This version of the form is not currently in use and is provided for reference only. Download this version of

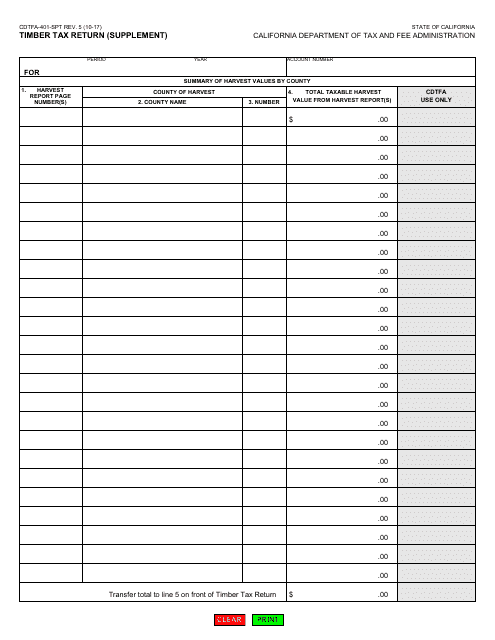

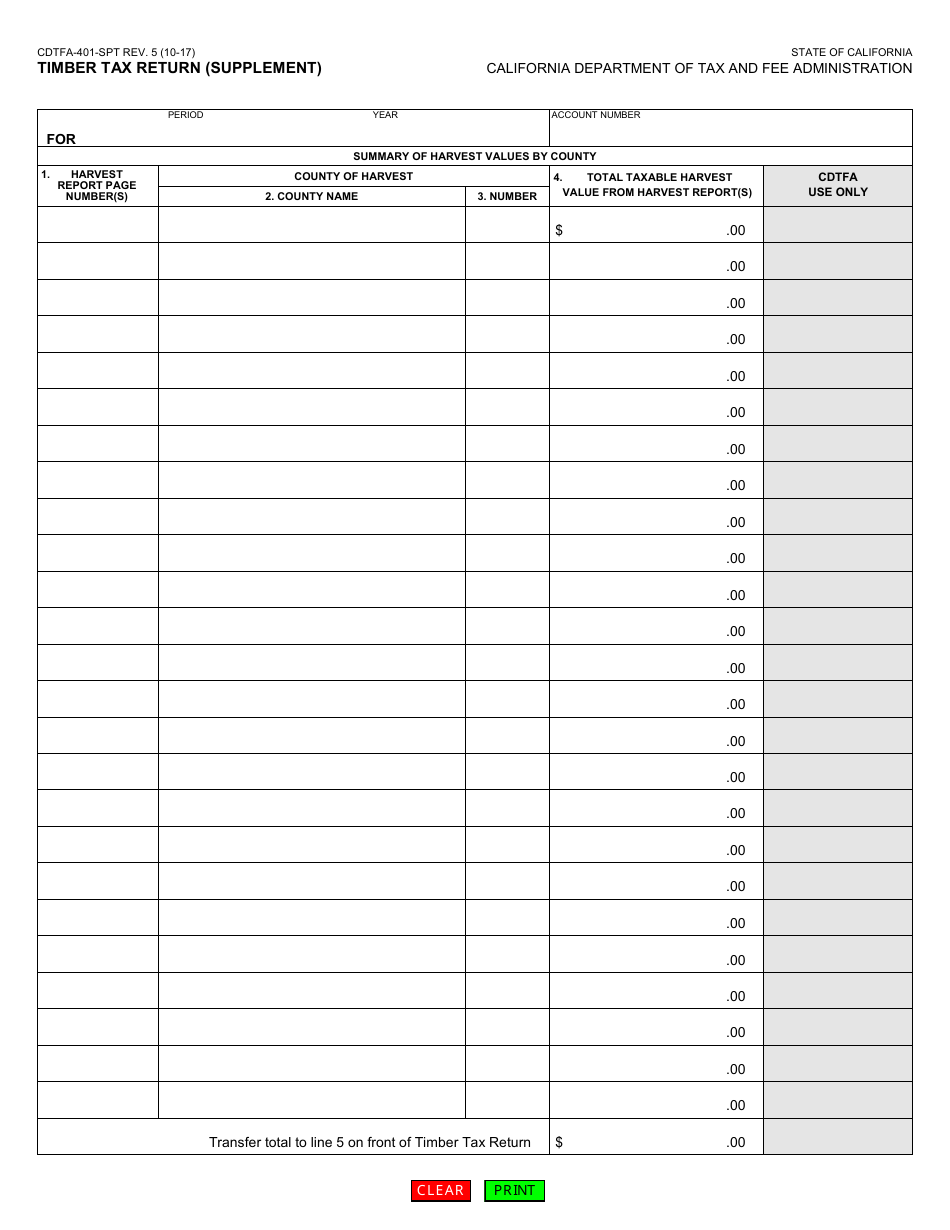

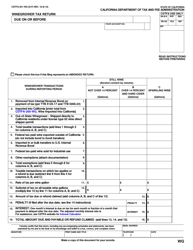

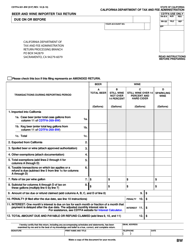

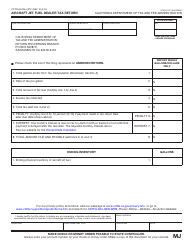

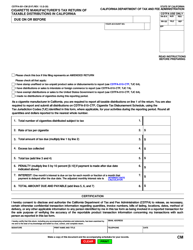

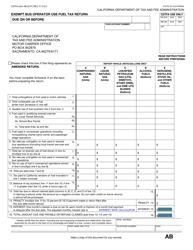

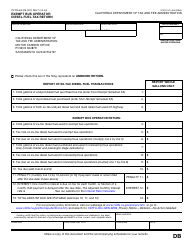

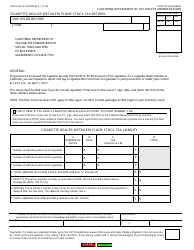

Form CDTFA-401-SPT

for the current year.

Form CDTFA-401-SPT Timber Tax Return (Supplement) - California

What Is Form CDTFA-401-SPT?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

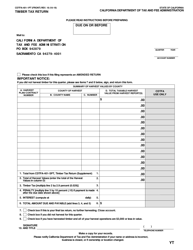

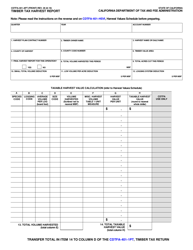

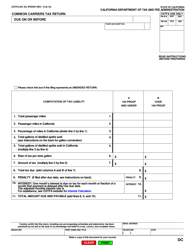

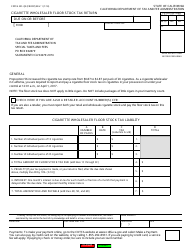

Q: What is CDTFA-401-SPT Timber Tax Return?

A: CDTFA-401-SPT Timber Tax Return is a supplemental form used in California to report timber tax.

