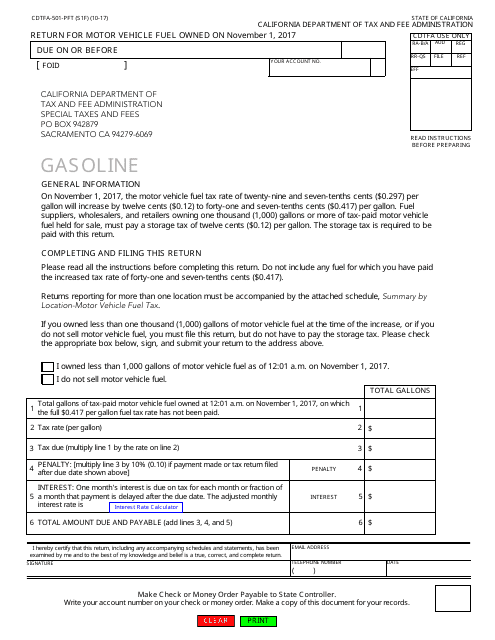

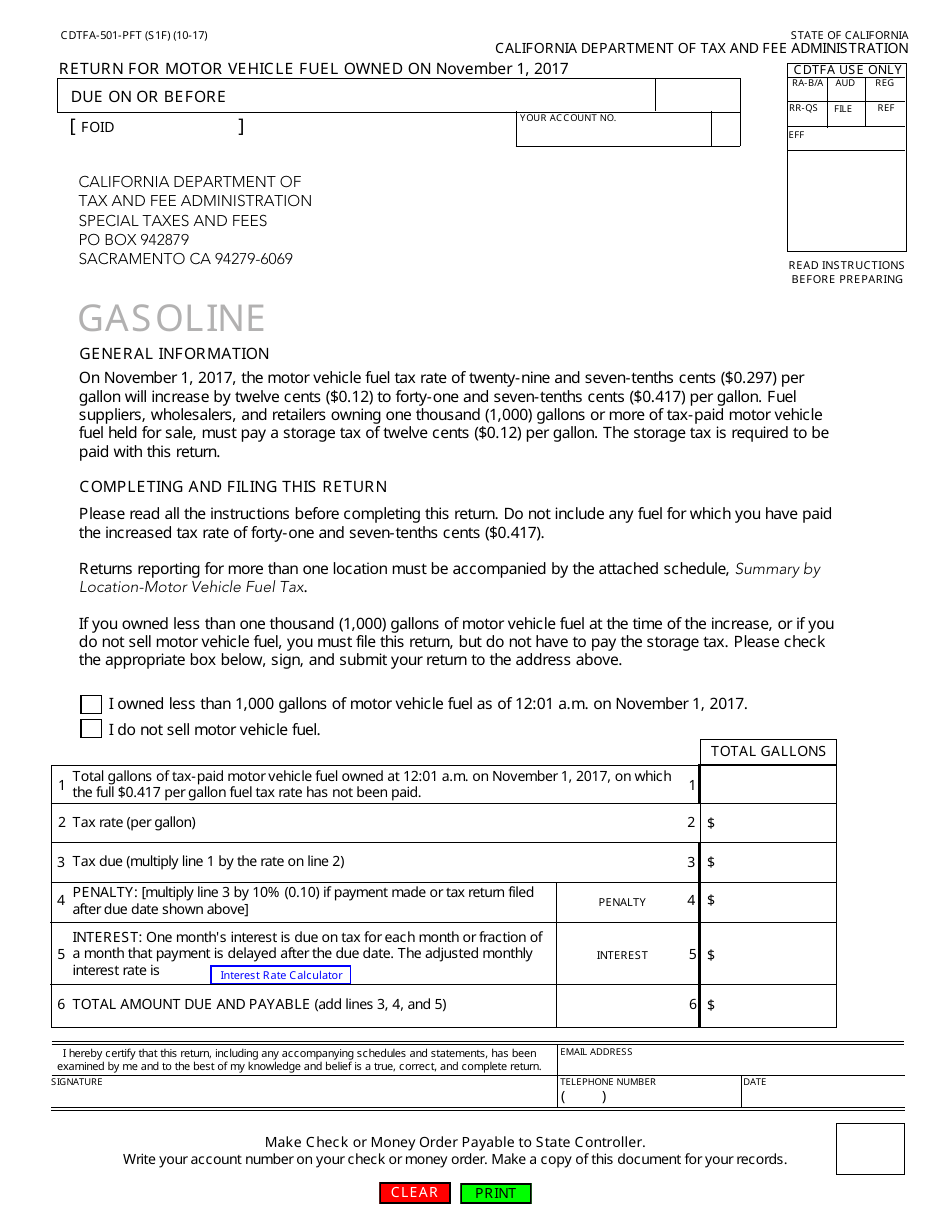

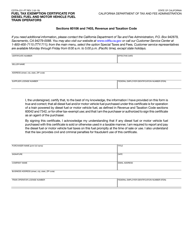

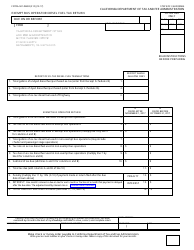

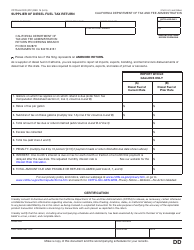

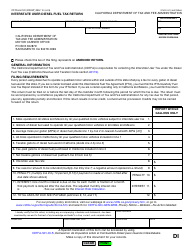

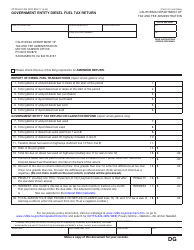

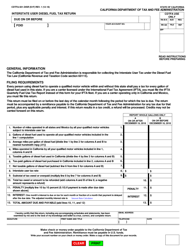

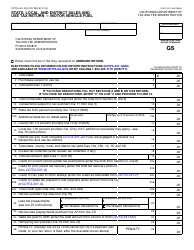

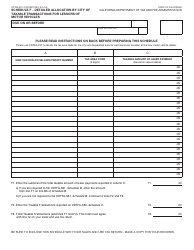

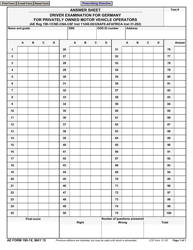

Form CDTFA-501-PFT Return for Motor Vehicle Fuel Owned on November 1, 2017 - California

