This version of the form is not currently in use and is provided for reference only. Download this version of

Form CDTFA-490

for the current year.

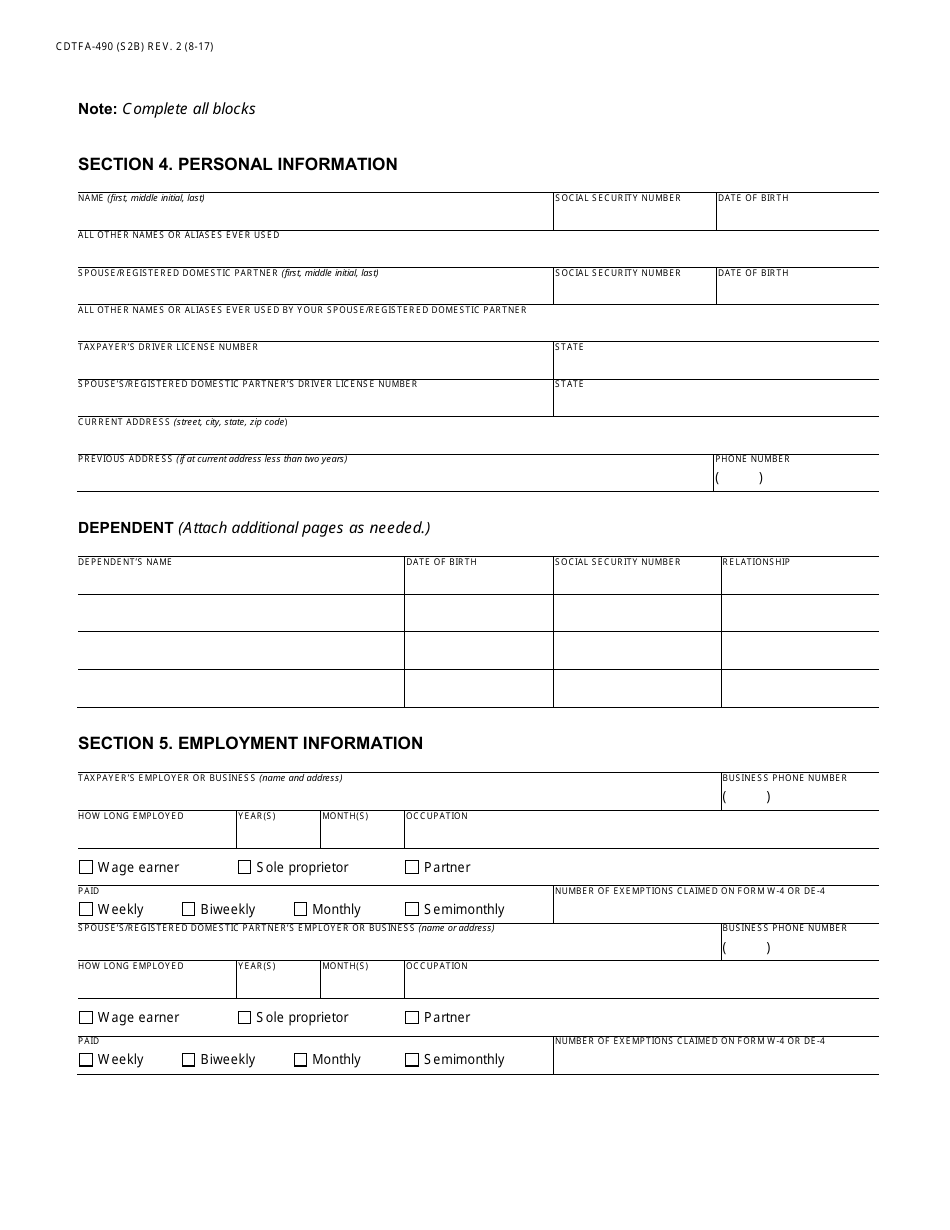

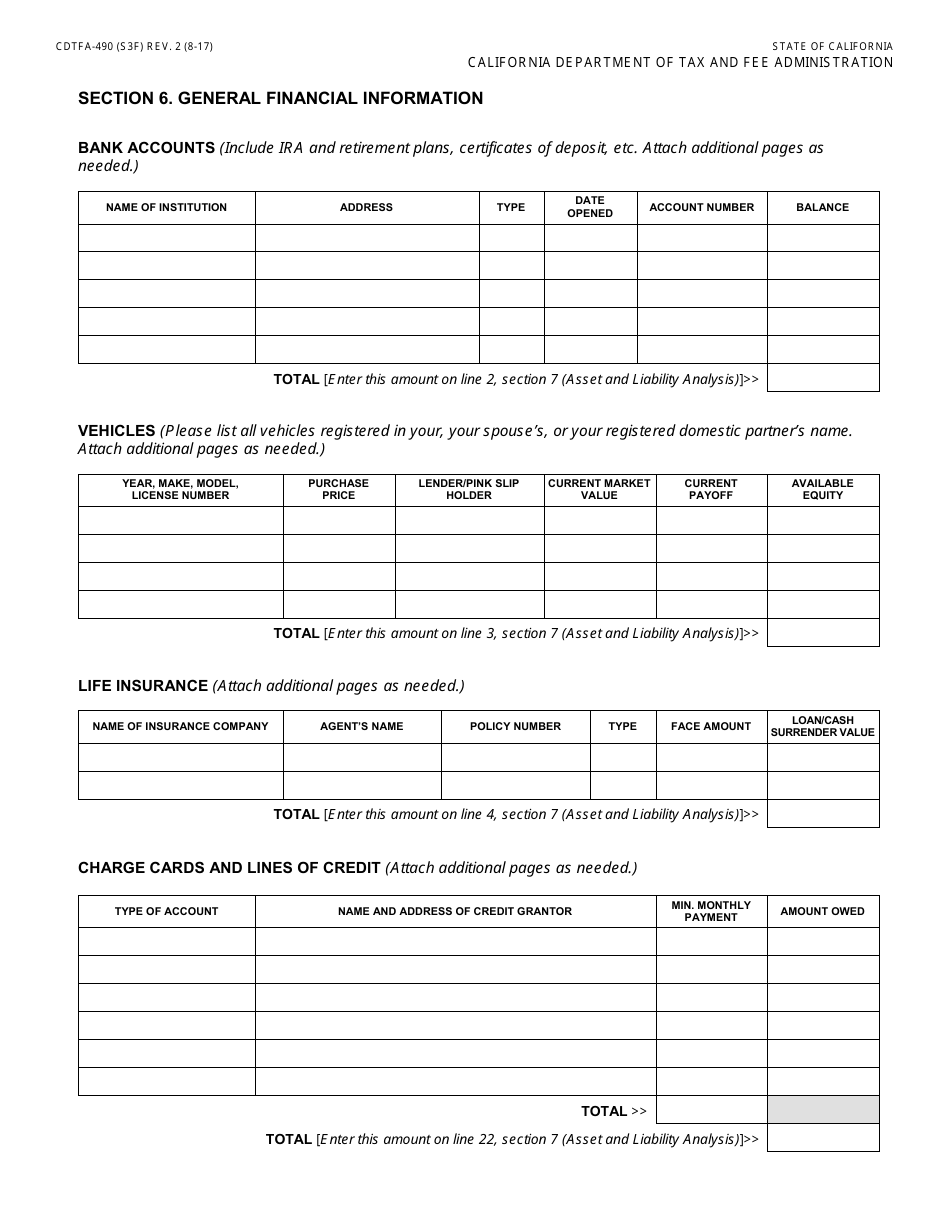

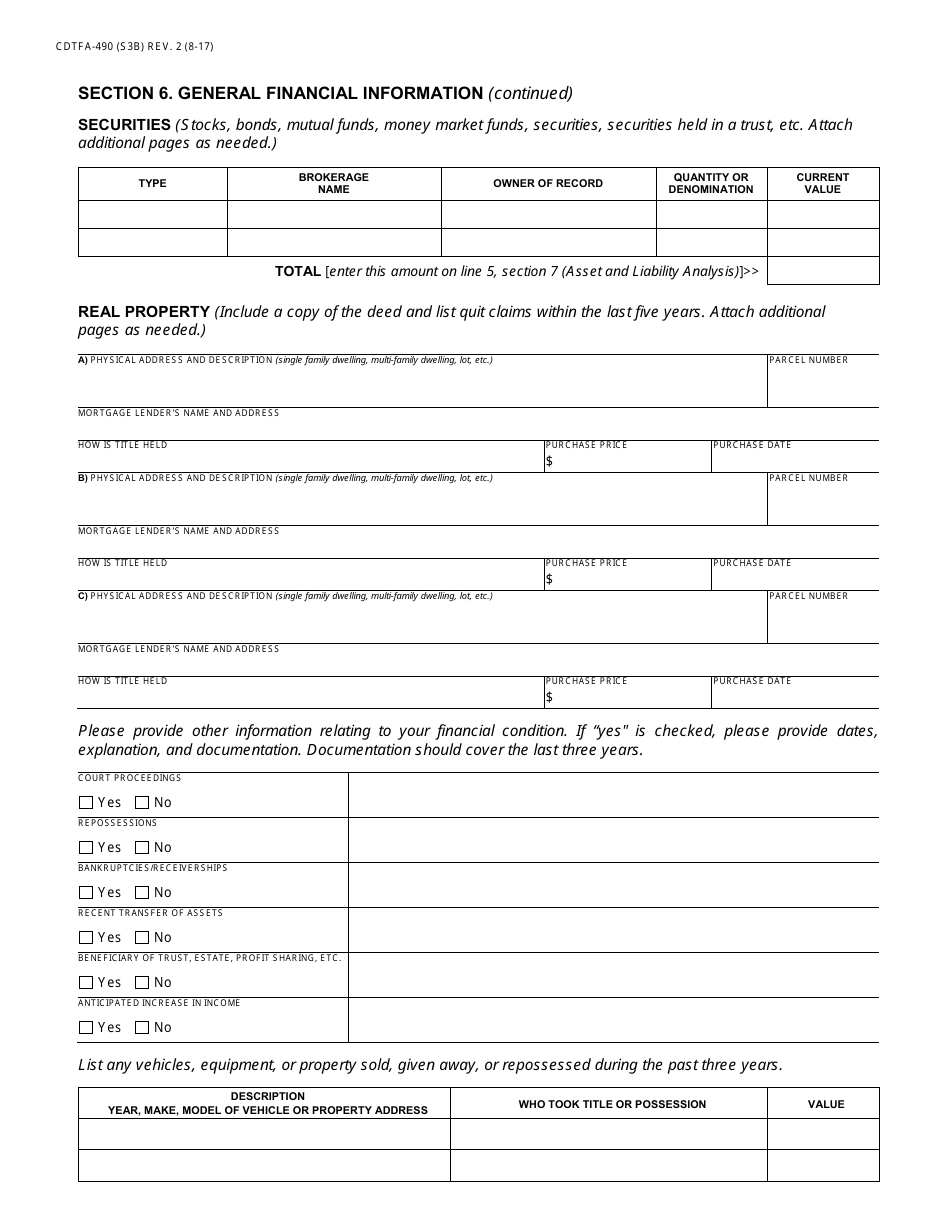

