This version of the form is not currently in use and is provided for reference only. Download this version of

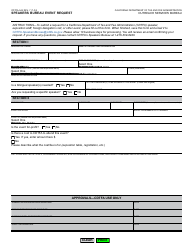

Form CDTFA-329

for the current year.

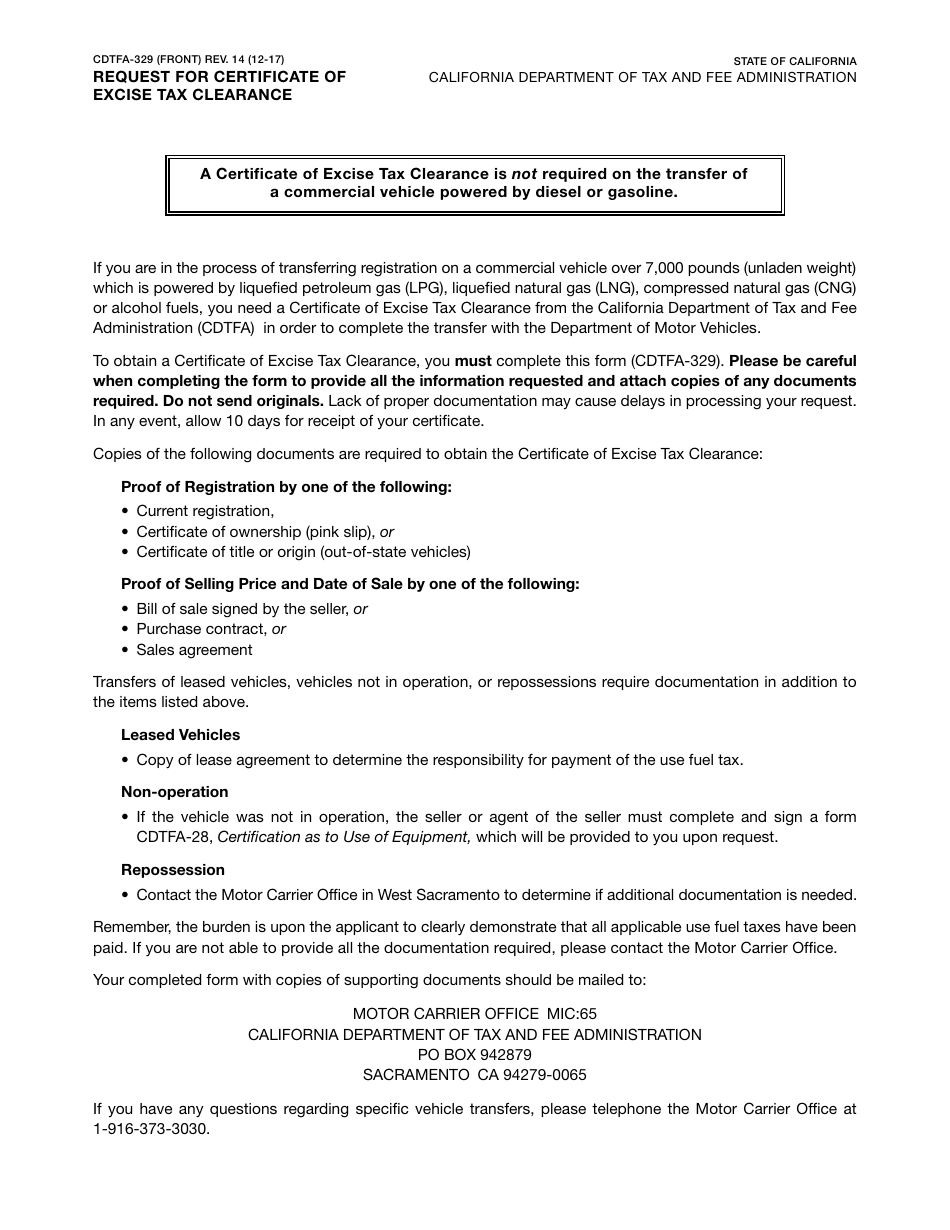

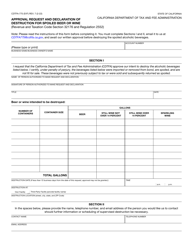

Form CDTFA-329 Request for Certificate of Excise Tax Clearance - California

What Is Form CDTFA-329?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-329?

A: Form CDTFA-329 is a document used to request a Certificate of Excise Tax Clearance in California.

Q: What is a Certificate of Excise Tax Clearance?

A: A Certificate of Excise Tax Clearance is a document that confirms that a taxpayer is in compliance with their excise tax obligations in California.

Q: Who should use Form CDTFA-329?

A: Form CDTFA-329 should be used by taxpayers who need to obtain a Certificate of Excise Tax Clearance in California.

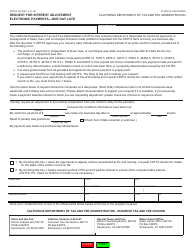

Q: Is there a fee to submit Form CDTFA-329?

A: No, there is no fee to submit Form CDTFA-329.