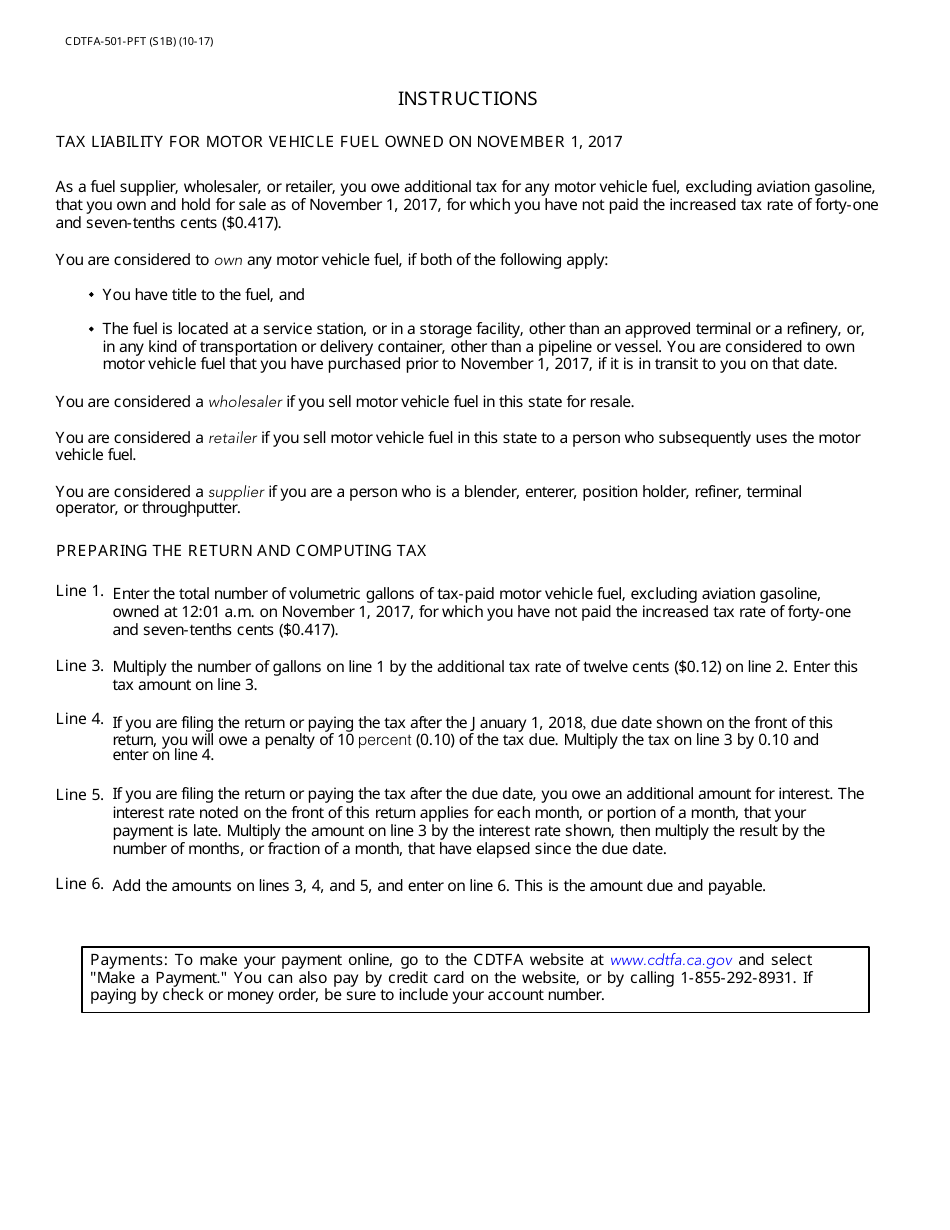

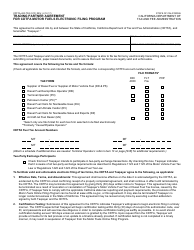

What Is Form CDTFA-501-PFT?

