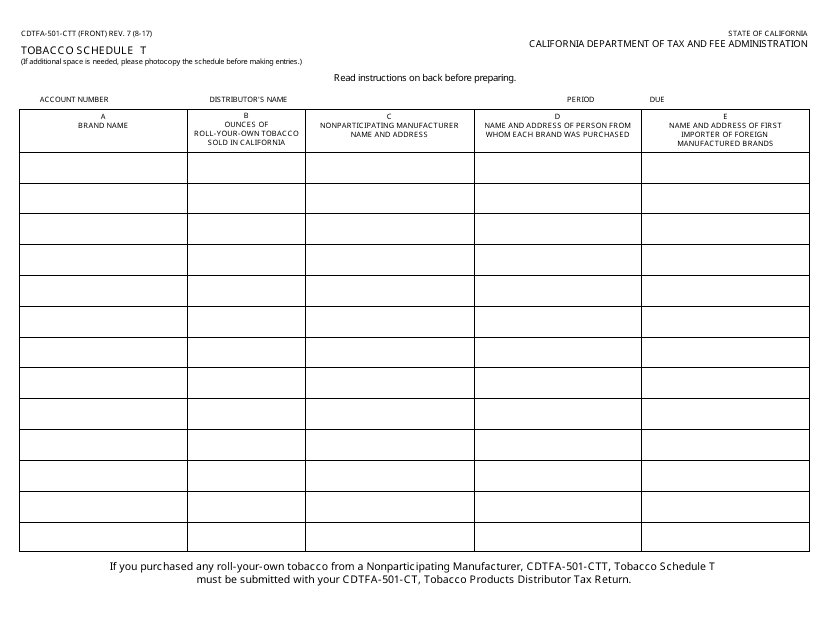

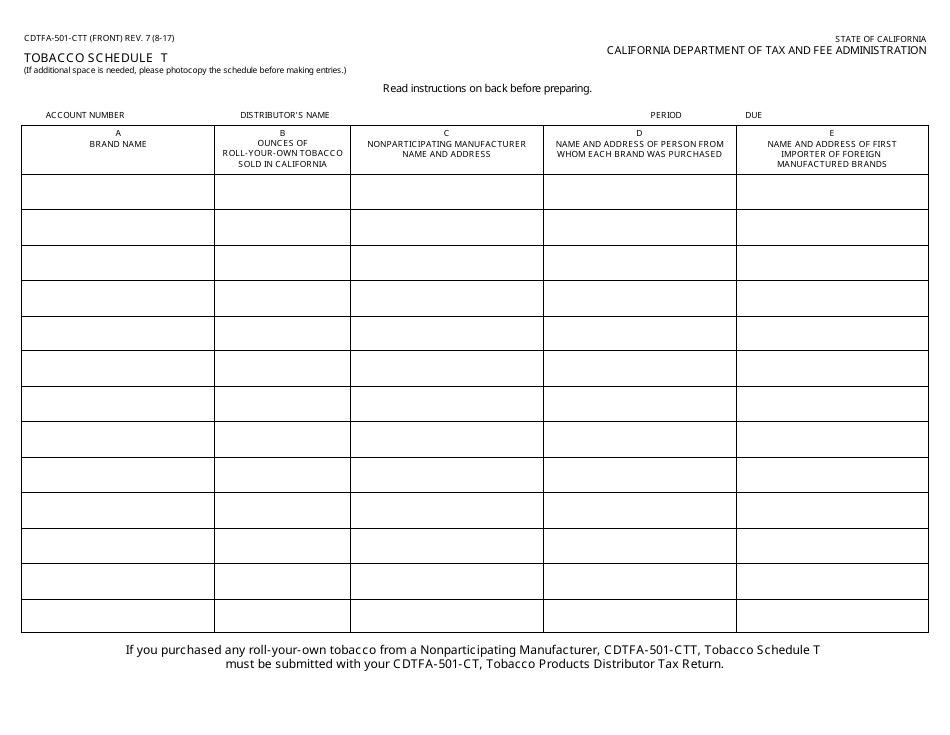

Form CDTFA-501-CTT Tobacco Schedule T - California

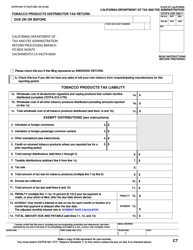

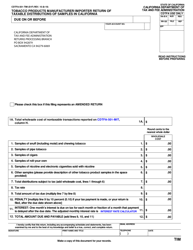

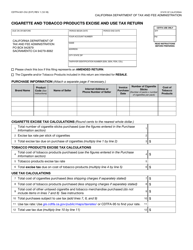

What Is Form CDTFA-501-CTT?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

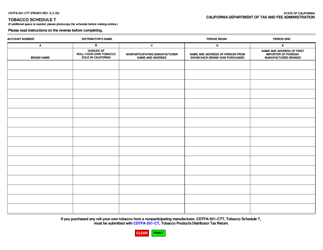

Q: What is CDTFA-501-CTT?

A: CDTFA-501-CTT is the form for the Tobacco Schedule T in California.

Q: What is the Tobacco Schedule T?

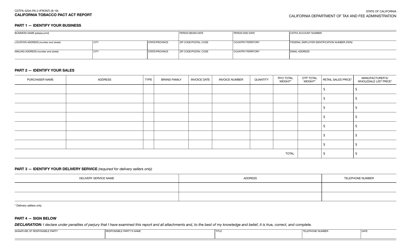

A: The Tobacco Schedule T is a form used by businesses in California to report and pay taxes on tobacco products.

