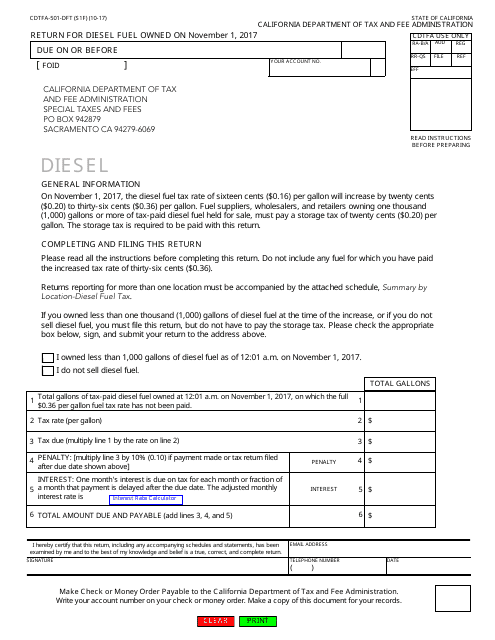

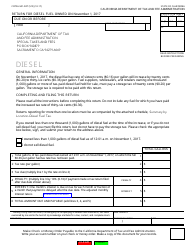

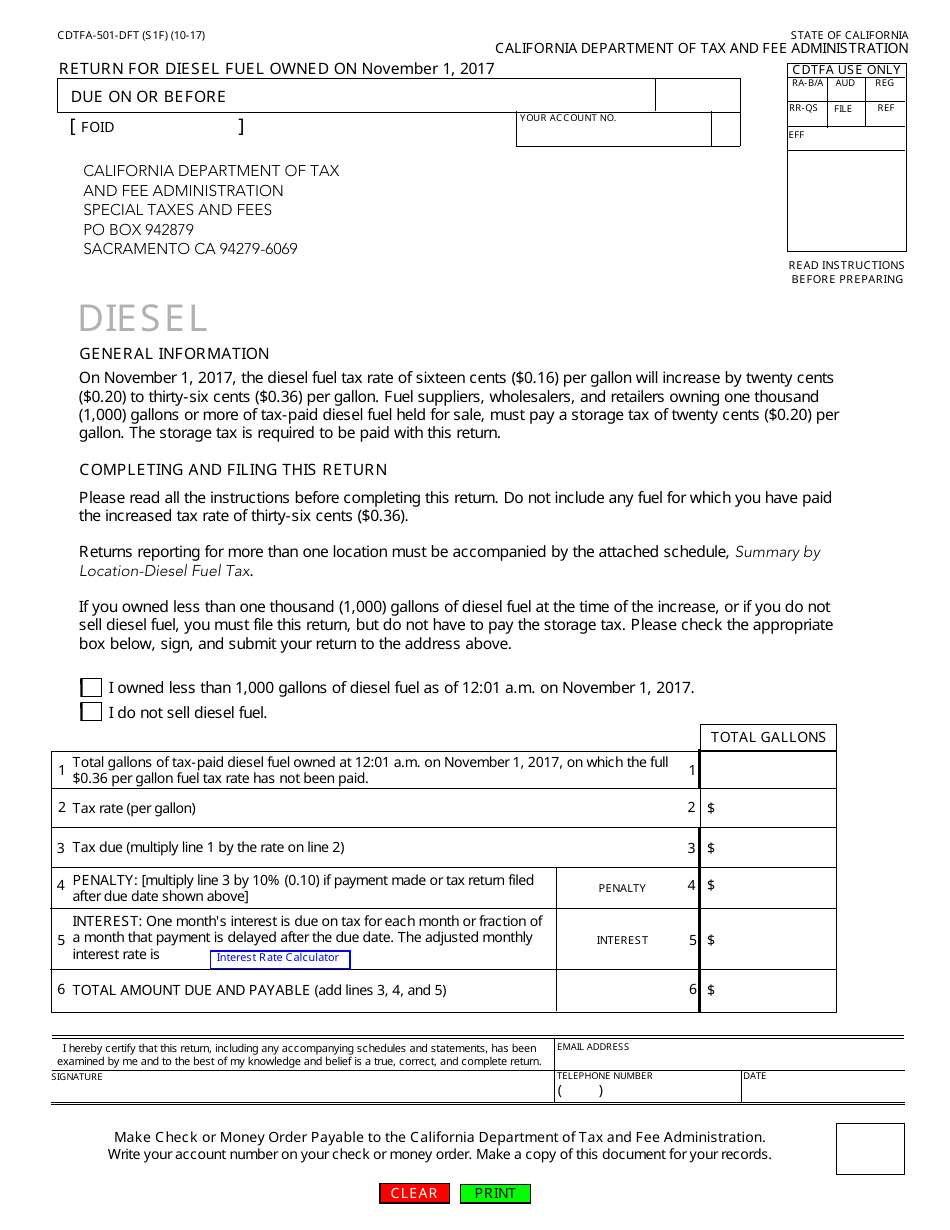

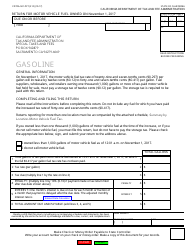

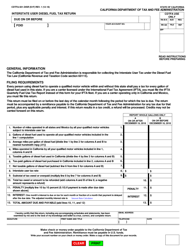

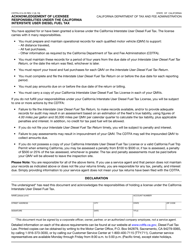

Form CDTFA-501-DFT Return for Diesel Fuel Owned on November 1, 2017 - California

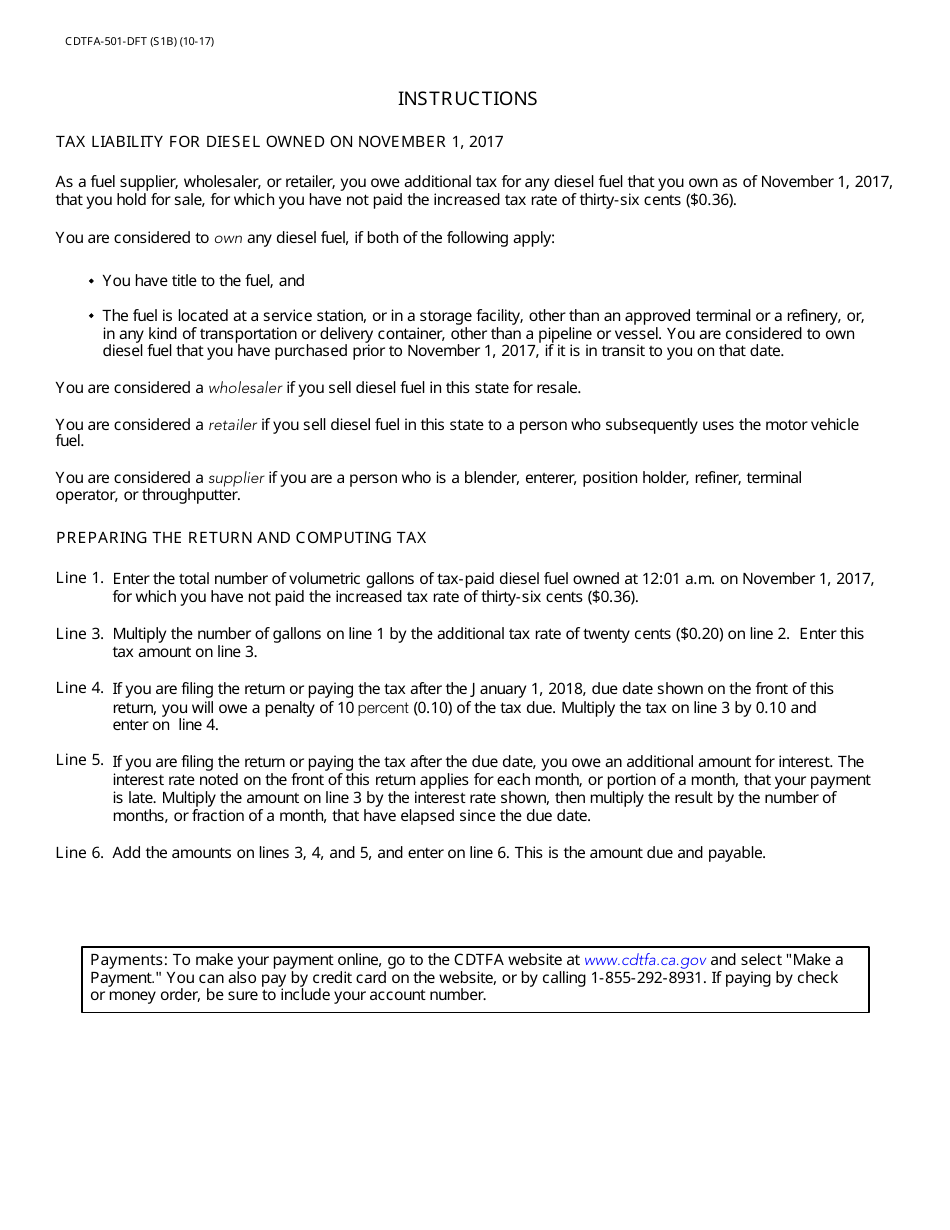

What Is Form CDTFA-501-DFT?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

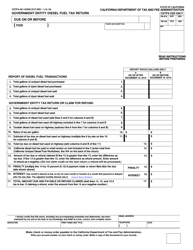

Q: What is CDTFA-501-DFT Return?

A: CDTFA-501-DFT Return is a form used to report diesel fuel ownership on November 1, 2017 in California.

Q: Who needs to file CDTFA-501-DFT Return?

A: Any individual or business that owns diesel fuel in California on November 1, 2017 needs to file CDTFA-501-DFT Return.

Q: When is the deadline to file CDTFA-501-DFT Return?

A: The deadline to file CDTFA-501-DFT Return is determined by the California Department of Tax and Fee Administration (CDTFA).

Q: Is there a penalty for not filing CDTFA-501-DFT Return?

A: Yes, there may be penalties for not filing CDTFA-501-DFT Return or filing it late. It is best to comply with the filing requirements.

