This version of the form is not currently in use and is provided for reference only. Download this version of

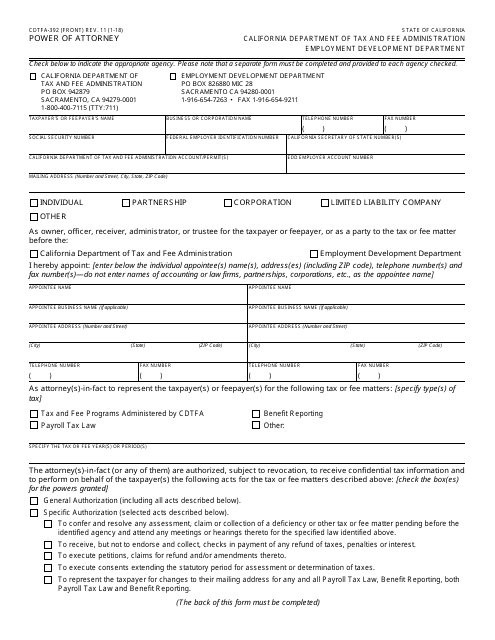

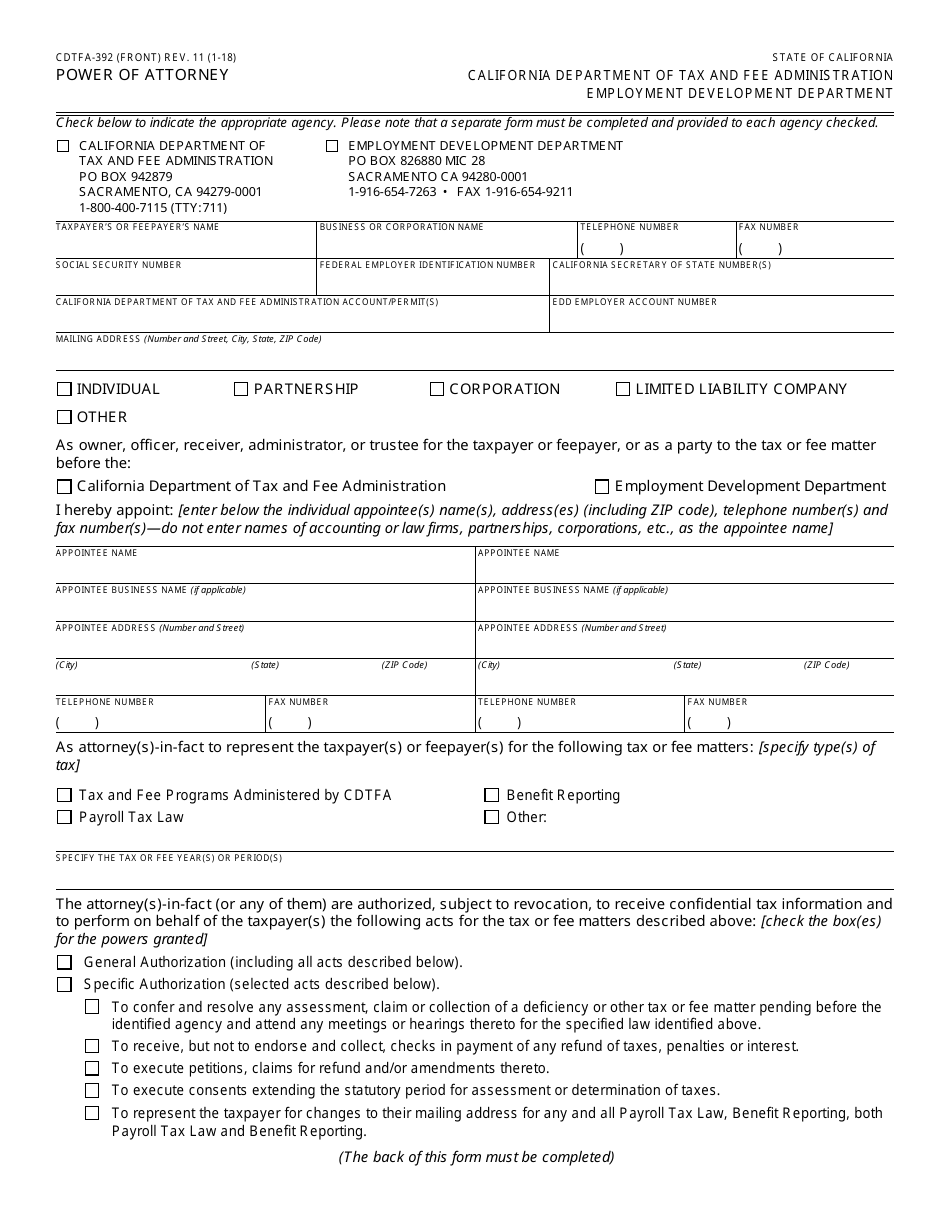

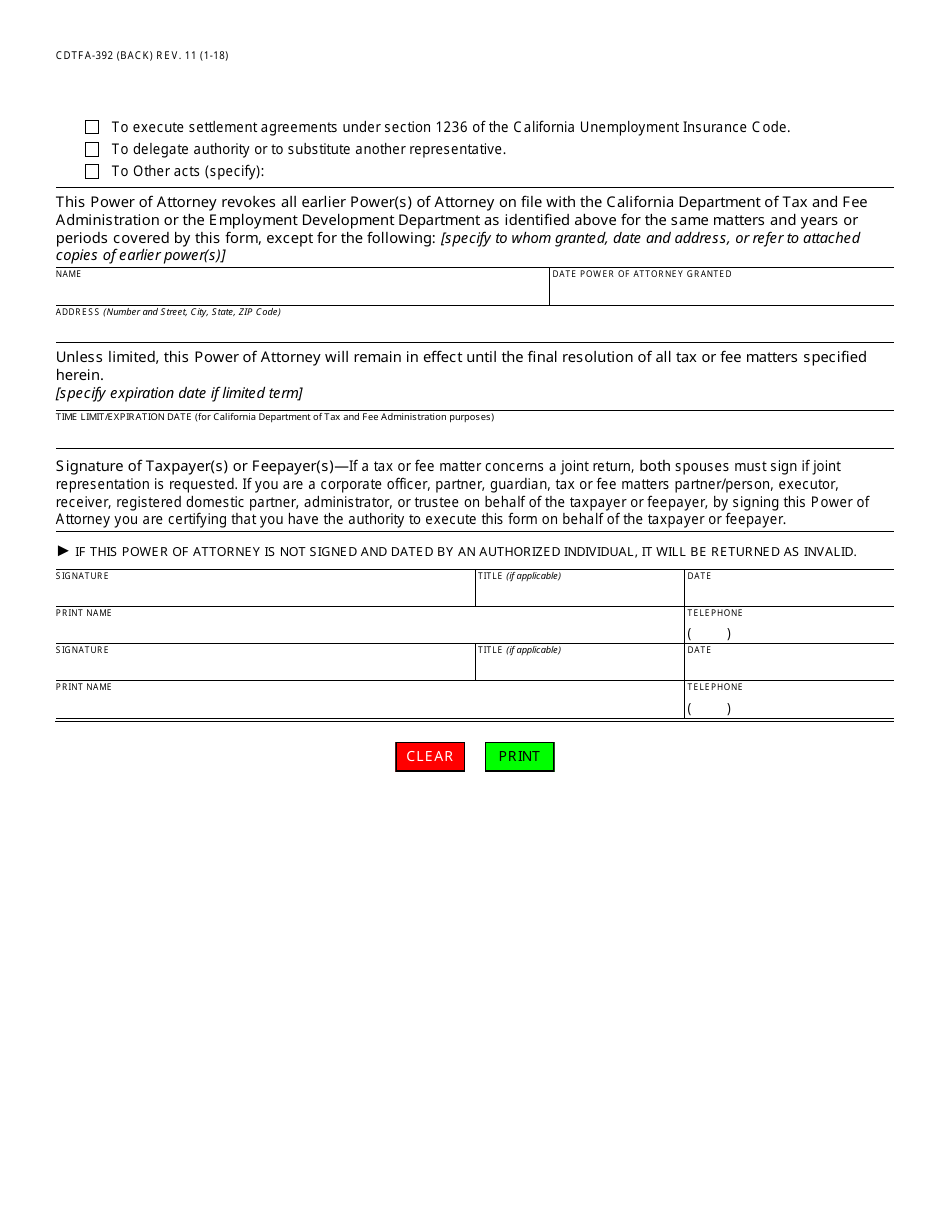

Form CDTFA-392

for the current year.

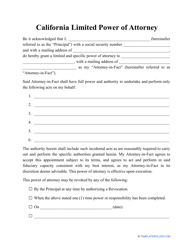

Form CDTFA-392 Power of Attorney - California

What Is Form CDTFA-392?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-392?

A: Form CDTFA-392 is the Power of Attorney form used in California.

Q: What is a Power of Attorney?

A: A Power of Attorney is a legal document that allows someone to act on behalf of another person or entity.

Q: Who can use Form CDTFA-392?

A: This form is used by taxpayers who want to authorize someone to represent them before the California Department of Tax and Fee Administration (CDTFA).

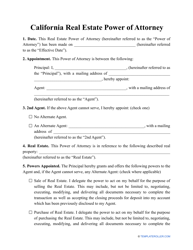

Q: What information is needed on the form?

A: The form requires the taxpayer's information, the representative's information, and details about the tax matter.

Q: Are there any fees associated with filing this form?

A: No, there are no fees associated with filing Form CDTFA-392.

Q: How long is the Power of Attorney valid?

A: The Power of Attorney is generally valid until it is revoked or the tax matter is resolved.

Q: Can I use this form for other states?

A: No, Form CDTFA-392 is specifically for the state of California. Other states may have their own power of attorney forms.

Q: Do I need additional documentation with this form?

A: In some cases, additional documentation, such as a copy of the representative's identification, may be required.

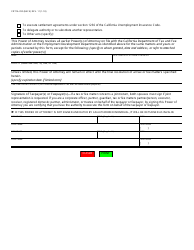

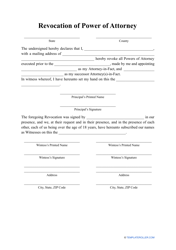

Q: Can I revoke a Power of Attorney?

A: Yes, you can revoke a Power of Attorney by sending a written notice to the CDTFA.

Q: What if I have more questions or need assistance with this form?

A: You can contact the CDTFA directly for assistance with Form CDTFA-392.

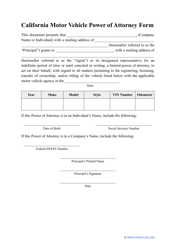

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-392 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.