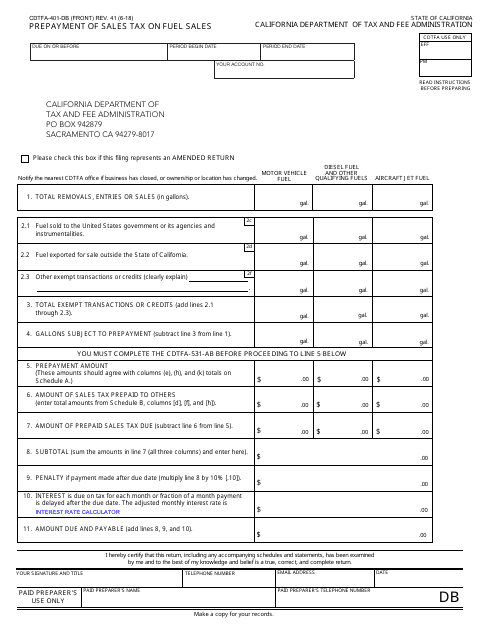

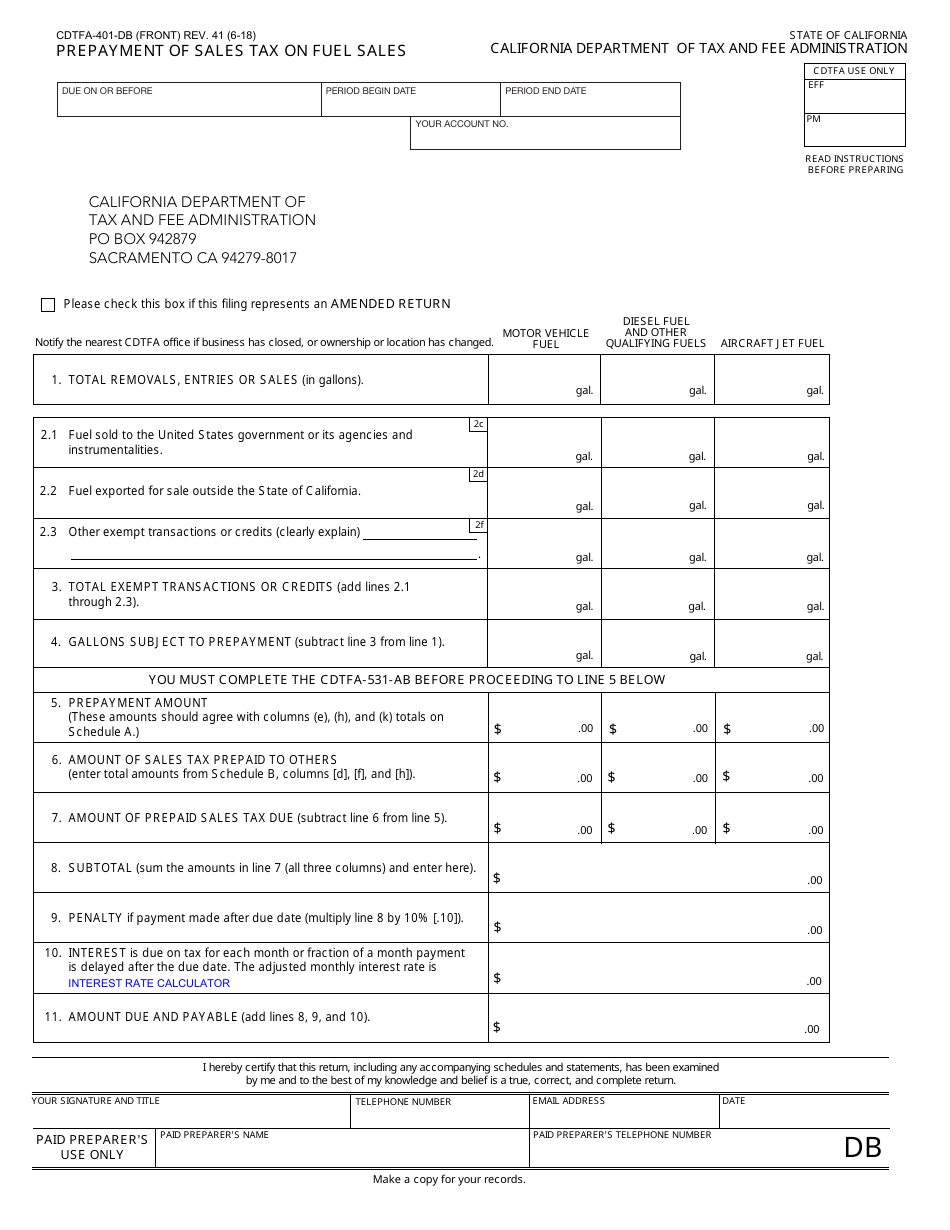

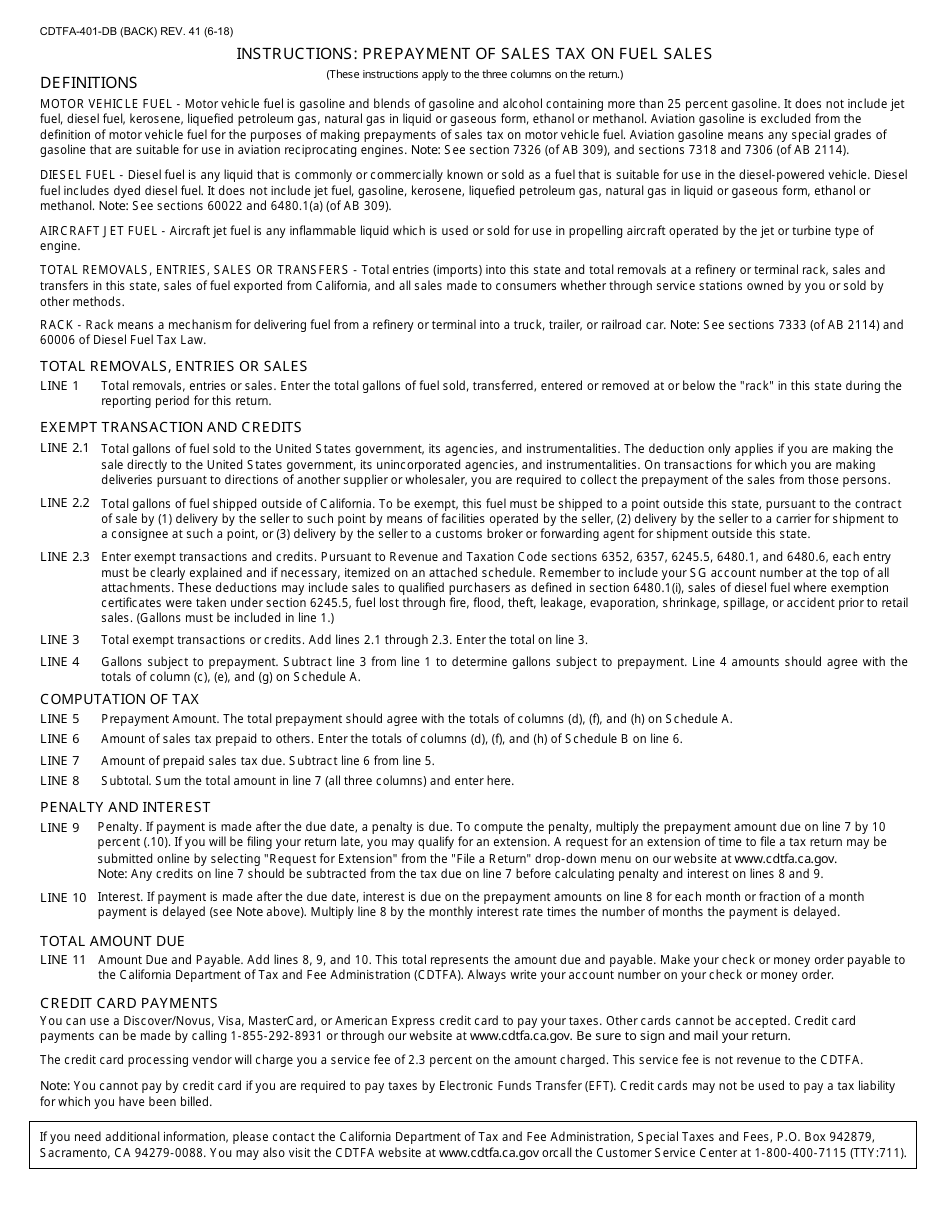

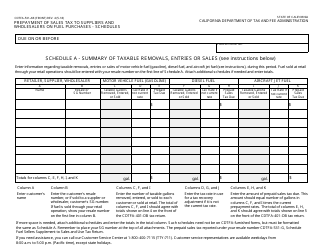

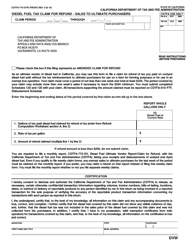

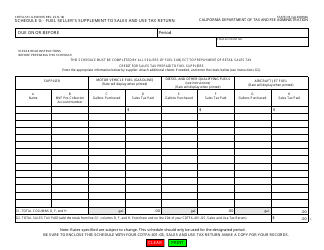

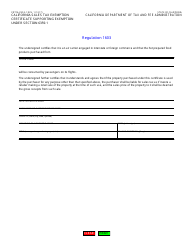

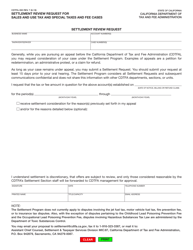

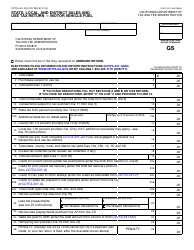

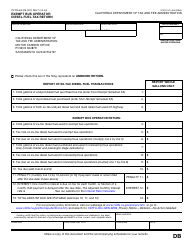

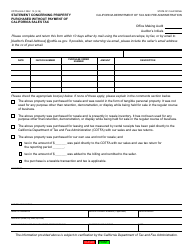

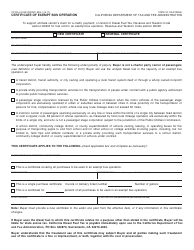

Form CDTFA-401-DB Prepayment of Sales Tax on Fuel Sales - California

What Is Form CDTFA-401-DB?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-401-DB?

A: Form CDTFA-401-DB is a prepayment form used to report and pay sales tax on fuel sales in California.

Q: Who needs to file Form CDTFA-401-DB?

A: Businesses that sell fuel in California and are required to collect sales tax need to file Form CDTFA-401-DB.

Q: What is the purpose of Form CDTFA-401-DB?

A: The purpose of Form CDTFA-401-DB is to report and prepay sales tax on fuel sales in California to the California Department of Tax and Fee Administration (CDTFA).

Q: How often do I need to file Form CDTFA-401-DB?

A: Form CDTFA-401-DB needs to be filed on a monthly basis if the total sales tax liability for fuel sales in California exceeds $10,000 in a 12-month period. Otherwise, it can be filed quarterly.

Q: Is there a deadline for filing Form CDTFA-401-DB?

A: Yes, the deadline for filing Form CDTFA-401-DB is on or before the last day of the month following the reporting period (monthly or quarterly).

Q: Are there any penalties for not filing Form CDTFA-401-DB?

A: Yes, there are penalties for not filing or late filing of Form CDTFA-401-DB, including interest charges and possible suspension or revocation of your seller's permit.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-401-DB by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.