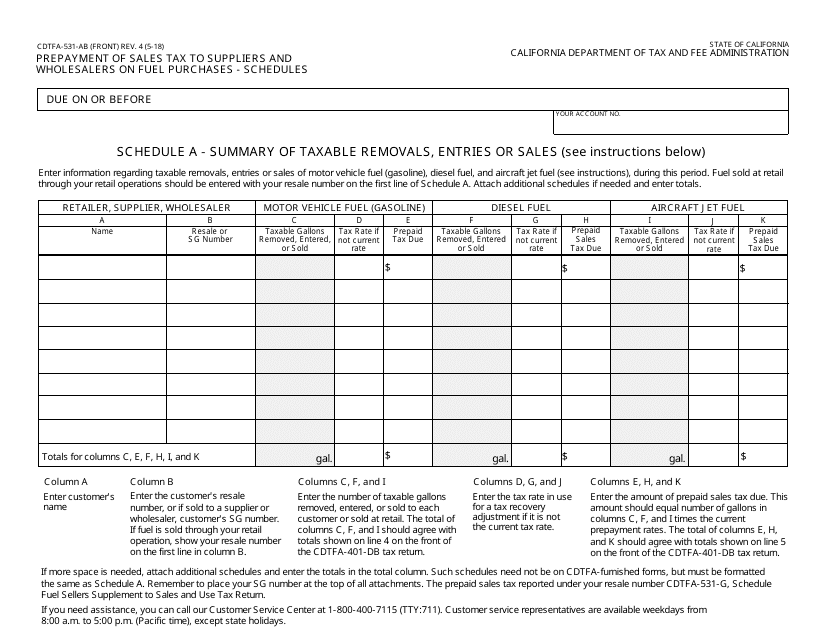

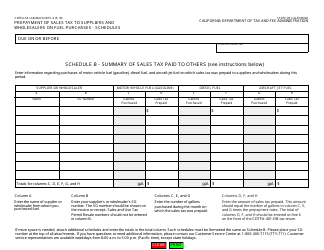

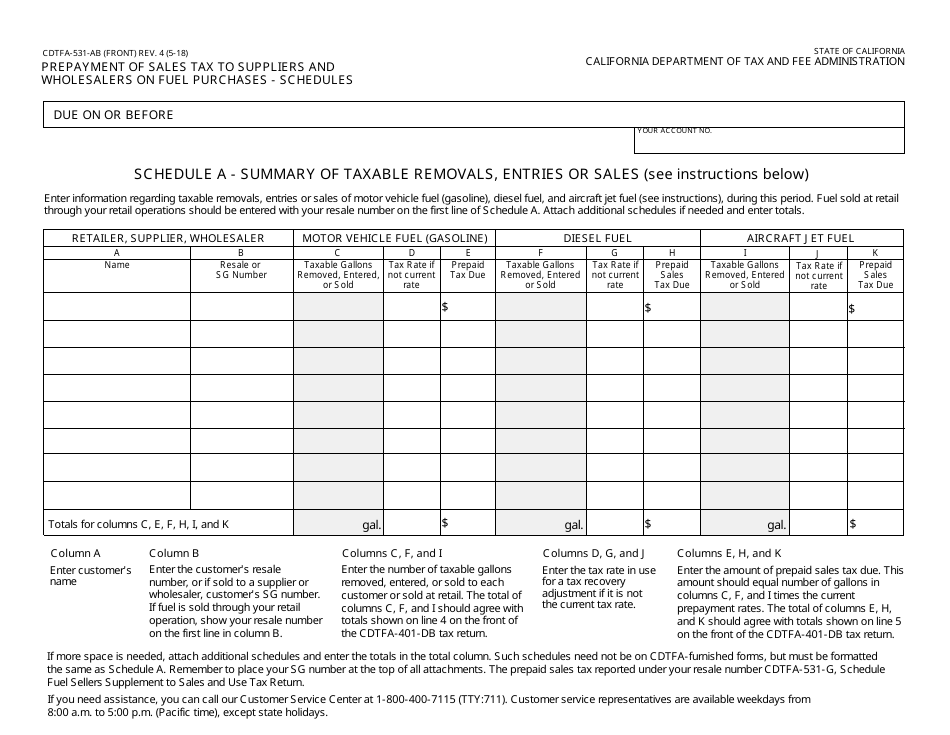

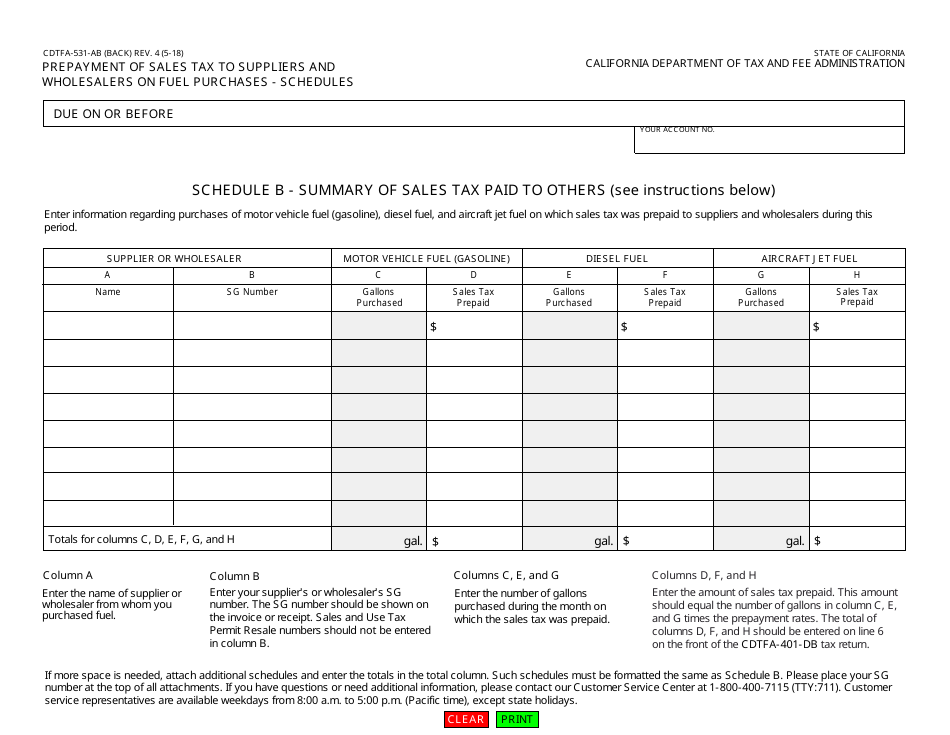

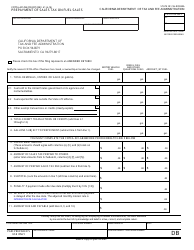

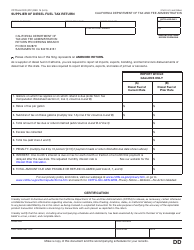

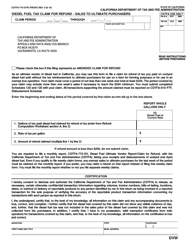

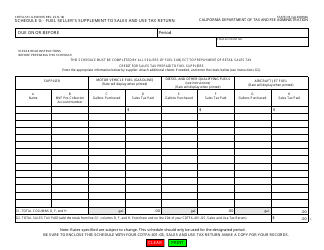

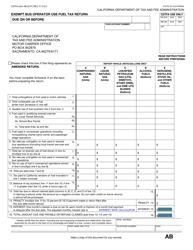

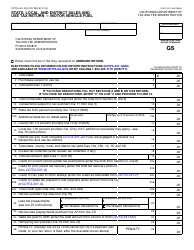

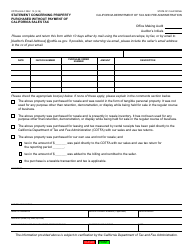

Form CDTFA-531-AB Prepayment of Sales Tax to Suppliers and Wholesalers on Fuel Purchases - Schedules - California

What Is Form CDTFA-531-AB?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-531-AB?

A: Form CDTFA-531-AB is a form used to prepay sales tax to suppliers and wholesalers on fuel purchases in California.

Q: Who needs to file Form CDTFA-531-AB?

A: Businesses that purchase fuel from suppliers and wholesalers in California need to file Form CDTFA-531-AB.

Q: What is the purpose of Form CDTFA-531-AB?

A: The purpose of Form CDTFA-531-AB is to prepay the sales tax on fuel purchases made from suppliers and wholesalers.

Q: When should Form CDTFA-531-AB be filed?

A: Form CDTFA-531-AB should be filed on a monthly basis by the 25th day of the month following the month of the fuel purchase.

Q: Are there any penalties for not filing Form CDTFA-531-AB?

A: Yes, failure to file Form CDTFA-531-AB or late filing can result in penalties and interest.

Q: What information is required when filing Form CDTFA-531-AB?

A: When filing Form CDTFA-531-AB, you will need to provide information such as your business details, fuel purchase details, and sales tax amounts.

Q: Is there a minimum amount of fuel purchases to file Form CDTFA-531-AB?

A: Yes, if your total fuel purchases from suppliers and wholesalers in a reporting period are less than $500, you are not required to file Form CDTFA-531-AB.

Q: Can I amend Form CDTFA-531-AB if I made a mistake?

A: Yes, you can amend Form CDTFA-531-AB by filing a new form with the corrected information.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-531-AB by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.