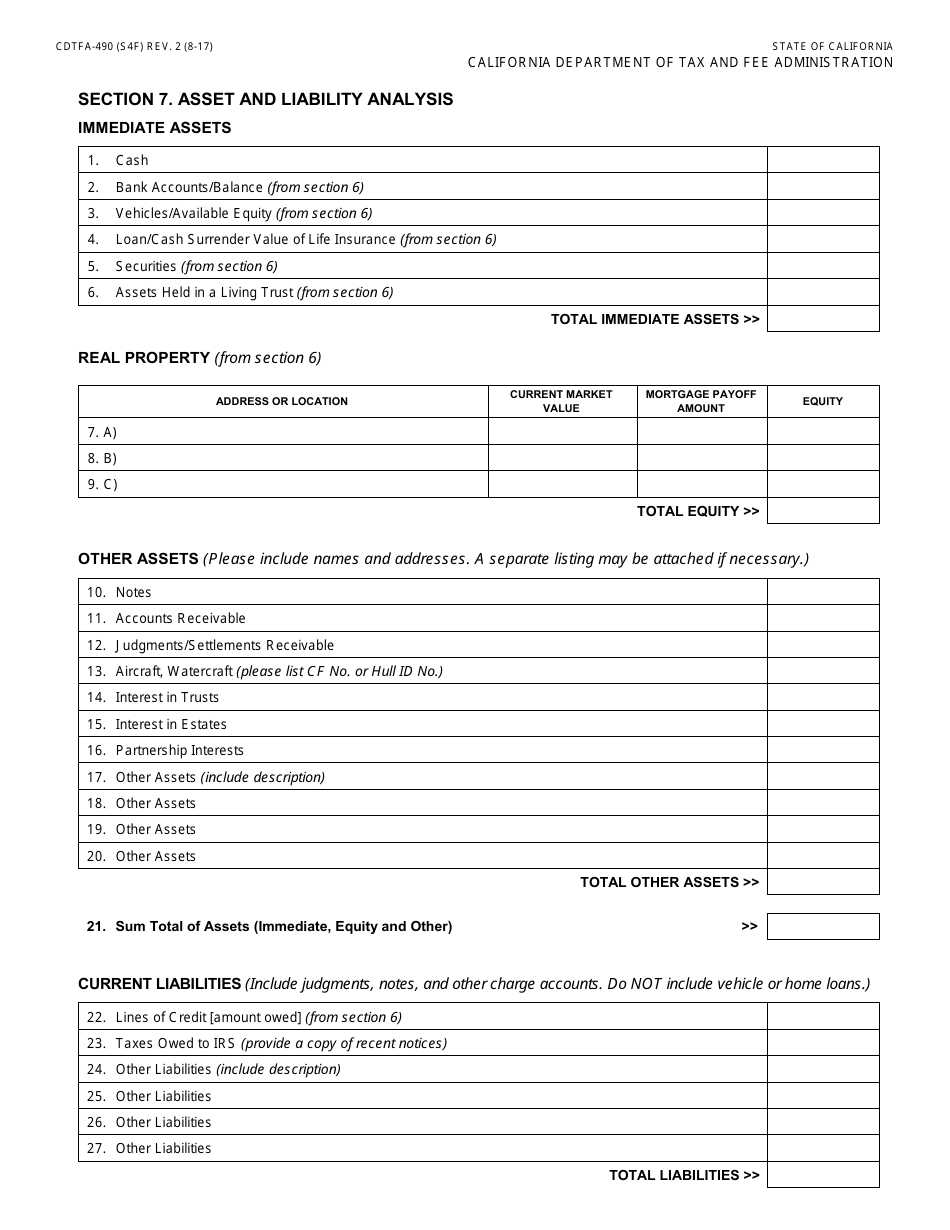

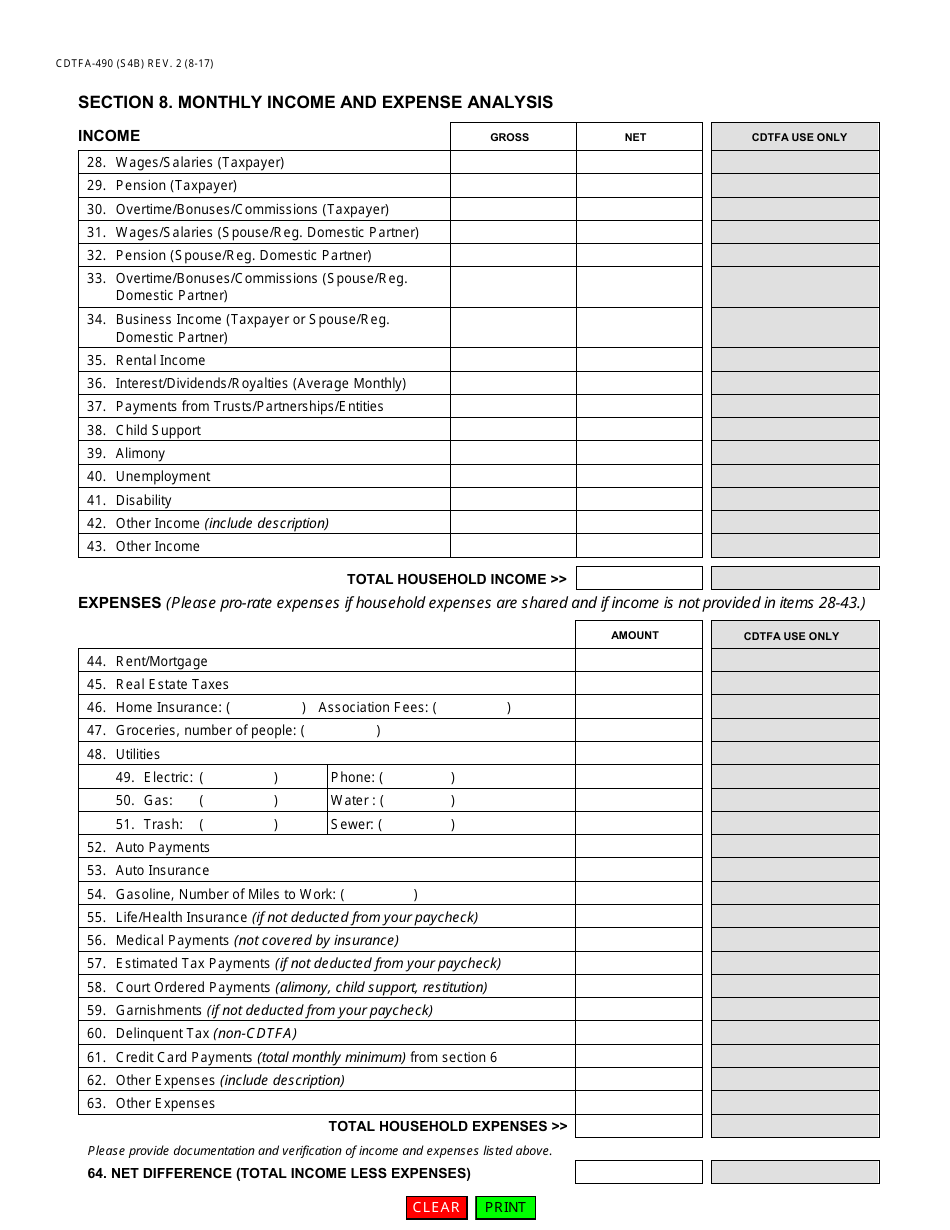

Form CDTFA-490 Offer in