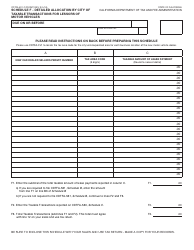

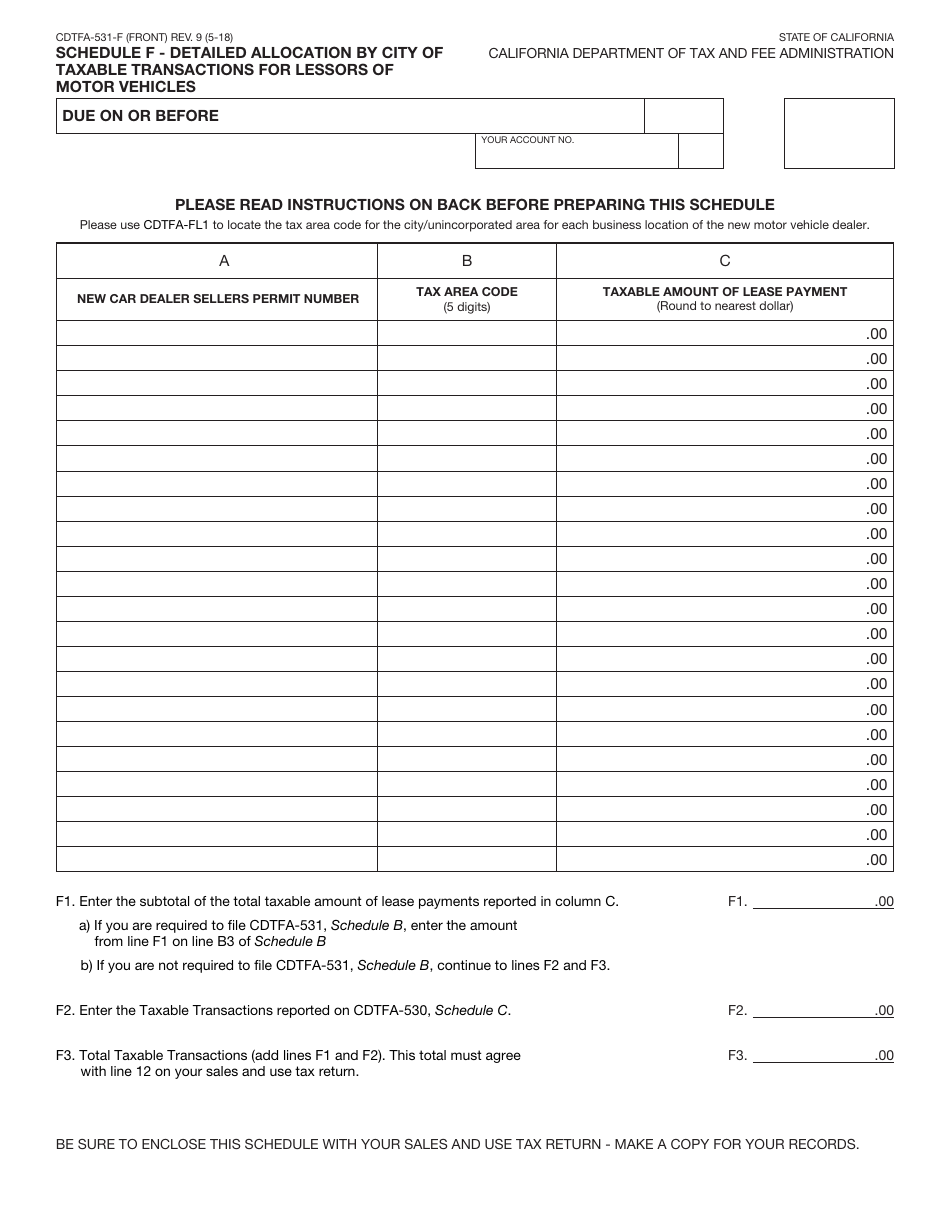

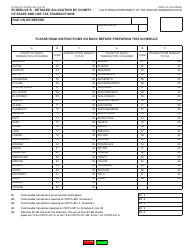

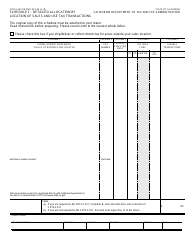

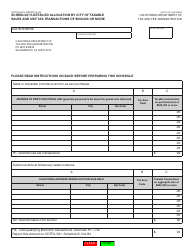

Form CDTFA-531-F Schedule F Detailed Allocation by City of Taxable Transactions for Lessors of Motor Vehicles - California

What Is Form CDTFA-531-F Schedule F?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-531-F?

