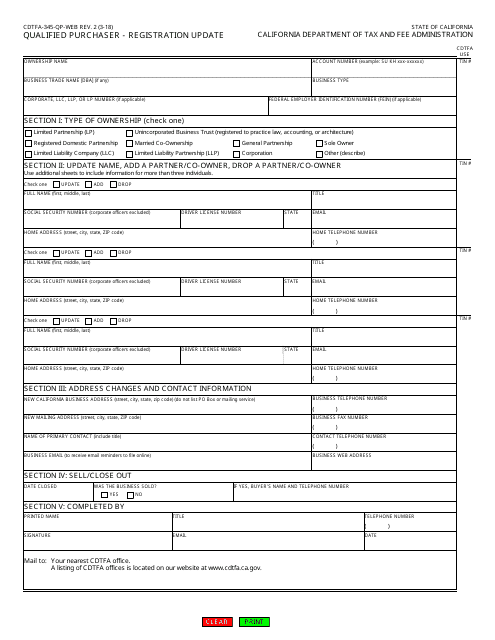

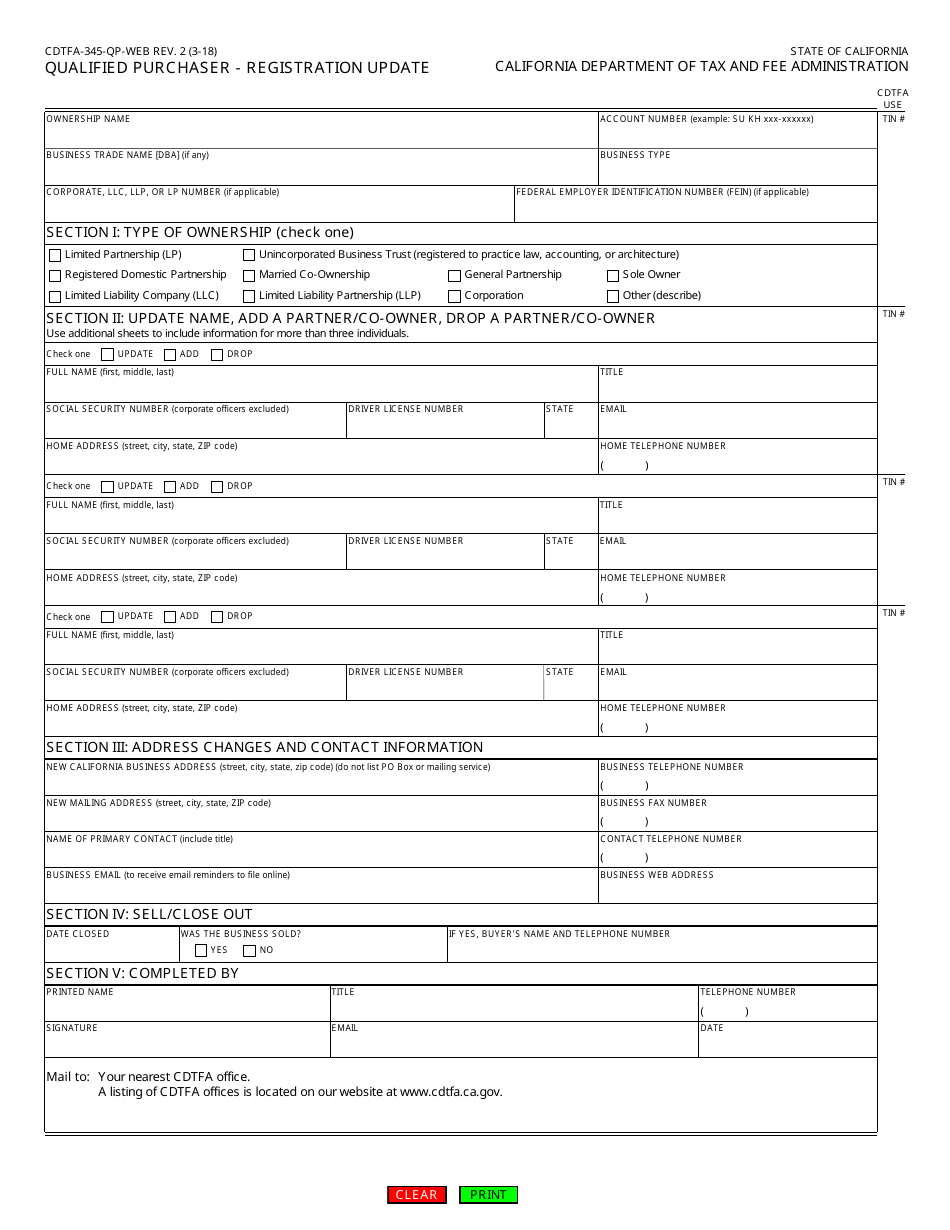

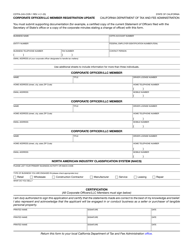

Form CDTFA-345-QP-WEB Qualified Purchaser - Registration Update - California

What Is Form CDTFA-345-QP-WEB?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-345-QP-WEB?

A: Form CDTFA-345-QP-WEB is a form used for qualified purchasers to update their registration information in California.

Q: Who is a qualified purchaser?

A: A qualified purchaser is an individual or business who is registered with the California Department of Tax and Fee Administration (CDTFA) to make tax-exempt purchases for resale, research and development, or manufacturing purposes.

Q: What is the purpose of updating registration information?

A: Updating registration information ensures that the CDTFA has accurate and up-to-date information on qualified purchasers, which helps in administering and enforcing tax laws.

Q: Is there a deadline for submitting Form CDTFA-345-QP-WEB?

A: There is no specific deadline mentioned for submitting the form. However, it is recommended to update registration information promptly to avoid any issues or penalties.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-345-QP-WEB by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.