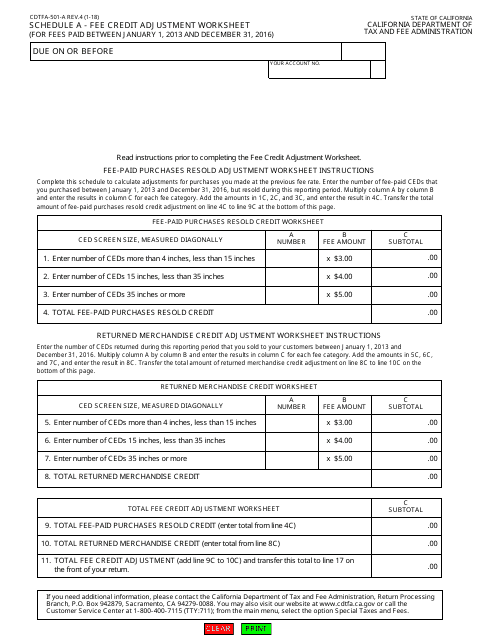

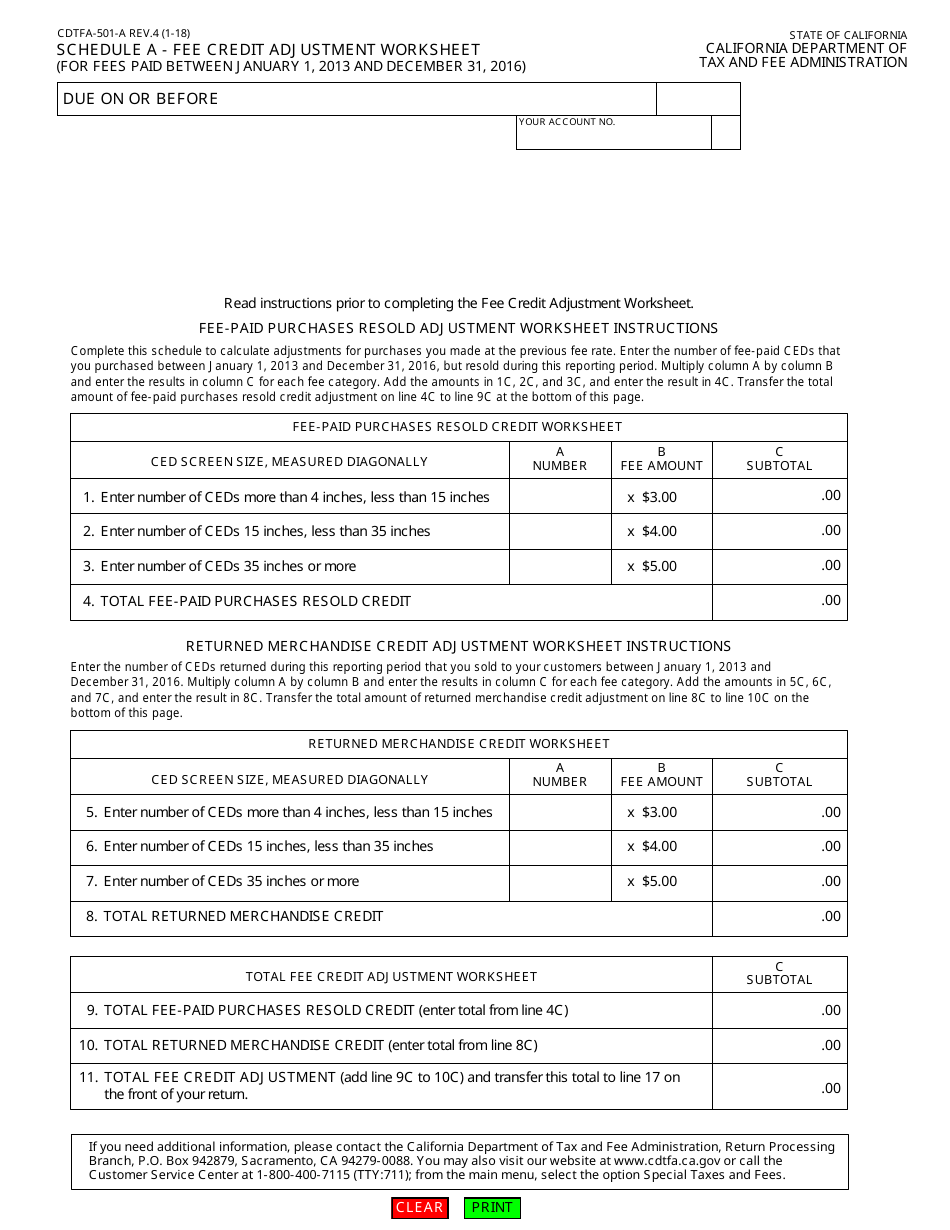

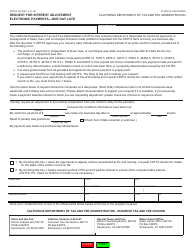

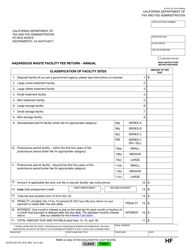

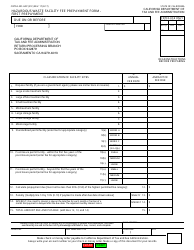

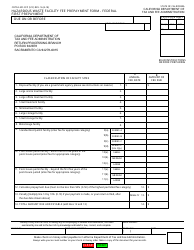

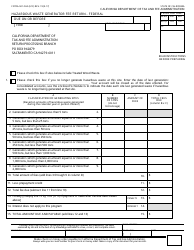

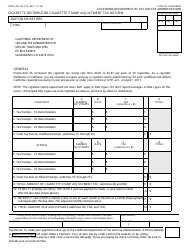

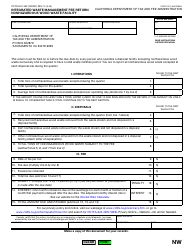

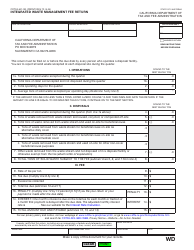

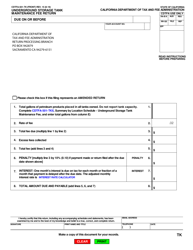

Form CDTFA-501-A Schedule A Fee Credit Adjustment Worksheet - California

What Is Form CDTFA-501-A Schedule A?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-A?

A: Form CDTFA-501-A is the Schedule A Fee Credit Adjustment Worksheet used in California.

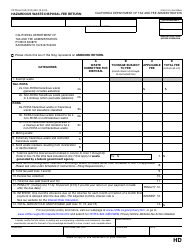

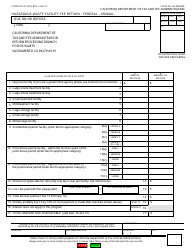

Q: What is the purpose of Form CDTFA-501-A?

A: The purpose of Form CDTFA-501-A is to calculate the fee credit adjustment for a taxpayer in California.

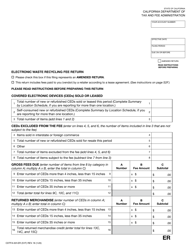

Q: Who needs to use Form CDTFA-501-A?

A: Taxpayers in California who are eligible for a fee credit adjustment need to use Form CDTFA-501-A.

Q: How do I use Form CDTFA-501-A?

A: To use Form CDTFA-501-A, you need to follow the instructions provided on the form and fill out the required information.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

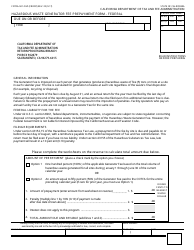

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-A Schedule A by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.