This version of the form is not currently in use and is provided for reference only. Download this version of

Form CDTFA-401-EZ

for the current year.

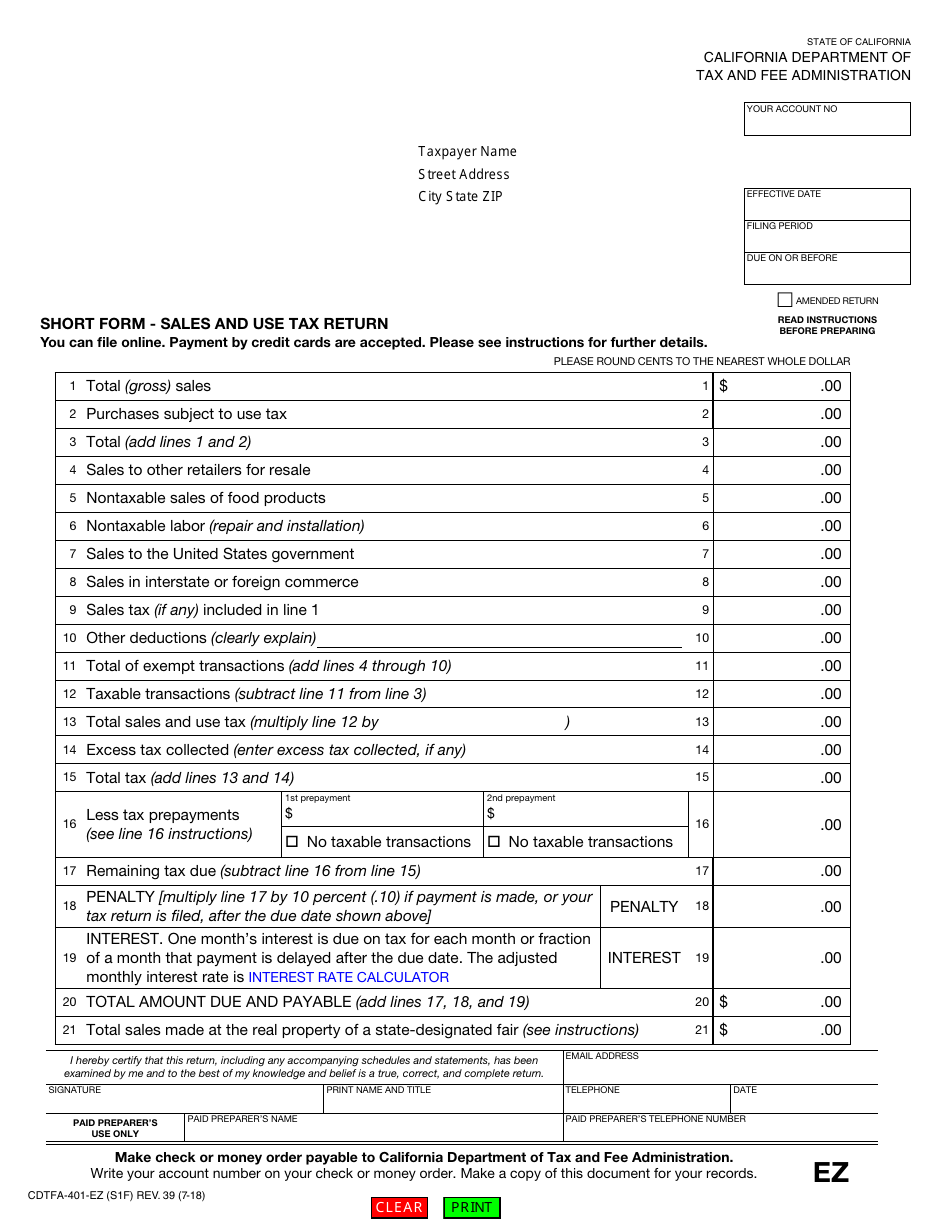

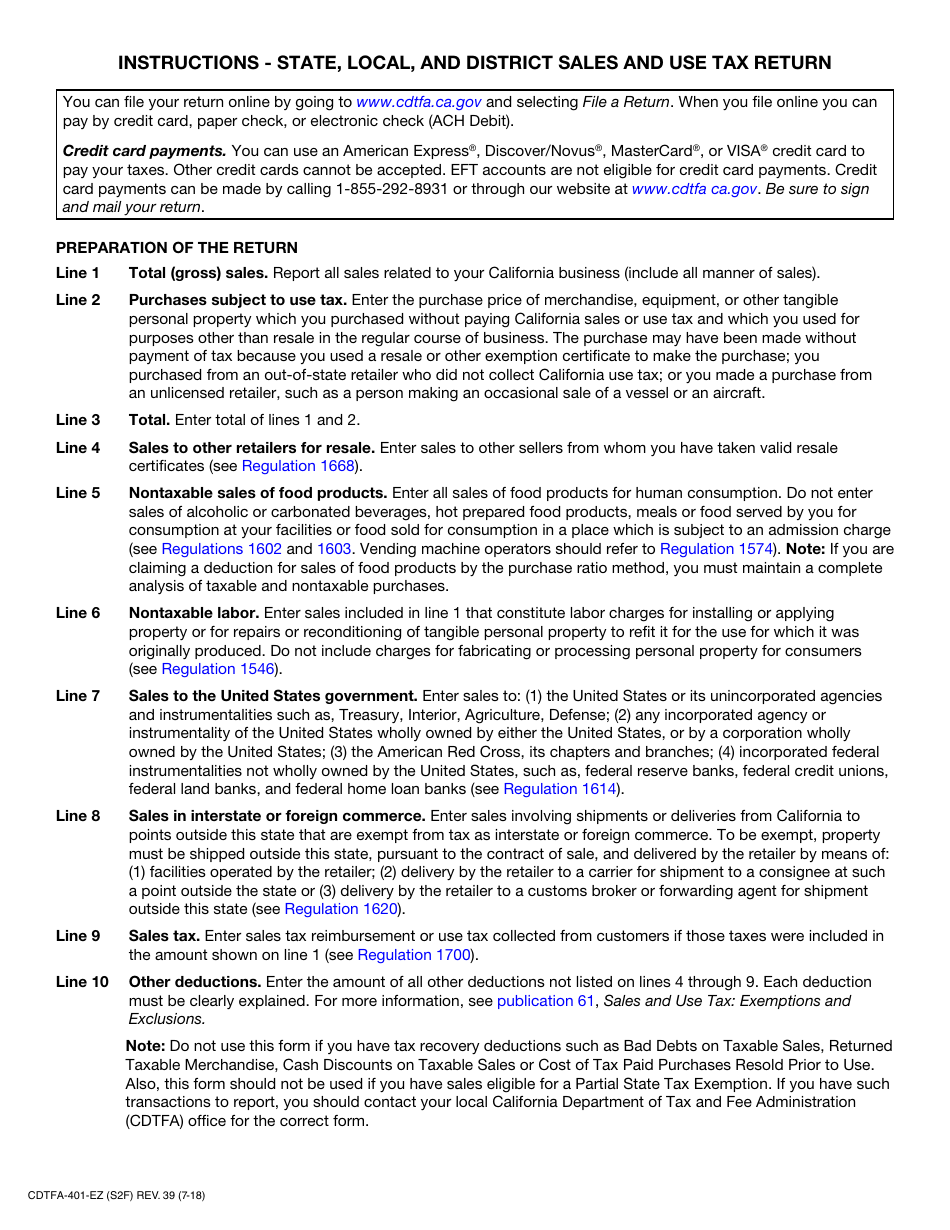

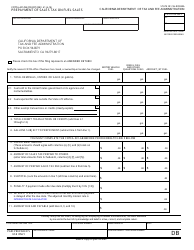

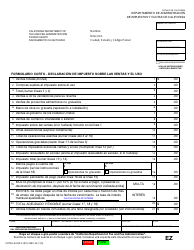

Form CDTFA-401-EZ Short Form - Sales and Use Tax Return - California

What Is Form CDTFA-401-EZ?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-401-EZ?

A: Form CDTFA-401-EZ is the short form for Sales and Use Tax Return in California.

Q: Who needs to file Form CDTFA-401-EZ?

A: Businesses in California that have sales and use tax obligations can use Form CDTFA-401-EZ if they meet the requirements.

Q: What is the purpose of Form CDTFA-401-EZ?

A: The purpose of Form CDTFA-401-EZ is to report and pay sales and use tax in California.

Q: What are the requirements to use Form CDTFA-401-EZ?

A: To use Form CDTFA-401-EZ, businesses must have total taxable sales and use tax liability of $1,000 or less per reporting period.

Q: What information is required on Form CDTFA-401-EZ?

A: Form CDTFA-401-EZ requires basic information about the business, total sales, taxable sales, and use tax owed.

Q: When is Form CDTFA-401-EZ due?

A: Form CDTFA-401-EZ is due on or before the last day of the month following the reporting period.

Q: What if my sales and use tax liability exceeds $1,000?

A: If your sales and use tax liability exceeds $1,000, you must use the regular Form CDTFA-401 instead of Form CDTFA-401-EZ.

Q: Are there any penalties for late or incorrect filing?

A: Yes, there may be penalties for late or incorrect filing. It is important to file Form CDTFA-401-EZ accurately and on time to avoid penalties.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-401-EZ by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.