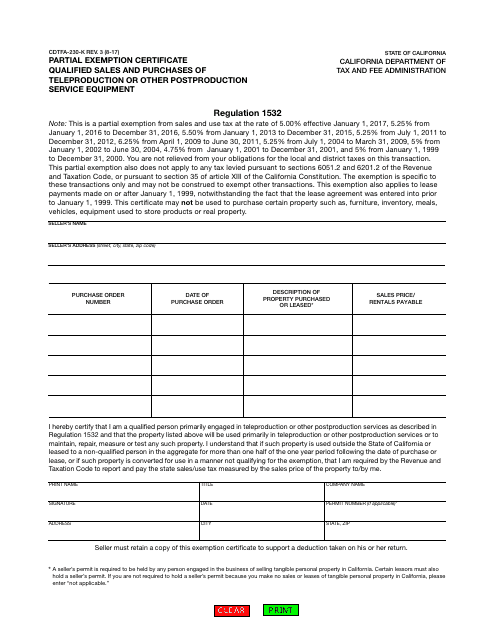

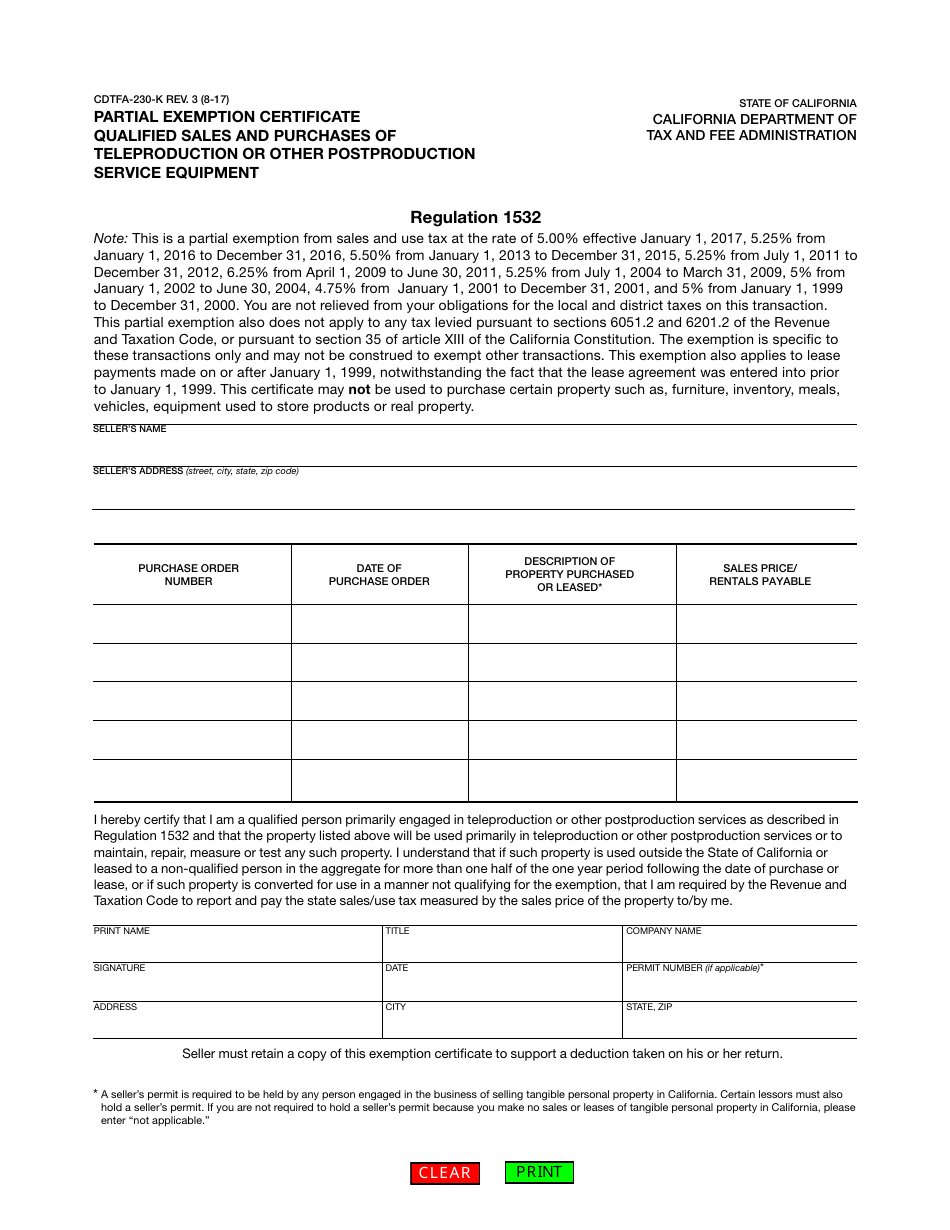

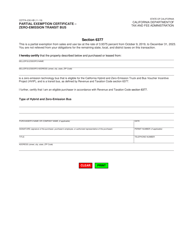

Form CDTFA-230-K Partial Exemption Certificate Qualified Sales and Purchases of Teleproduction or Other Postproduction Service Equipment - California

What Is Form CDTFA-230-K?

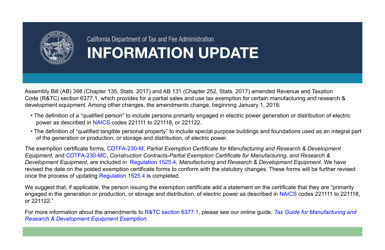

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-K?

A: Form CDTFA-230-K is a certificate for partial exemption for qualified sales and purchases of teleproduction or other postproduction service equipment in California.

Q: What is the purpose of Form CDTFA-230-K?

A: The purpose of Form CDTFA-230-K is to claim a partial exemption from sales and use taxes on the purchase or lease of teleproduction or other postproduction service equipment.

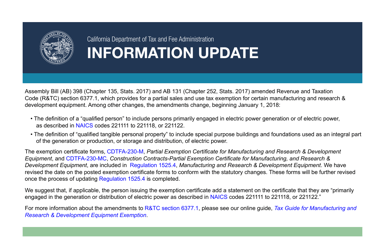

Q: What qualifies for the partial exemption?

A: Teleproduction or other postproduction service equipment that is used primarily for qualified production services and meets certain criteria may qualify for the partial exemption.

Q: Who can use Form CDTFA-230-K?

A: Manufacturers, producers, and service providers engaged in qualified production services in California can use Form CDTFA-230-K to claim the partial exemption.

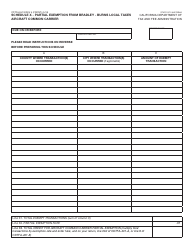

Q: How to complete Form CDTFA-230-K?

A: To complete Form CDTFA-230-K, provide the required information about the equipment and production services, sign the form, and submit it to the California Department of Tax and Fee Administration (CDTFA).

Q: Is the partial exemption automatic?

A: No, you need to properly complete and submit Form CDTFA-230-K to claim the partial exemption.

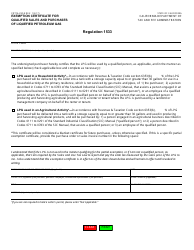

Q: Are there any restrictions or limitations for the partial exemption?

A: Yes, there are restrictions and limitations for the partial exemption. You should review the instructions and regulations for more information.

Q: What is the benefit of the partial exemption?

A: The partial exemption reduces the amount of sales and use taxes you owe on the purchase or lease of qualified teleproduction or other postproduction service equipment.

Q: Can I use Form CDTFA-230-K for other types of equipment?

A: No, Form CDTFA-230-K is specifically for teleproduction or other postproduction service equipment. There are other forms available for different types of exemptions.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-K by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.