This version of the form is not currently in use and is provided for reference only. Download this version of

Form CDTFA-501-OA

for the current year.

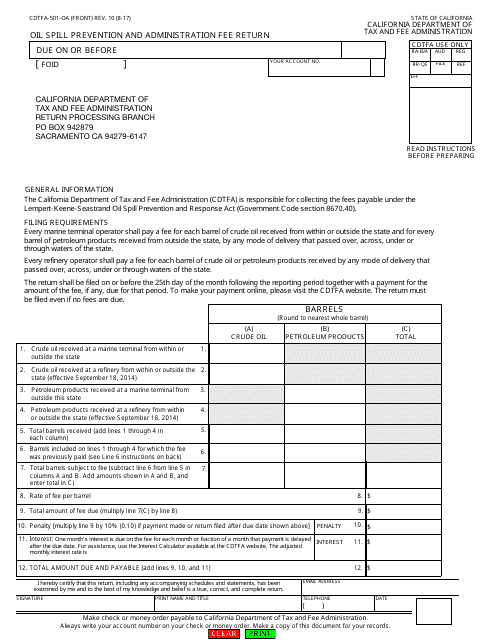

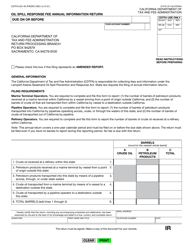

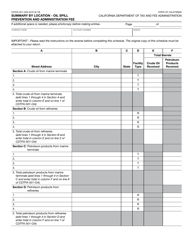

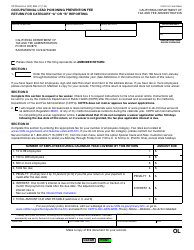

Form CDTFA-501-OA Oil Spill Prevention and Administration Fee Return - California

What Is Form CDTFA-501-OA?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CDTFA-501-OA?

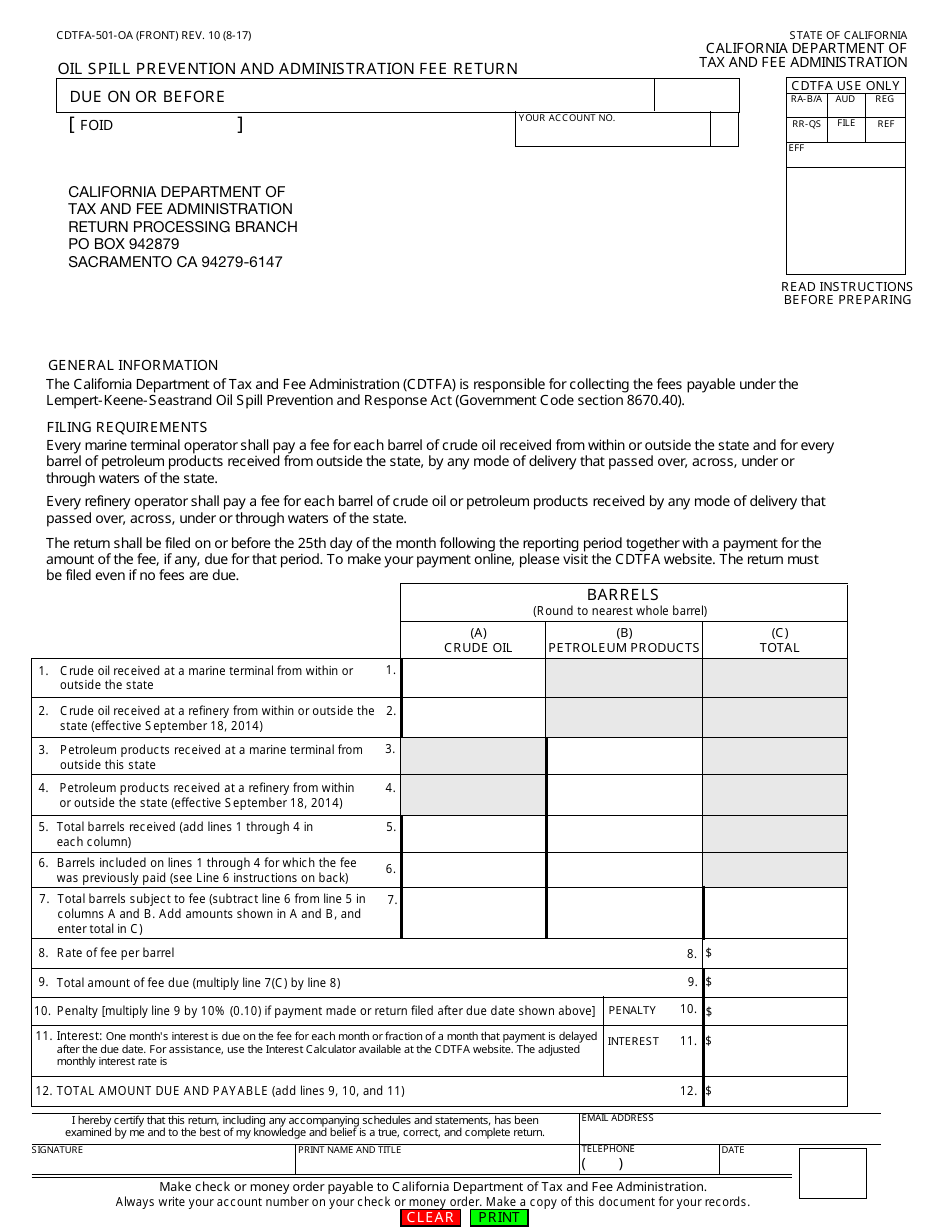

A: CDTFA-501-OA is a form used to file the Oil Spill Prevention and Administration Fee Return in California.

