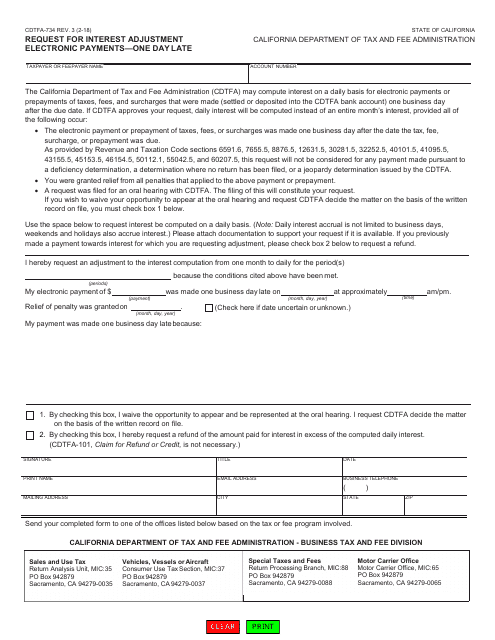

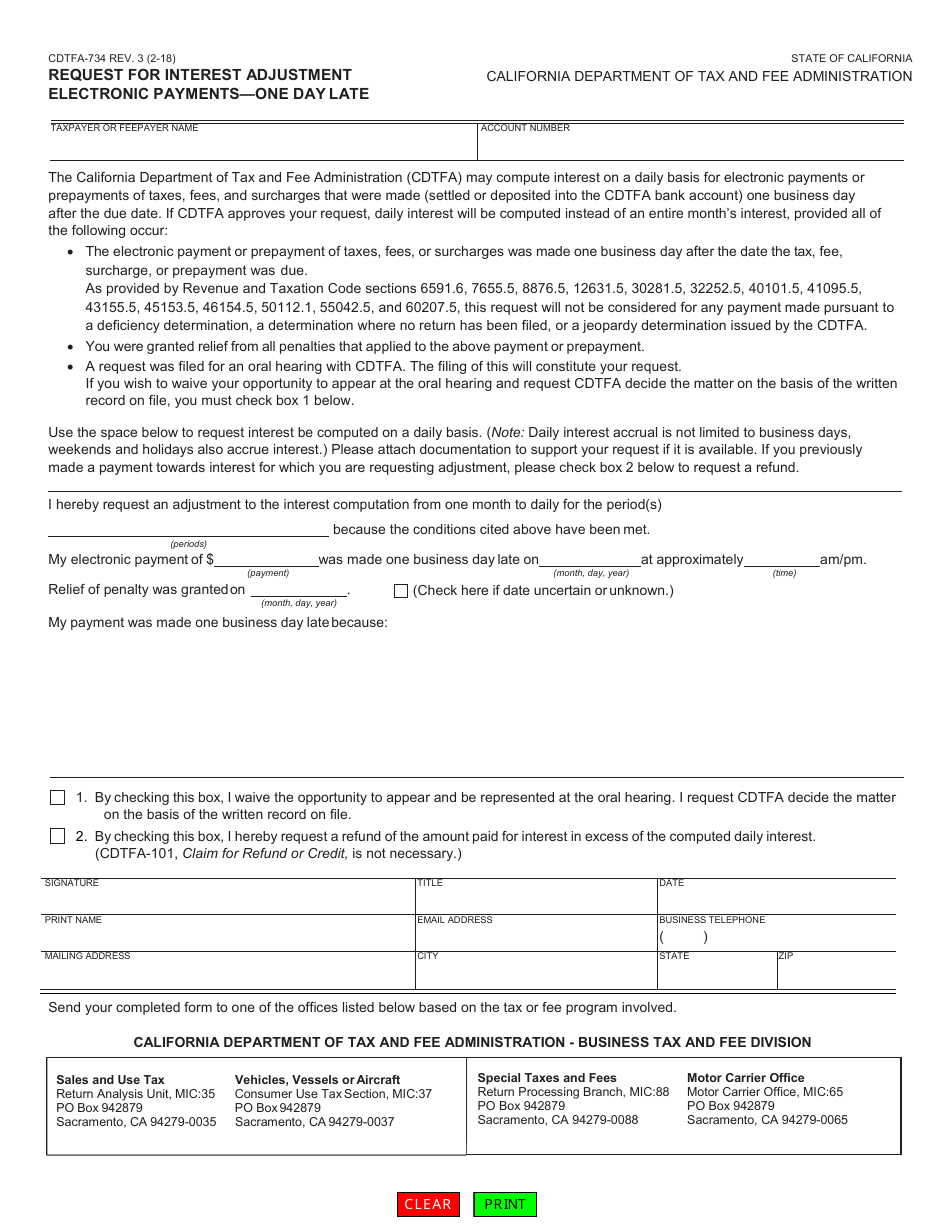

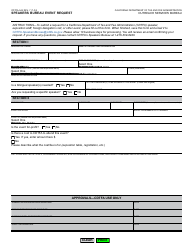

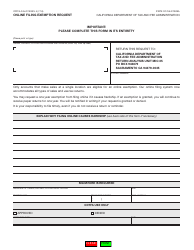

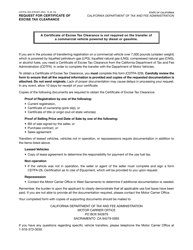

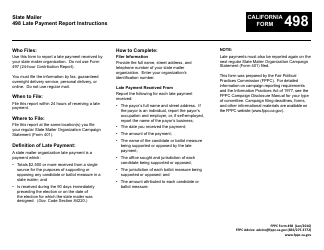

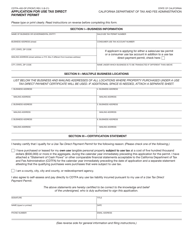

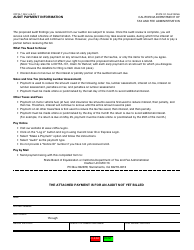

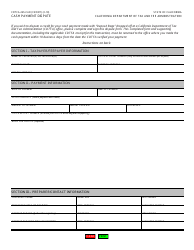

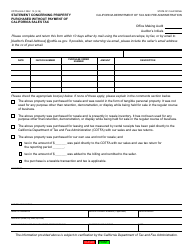

Form CDTFA-734 Request for Interest Adjustment Electronic Payments - One Day Late - California

What Is Form CDTFA-734?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-734?

A: Form CDTFA-734 is a request form used to request an interest adjustment for electronic payments that are one day late in California.

Q: What is an interest adjustment?

A: An interest adjustment is a request to have the interest on a late payment reduced or removed.

Q: When should Form CDTFA-734 be used?

A: Form CDTFA-734 should be used when an electronic payment is one day late and the taxpayer wishes to request an interest adjustment.

Q: What is the purpose of Form CDTFA-734?

A: The purpose of Form CDTFA-734 is to request an interest adjustment for electronic payments that are one day late in California.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-734 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.