This version of the form is not currently in use and is provided for reference only. Download this version of

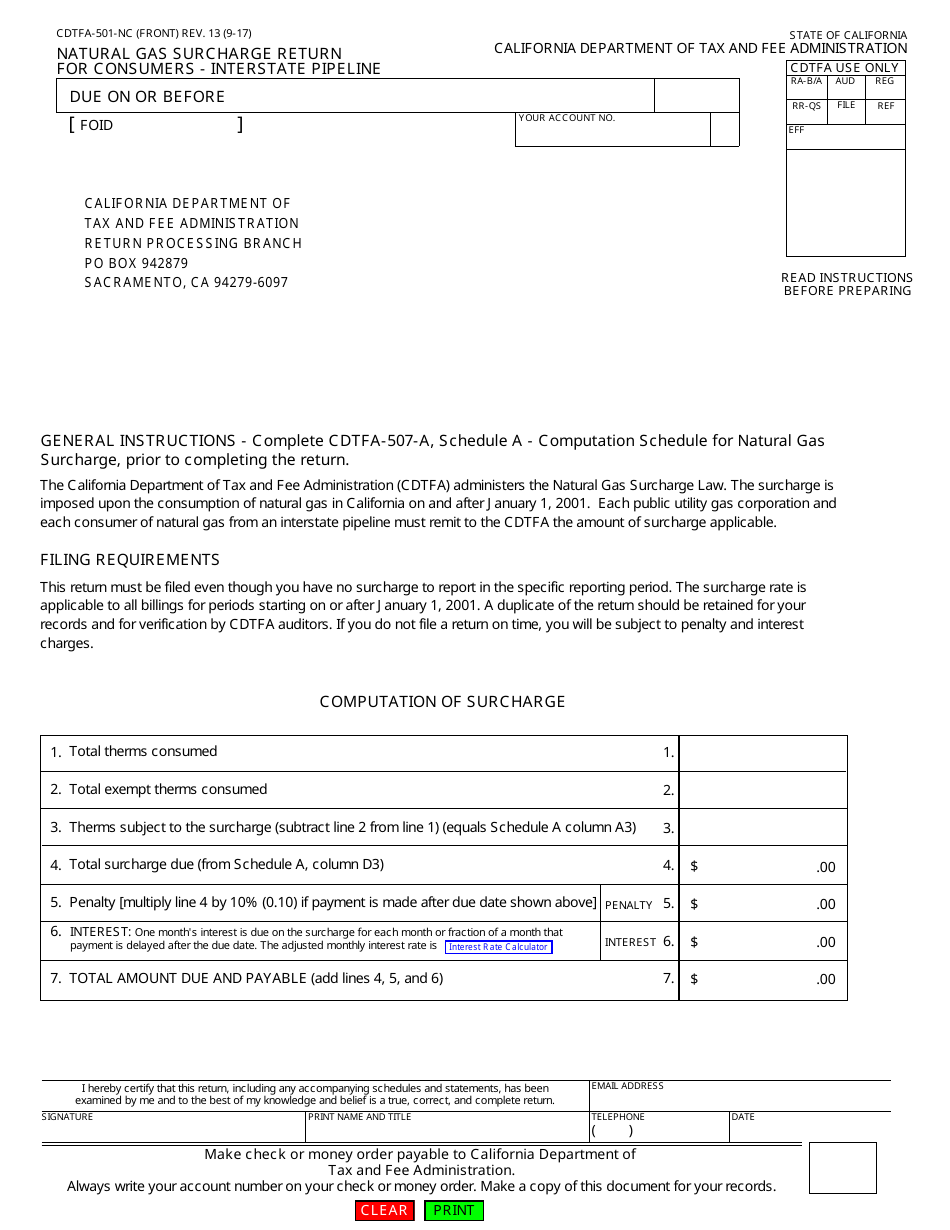

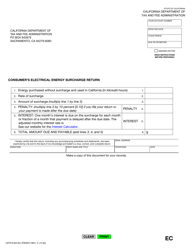

Form CDTFA-501-NC

for the current year.