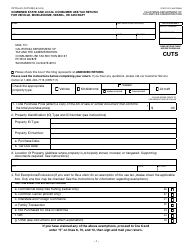

Q: Who needs to file the CDTFA-401-SPT Timber Tax Return?

A: Anyone who is engaged in the business of growing or harvesting timber in California needs to file this form.

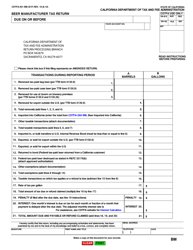

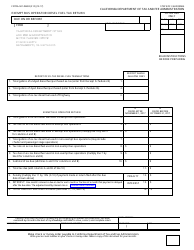

Q: When is the due date for filing CDTFA-401-SPT Timber Tax Return?

A: The due date for filing the CDTFA-401-SPT Timber Tax Return is on or before the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of CDTFA-401-SPT Timber Tax Return?

A: Yes, there are penalties for late filing of CDTFA-401-SPT Timber Tax Return. The penalties can range from a percentage of the tax due to a flat fee, depending on the length of delay in filing.

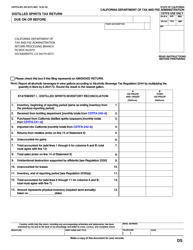

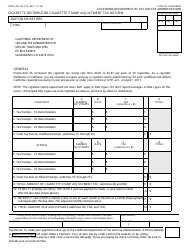

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-401-SPT by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.