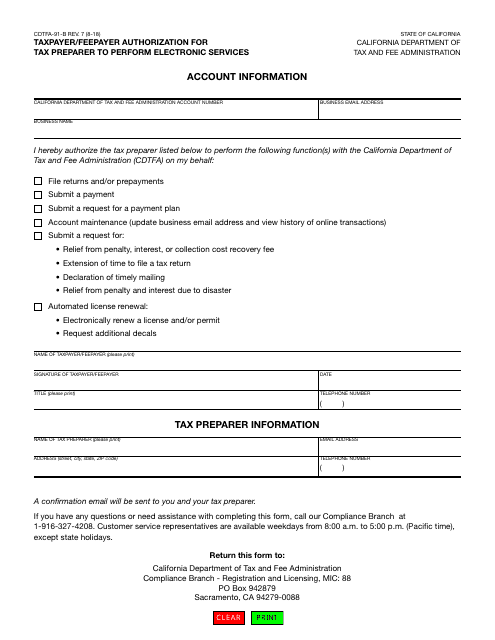

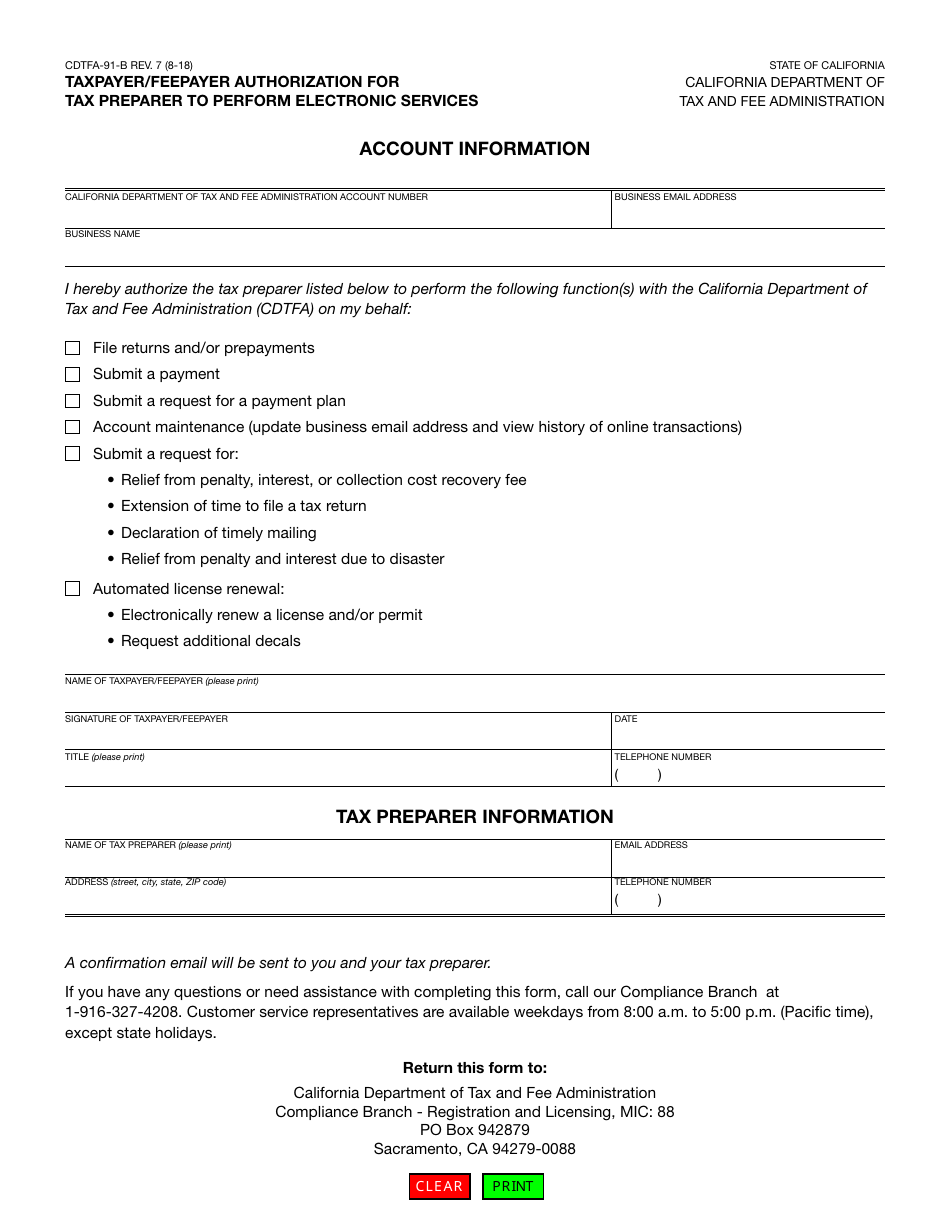

Form CDTFA-91-B Taxpayer / Feepayer Authorization for Tax Preparer to Perform Electronic Services - California

What Is Form CDTFA-91-B?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CDTFA-91-B?

A: CDTFA-91-B is a form used for authorizing a tax preparer to perform electronic services in California.

Q: Who needs to fill out CDTFA-91-B?

A: Taxpayers or feepayers in California who want to allow a tax preparer to perform electronic services on their behalf need to fill out this form.

Q: What is the purpose of CDTFA-91-B?

A: The purpose of this form is to grant a tax preparer authorization to perform electronic services on behalf of a taxpayer or feepayer.

Q: Is there a fee for filing CDTFA-91-B?

A: No, there is no fee for filing CDTFA-91-B.

Q: What are electronic services?

A: Electronic services refer to various tax-related activities that can be performed electronically, such as filing tax returns or making payments.

Q: Do I need to submit CDTFA-91-B every year?

A: No, CDTFA-91-B only needs to be submitted once unless there are changes to the authorization or the tax preparer.

Q: Can I revoke the authorization given on CDTFA-91-B?

A: Yes, the authorization can be revoked at any time by submitting a written request to the CDTFA.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-91-B by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.