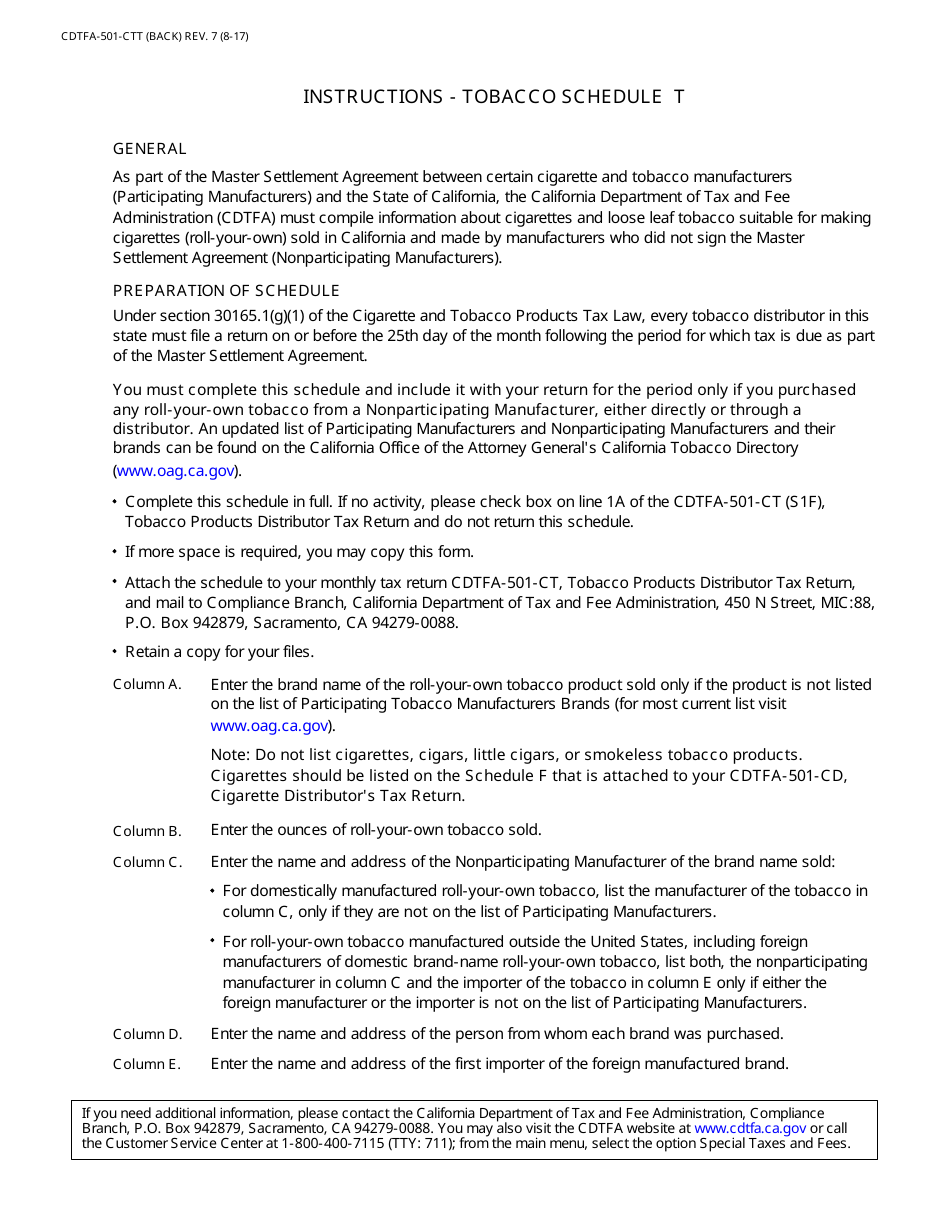

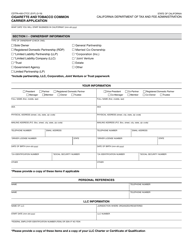

Q: Who needs to file the Tobacco Schedule T?

A: Businesses that sell or distribute tobacco products in California need to file the Tobacco Schedule T.

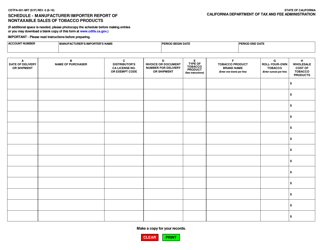

Q: What information is required on the Tobacco Schedule T?

A: The Tobacco Schedule T requires businesses to provide details of their tobacco sales and calculate the amount of tax owed.

Q: When is the deadline for filing the Tobacco Schedule T?

A: The deadline for filing the Tobacco Schedule T in California is generally the 25th day of the month following the reporting period.

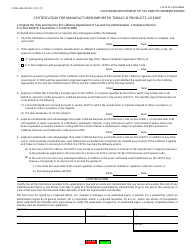

Q: Are there any penalties for late filing of the Tobacco Schedule T?

A: Yes, there may be penalties for late filing of the Tobacco Schedule T, including interest charges on any unpaid taxes.

Q: Are there any exemptions or deductions available for tobacco taxes?

A: There may be exemptions or deductions available for certain types of tobacco products or for businesses that meet specific criteria. It is best to consult the CDTFA or a tax professional for more information.

Q: What should I do if I have additional questions about the Tobacco Schedule T?

A: If you have additional questions about the Tobacco Schedule T, you should contact the California Department of Tax and Fee Administration (CDTFA) for assistance.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-CTT by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.