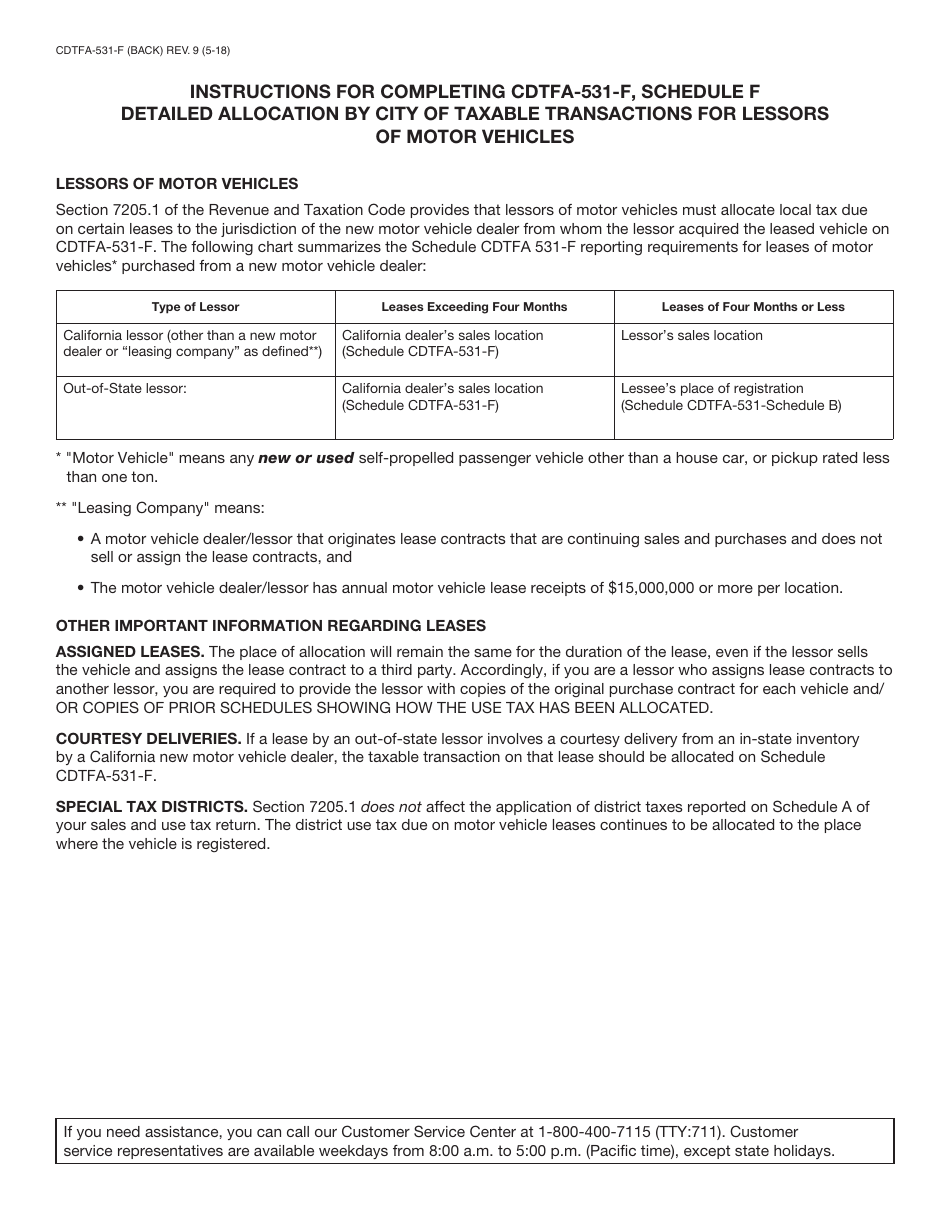

A: Form CDTFA-531-F is a document used by lessors of motor vehicles in California to provide a detailed allocation of taxable transactions by city.

Q: What is the purpose of Form CDTFA-531-F?

A: The purpose of Form CDTFA-531-F is to report the allocation of taxable transactions by city for lessors of motor vehicles in California.

Q: Who needs to file Form CDTFA-531-F?

A: Lessors of motor vehicles in California need to file Form CDTFA-531-F if they want to provide a detailed allocation of taxable transactions by city.

Q: What information is required on Form CDTFA-531-F?

A: Form CDTFA-531-F requires lessors of motor vehicles to provide a detailed allocation of taxable transactions by city, including the city name and the amount of taxable transactions.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-531-F Schedule F by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.