This version of the form is not currently in use and is provided for reference only. Download this version of

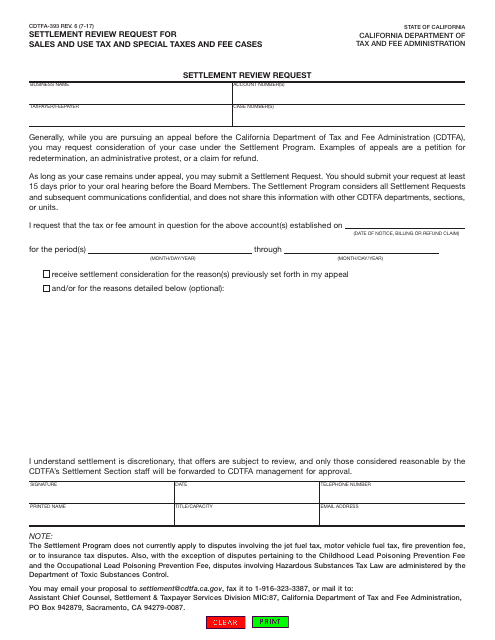

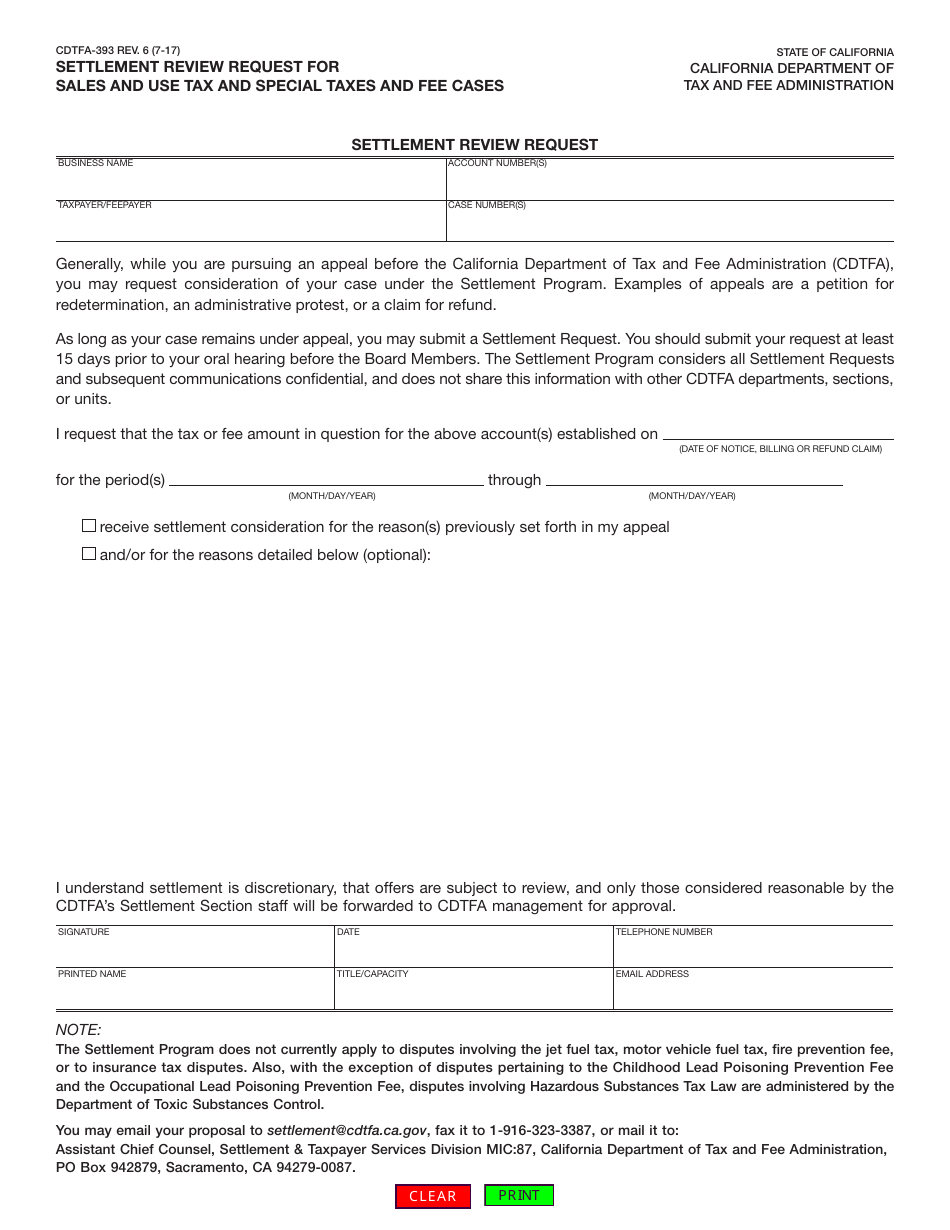

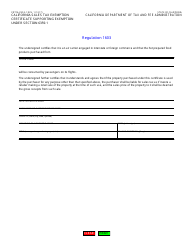

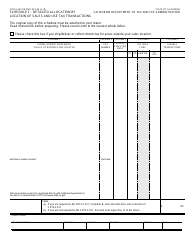

Form CDTFA-393

for the current year.

Form CDTFA-393 Settlement Review Request for Sales and Use Tax and Special Taxes and Fee Cases - California

What Is Form CDTFA-393?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-393?

A: Form CDTFA-393 is a settlement review request form for sales and use tax and special taxes and fee cases in California.

Q: What is the purpose of Form CDTFA-393?

A: The purpose of Form CDTFA-393 is to request a settlement review for sales and use tax and special taxes and fee cases in California.

Q: Who can use Form CDTFA-393?

A: Form CDTFA-393 can be used by individuals or businesses involved in sales and use tax and special taxes and fee cases in California.

Q: Is there a fee for submitting Form CDTFA-393?

A: No, there is no fee for submitting Form CDTFA-393.

Q: Is Form CDTFA-393 mandatory?

A: No, Form CDTFA-393 is not mandatory. It is optional for individuals or businesses involved in sales and use tax and special taxes and fee cases in California.

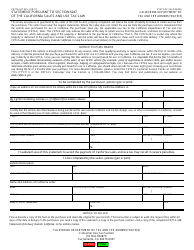

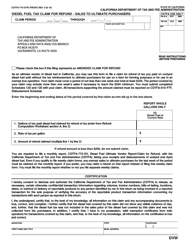

Q: How do I submit Form CDTFA-393?

A: Form CDTFA-393 can be submitted electronically or by mail to the California Department of Tax and Fee Administration (CDTFA).

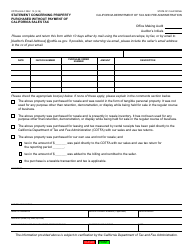

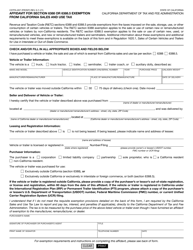

Q: What information is required on Form CDTFA-393?

A: Form CDTFA-393 requires information such as taxpayer's name, address, case number, and a detailed explanation of the proposed settlement.

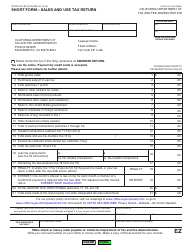

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-393 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.