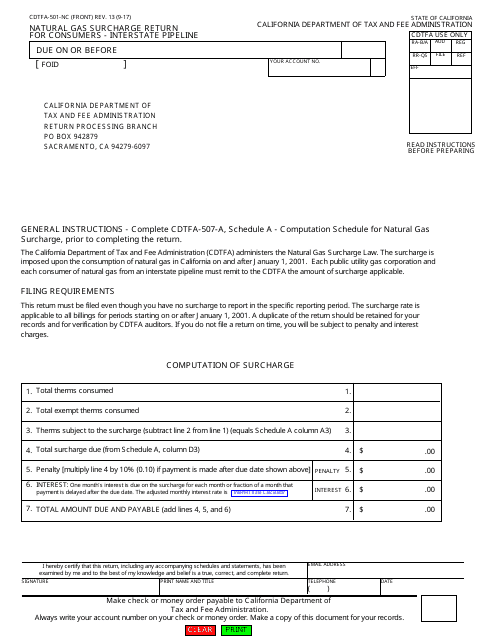

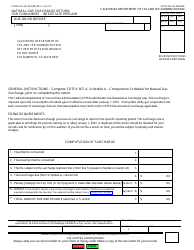

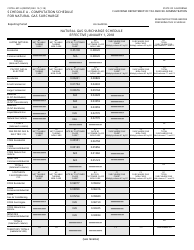

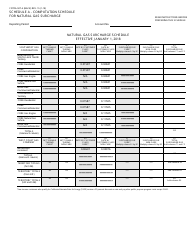

Form CDTFA-501-NC Natural Gas Surcharge Return for Consumers - Interstate Pipeline - California

What Is Form CDTFA-501-NC?