Compromise Application - California

What Is Form CDTFA-490?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

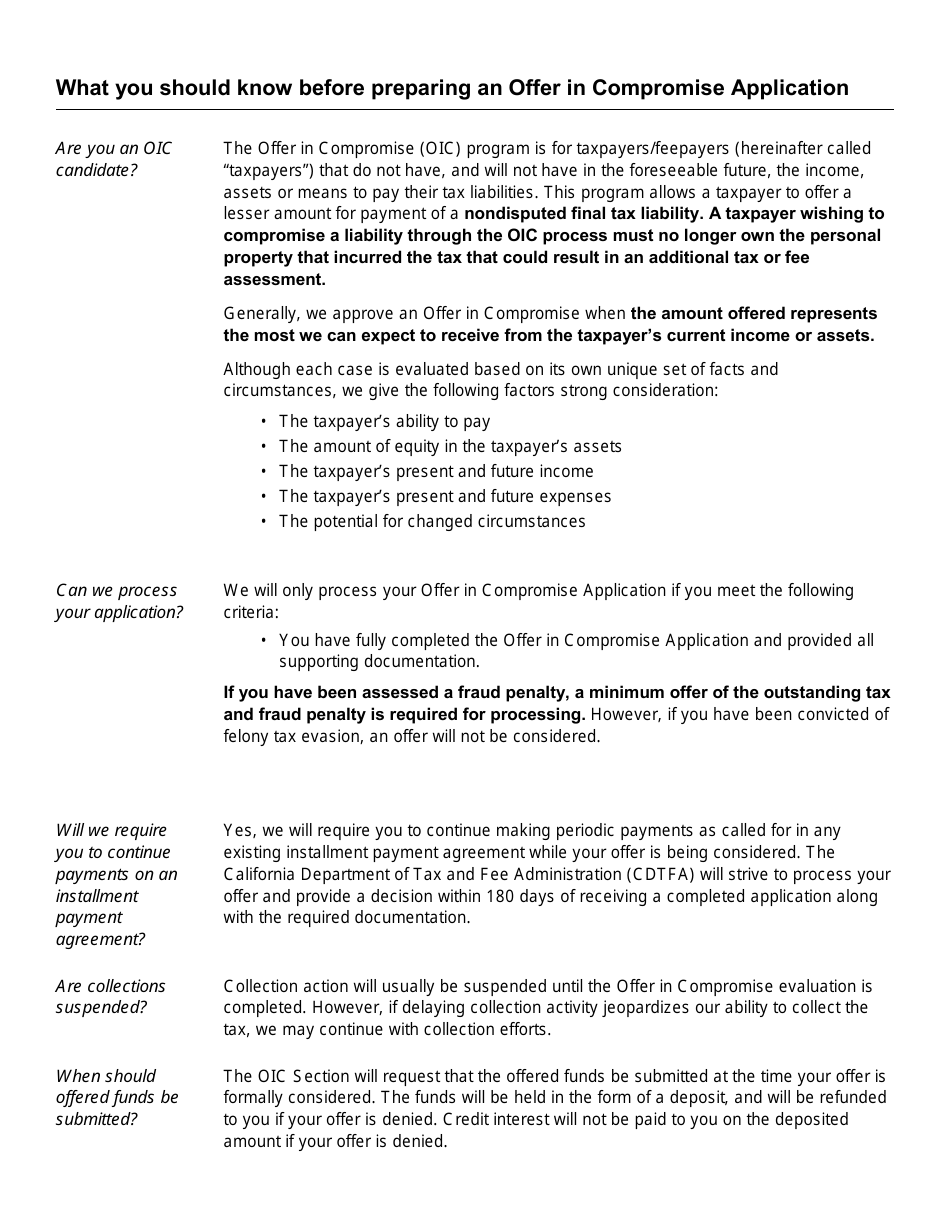

Q: What is Form CDTFA-490?

A: Form CDTFA-490 is the Offer in Compromise Application used in California.