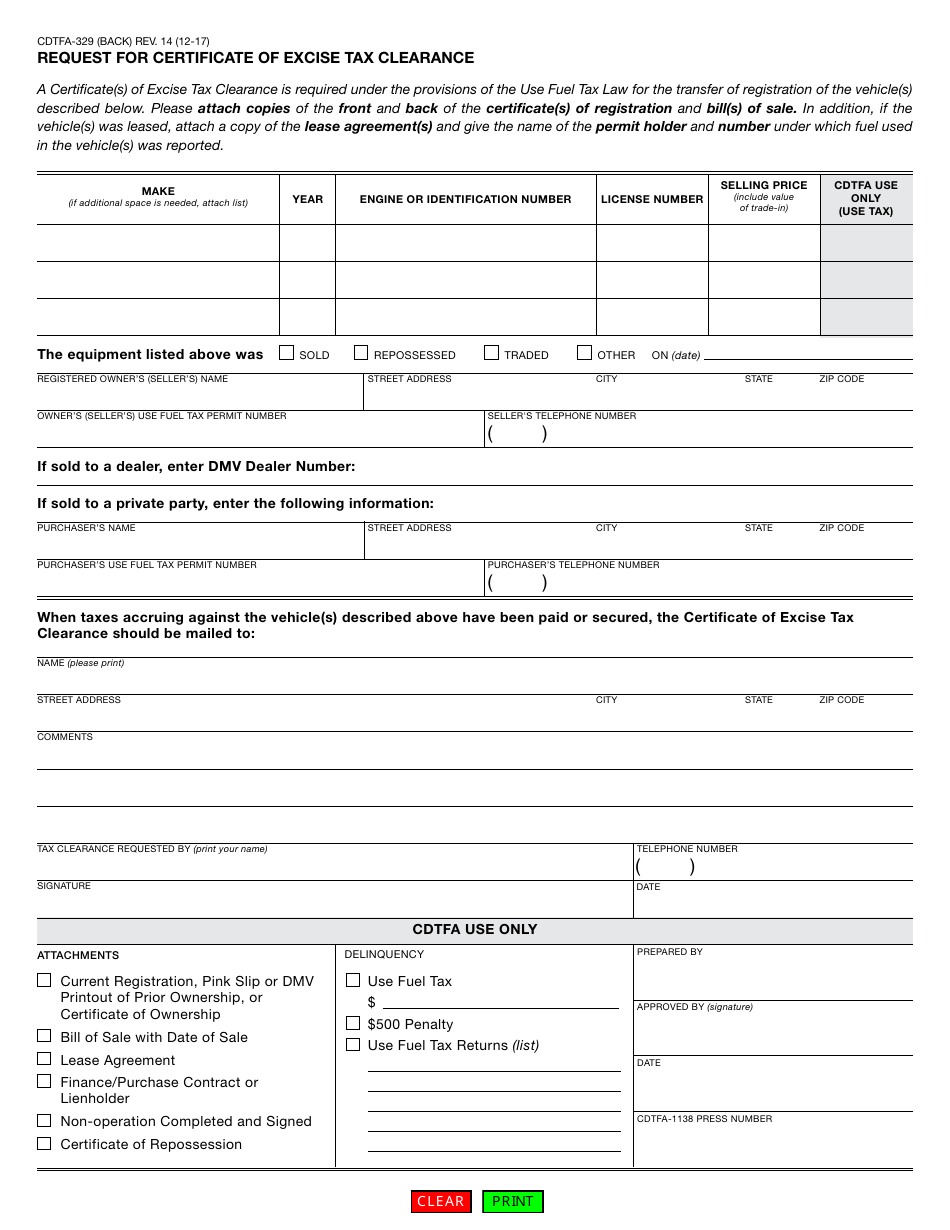

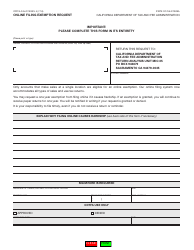

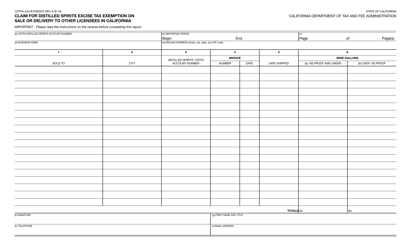

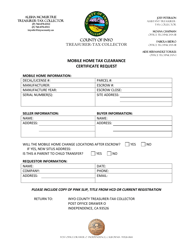

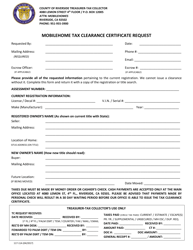

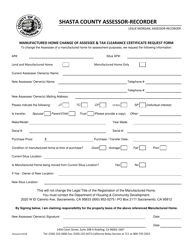

Q: What information is required on Form CDTFA-329?

A: Form CDTFA-329 requires information such as the taxpayer's name, contact information, and details about their excise tax accounts.

Q: How long does it take to receive a Certificate of Excise Tax Clearance?

A: The processing time for a Certificate of Excise Tax Clearance varies. It is recommended to allow at least two weeks for processing.

Q: Why would I need a Certificate of Excise Tax Clearance?

A: A Certificate of Excise Tax Clearance may be required when applying for certain licenses, permits, or contracts in California.

Q: Can I request a Certificate of Excise Tax Clearance for another person or business?

A: No, Form CDTFA-329 can only be used to request a Certificate of Excise Tax Clearance for yourself or your own business.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

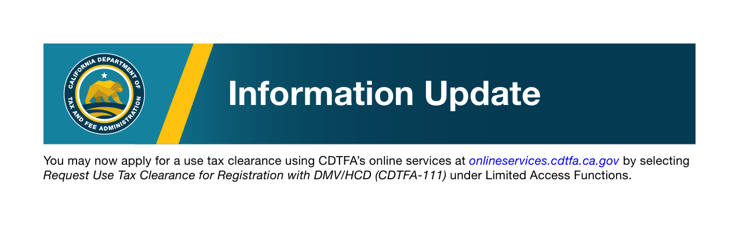

Download a fillable version of Form CDTFA-329 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.