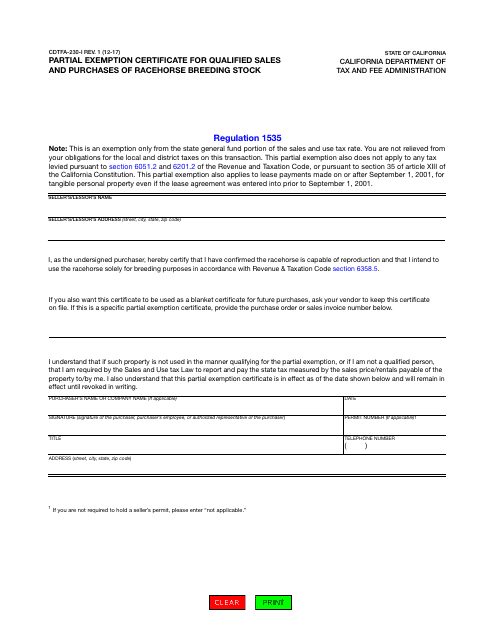

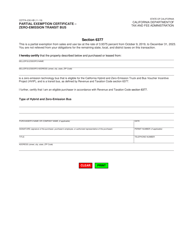

Form CDTFA-230-I Partial Exemption Certificate for Qualified Sales and Purchases of Racehorse Breeding Stock - California

What Is Form CDTFA-230-I?

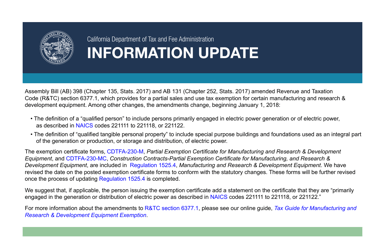

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

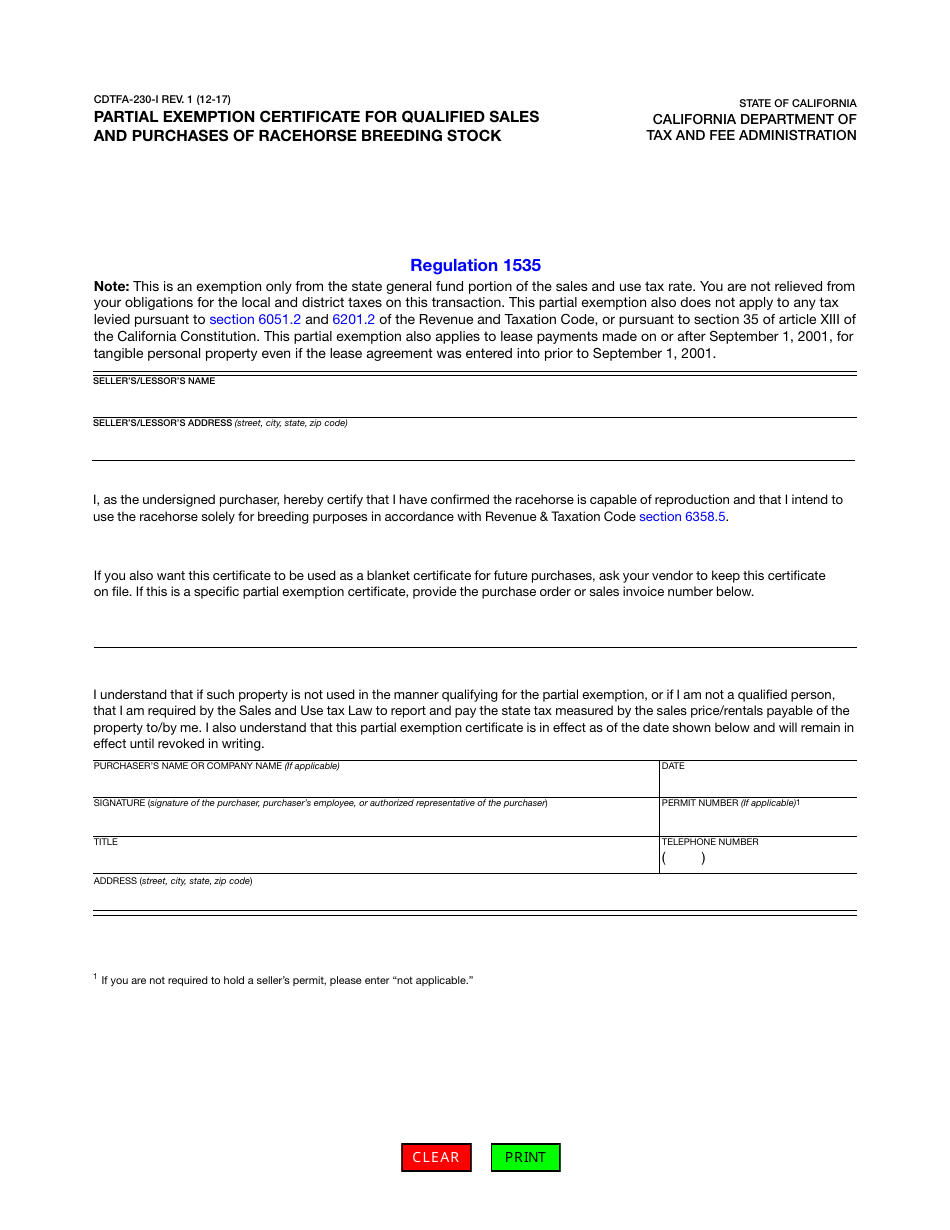

Q: What is form CDTFA-230-I?

A: Form CDTFA-230-I is the Partial Exemption Certificate for Qualified Sales and Purchases of Racehorse Breeding Stock in California.

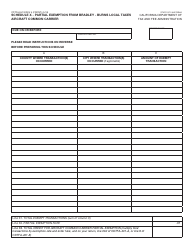

Q: What is the purpose of form CDTFA-230-I?

A: The purpose of form CDTFA-230-I is to claim a partial sales and use tax exemption for qualified sales and purchases of racehorse breeding stock in California.

Q: Who can use form CDTFA-230-I?

A: Form CDTFA-230-I can be used by qualifying taxpayers who are involved in the sales and purchases of racehorse breeding stock in California.

Q: What is the benefit of using form CDTFA-230-I?

A: Using form CDTFA-230-I allows qualifying taxpayers to claim a partial sales and use tax exemption on their racehorse breeding stock transactions in California.

Q: Are there any eligibility requirements to use form CDTFA-230-I?

A: Yes, there are eligibility requirements to use form CDTFA-230-I. Taxpayers must meet certain criteria to qualify for the partial sales and use tax exemption for racehorse breeding stock purchases in California.

Q: Can form CDTFA-230-I be used for purchases of other types of livestock?

A: No, form CDTFA-230-I specifically applies to qualified sales and purchases of racehorse breeding stock in California.

Q: What should I do with form CDTFA-230-I once completed?

A: Once completed, form CDTFA-230-I should be retained by the taxpayer and provided to the seller or lessor when claiming the partial sales and use tax exemption for racehorse breeding stock transactions in California.

Q: Is there a deadline for submitting form CDTFA-230-I?

A: There is no specific deadline for submitting form CDTFA-230-I. However, it should be provided to the seller or lessor at the time of the qualified transaction.

Q: Is the information provided on form CDTFA-230-I confidential?

A: Yes, the information provided on form CDTFA-230-I is confidential and will only be used for official purposes by the California Department of Tax and Fee Administration (CDTFA).

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-I by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.