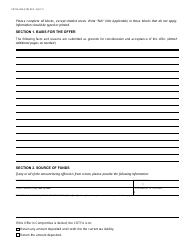

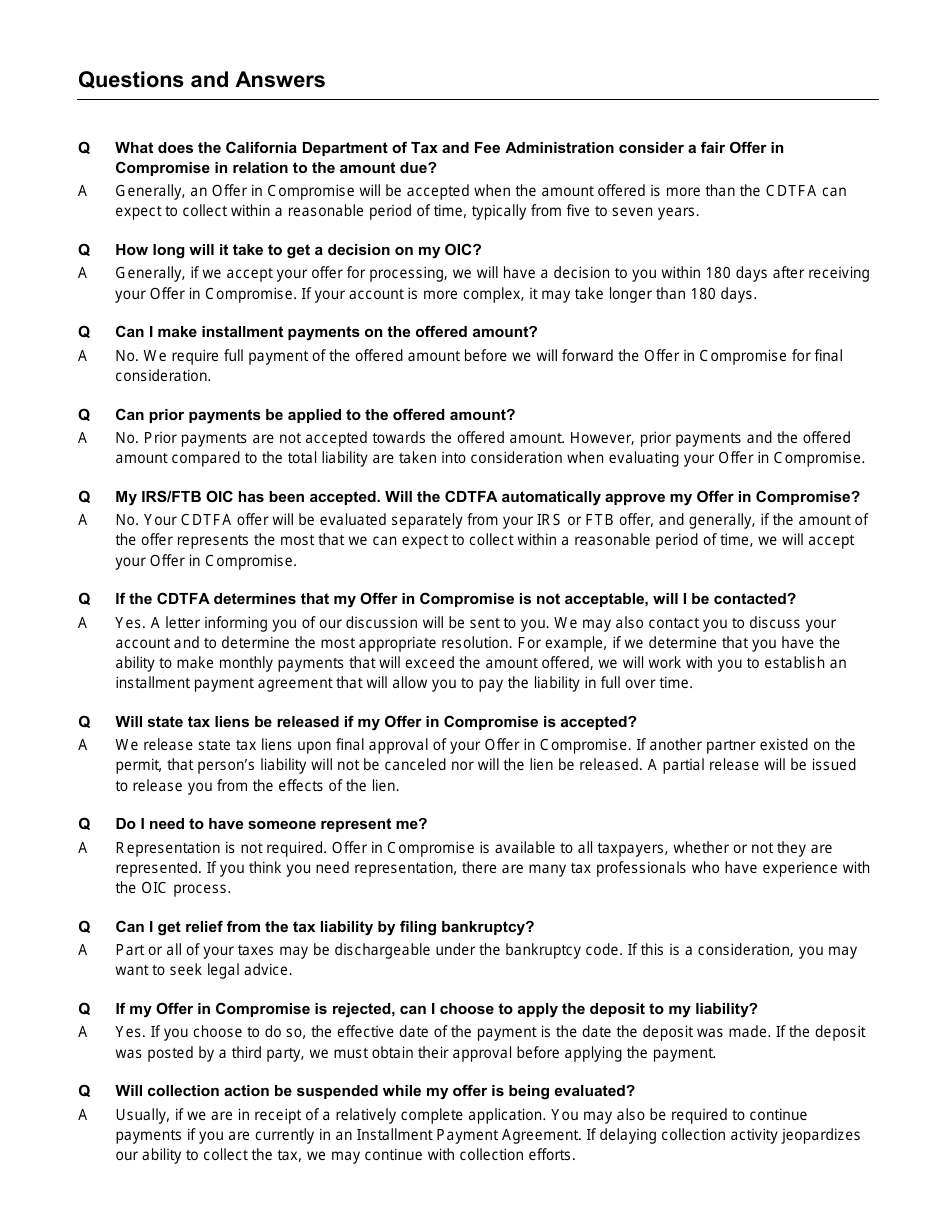

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program that allows taxpayers to settle their tax debt for less than the full amount owed.

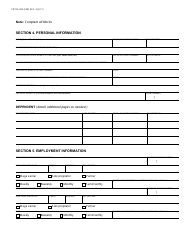

Q: Who can use Form CDTFA-490?

A: Individuals, businesses, and other entities that owe taxes to the California Department of Tax and Fee Administration (CDTFA) can use this form.