Q: What is the purpose of the Oil Spill Prevention and Administration Fee?

A: The purpose of the Oil Spill Prevention and Administration Fee is to fund oil spill prevention and response efforts in California.

Q: Who needs to file the CDTFA-501-OA form?

A: Entities engaged in activities that pose a risk of oil spills in California, including marine terminal operators, pipeline operators, and oil refineries, need to file the CDTFA-501-OA form.

Q: How often is the CDTFA-501-OA form filed?

A: The CDTFA-501-OA form is filed on a quarterly basis.

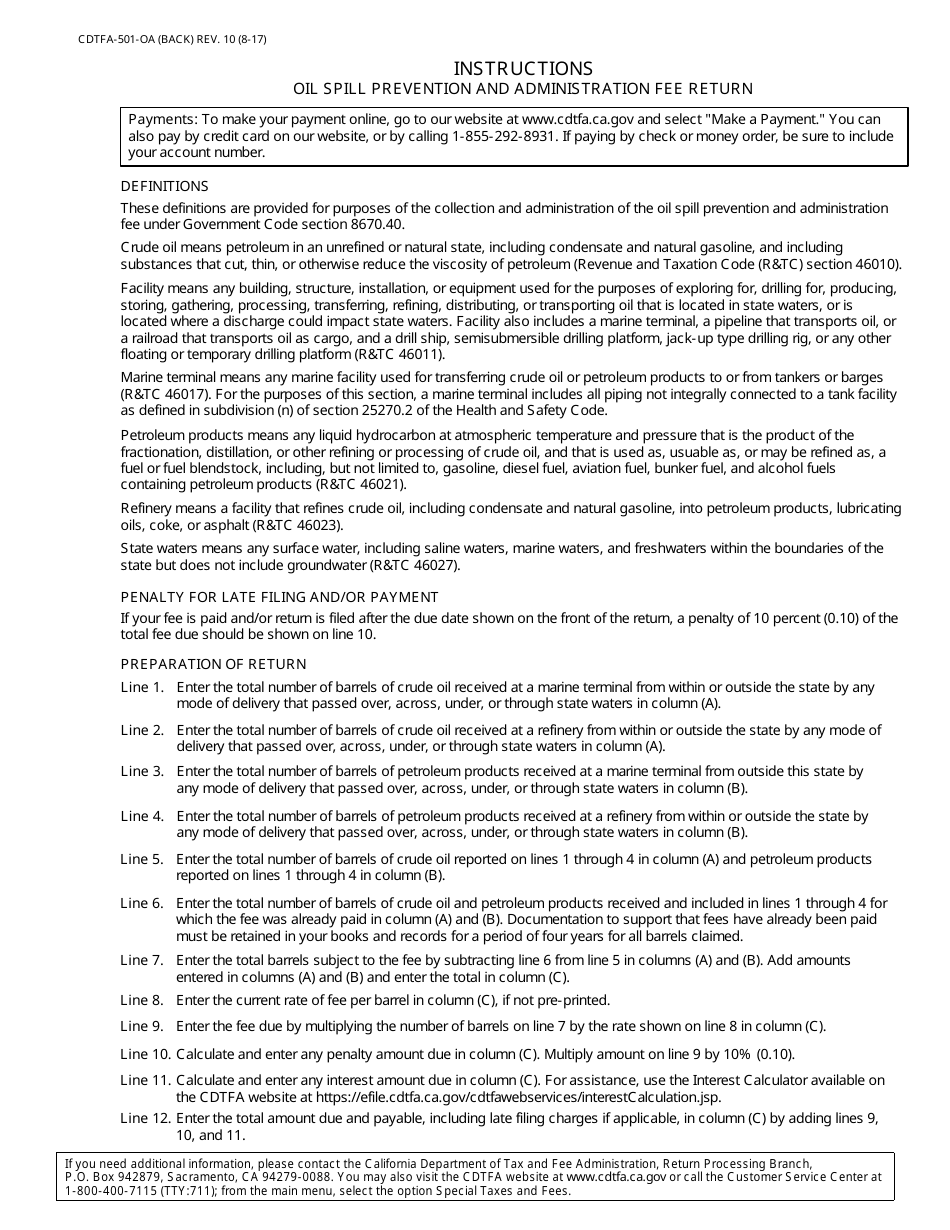

Q: What information is required to complete the CDTFA-501-OA form?

A: The form requires information such as gross oil receipts, deductions, and calculations of the oil spill prevention and administration fee.

Q: Are there any penalties for not filing the CDTFA-501-OA form?

A: Yes, there may be penalties for not filing the form or for filing it late, including interest and other fees.

Q: Who can I contact for more information about the CDTFA-501-OA form?

A: For more information about the CDTFA-501-OA form, you can contact the California Department of Tax and Fee Administration (CDTFA).

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-OA by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.