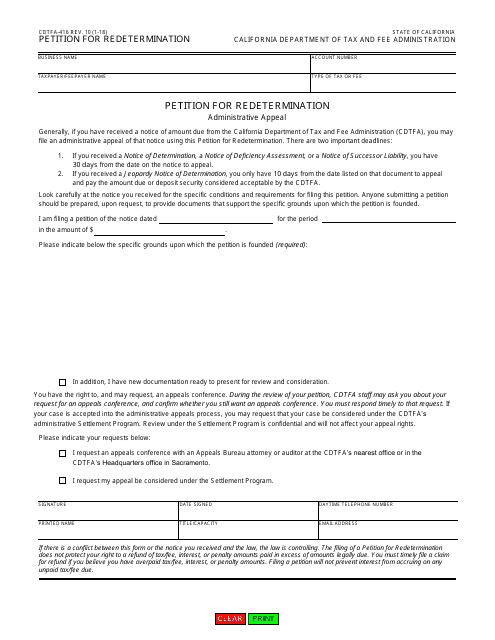

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CDTFA-416

for the current year.

Form CDTFA-416 Petition for Redetermination - California

What Is Form CDTFA-416?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

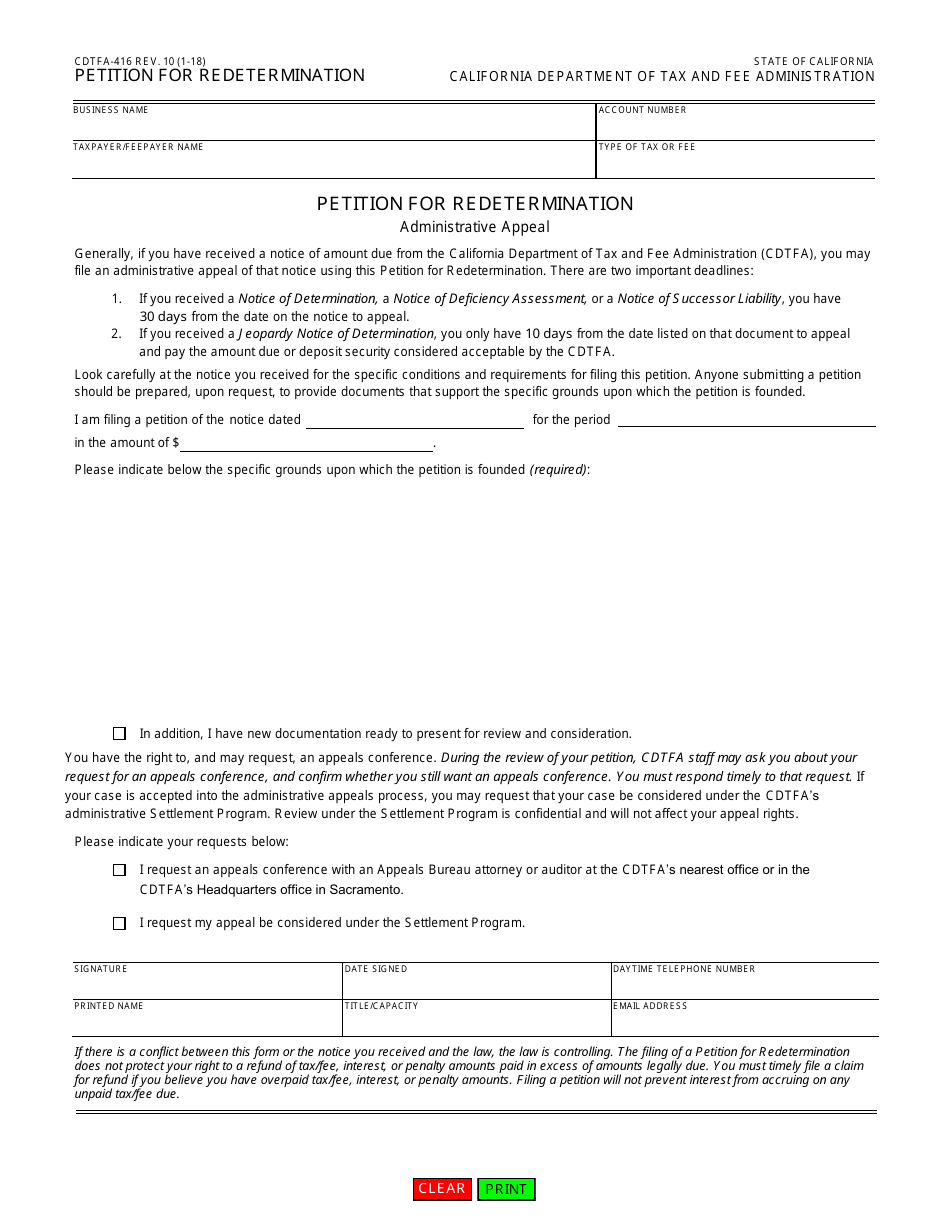

Q: What is Form CDTFA-416?

A: Form CDTFA-416 is the Petition for Redetermination form used in California.

Q: When should I use Form CDTFA-416?

A: You should use Form CDTFA-416 when you want to contest a tax decision made by the California Department of Tax and Fee Administration (CDTFA).

Q: What is a Petition for Redetermination?

A: A Petition for Redetermination is a formal request to the CDTFA to reconsider a tax decision.

Q: Can I use Form CDTFA-416 for any tax issue?

A: Yes, you can use Form CDTFA-416 to contest any tax decision made by the CDTFA.

Q: Are there any fees associated with filing Form CDTFA-416?

A: There are no fees required to file Form CDTFA-416.

Q: How long do I have to file Form CDTFA-416?

A: You generally have 30 days from the date of the CDTFA's notice of determination or denial to file Form CDTFA-416.

Q: What documents should I include with Form CDTFA-416?

A: You should include any supporting documents or evidence that are relevant to your case.

Q: What happens after I submit Form CDTFA-416?

A: After you submit Form CDTFA-416, the CDTFA will review your petition and may schedule a hearing or request additional information if needed.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-416 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.