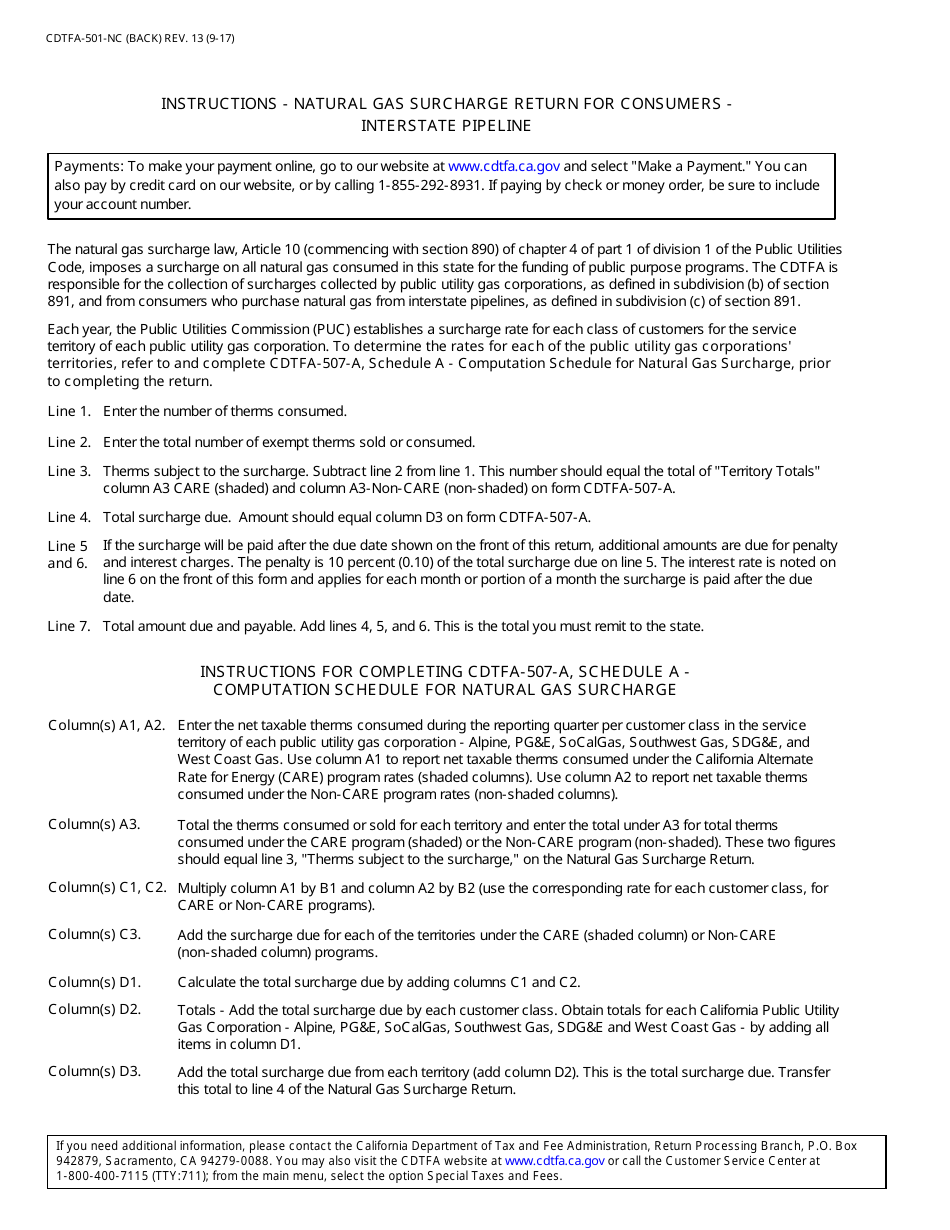

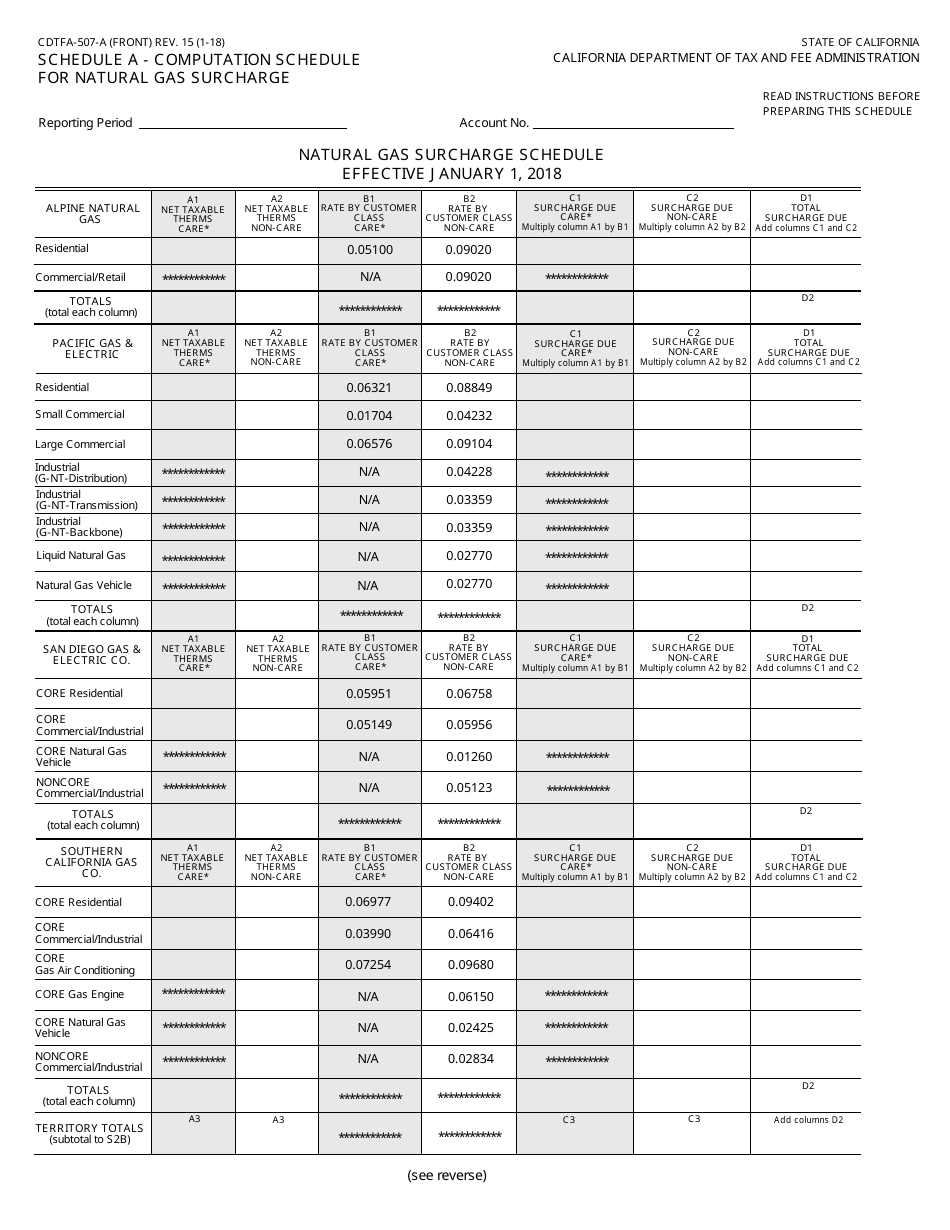

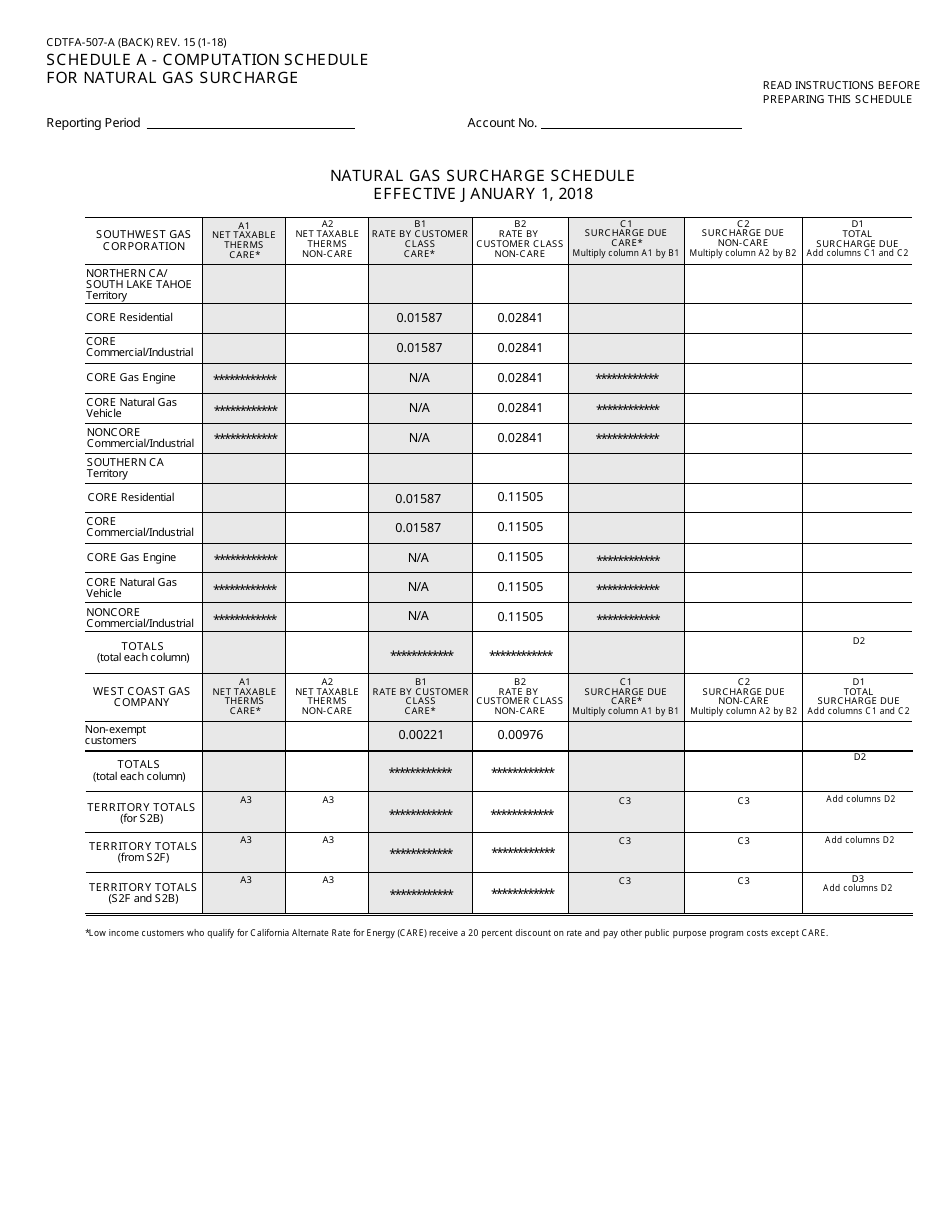

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

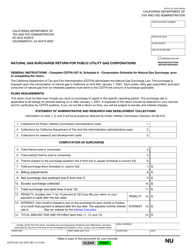

Q: What is Form CDTFA-501-NC?

A: Form CDTFA-501-NC is a Natural Gas Surcharge Return for Consumers - Interstate Pipeline in California.

Q: Who needs to file Form CDTFA-501-NC?

A: Any consumer who received natural gas from an interstate pipeline in California needs to file Form CDTFA-501-NC.

Q: What is the purpose of Form CDTFA-501-NC?

A: The purpose of Form CDTFA-501-NC is to report and remit the natural gas surcharge to the California Department of Tax and Fee Administration (CDTFA).

Q: When is Form CDTFA-501-NC due?

A: Form CDTFA-501-NC is due on a quarterly basis and must be filed by the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing or non-filing of Form CDTFA-501-NC?

A: Yes, penalties may be imposed for late filing or non-filing of Form CDTFA-501-NC. It is important to file the return and remit the surcharge on time to avoid penalties.

Q: Is there any exemption or credit available for the natural gas surcharge?

A: No, there are no exemptions or credits available for the natural gas surcharge. All consumers receiving natural gas from an interstate pipeline in California are required to pay the surcharge.

Q: What supporting documentation is required when filing Form CDTFA-501-NC?

A: When filing Form CDTFA-501-NC, you may be required to provide supporting documentation such as invoices or receipts to substantiate the natural gas surcharge reported.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-NC by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.