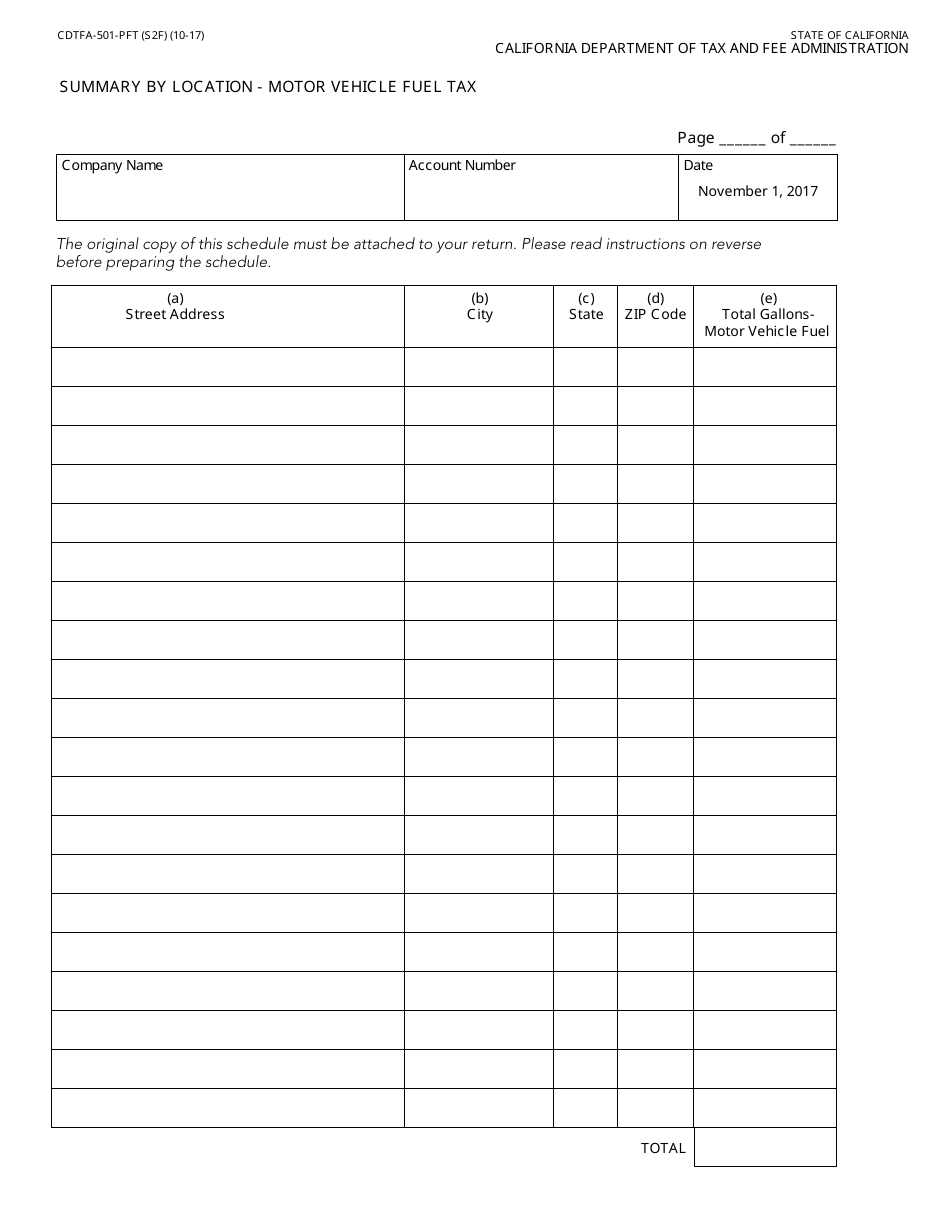

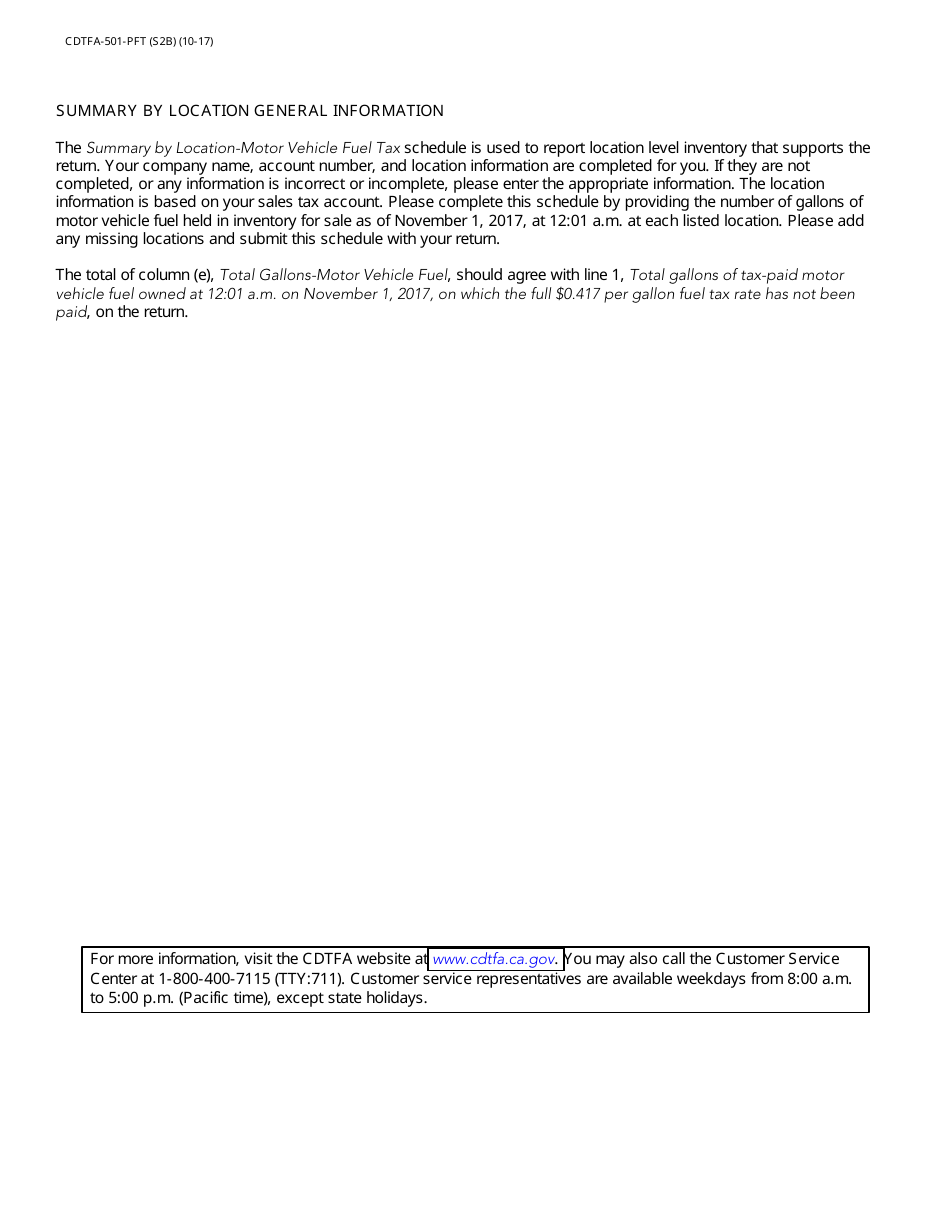

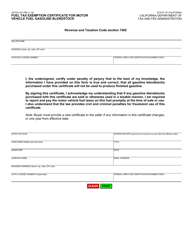

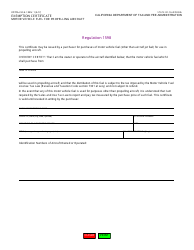

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

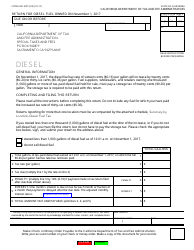

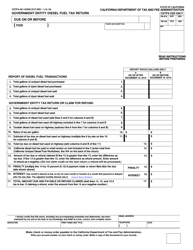

Q: What is Form CDTFA-501-PFT?

A: Form CDTFA-501-PFT is a return for motor vehicle fuel owned on November 1, 2017 in California.

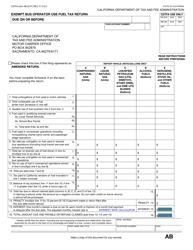

Q: Who needs to file Form CDTFA-501-PFT?

A: Those who owned motor vehicle fuel on November 1, 2017 in California need to file Form CDTFA-501-PFT.

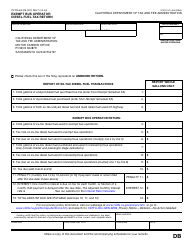

Q: What is the purpose of Form CDTFA-501-PFT?

A: The purpose of Form CDTFA-501-PFT is to report and pay the motor vehicle fuel tax owed for fuel owned on November 1, 2017 in California.

Q: When is the due date for filing Form CDTFA-501-PFT?

A: The due date for filing Form CDTFA-501-PFT is provided by the California Department of Tax and Fee Administration (CDTFA).

Q: Are there any penalties for not filing Form CDTFA-501-PFT?

A: Yes, there may be penalties for not filing Form CDTFA-501-PFT, as determined by the California Department of Tax and Fee Administration (CDTFA).

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-PFT by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.