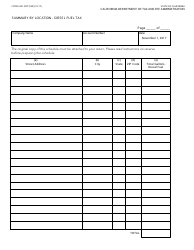

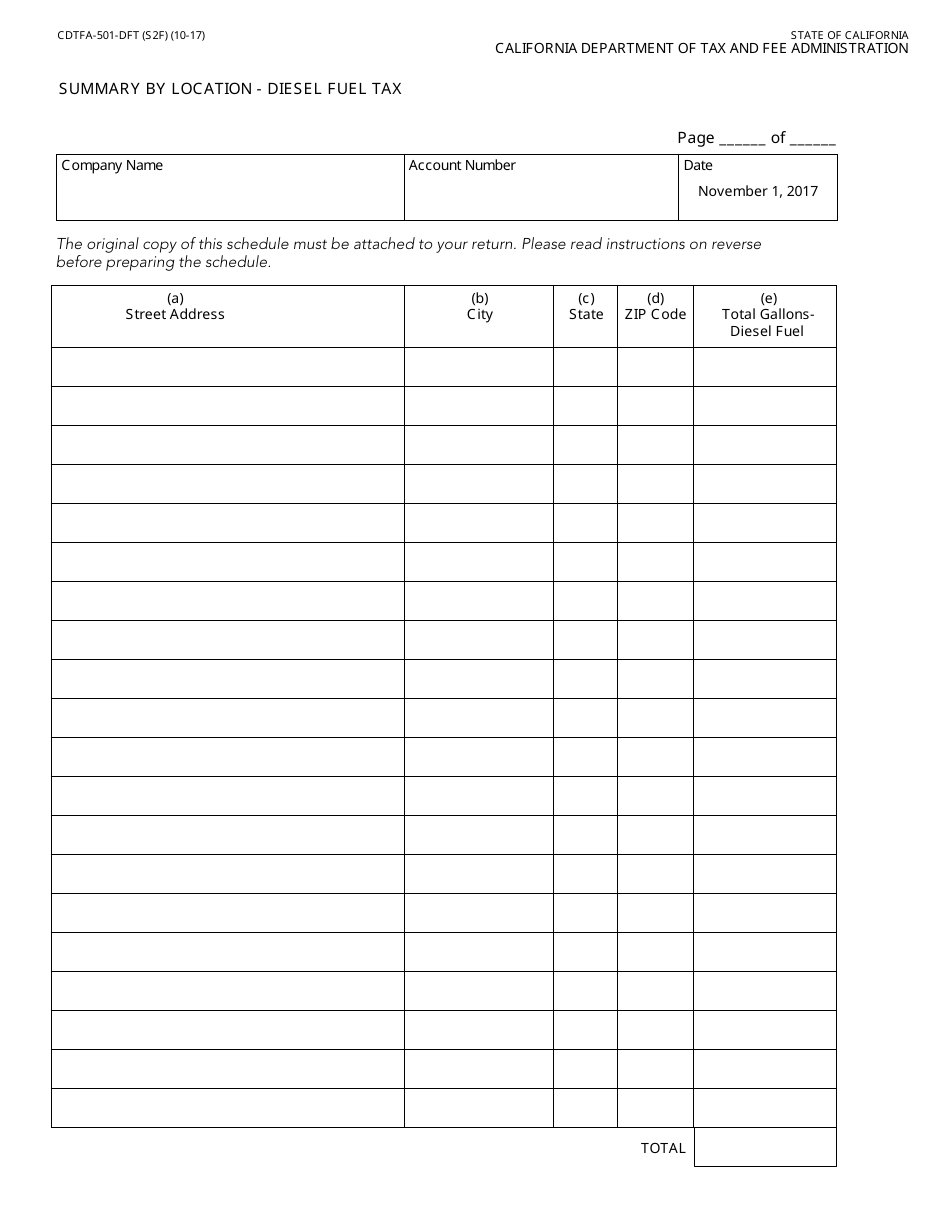

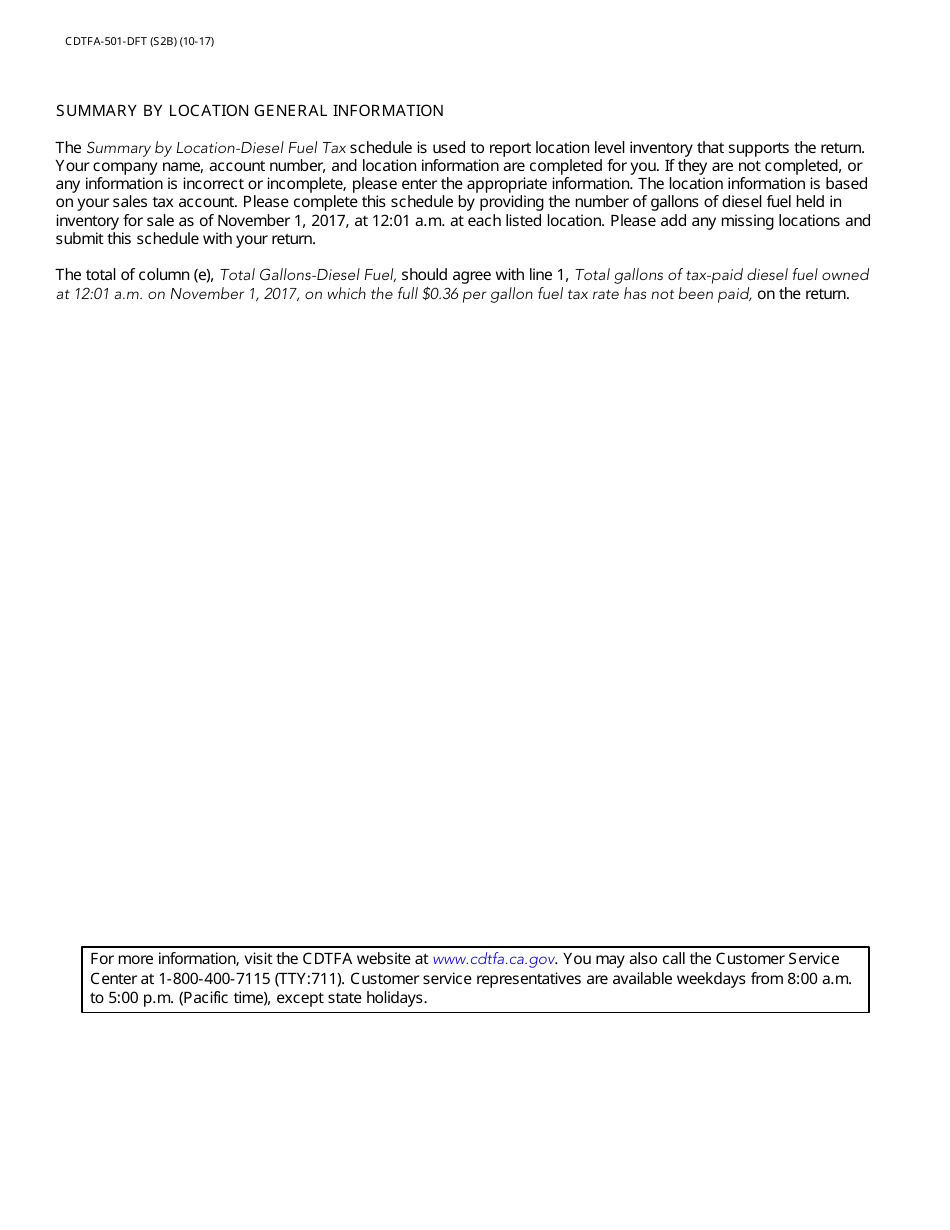

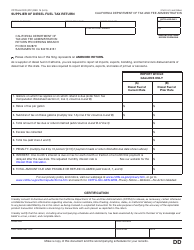

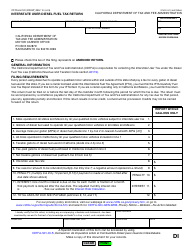

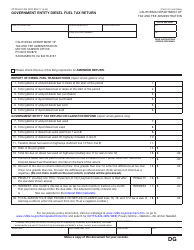

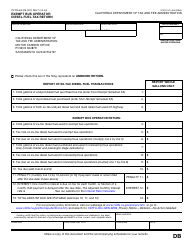

Q: What information do I need to provide on CDTFA-501-DFT Return?

A: You will need to provide information about the quantity and type of diesel fuel you owned on November 1, 2017 in California.

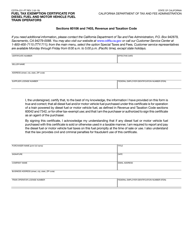

Q: Are there any exemptions or deductions available for CDTFA-501-DFT Return?

A: There may be exemptions or deductions available for certain entities. It is advised to consult the California Department of Tax and Fee Administration (CDTFA) for more information.

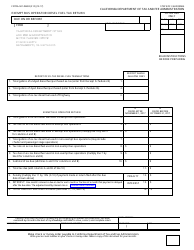

Q: What should I do if I have questions about CDTFA-501-DFT Return?

A: If you have questions about CDTFA-501-DFT Return, you should contact the California Department of Tax and Fee Administration (CDTFA) for assistance.

Q: Is CDTFA-501-DFT Return only applicable to California?

A: Yes, CDTFA-501-DFT Return is specific to reporting diesel fuel ownership on November 1, 2017 in California.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-DFT by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.