This version of the form is not currently in use and is provided for reference only. Download this version of

Form CDTFA-501-MIT

for the current year.

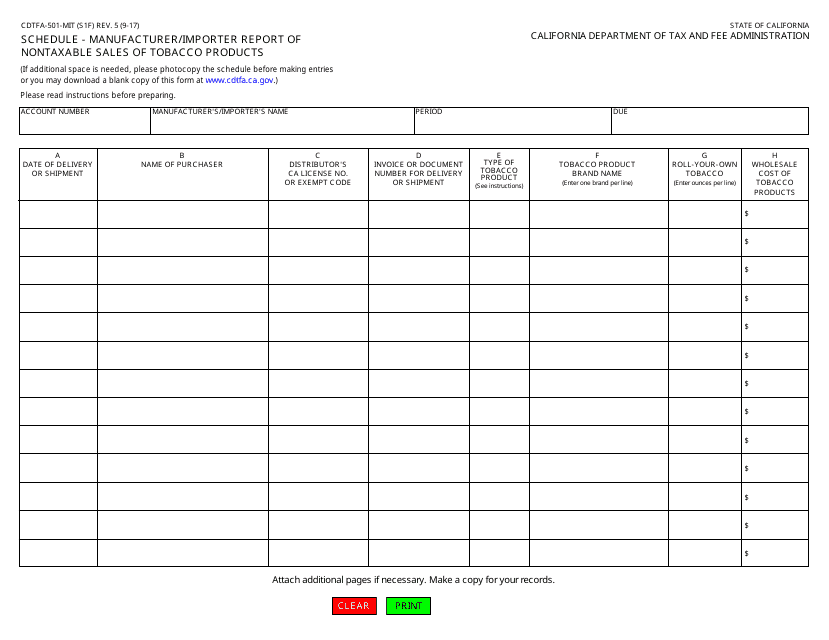

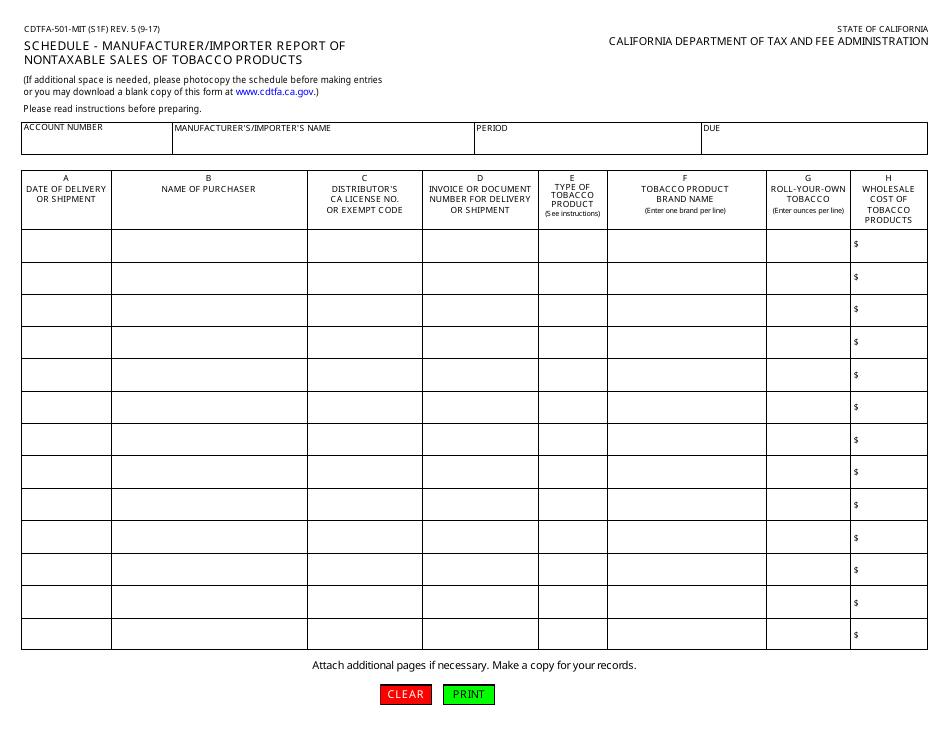

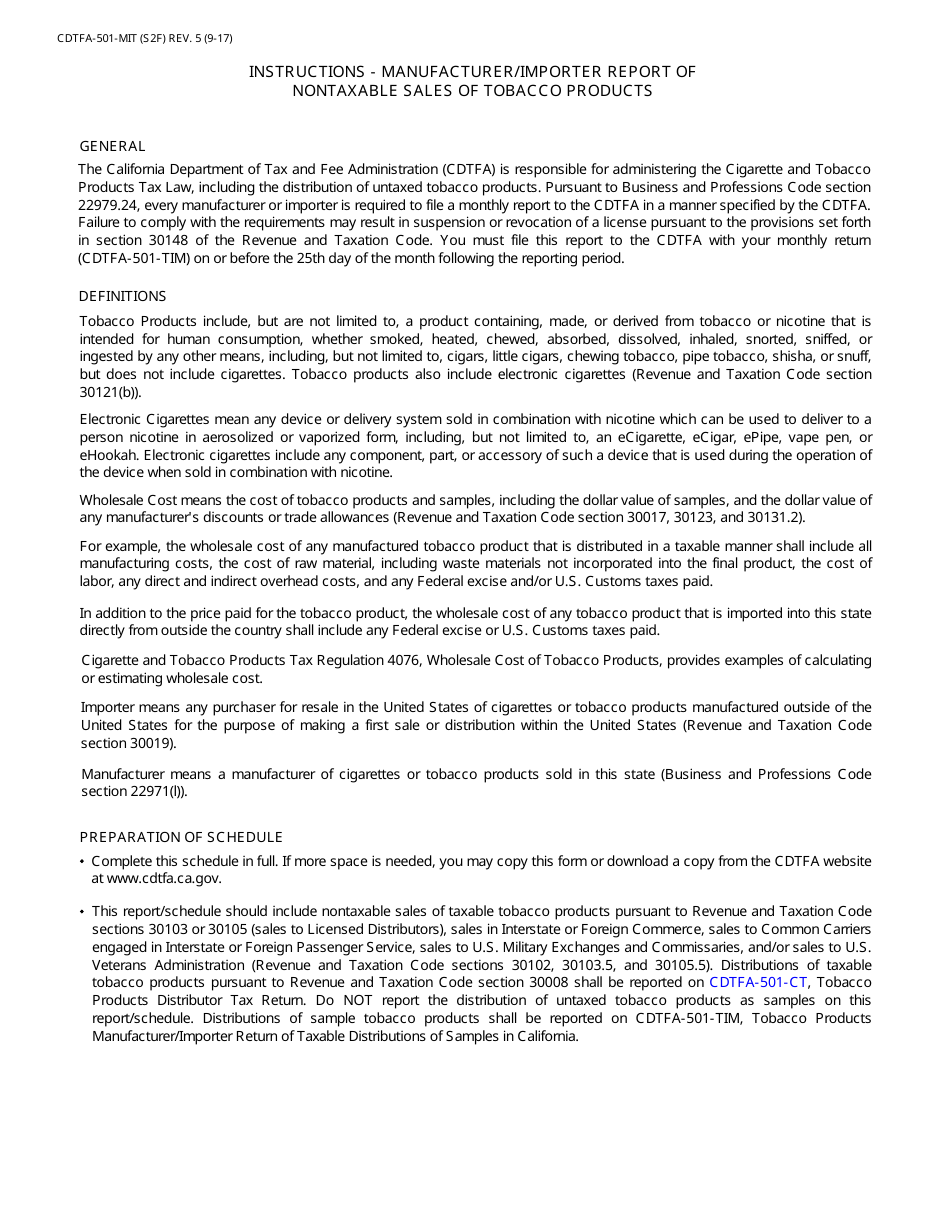

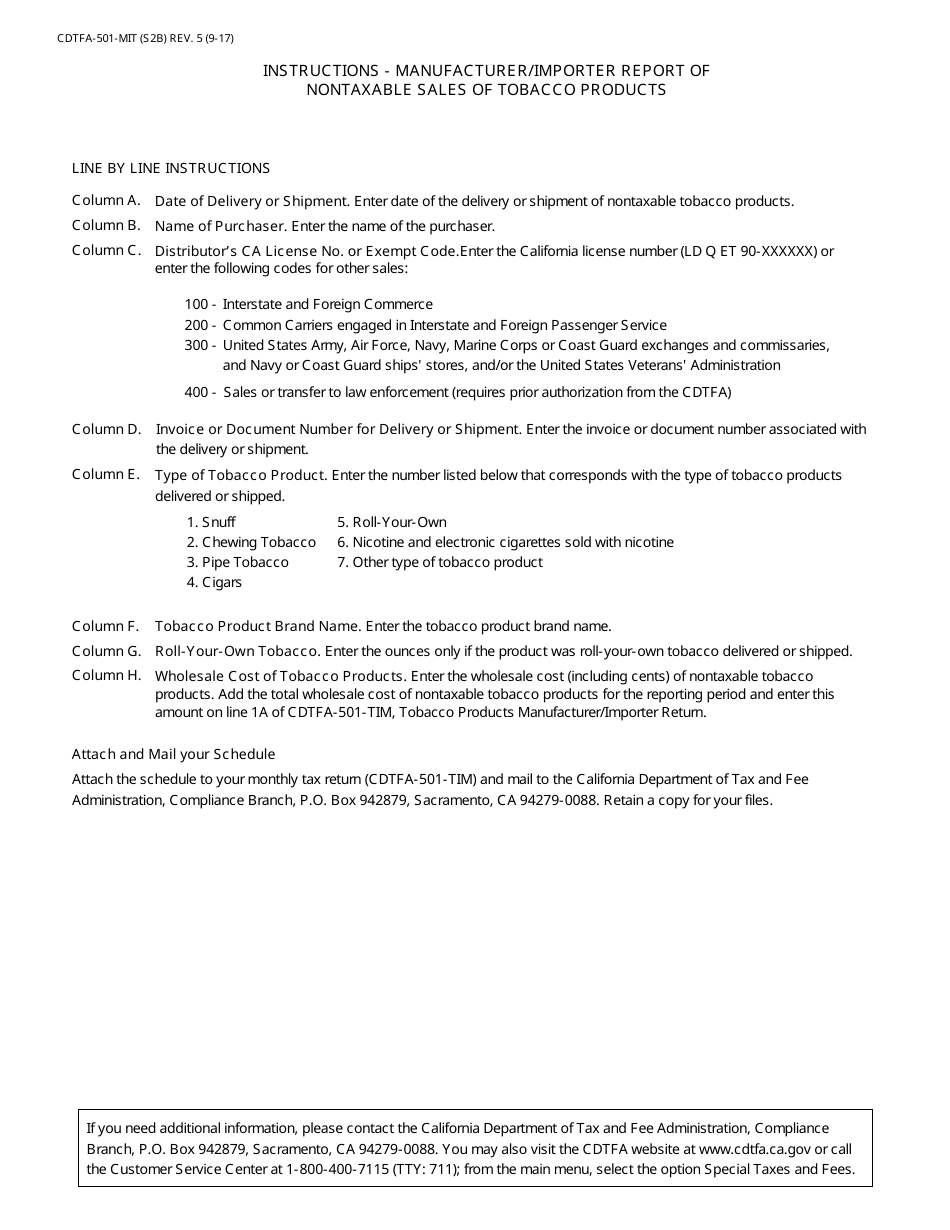

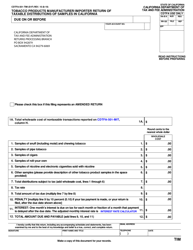

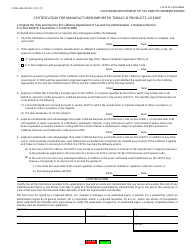

Form CDTFA-501-MIT Schedule - Manufacturer / Importer Report of Nontaxable Sales of Tobacco Products - California

What Is Form CDTFA-501-MIT?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CDTFA-501-MIT Schedule?

A: Form CDTFA-501-MIT Schedule is a report used by manufacturers and importers in California to report their nontaxable sales of tobacco products.

Q: Who is required to file Form CDTFA-501-MIT Schedule?

A: Manufacturers and importers of tobacco products in California are required to file Form CDTFA-501-MIT Schedule.

Q: What is the purpose of Form CDTFA-501-MIT Schedule?

A: The purpose of Form CDTFA-501-MIT Schedule is to report nontaxable sales of tobacco products in California.

Q: What information do I need to provide on Form CDTFA-501-MIT Schedule?

A: You need to provide information about your nontaxable sales of tobacco products, including the quantity and value of the products sold.

Q: When is the deadline to file Form CDTFA-501-MIT Schedule?

A: The deadline to file Form CDTFA-501-MIT Schedule is usually the last day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form CDTFA-501-MIT Schedule?

A: Yes, there can be penalties for not filing Form CDTFA-501-MIT Schedule, including monetary fines and other consequences as determined by the CDTFA.

Q: Do I need to keep a copy of Form CDTFA-501-MIT Schedule for my records?

A: Yes, it is recommended to keep a copy of Form CDTFA-501-MIT Schedule for your records in case of any future inquiries or audits by the CDTFA.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-MIT by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.