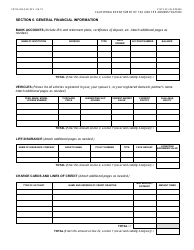

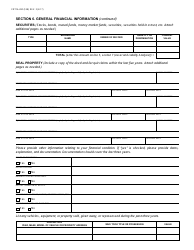

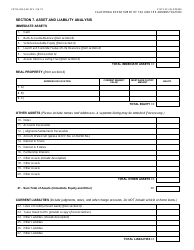

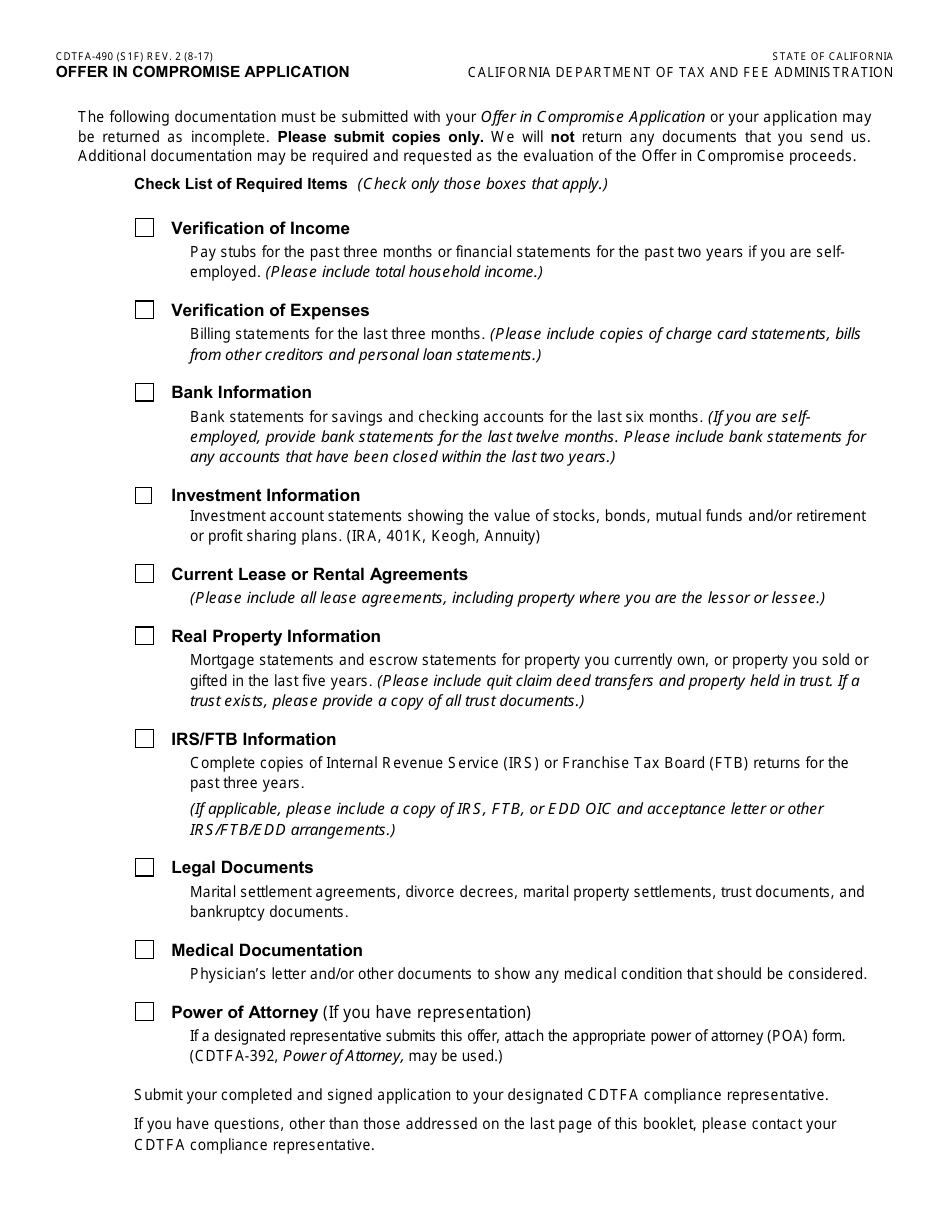

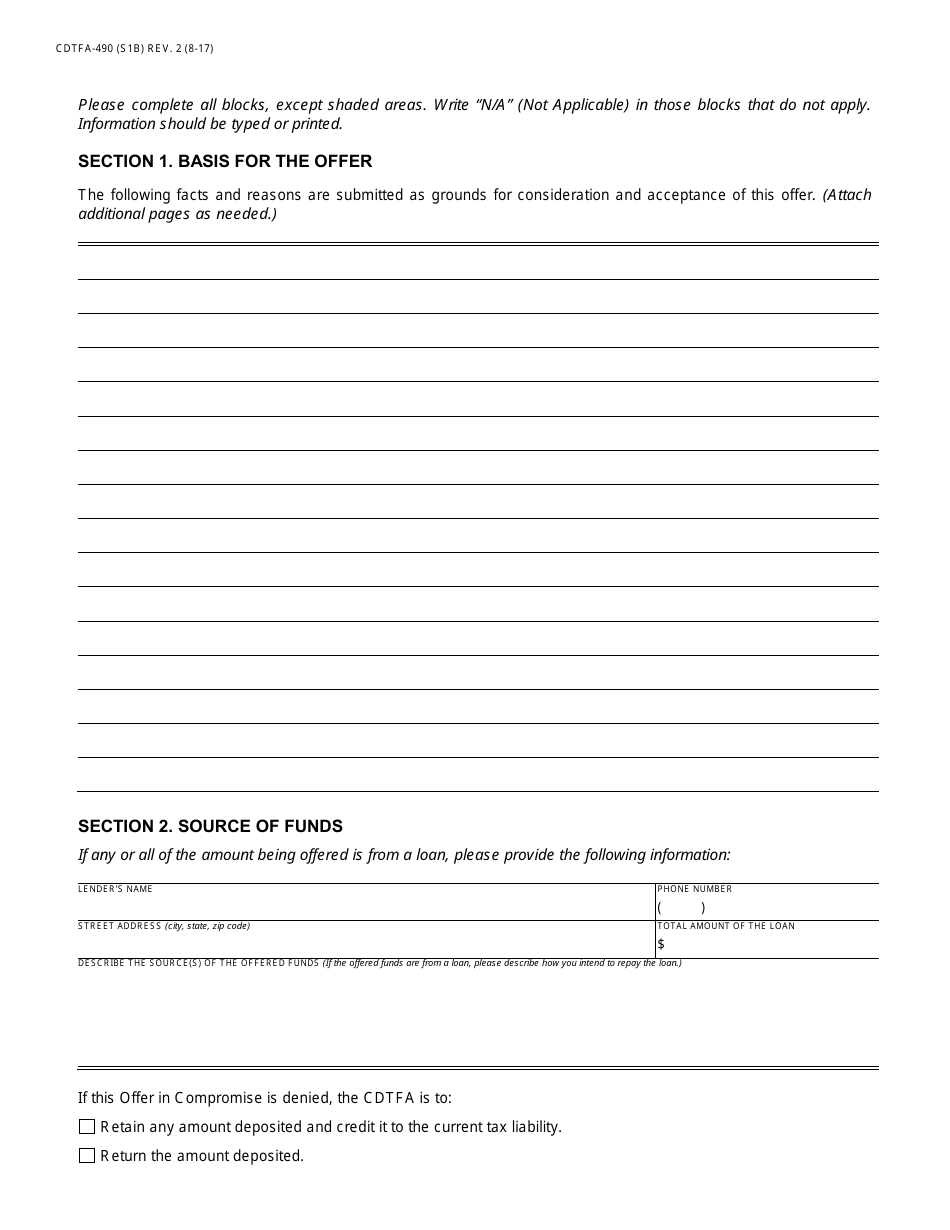

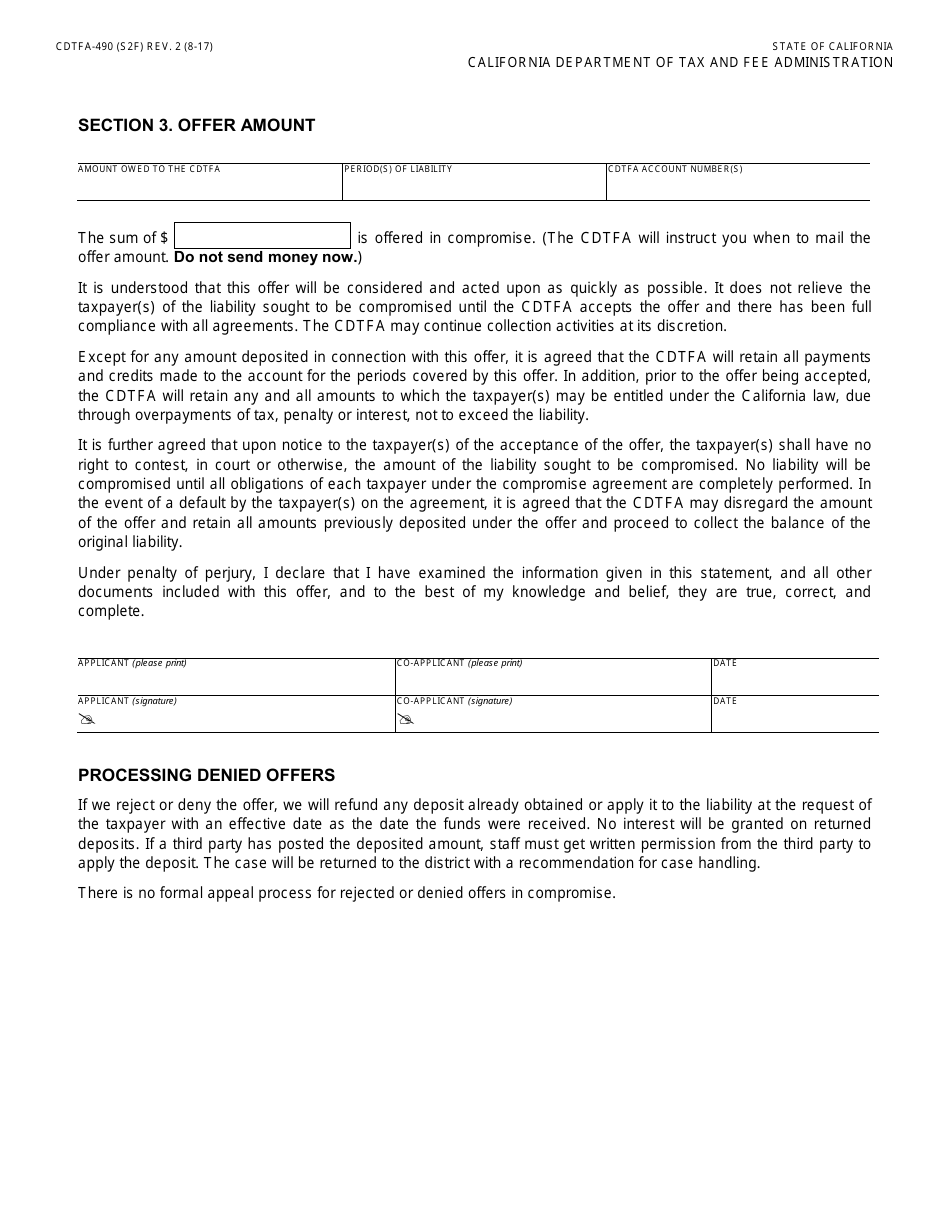

Q: How do I fill out Form CDTFA-490?

A: The form requires detailed financial information and documentation. It is recommended to seek professional assistance or refer to the instructions provided with the form.

Q: Are there any fees associated with submitting Form CDTFA-490?

A: Yes, there is a non-refundable application fee that must be included with the form.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-490 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.